How to get out of debt

Eight approaches to managing debt

Paying off debt isn’t easy, but there are general approaches people may consider to manage or reduce debt and work towards great financial stability. Read on to learn more about common strategies for managing debt, and find information on organisations offering free, FCA-authorised debt advice.

Key takeaways

: There are two different types of debt: secured, which requires collateral, and unsecured debt

: Prioritising debts and budgeting money can help you organise your finances more effectively

: Common approaches include paying more than the monthly minimum, consolidating debts, and seeking formal debt solutions if needed

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

What are the different types of debt?

There are two main types of debt: secured and unsecured.

Secured debt is where something of high value you own, such as property or a vehicle, is used as collateral. If you’re unable to repay your loan, the lender might take possession of your collateral to pay off the debt. Examples include mortgages and some car loans.

Unsecured debt, sometimes called consumer debt, doesn’t require collateral. You borrow money from a lender and agree to make regular payments until it is paid back in full. Because there is no security, interest rates on unsecured debt are typically higher. Examples include overdrafts, buy now pay later, personal loans, and credit cards. Student loans are slightly different in that repayments depend on your income.

Some debts don’t fall into these two main categories, including money owed to Government agencies (such as unpaid council tax or income tax) rent arrears or overdue utility bills.

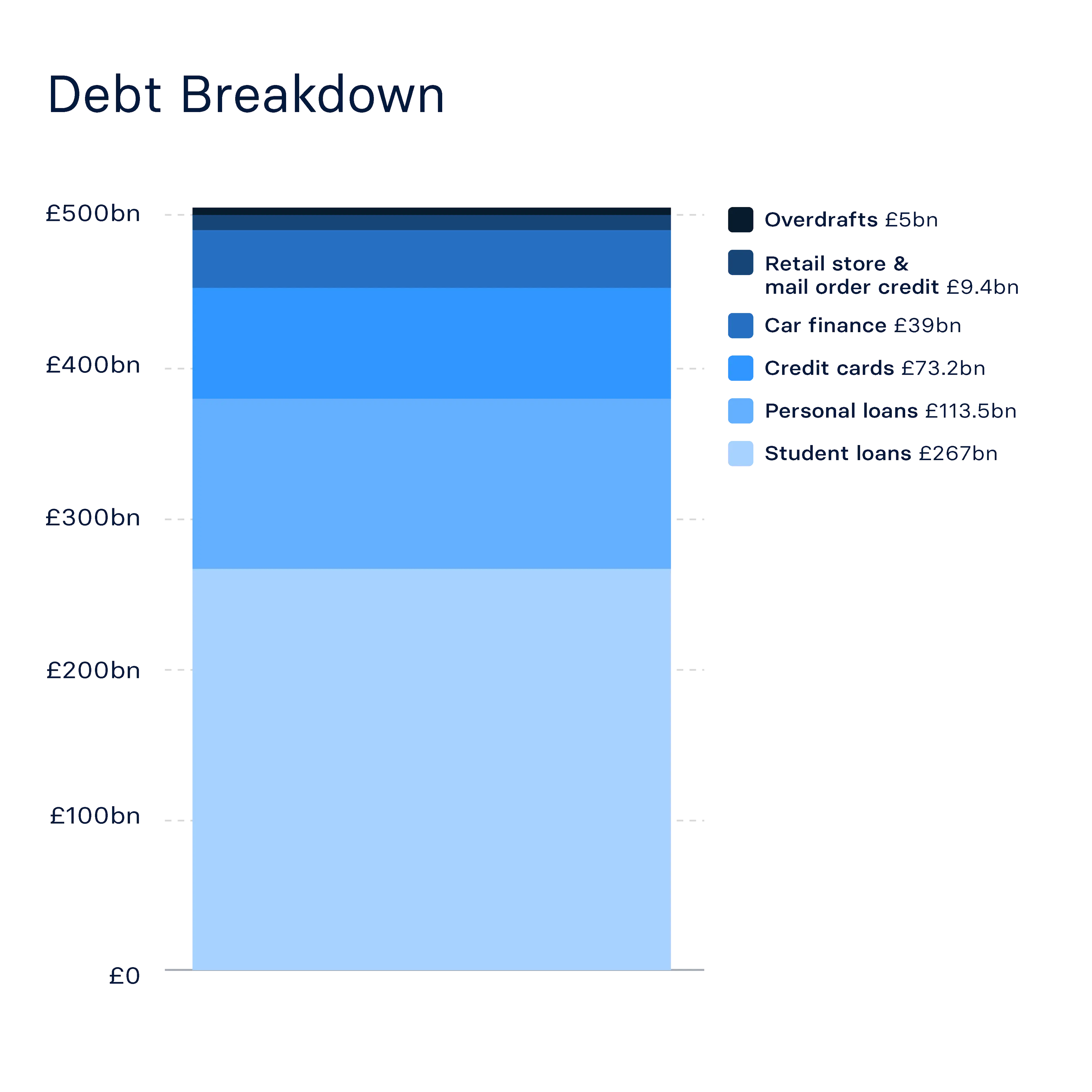

Debt can build up in many different ways. The chart below breaks down total UK household debt by type (not including mortgages).

Problem debt vs. managed debt

Debt is sometimes described as either ‘problem’ or ‘managed’ debt. These terms reflect how manageable a person’s debt is in relation to their income and financial commitments.

- Problem debt is typically used to describe a situation where your total debt payments equate to more than your income, meaning you are struggling to pay it off. This can also apply if you regularly need to borrow to cover essentials or if you’ve fallen behind on key bills such as rent, council tax, or utilities.

- Managed debt includes regular payments, like mortgage or personal loan payments, and any debt you can afford to pay back.

Eight common approaches to dealing with debt

If you’re looking for practical ideas on how to get out of debt, there are several practical steps that may help. What works best will depend on your individual circumstances, and it can be useful to seek guidance from an FCA-authorised debt adviser before taking action.

1. Focus on high-interest debt

Some people focus on paying off the most expensive debt first. This could mean tackling debts with the highest APR (annual percentage rate), such as credit cards or store cards, because doing so can reduce the total interest paid over time.

A 0 % balance-transfer card can sometimes help by offering an interest-free period on existing credit-card debt. However, these cards usually involve fees and eligibility criteria, and the 0 % rate is time-limited.

At the same time, certain debts may take priority due to the potential consequences if left unpaid. For example, missing gas or electricity payments can lead to energy being cut off. Considering what type of debt you are facing and its urgency can help you plan how to get out of debt.

2. Create a budget

Understanding where your money goes each month can help you distinguish between essential and non-essential spending, and identify areas where you can free up cash to pay off debts.

Raisin UK’s free budget planner can help you categorise expenses and compare your spending to your income. There are also various apps available where users can track spending and manage their budget.

3. Reduce outgoings

Looking at recent bank or credit card statements can highlight recurring payments for services you no longer use, like subscriptions or memberships. These could be halted temporarily to focus on clearing debt. You may also be able to shop around for a better deal on your mobile phone or broadband.

Read more about how to stop spending money.

4. Pay more than the minimum

The amount you repay each monthcan have a significant impact on how long it takes to clear a debt and how much interest you pay overall. Some people choose to pay more than the minimum payment requirements each month to reduce the cost and term of their debt.

Example of a £2,000 credit card balance with a 20% APR:

Making only the minimum payment of 2.5% (£50) each month could take decades to repay and result in several thousand pounds in interest, depending on the compounding method.

Increasing the monthly payment to £100 could reduce the repayment period to around two years, with total interest around £500 - £550.

These numbers are for illustration purposes only. Exact amounts may vary depending on compounding method and timing of payments.

5. Pay in cash rather than by credit card

According to a report in the Financial Times, borrowing costs on credit cards are at their highest levels in nearly two decades.* Using a credit card for everyday purchases can sometimes lead to overspending and further debt due to the repayment costs.

Some people who want to reduce reliance on credit cards may find it helpful to use cash instead. Physically removing the credit card from a purse or wallet – or uninstalling it from a digital wallet – might help reduce the urge to spend.

6. Explore ways to increase income

Increasing your income can sometimes ease pressure on your finances and make it easier to keep up with debt repayments. Some approaches people commonly consider include:

Checking entitlement to benefits – You may be eligible for benefits you’re not currently claiming. The Gov.uk website contains calculators to help determine what you might qualify for.

Making sure you’re on the right tax code – An incorrect tax code can lead to overpaid tax. HMRC has tools to help check your code and update it if necessary.

Sell unwanted items – Selling items that are no longer needed can generate extra cash.

Reclaim charges – In some cases, it may be possible to recover money from mis-sold loans, bank charges, or other repayments. Independent advice can help you understand your rights.

Rent out a room – Schemes such as the Government’s Rent a Room Scheme allow people to earn tax-free income (up to £7,500 in 2025/26) by letting out a room.

- Offering services or products – Some people use platforms like Fiverr, PeoplePerHour, or Etsy to earn additional income through services or crafts. Keep in mind that extra income above certain thresholds may need to be declared to HMRC.

7. Debt consolidation

Debt consolidation involves taking out a new loan to pay off multiple existing debts. Some people explore this option if they have loans or credit cards with high interest rates and payments that are difficult to keep up with.

However, consolidation carries risks. The new loan might extend the repayment term, increase overall interest, or be secured against your home or another asset. Always review the total cost and terms before making a decision and seek impartial advice from an FCA-authorised debt adviser if you’re unsure.

8. Talk to creditors

If someone is finding it hard to keep up with repayments, creditors may offer options for outstanding balances. Under guidance from the Financial Conduct Authority (FCA), lenders have a duty to treat customers in financial difficulty fairly and offer them options.**

Some people choose to write to their creditors. For example, Citizens Advice provides a sample letter that illustrates how to notify a creditor of financial difficulties and outlines potential repayment arrangements.

What is the Debt Respite Scheme (Breathing Space)?

If you’re struggling to get out of debt, the UK Government’s respite scheme, known as Breathing Space, offers up to 60 days’ protection from creditor action while you seek debt advice.

There are two types:

Standard Breathing Space – creditors cannot take enforcement action, contact you regarding any eligible debts, or can they charge any interest, for 60 days.

Mental Health Crisis Breathing Space – this scheme offers extra protection to those who are undergoing treatment for a mental health crisis.

To be eligible for the Standard Breathing Space you must:

Live in England or Wales

Not be in a Debt Relief Order, Individual Voluntary Arrangement or be an undischarged bankrupt

Not have used Breathing Space scheme in the last 12 months, unless it was for a mental health crisis

Apply through an approved debt adviser authorised by the FCA.

Find out more about the Breathing Space scheme at Gov.uk.

What if you can’t pay your debts?

Below are some of the formal debt solutions available in the UK. Each has different eligibility criteria and long-term consequences. It’s important to seek independent advice before entering any agreement. The FCA has issued guidance on avoiding unsuitable or unauthorised advice on how to get out of debt.

Debt Management Plan

A debt management plan is an informal agreement between a debtor and their creditors to pay off all of their debts. They are often used when someone can only afford to pay a small amount each month, or when temporary financial problems mean debts can’t be cleared in full straight away. A plan can be set up directly with creditors or arranged through a licensed debt management company. It’s important to be aware of any fees and not enter into an agreement before you know the details. Some companies may charge fees, while direct arrangements with creditors might not.

Individual Voluntary Arrangement

An individual voluntary arrangement (IVA) is a legally binding agreement between a person and their creditors to repay part of or all of their debts. Repayments are usually made in regular installments to an insolvency practitioner, who then distributes this money to creditors.

IVAs typically last for a fixed period of around five to six years***, and at the end of the term, any remaining qualifying debt may be written off. An IVA must be set up through a licensed insolvency practitioner, and fees are usually charged as part of the arrangement.

Administration Order

An administration order is typically an option if:

- You have a county court or High Court judgement against you and can’t afford to pay in full

- Your total debts are £5,000 or less.

If the eligibility requirements are met, the debtor will make a single monthly repayment to the court who will divide it between your creditors. Application involves completing form N92 and sending it to alocal court.

Debt Relief Order

A Debt Relief Order (DRO) can help if you:

Owe £50,000 or less

Don’t own your home

Have little disposable income and few assets.

A DRO must be applied for through an authorised debt adviser. While the Debt Relief Order is in place, creditors cannot take action to recover debts included in the order. After 12 months, most debts may be written off. The DRO stays on a credit record for six years.

Bankruptcy Order

A bankruptcy order is a formal insolvency process for people who cannot pay off their debts. An application is considered by an adjudicator, who will ultimately decide whether bankruptcy is appropriate.

During a 12-month period of bankruptcy, any non-essential assets may be used to pay creditors. At the end of this period, most debts included in the bankruptcy are written off.

Declaring bankruptcy has a serious, long-term effect on the bankrupt’s credit rating. It will remain on your credit file for six years. This could make it hard to obtain credit, a mortgage, or open a new bank account.

Should I use my savings to clear debt?

Deciding whether to clear debt with your savings primarily depends on your personal circumstances, including the type of debt, interest rates and your financial goals. We cover this topic in more detail on our page: Pay off debt or save?

If you decide to keep saving, it can be worth checking you’re earning a competitive interest rate. Compare savings accounts through Raisin UK to find an option to suit your needs.

Does being in debt affect my credit score?

Debt can affect your financial wellbeing, including your credit score. If you miss a payment, for example, there’s a chance your lender may report it to the credit bureaus. If you carry high balances or are at or near your credit limit on your credit cards on a monthly basis, this may also negatively affect your credit score.

Maintaining regular repayments and keeping borrowing within manageable limits may support a more stable credit profile over time. You can learn more in our guide on how to improve your credit score.

Free debt help and advice

Dealing with debt can be a worrying and stressful experience, but support is available. If you’re struggling to get out of debt, there are several debt charities and debt advice services that can provide free and impartial advice:

If your financial troubles are affecting your mental and physical health, both Mind and the NHS websites contain information and advice.

*https://www.ft.com/content/02f92090-67a4-4195-9d5b-b065e681714b

**https://www.handbook.fca.org.uk/handbook/CONC/7/3.html?

***https://debtsupportdirect.co.uk/debt-solutions/individual-voluntary-arrangement-iva/

Save smarter with the Raisin UK newsletter!

What’s in it for me?

Receive exclusive updates on market-leading rates

Ensure you never miss a bonus offer

Keep your finger on the pulse with the latest financial news

About us

Savings accounts

Guides

About us

Savings accounts

Guides

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time.

Raisin UK is a trading name of Raisin Platforms Limited which is authorised and regulated by the Financial Conduct Authority (FRNs 813894 and 978619). Raisin Platforms Limited is registered in England and Wales, No 11075085. Registered office: Cobden House, 12-16 Mosley Street, Manchester M2 3AQ, United Kingdom. The information on this website does not constitute financial advice, always do your own research to ensure it's right for your specific circumstances. Tax treatment depends on the individual circumstances of each customer and may be subject to change in the future.