What is inflation?

How prices are changing in the UK

Home › Finance glossary › Inflation

Inflation: it’s a word you often hear in news reports on the economy. But what does it mean? Inflation is the pace at which prices rise, so your money might not go as far as it used to. By understanding what causes inflation, you can make sense of these changes in the cost of living and plan ahead. Here, we take a close look at how inflation works and what you can do to prepare your finances. Plus, you can find out how inflation has pushed up the prices of the nation’s favourite items in Raisin’s inflation study.

Key takeaways

Inflation is the general increase in prices of goods and services, which affects how much you get for your money

: Inflation is generally affected by the supply and demand of goods or services. If supply is high, it typically follows that goods will cost less

The Bank of England’s inflation target is 2%, although recent global events have pushed the current UK inflation rate higher than this

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Inflation explained in simple terms

Inflation is a way of measuring how much the prices of goods and services rise in a given period, and how the same amount of money might buy you less than before.

The percentage tells you how quickly the prices have increased. A higher inflation rate means prices are rising faster, while a lower rate means they’re still going up, but more slowly. By definition, inflation and the loss of purchasing power have an impact on the cost of living.

How does inflation work?

In the UK, the Office for National Statistics is the body in charge of tracking the prices of a basket of everyday goods and services, which includes food, clothes, travel, and energy costs. The inflation rate is then calculated by comparing today’s prices for those items with those from a year ago.

An inflation rate of 3% means that prices are, broadly speaking, 3% higher than they were this time last year. For example, a pint of milk that cost £1 a year ago might now cost £1.03.

How is inflation measured?

There are a few different indices for measuring inflation. The changing price of the basket of goods and services is most often measured with the Consumer Price Index (CPI). A separate index, known as the Consumer Prices Index including owner occupiers’ housing costs (CPIH), additionally accounts for the costs of living in and maintaining a home. The CPIH may therefore provide a more complete picture of inflation for households.

What causes inflation?

Inflation is affected by the supply and demand for goods and services. In an open market where the demand for a product is great, the price for that product might also increase as supply diminishes due to people purchasing. By contrast, if the supply is greater than the demand, then the prices of the goods or services may decrease, tempting people into buying them.

Here are the different causes of inflation explained:

Demand-pull inflation. This is one of the main causes of inflation. It happens when the demand for goods or services is higher than the supply. As people want to purchase a specific type of product, they must be willing to pay a higher price.

Cost-push inflation. This happens when the cost of producing goods and services rises, and businesses pass these higher costs onto consumers in the form of higher prices. For example, if a natural disaster damages gas supply lines, there could be a shortage in the gas supply, pushing up end prices.

Money supply. This happens when a government prints too much money, resulting in too much capital for the volume of goods available and creating either demand-pull or cost-push inflation.

- Built-in inflation. This happens when people expect wages to increase as the price of goods increases. However, higher wages mean the cost of production also increases, and this, in turn, raises the price of goods and services again. Built-in inflation creates a continuous cycle that can greatly affect the economy.

How is inflation managed?

Central banks use monetary policy to keep price rises (inflation) under control. Monetary policy, which includes setting interest rates, is an action taken to influence how much money is in the economy, and how much it costs to borrow. The goal is to keep inflation close to a target rate so that prices remain stable. The UK’s target inflation rate is 2% over a year.

In the UK, the Bank of England’s Monetary Policy Committee (MPC) adjusts the bank rate (which affects interest rates) to influence spending and borrowing. If inflation rises above target, the Committee might increase the bank rate in a bid to curb price growth. They might tolerate the rate increasing away from the target, because some factors can push up inflation temporarily, but their aim is to maintain stability.

What is the current rate of inflation in the UK?

The current rate of inflation in the UK is 3% (as of January 2026). The latest rates can be checked on the Bank of England’s website.

This chart shows the UK’s historic inflation rates:

Different ways inflation can affect the economy

Aside from the standard types of inflation, there are a few related economic trends to know about:

Disinflation – when the rate of inflation in the UK falls, but prices are still rising in small amounts

Deflation – the direct opposite of inflation, deflation happens when the rate of inflation drops below 0%, making goods and services cheaper. Although this may sound like a good thing, it may have other effects on the economy. One such effect is that people may spend less because the value of money is high. Deflation generally encourages people to save rather than spend

Stagflation – this happens when there is no economic growth and unemployment is rising with inflation. This means people’s real wages (adjusted for inflation) may fall, even if their nominal wages stay flat

- Reflation – this signifies the start of an inflation cycle after a recession has occurred. It can refer to a growing economy in conjunction with rising prices of goods and services.

How do I beat inflation?

There’s no proven way to ‘beat’ inflation, but some people might shop around for products with competitive interest rates to make sure that their savings can at least keep pace.

At Raisin UK, our marketplace is home to savings accounts with competitive interest rates from a range of partner banks and building societies, including some with rates that are higher than inflation*. You can choose from:

Fixed rate bonds. Lock in a guaranteed interest rate for a set period, often giving the most competitive rates on longer-term savings.

Notice accounts. Savings accounts that require a brief period of notice (typically between 30 and 90 days) before withdrawals. They often have higher rates than easy access savings accounts.

- Easy access savings accounts. Withdraw anytime with no notice.

How does inflation affect savings?

Because inflation lowers the value of money over time, savings held in current or low-interest accounts can also be worth less (in real terms). To illustrate the effect: if your savings earn 1% interest but inflation is 3%, your money is not keeping up with inflation and is effectively losing value. Even if the amount in your account stays the same, you might not be able to buy as much in the future.

Learn more about the relationship between inflation and interest rates.

Apply for a Raisin UK Account today

It’s free to register for a Raisin UK Account, and, once registered, you can apply for any savings account in our marketplace.

You can:

Compare and choose from multiple UK partner banks and building societies in one place.

Apply for easy access savings accounts, fixed rate bonds, and notice accounts with competitive rates and no hidden fees.

Apply online in just a few clicks.

Manage your account securely through Raisin UK.

All partner banks are FSCS-protected, so eligible deposits are protected up to a limit of £120,000 per person, per bank.

Find out more about how Raisin UK works, or register now for free to start growing your savings.

FAQs about inflation

What is the difference between the CPI, CPIH, and RPI?

All three are indices for measuring inflation. CPI (Consumer Price Index) tracks prices of goods and services and is the UK’s main measure of inflation. CPIH (CPI including owner occupiers’ housing costs) adds housing costs and council tax. The RPI (Retail Prices Index) includes goods, services, and mortgage interest. The RPI is an older index and usually runs slightly higher.

When will prices go down in the UK?

Although inflation has come down since the highs of 2022, prices are still rising, just not as quickly. A few factors are at play. Rising energy costs are pushing up inflation in the UK. Food is also becoming more expensive. Prices are being pushed up by higher wholesale costs for items like beef and coffee, coupled with increased labour costs. As of August 2025, the Bank of England expects that inflation will increase slightly before falling back towards its 2% target**.

What is the formula to calculate inflation?

Inflation can be calculated as follows:

Inflation (%) = (current price − base price) ÷ base price × 100

Base price is the price in the past.

Example: A loaf of bread cost £1 in 2024 and £1.10 in 2025. Inflation = (1.10 − 1) ÷ 1 × 100 = 10, meaning bread prices went up 10% that year.

The Bank of England’s inflation calculator lets you see how much something in today’s money would have cost in years gone by.

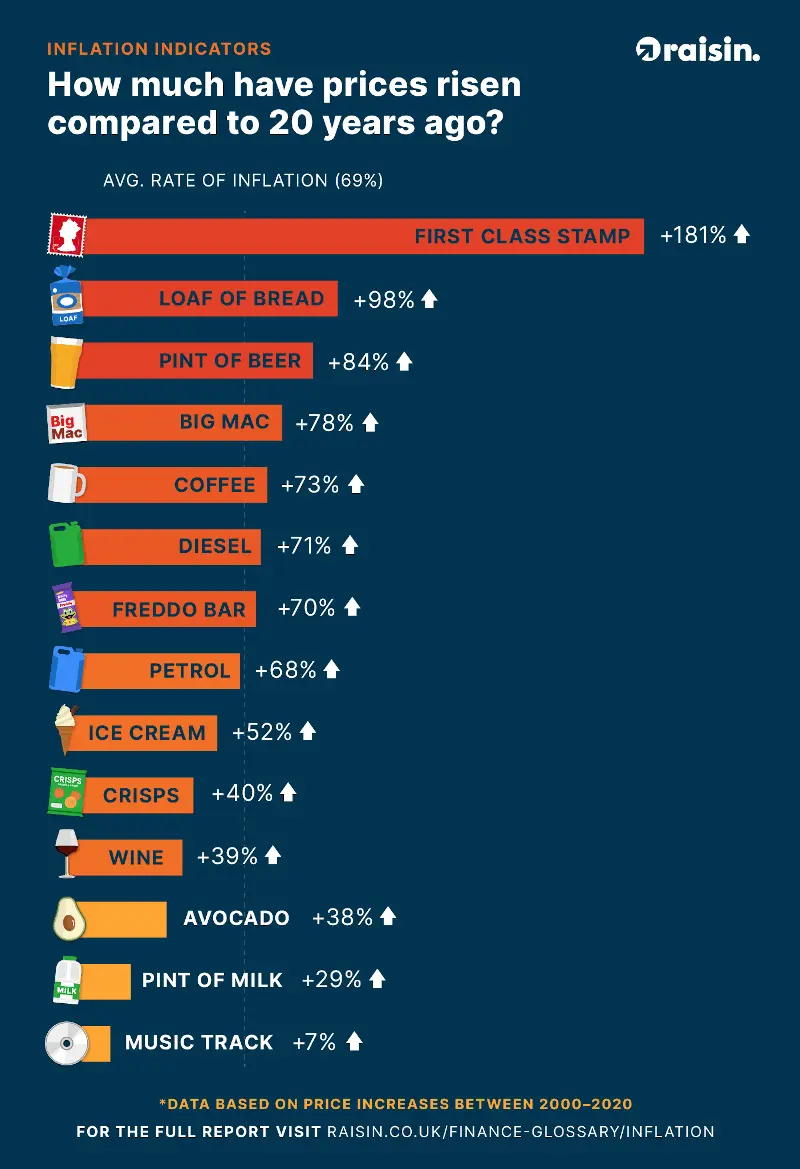

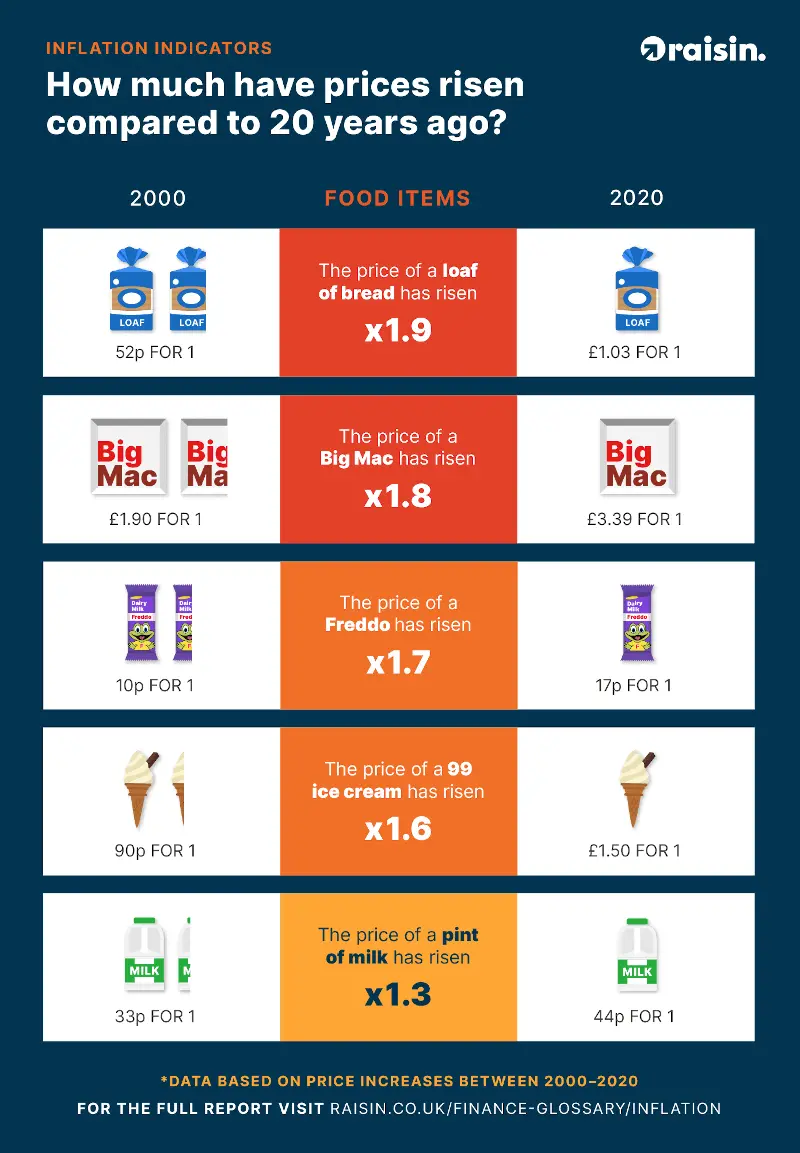

Inflation nation - how the price of everyday items has increased between 2005-2025

As the years go by, it’s not uncommon to see the prices of our favourite products rise to meet inflation. Goods and services that cost £10 in 2025 would have set you back just £5.62 in 2005. That’s an overall increase of around 78% over the past 20 years, according to Bank of England data. But just how many of our favourite products have risen above, inline or below the rising cost on average in the UK?

Is there anything more British than remarking on the price of a Freddo? Our research has revealed that the frog-shaped chocolate bar has doubled in price since the year 2005, and while it will still on average only set you back about 30p, that’s enough to earn the wrath of any snacking shopper.

But it’s not just the infamous amphibian that’s putting more pressure on people’s pockets. We look at how the cost of everyday items has increased over the past 20 years, showing how inflation is impacting our outgoings.

Our table shows how much inflation is costing us for everyday items

Stamps (First Class) | £0.30 | £1.70 | 467% |

Loaf of bread | £0.70 | £1.40 | 100% |

Pint of beer | £2.40 | £4.83 | 101% |

Big Mac | £2.29 | £5.09 | 122% |

Instant coffee (100g) | £1.70 | £3.85 | 126% |

Diesel | £0.93 | £1.42 | 53% |

Freddo | £0.15 | £0.30 | 100% |

Petrol | £0.90 | £1.37 | 52% |

99 ice cream | £0.99 | £2.64 | 167% |

Packet of crisps | £0.30 | £1.14 | 280% |

Wine (175ml) | £2.90 | £5.17 | 78% |

Avocado | £0.70 | £0.94 | 34% |

Pint of milk | £0.35 | £0.65 | 86% |

Note: The above information is based on available data and may vary over time. Always refer to the latest statistics for the most accurate information.

A loaf of bread will cost twice as much dough

In 2005, a loaf of white, sliced bread would only cost you 70p, but 20 years later, the price has doubled to £1.40.

Bread isn’t the only food to cost more to chow down on. The price of a Big Mac, once a tasty bargain at £2.29, will now cost fast food lovers £5.09 – a whopping 122% increase. A packet of crisps has also seen a 280% rise to £1.14), while a 99 ice cream doesn’t – as the name suggests – only cost 99p. The 2025 price is now a whole £2.64. Meanwhile, the demand for avocados has also impacted their price. A 34% increase has seen their cost shoot up to 94p, showing how changing tastes have brought about higher price margins.

How much for a pint?

Milk has seen an 86% increase. In 2005, you’d have had to pay 35p to take home a pint, while 20 years later the price has gone up to 65p. Pints of another kind, however, have fared far worse. In a pub two decades ago, you could have a big night out for under £20, with a pint of beer only costing you £2.40. The UK average has shot up since then, with pubs charging you £4.83 for their standard serving. Savings can’t be found anywhere else on the menu either. A 175ml glass of wine would have cost you £2.90 in the year 2005, but anyone looking for a drink now would have to hand over £5.17 – a 78% increase.

The price of fuel is now more than 50% higher

Filling up your car costs motorists thousands of pounds throughout the year, and the cost of getting from A to B is showing no signs of getting cheaper. A litre of diesel was only 93p 20 years ago, while it now costs drivers £1.42 at the pumps. Petrol, meanwhile, is close behind. A 52% increase has seen the price per litre go up from 90p to £1.37.

Protecting your money from inflation

With prices rising across the board, it’s easy to see how inflation can quietly eat into your spending power. One way to help your money keep pace is by putting it in a competitive savings account. Unlike cash left in a current account or under the mattress, money in a good savings account can grow over time and sometimes even outpace inflation.

By depositing your money in a savings account with a rate better than the rate of inflation, your money will become worth more over time. Savings accounts rates can fluctuate in line with the base rate, but at Raisin UK, you’ll find savings accounts featuring competitive rates, some of which are higher than inflation*.

Methodology

Using data from the ONS Retail Price Index and available information on historical prices, we’ve calculated the percentage increase in the price of these products from 2005 to 2025. Measured against the UK’s inflation rate (which has increased by 78%), we can determine if products are rising faster or slower than the average rate of inflation.

* At the time of writing (July 2025), the rate of inflation in the UK was 3.8% and the Raisin UK savings marketplace featured savings accounts with rates that exceeded this amount.

**https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2025/august/monetary-policy-report-august-2025.pdf

About us

Savings accounts

Guides

About us

Savings accounts

Guides

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time.

Raisin UK is a trading name of Raisin Platforms Limited which is authorised and regulated by the Financial Conduct Authority (FRNs 813894 and 978619). Raisin Platforms Limited is registered in England and Wales, No 11075085. Registered office: Cobden House, 12-16 Mosley Street, Manchester M2 3AQ, United Kingdom. The information on this website does not constitute financial advice, always do your own research to ensure it's right for your specific circumstances. Tax treatment depends on the individual circumstances of each customer and may be subject to change in the future.