How to open a savings account with Raisin UK

With your free Raisin UK account, you can open and manage savings accounts from over 40 partner banks and building societies. Here’s how to start saving:

1. Create your Raisin UK Account

- Visit raisin.com/en-gb and click Register.

- Enter your details and submit your application.

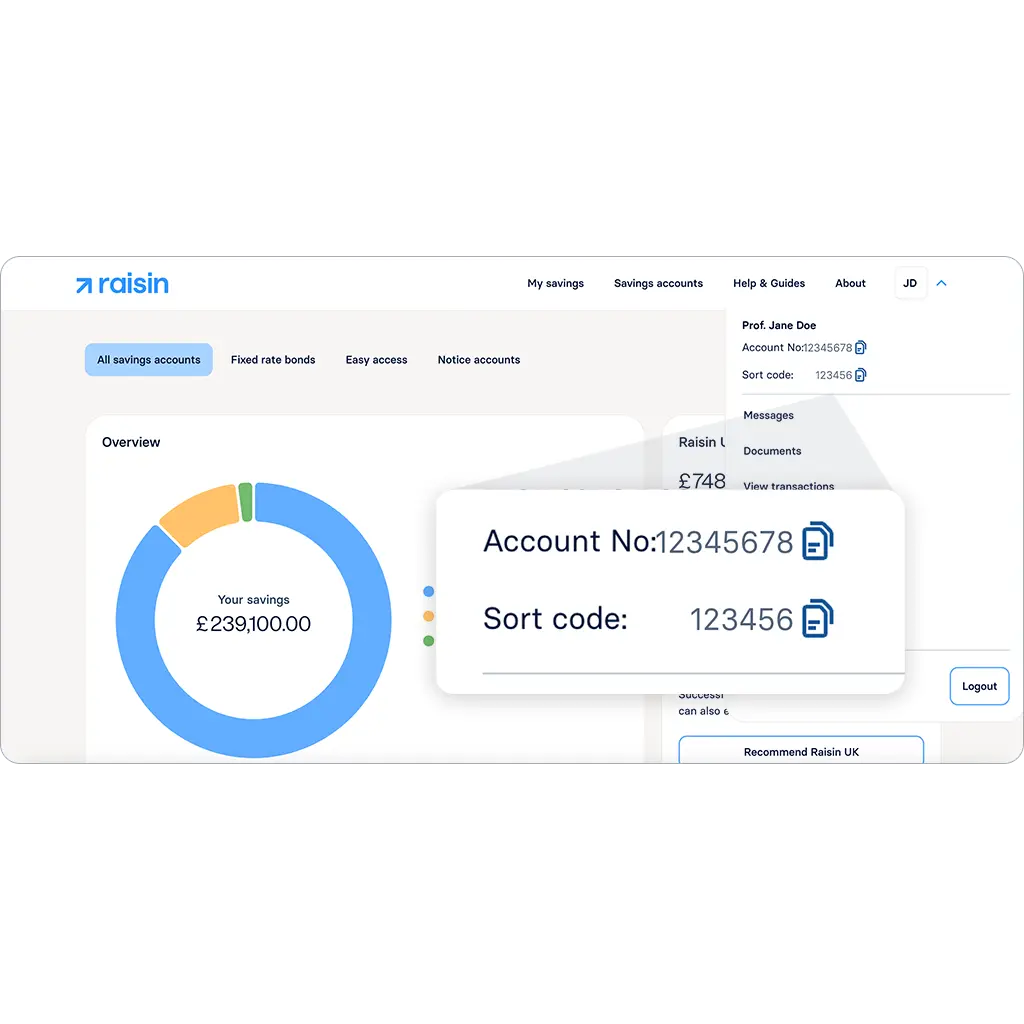

- Once approved, your Transaction Account details (sort code and account number) will appear on your dashboard. Keep an eye on your inbox; we’ll email you when your account is ready to use.

You can browse and apply for savings accounts before approval, but you can only fund a savings account when your Raisin UK Account is fully active.

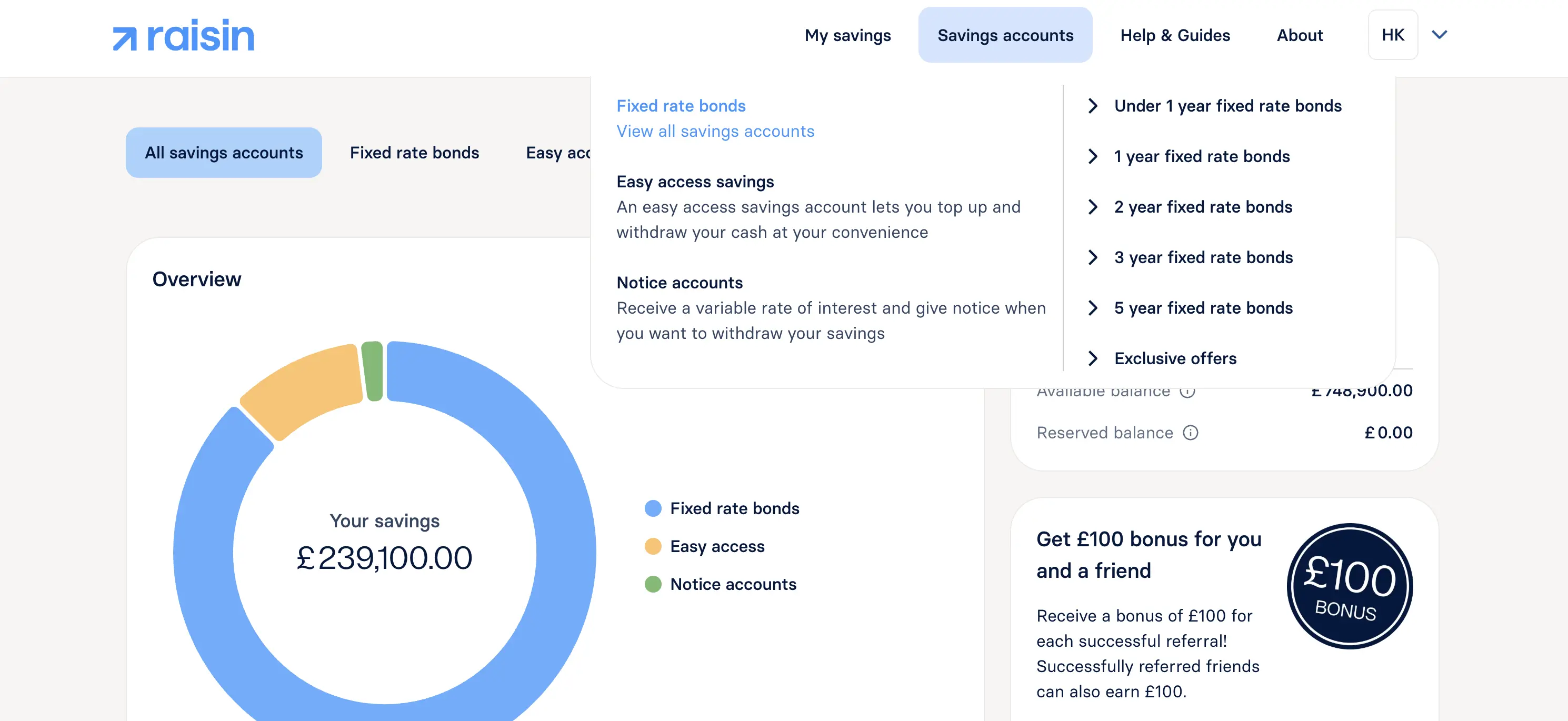

2. Explore savings accounts

After logging in, open your Dashboard and select Savings accounts.

Here you’ll find the full range of savings accounts on offer, including:

- Fixed rate bonds: lock in a rate for a set term

- Easy access accounts: withdraw whenever you need

- Notice accounts: withdraw your funds after an agreed notice period

Our offer table lets you compare interest rates, view accounts with different terms and see how much interest you can expect to earn.

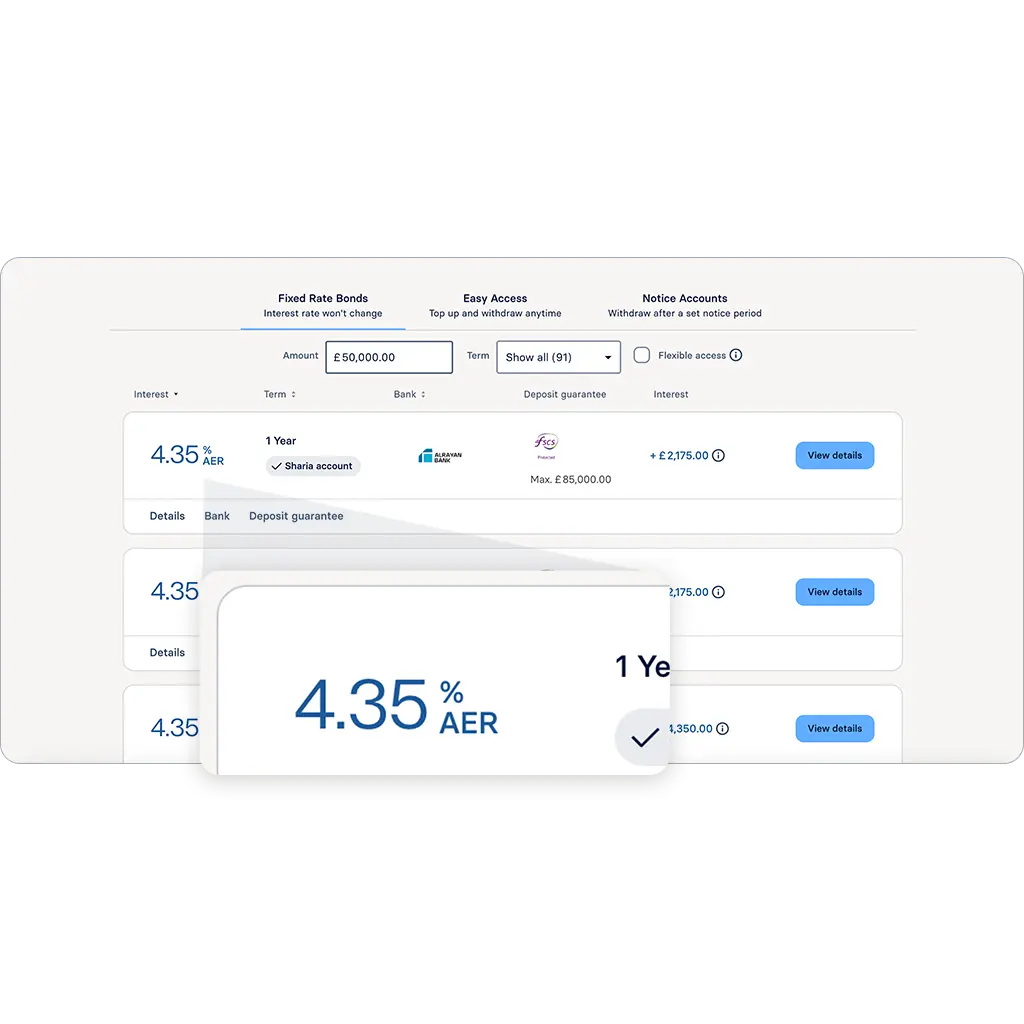

3. Select an account and review details

Select the account you want to open. When you select an account, you’ll find a dedicated page with these details:

- Interest rate

- Deposit limits (such as minimum investment)

- Withdrawal terms

- How interest is paid

After reviewing these details, click Order now.

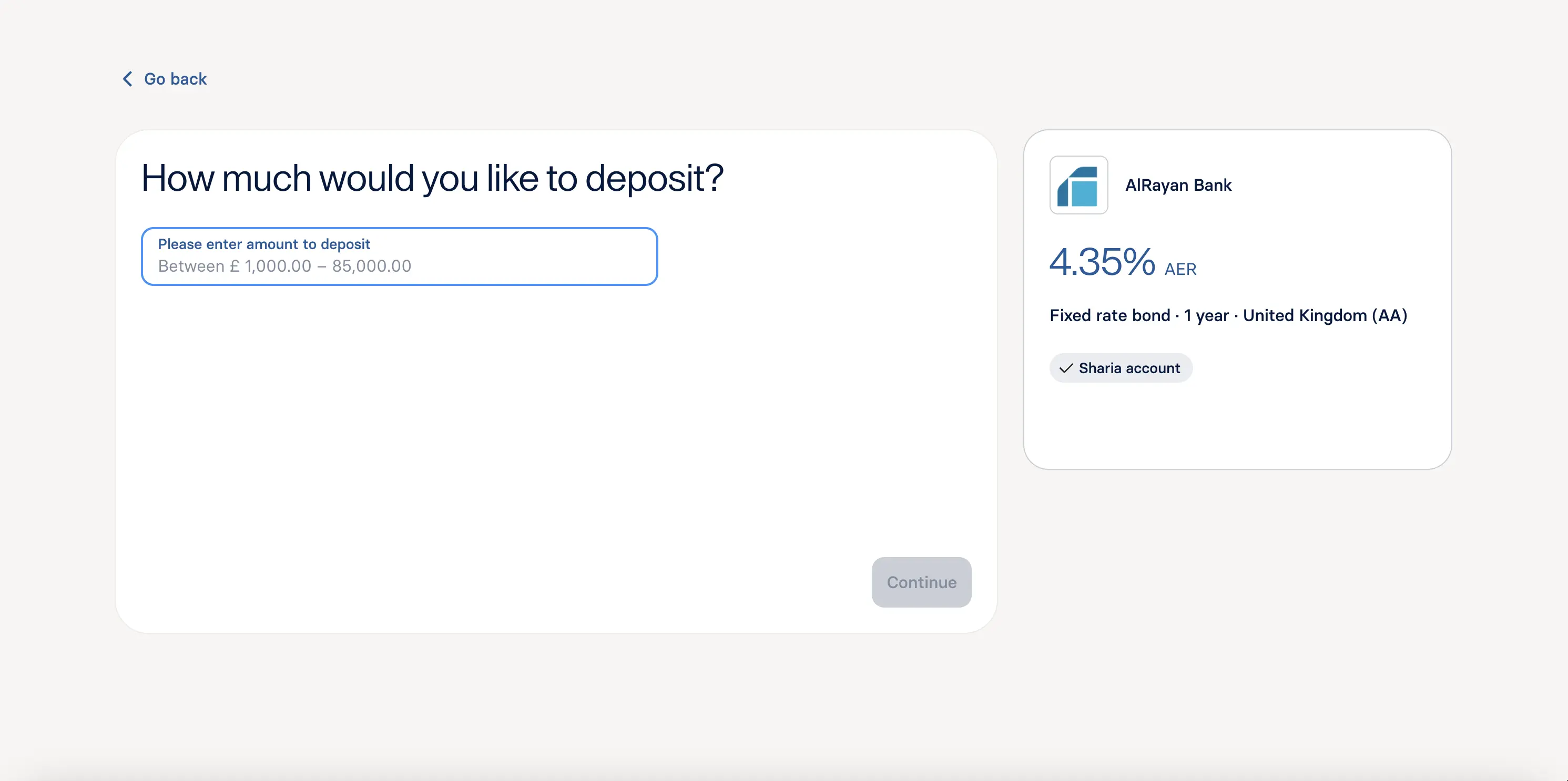

4. Enter your deposit amount

Choose how much you want to deposit into your account. Most accounts have a minimum investment amount (between £100 - £1,000, depending on the account) and a maximum investment amount of £85,000, the protection limit covered by the Financial Services Compensation Scheme (FSCS).

- Deposits into fixed rate bonds are set for the agreed term, which means you can’t top-up or withdraw before maturity.

- You can top-up and withdraw from easy access accounts as needed (but keep the minimum withdrawal and top-up amounts in mind).

If you want to change the amount you’ve deposited after submitting your application, you’ll need to cancel the deposit before it’s confirmed. You can do this by logging into your Raisin UK account, opening the relevant deposit and selecting Cancel.

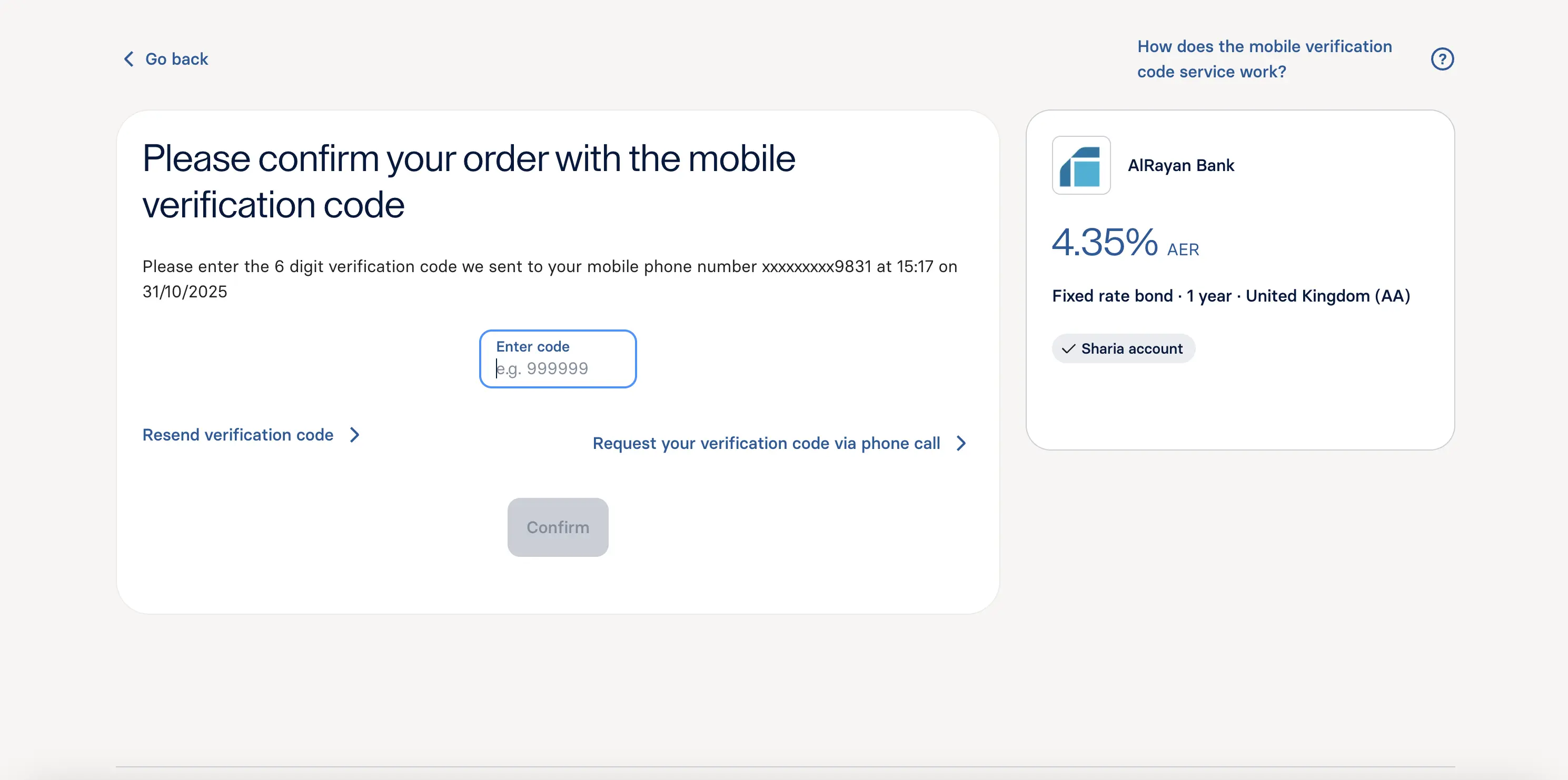

5. Confirm and verify

- Read and tick the terms and conditions for your chosen savings account.

- Enter the six-digit code sent to your mobile phone to confirm your application.

Your account setup is nearly complete.

6. Transfer your deposit

Transfer your funds from your Nominated Account to your Transaction Account via Faster Payments bank transfer (using your online banking or app). You’ll find your Transaction Account details on your dashboard.

Remember:

- Only transfer from your nominated bank account

- Use the same name registered in your Raisin UK Account

Funds typically appear within a few minutes of a transfer.

7. Application review and confirmation

Once your deposit is received, we’ll process your application. Most accounts open within two business days. You’ll receive an email as soon as your savings account is active.

Some things to keep in mind

You might find the following information about applying for a savings account at Raisin UK useful:

Additional information

You may need to provide additional identification, such as a scan of your passport when applying for some savings accounts. We will let you know if this is the case.

Funding window

You have a funding window (typically 60 days) within which to fund a fixed rate bond through our marketplace. You don’t have to transfer your full deposit amount to your Transaction Account in one go, but if you don’t transfer the full amount you asked to deposit within the funding window, your application will be cancelled and any funds you’ve transferred will remain in your Transaction Account.

Amending your application

You can’t change the deposit amount you entered when applying for a savings account once you’ve applied, but you can withdraw your application and start a new one with a different deposit amount. Please be aware that once you’ve transferred the full deposit amount, your application will be sent to the partner bank. Once a fixed rate bond savings account has been sent to a partner bank for review, you cannot cancel your application or close your savings account unless there are exceptional circumstances, as explained in our terms and conditions.

Want to know more?

Have you found the information that you’re looking for? Please read our FAQs, where you will find further information, or read more of our guides.

About us

Savings accounts

Guides

About us

Savings accounts

Guides

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time.

Raisin UK is a trading name of Raisin Platforms Limited which is authorised and regulated by the Financial Conduct Authority (FRNs 813894 and 978619). Raisin Platforms Limited is registered in England and Wales, No 11075085. Registered office: Cobden House, 12-16 Mosley Street, Manchester M2 3AQ, United Kingdom. The information on this website does not constitute financial advice, always do your own research to ensure it's right for your specific circumstances. Tax treatment depends on the individual circumstances of each customer and may be subject to change in the future.