Dear readers,

We are pleased to present our latest interest rate radar.

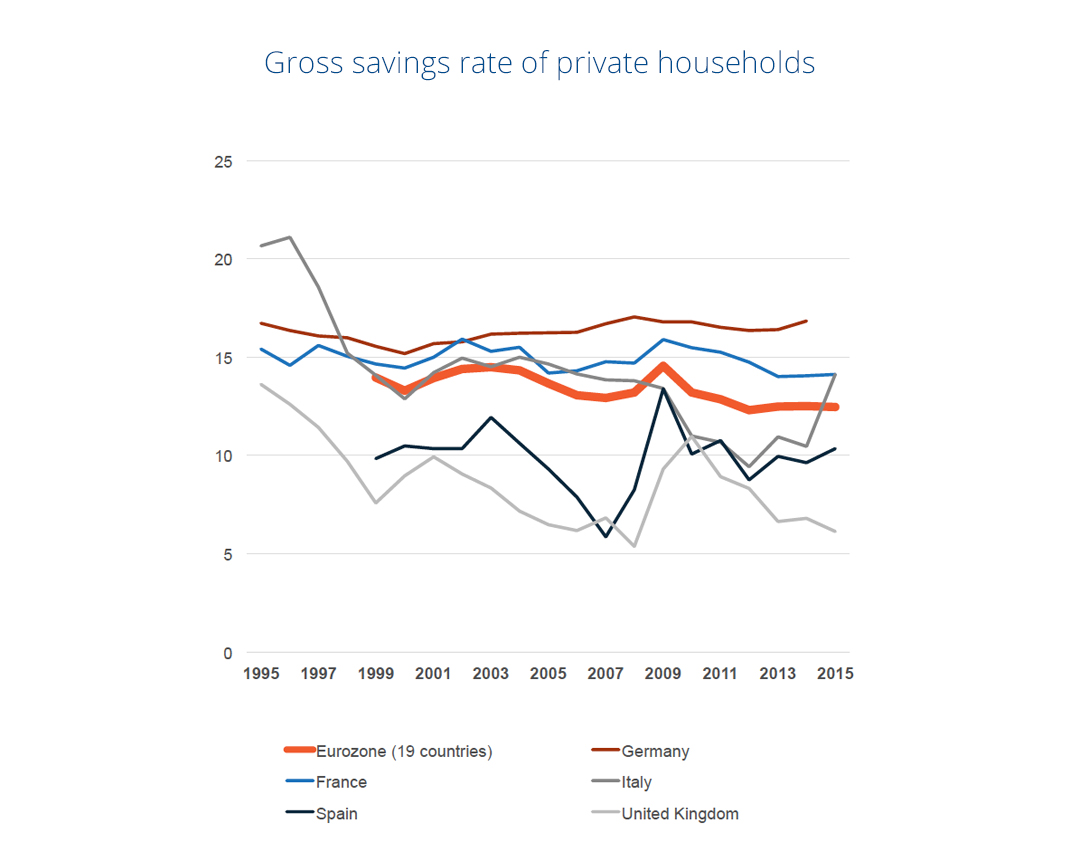

In this issue, we would like to give you a brief overview of the European savings behavior and more details on the gross savings rate of private households. The gross savings rate (hereinafter “savings rate”) is an economic factor which describes the ratio between the gross savings and the gross disposable income. The private savings is gross disposable income that is not spent on consumption expenditure.

The following graph describes the development of savings rates in selected countries of the European Union. The analysis starts in 1995 and is based on the data of the Statistical Office of the European Union (“Eurostat”).

Source: http://ec.europa.eu/eurostat/tgm/table.do?tab=table&init=1&language=de&pcode=tsdec240&plugin=1

The graph shows a quite heterogeneous development of private household savings rates. Savings rates vary strongly in countries such as Spain or the UK. They are influenced by factors such as economic conditions, distribution of income, and higher willingness to take out loans. By contrast, the German and French savings rates are fairly stable and react less to changes in economic conditions. In addition, the data by Eurostat confirm that Germans and French are strong savers – their savings rates being well above Eurozone average. Furthermore, the data illustrates that in spite of a declining interest rate level private household savings rates are not decreasing significantly.

In addition to the monetary and interest rate policy of the European Central Bank, economic conditions and the competition in the banking sector, the propensity to save and the investment behavior of private households play a crucial role in driving interest rates in the respective countries. The current trend shows a constant or even slightly increasing propensity to save across Europe. Despite low interest rates European private households continue to look for attractive products to invest their savings.

About the interest rate radar

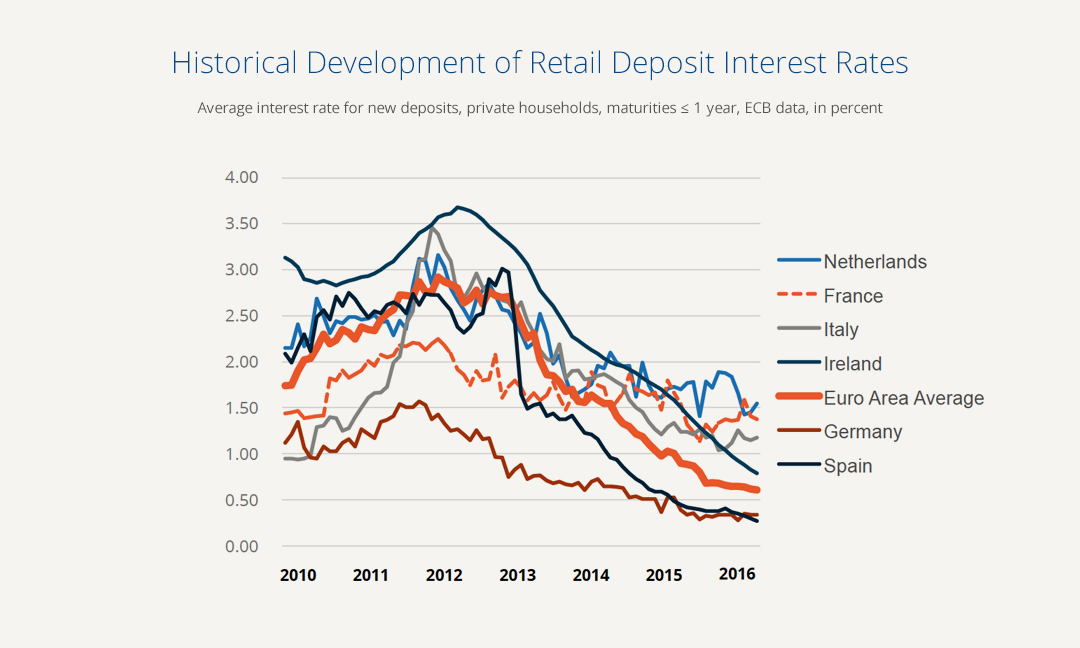

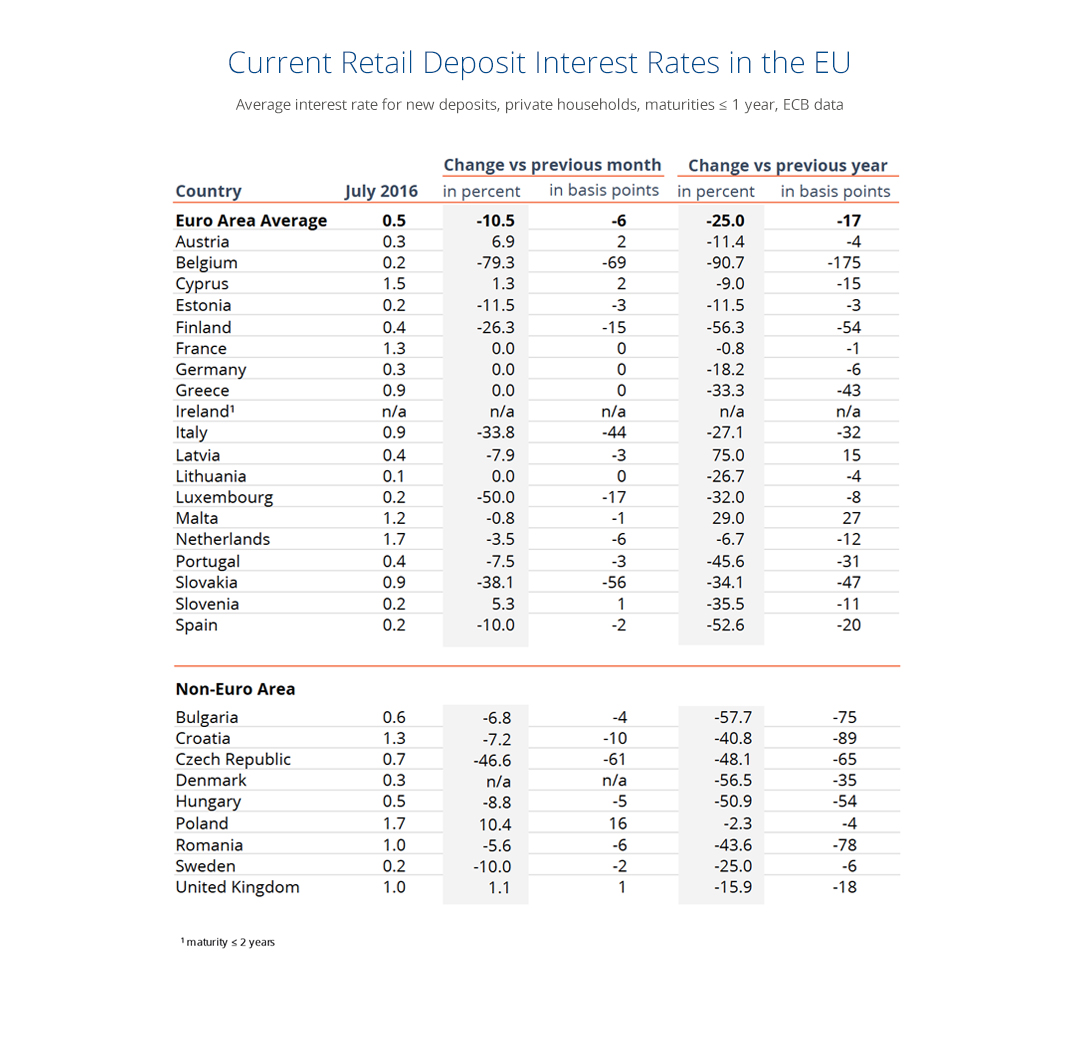

We at Raisin believe that transparency can make the decision for the right savings product easier. Since deposits are still one of the main sources of funding of banks and continue to be the most popular investment product for private customers, we want to provide you with the most up-to-date information on interest rates, including country-specific developments in our monthly publication.

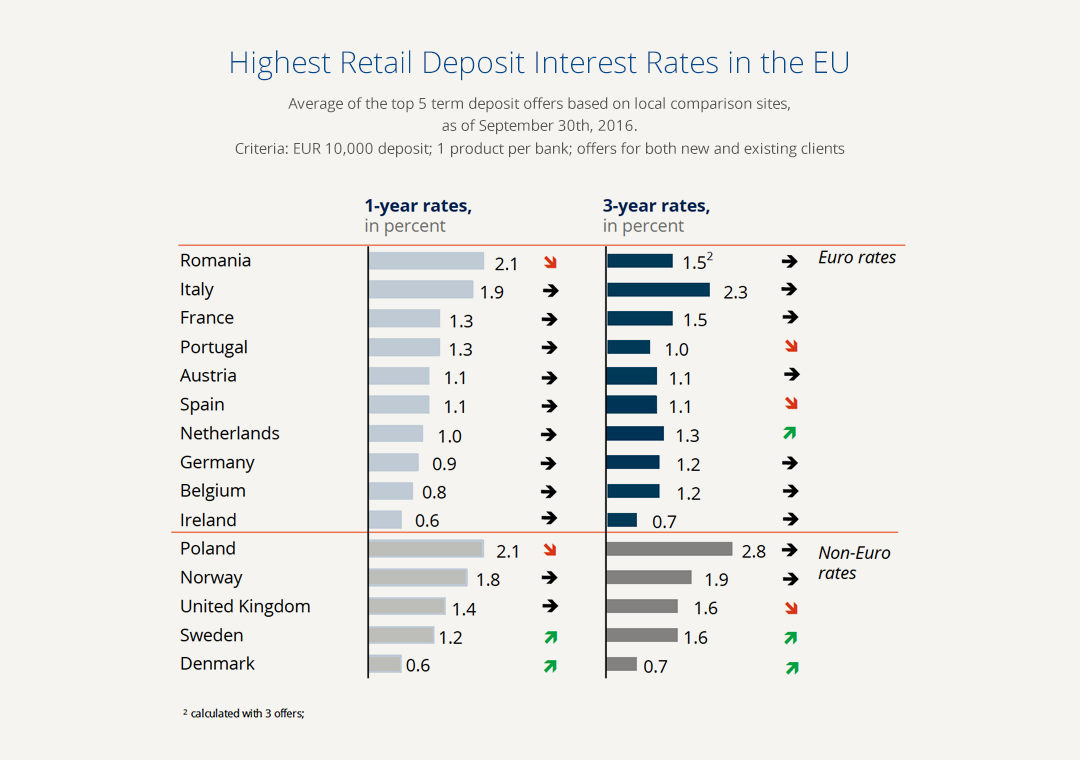

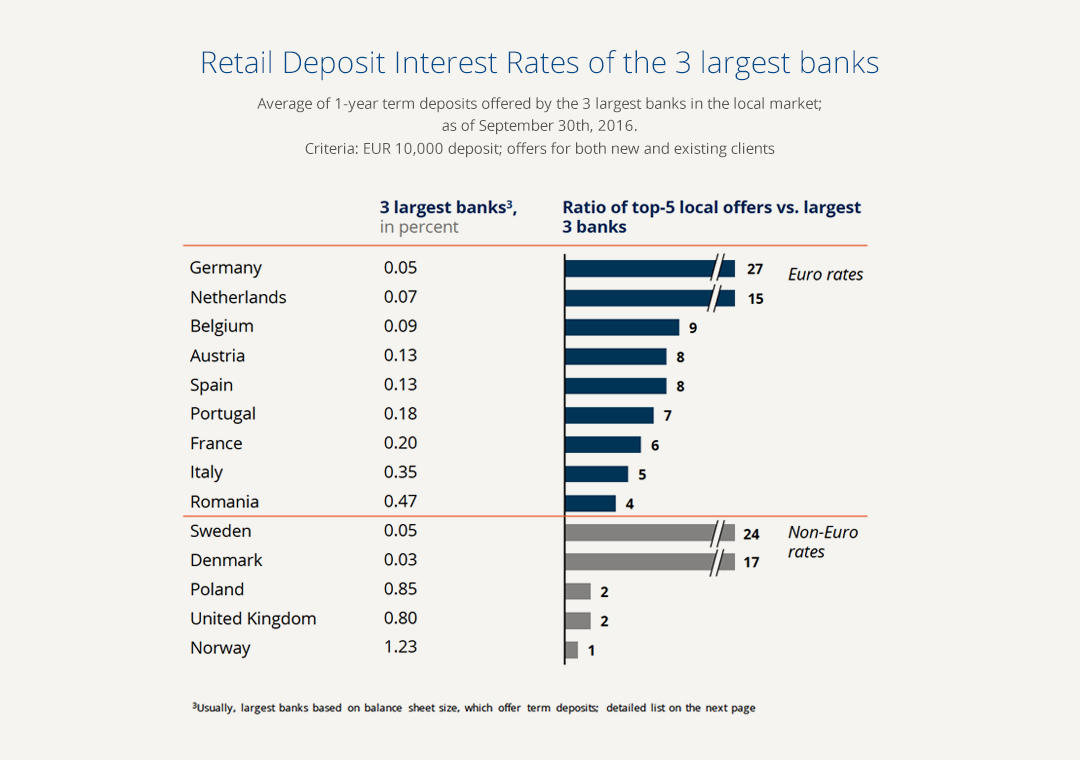

Effective date: 30/09/2016, Sources:

Austria: biallo; Erste Bank, Bank Austria, Landesbank Oberösterreich

Belgium: Spaargrids; ING Belgien, KBC, Belfius Bank

Denmark: maybanker; Dankse Bank, Nykredit, Nordea

France: FranceTransactions; BNP Paribas, Societe Generale, Credit Mutuel

Germany: biallo; Deutsche Bank, Commerzbank, HypoVereinsbank

Ireland: Bonkers.ie; Bank of Ireland, AIB, Ulster Bank

Italy: Conti Deposito; UniCredit, Monte Dei Paschi Di Siena, Mediobanca

Netherlands: Spaarrente; ING, Rabobank, Abn-Amro

Norway: Norsk Familieøkonomi; DNB, Danske Bank, Nordea

Poland: Oprocentowanie; PKO Bank Polski, Bank Pekao, mBank

Portugal: Pedro Pais; BPI, BCP, Novo Banco

Romania: moneycenter; BCR, BRD, Banca Transilvania

Spain: tucapital; Santander, BBVA, Sabadell

Sweden: Finansportalen; SEB, Nordea, Swedbank

United Kingdom: Moneyfacts; HSBC, Barclays, RBS