How Raisin UK works

What will I need?

In order to register with Raisin UK, you will need to provide some information about yourself such as your name, address, date of birth and National Insurance number. In some cases, you may have to provide further identification (e.g. a scan of your passport).

To apply for an online savings account, you need to be aged 18 or over and have a valid email address and mobile phone number. You’ll also need to provide details of the bank or building society account (including your account number or sort code) from which you plan to fund your account.

Your money journey

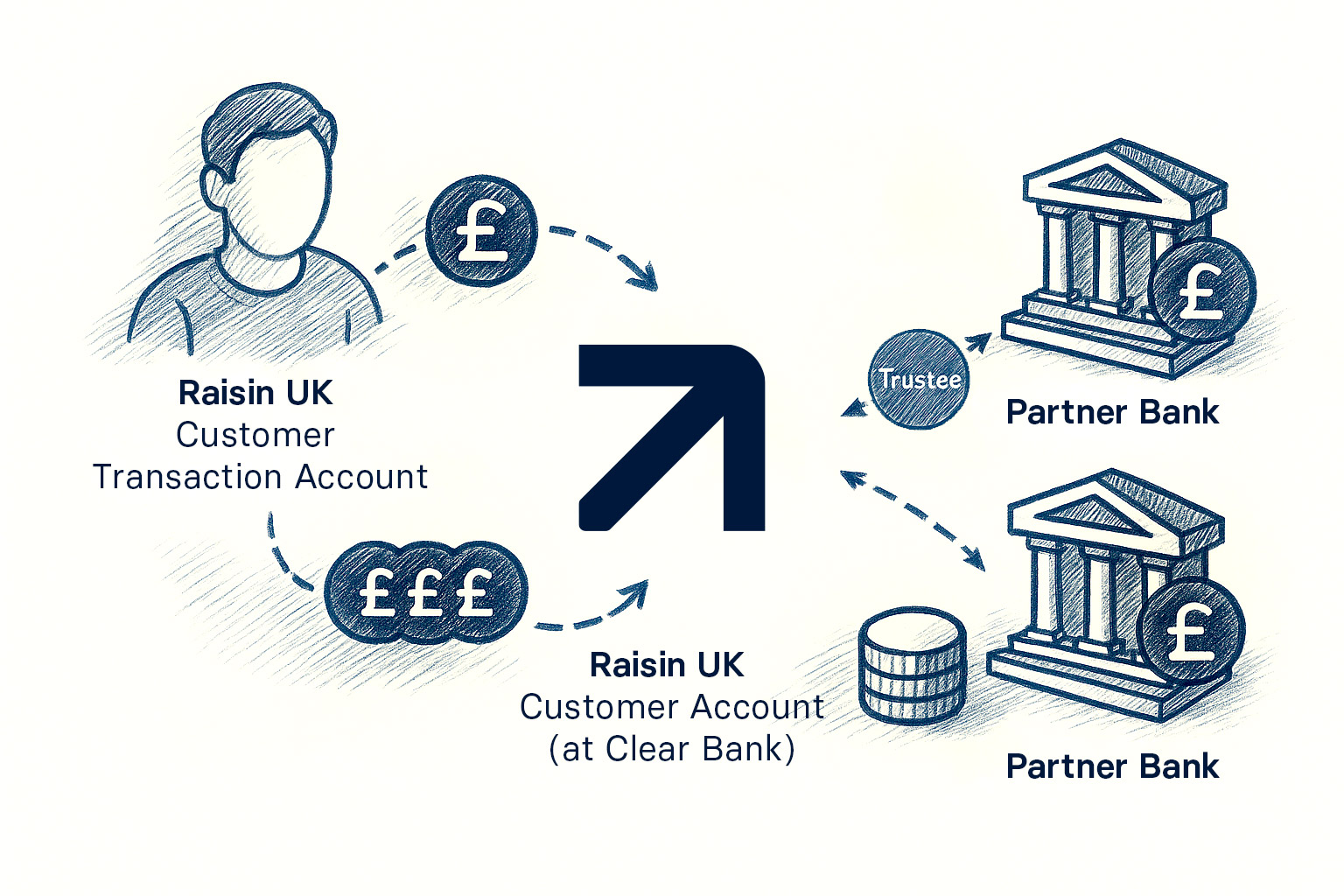

This diagram shows the journey of your money from your bank or building society account to a savings account:

Your money’s journey begins when you transfer funds from your Nominated Account to your Raisin UK Transaction Account, held at ClearBank.

When you place a deposit with one of our partner banks or building societies, the funds are transferred to a bare trustee (Raisin Platforms Limited) or may be transferred directly to your chosen partner bank.

When you choose a product with a partner bank that uses a bare trustee, Raisin Platforms Limited will place the money you wish to invest into your chosen partner bank's savings account and will return your money, along with any interest or profit, to you on maturity. Raisin Platforms Limited has no claim to your funds and administers them on your behalf while providing this service.

To learn more about this process, and the role of trustees, please read our FAQs.

Safe

We’re authorised and regulated by the FCA, and we only work with banks that are protected by the FSCS or the European equivalent scheme

Competitive

We offer rates from over 40 partner banks and building societies

Straightforward

Say goodbye to application forms, endless logins and hidden fees with our easy, free-to-use service

Learn more about your savings

We want you to make informed decisions about your savings, which is why we give everyone access to our growing collection of savings guides, which includes advice on how to get the most out of Raisin UK.

Peace of mind with deposit protection

Knowing that your savings are safe is priceless, which is why deposits made into every savings account offered by our UK based partner banks are protected by the Financial Services Compensation Scheme (FSCS), up to £85,000 per person, per bank.

Savings accounts offered by our partner banks based in other European countries are protected by the their country's relevant Deposit Guarantee Scheme (DGS).

How we make money

We earn an intermediary fee from our partner banks, who pay us for every savings account opened through our marketplace, which is why our savings service is free to use. We don’t earn money while deposits transfer to savings accounts.

Raisin UK and ClearBank

ClearBank provides your Raisin UK Transaction Account, which allows you to transfer money between your Nominated Account and your Transaction Account in order to open savings accounts on the Raisin UK marketplace.

Deposits held in the Raisin UK Transaction Account (powered by ClearBank) are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000, subject to eligibility. Please note that the £85,000 FSCS protection limit applies to all eligible deposits held at the same bank, so any other products/services you hold with ClearBank will count towards the protection limit and may limit the amount protected in your Raisin UK Transaction Account. You can view the other deposit providers with accounts using ClearBank's banking licence on this page: https://clear.bank/fscs-protection. To find out more about the FSCS, visit https://www.fscs.org.uk/about-us/.

Want to know more?

Please read the FAQs below if you want to know more, or visit our FAQs page where you’ll find answers to our most frequently asked questions.

- General information about Raisin UK

- Your Transaction Account

- Applying for savings accounts at Raisin UK