Great British Savings Report

Insights into the UK savings landscape and barriers to financial security.

Welcome to Raisin’s Great British Savings Report – our annual barometer of the nation’s money habits.

Each year we ask people across the UK how they save, what they are aiming for, and where they feel the squeeze most.

This year, the findings come against a shifting backdrop. ISA allowances are frozen until 2030. After hitting a sixteen year high in 2023, the Bank of England has started to reduce interest rates. Inflation has eased but is still above target. Together these pressures shape how households are saving, spending and planning.

In this report, you’ll learn more about:

- The national mood around saving and confidence

- How many people are raiding pots to pay bills

- Who is taking advantage of ISAs, and who isn’t

- Why some prefer to lock in, while others want easy access

- Generational and regional differences across the UK

Taken together, these insights form an annual snapshot of Britain’s savings culture – its strengths, its gaps and the opportunities to build resilience.

Methodology

This report is based on a comprehensive survey of 4,000 British adults, conducted in September 2025. The survey covered various aspects of saving habits, financial goals, and attitudes towards different savings products and institutions. Additional data from external sources has been incorporated to provide a broader context to our findings.

How do Britons feels about their financial situation?

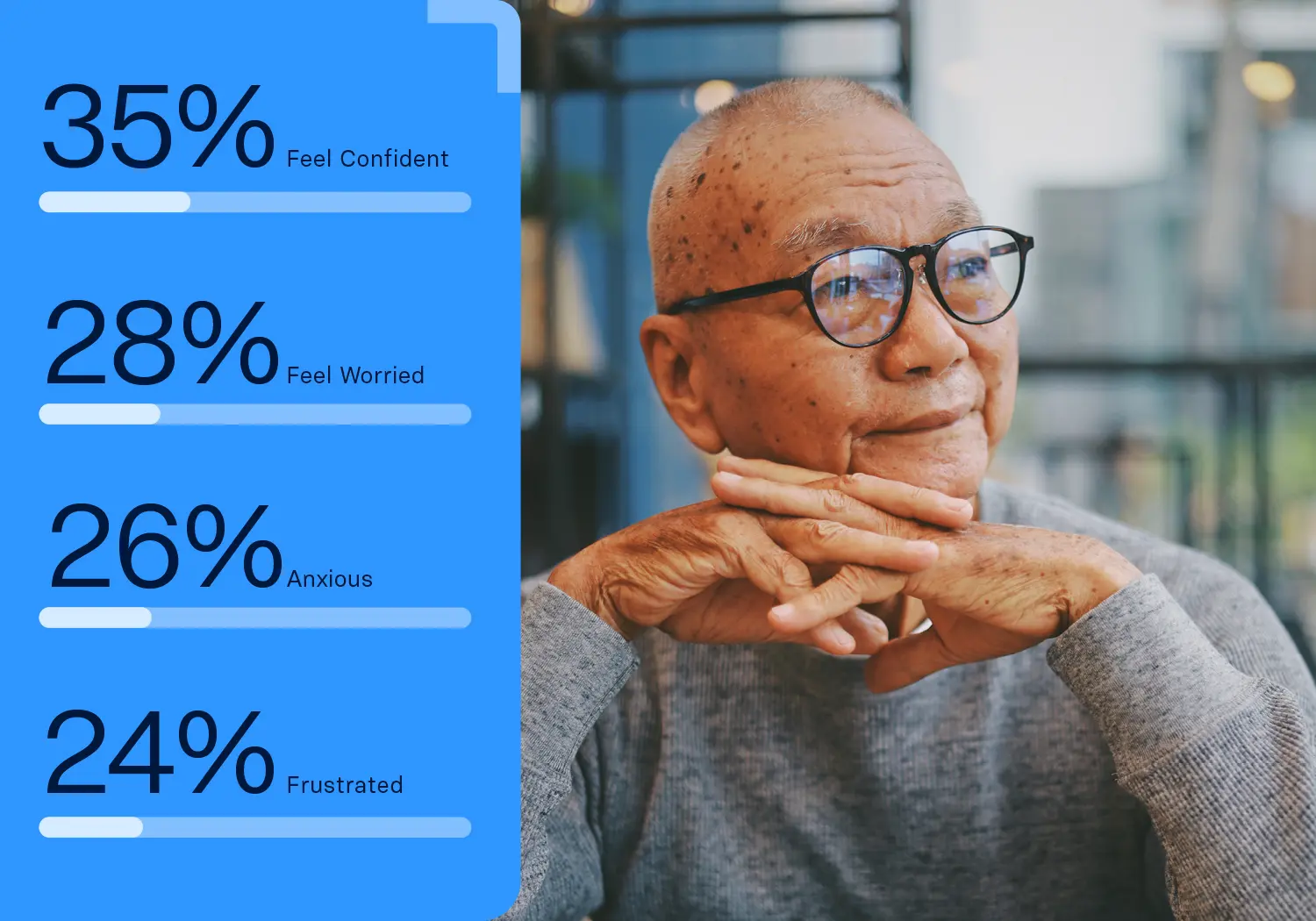

When we asked people how they felt about their savings, the answers revealed a nation that is divided and often conflicted.

Many feel vulnerable when it comes to money.

- Only 35% feel in control and confident about their savings

- 28% feel worried

- 26% feel anxious

- 24% feel frustrated

This sense of financial vulnerability is echoed by wider data, with the Office of National Statistics reporting that over two fifths (42%) cite financial issues among their top recent worries.

How many Britons dip into their savings?

60% of Britons dipped into their savings last year. Here are the main reasons why:

- 20% used savings to pay day-to-day bills

- 19% paid for travel and holidays

- 15% covered unexpected household repairs

- 6% covered existing debts

The regional picture reveals sharper contrasts. In Cardiff, 41% of savers dipped into pots for bills, double the national average (20%). This highlights how uneven the cost-of-living impact has been across the UK.

The data underlines the dual nature of Britain’s savings story. While some are putting money aside for holidays and long-term goals, others are forced to spend savings on essentials.

How many Britons have idle savings?

Despite a year of relatively high interest rates and growing awareness of tax allowances, more than half of savers simply left their money where it was.

Among those who did transfer their savings into an ISA, the most common transfers were between £1,001 - £4,999 (17%).

The average savings transfer was £4,287, but this figure is inflated by a smaller group moving larger sums. Most savers didn’t move their money at all.

What is the potential cost of leaving your savings idle?

With over £116 billion in fixed-rate savings set to mature in 2025, many accounts default to easy access rates of around 2.5% from the 4.5% many savers are used to. That’s potentially £2.3 billion in lost interest across the country in the next 12 months.

This pattern is well known. The Financial Conduct Authority review of the cash savings market found that many customers remain in low-paying accounts because of “loyalty bias” or lack of awareness.

Why do people leave their savings idle?

For some, it is a matter of confidence – uncertainty about how to move money safely. For others, it is simply a lack of time or motivation. The habit of staying put is strong, even when the rewards for moving are clear.

The gap between the active minority and the passive majority is striking. Those who moved funds last year tended to benefit from higher rates and better terms. Those who did not potentially missed out on hundreds of pounds in extra interest. With inflation still higher than the Bank of England’s 2% target, failing to act risks eroding savings in real terms.

How do Britons save their money?

ISAs

ISAs offer a tax-efficient way to save, with no tax on deposits up to £20,000 per year. Despite this, the majority of our respondents didn’t move any money into an ISA over the past year. 17% moved between £1,001 and £4,999.

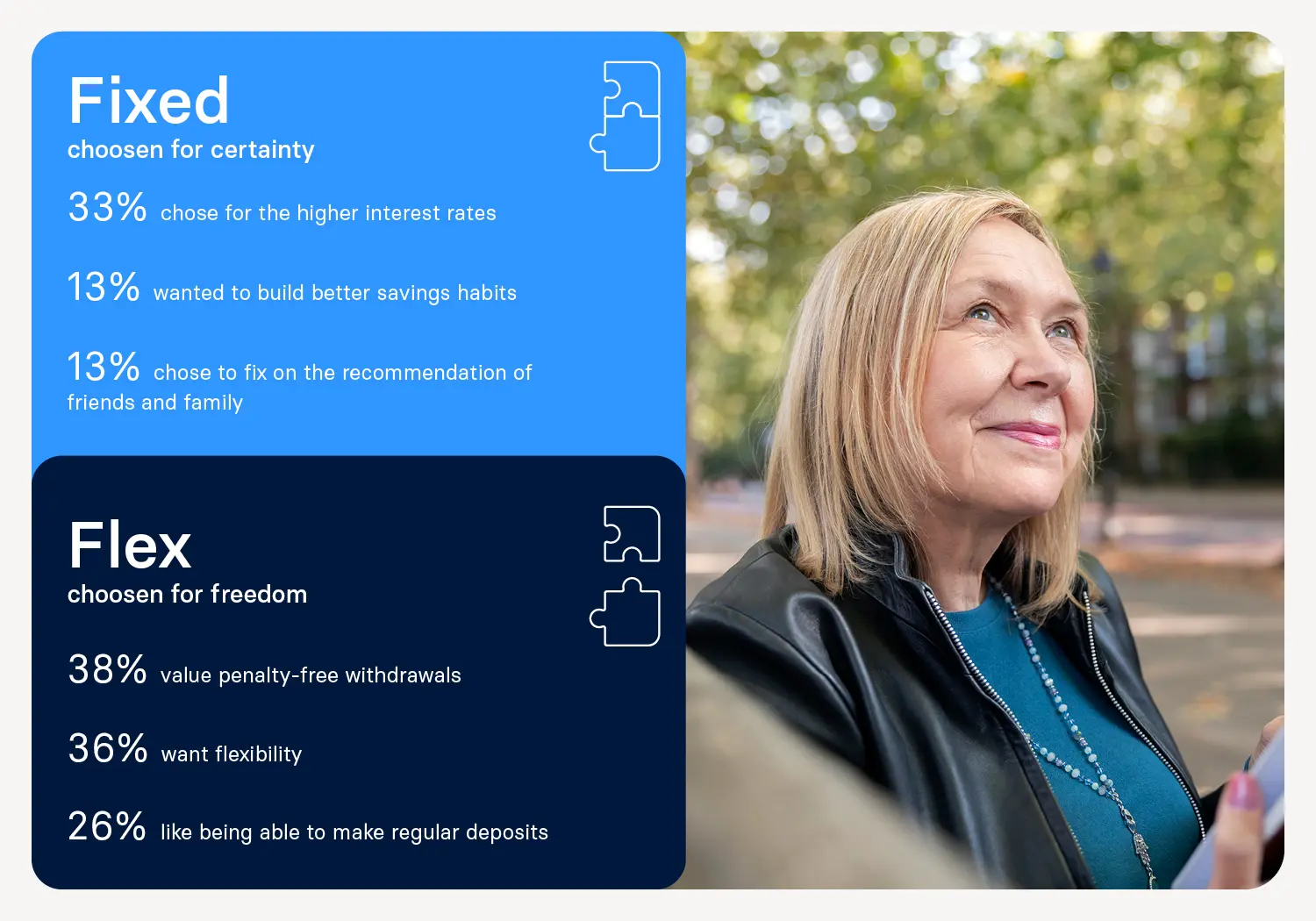

Fixed or flexible?

Almost six in ten (59%) like fixed-term accounts because of the higher interest rates compared with easy access. Among easy access users, 38% value penalty-free withdrawals, 36% want flexibility, and 26% like being able to make regular deposits.

Choosing a savings account

41% chose their savings account on the same day they found it, suggesting a lack of in-depth research on the options available.

35% admitted to skimming the terms and conditions of their account, with 12% not understanding how their account worked. One in ten savers said they missed out on benefits because they skimmed the small print.

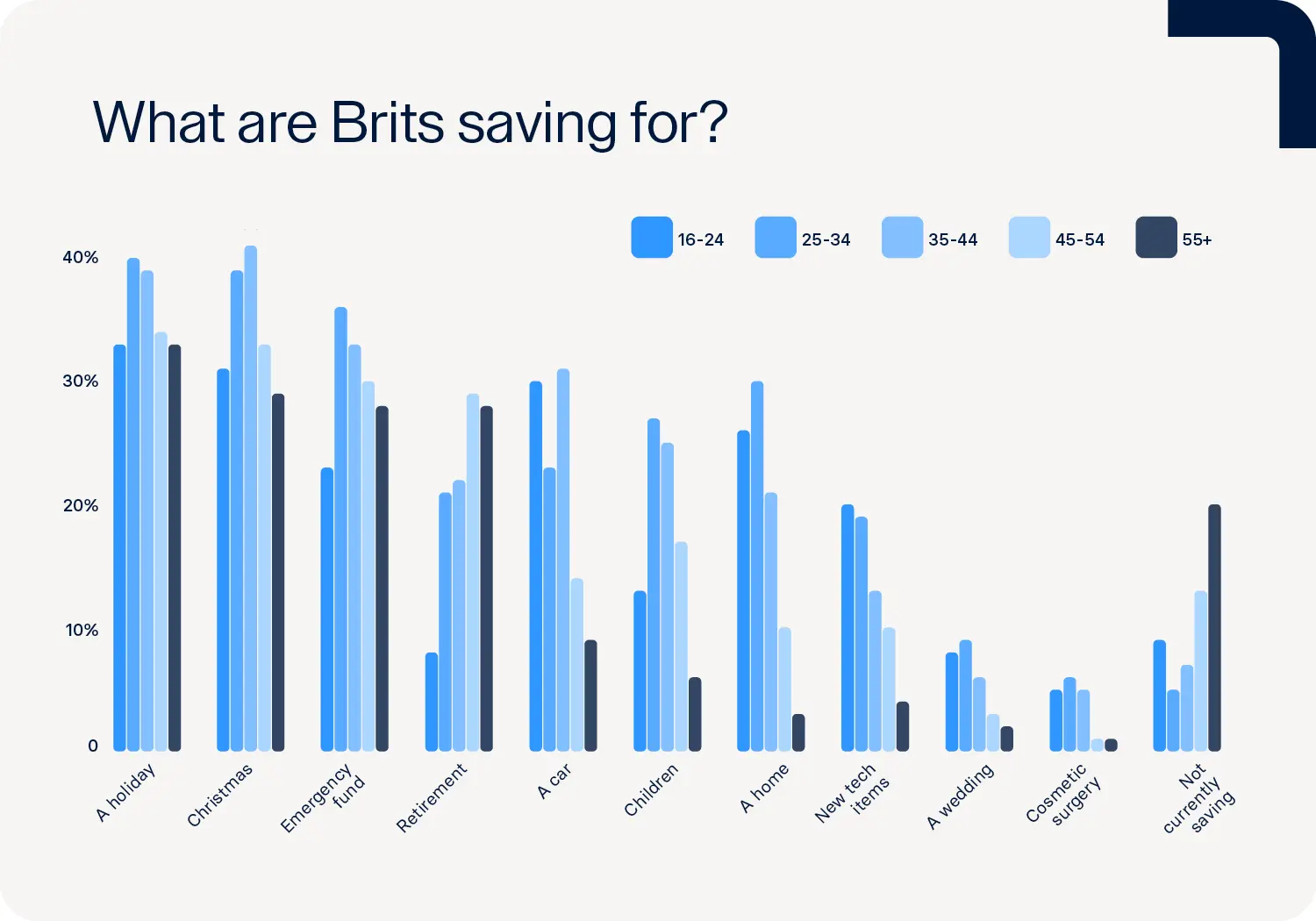

What are Britons saving for?

- 31% save for holidays

- 30% save for emergencies

- 23% of 18-24 year olds are saving for a house deposit

- 32% of over-55s are saving for retirement

Our research found that, unsurprisingly, younger savers focus on more aspirational savings goals such as holidays and homeownership. Older savers are more focused on security, with their main focus on retirement and rainy-day funds.

How do Britons learn more about finance?

While many of our survey respondents had different viewpoints on saving, there was one topic most agreed on - our children should learn more about money at school. 76% felt that schools should teach more about money, helping to give children the skills and confidence they need to manage their finances in the future.

With most Britons feeling they didn’t learn enough about money at school, they’ve turned to alternative sources of education. 30% rely on advice from banks, with 25% turning to friends and family, 20% talking to financial advisors and 20% relying on comparison sites.

Interestingly, younger generations are turning to social media and AI for financial information. Over one in 10 have turned to ChatGPT for guidance, while 8% get money tips from TikTok.

How do UK regions differ in savings habits?

Britain isn’t a single savings market. There are many, with sharp differences across cities and regions. These local quirks show how culture, cost of living and confidence shape habits in very different ways.

- Cardiff: 41% of savers dipped into pots to cover bills, compared with 20% nationally.

- Belfast: 36% said they use easy access accounts simply ‘to build the habit’, far higher than the 8% national average.

- Glasgow: 55% chose their savings account on the same day they found it, versus 41% nationally.

- London: Savers in the capital were the most likely to move larger sums into ISAs, with a significant cluster reporting transfers of over £10,000.

- Manchester: Residents were more likely than average to save for holidays (36% vs 31%).

- Birmingham: Households here were more likely to dip into savings for healthcare costs (7% vs 5% nationally).

- Leeds: Savers showed above-average confidence, with 42% saying they feel in control of their money compared with the 35% national figure.

Revisiting the Great British Savings Report 2024

Did you know that up to a third of Brits (34%) have either no savings or less than £1,000 in a savings account? This equates to around 22.8 million people with very little or no money to fall back on, with under half (47%) of 18-24 year-olds having less than £1,000 in their savings account. In reality, savings habits and financial security vary greatly across age groups. With the rising cost of living, it’s no surprise that saving money can feel like an uphill struggle, especially for younger adults. But no matter your age or situation, there are ways to build better habits that can help you save more effectively.

This report lays bare the financial divide between generations, highlighting a sharp disparity in security and savings. Adults 55 and older generally feel more financially stable, having had decades to accumulate savings and tackle major expenses like mortgages. However, even this group isn’t safe from economic threats—rising inflation and skyrocketing living costs are steadily eroding their nest eggs.

In stark contrast, younger generations, especially those under 35, are struggling just to get by. For many, long-term financial goals like retirement seem distant, if not impossible. The grim reality? A staggering 34% of Brits have either no savings or less than £1,000 in their accounts—that’s roughly 22.8 million people without a meaningful financial safety net. Among 18-24-year-olds, nearly half have under £1,000 saved, underscoring just how hard it is for them to put money away for the future.

With the rise in living costs, saving has become a daunting challenge for younger adults. Yet, no matter the age or financial standing, there are ways to develop stronger habits that can lead to better financial security. The time to act is now before the gap widens even further.

Saving goals across generations

As we go through different life stages, our financial priorities naturally shift, and understanding these changes can significantly improve savings habits. Younger adults often focus on saving for big, immediate purchases, while older generations prioritise long-term financial security.

Across the UK, holidays (35%) and Christmas (34%) top the list of savings goals, particularly among adults aged 35-44, who are juggling family life and major life events.

However, saving for retirement - a more serious long term goal - still falls surprisingly low on the list of priorities. Overall, just 23% of Brits are actively putting money aside for retirement4. Among those who are in full-time work, only 31% are saving with retirement in mind, with men slightly more focused on this goal than women (26% vs. 20%).5

But what’s even more surprising is that the percentages don’t significantly improve as people near retirement age. Only 22% of those aged 35-44 are saving for retirement - a time when reality should start hitting home. For those aged 45-54, it’s only slightly better at 29%, and by 55+ it levels off again at 28%.

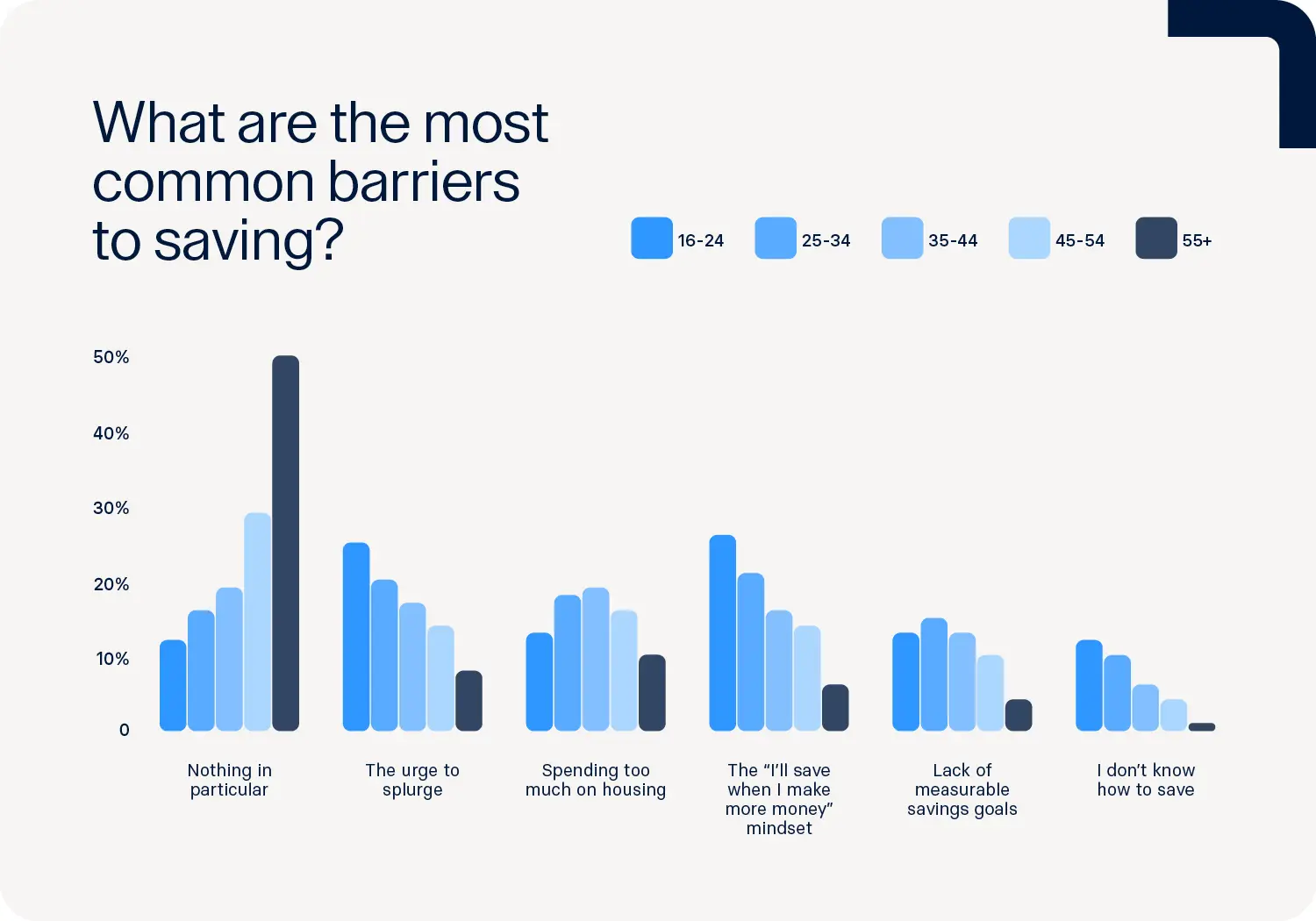

Barriers to saving and confidence in financial security

A key question is: What stops people from saving more? Rising living costs, unexpected expenses, and the occasional temptation to splurge are common barriers. But the reasons vary across age groups.

Younger adults are in the toughest spot. They’re drawing their savings over six times a month—three times more often than those over 55.9 This constant dipping disrupts their ability to build a safety net. A staggering 25% of under-25s blame impulsive spending for their financial struggles, compared to just 8% of those 55 and older.10

The numbers are clear: only 12% of young adults report having no major barriers to saving, underscoring the lack of financial discipline and growing difficulties they face in getting ahead.

And confidence? It’s shaky. While 71% of Brits feel somewhat confident about hitting their savings targets, only 21% feel truly secure. Even older adults aren’t immune—despite having 10 times more savings than 18 to 24-year-olds, concerns about inflation and skyrocketing costs weigh them down. The pension pot needed for a basic standard of living has soared from £68,300 to £107,800 in just three years. Rising financial pressures are squeezing everyone, but for younger generations, the outlook is especially grim.

Savings habits and mistakes

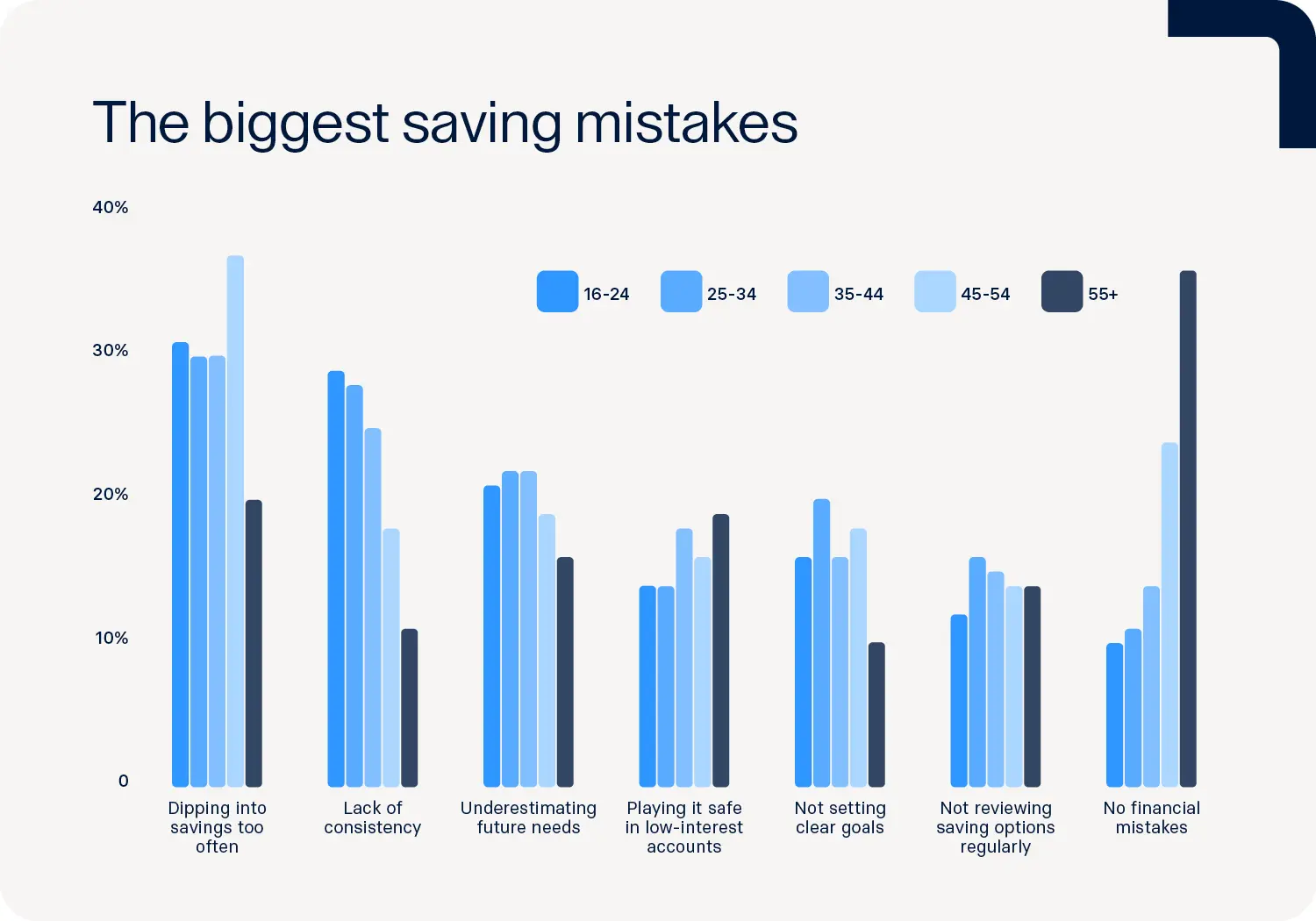

We all make mistakes with our savings, but learning from them can help you make smarter financial choices. Across the board, the most prevalent misstep is dipping into savings too frequently. This impacts a quarter of Brits (26%), particularly younger individuals, with 31% of those aged 16-24 dipping into their savings frequently.

Older adults tend to avoid this mistake but face a different challenge: playing it too safe. About 19% of those aged 55+ report keeping their money in low-interest accounts, which can be detrimental in the long run, especially with inflation eating away at purchasing power. In fact, with an estimated £253 billion of money sitting in people’s bank and building society accounts paying no interest, many older savers in particular are seeing their hard-earned money slowly diminish over time. Moreover, a significant portion of this group (14%) also admits to not regularly reviewing their savings options, which can lead to missed opportunities for better returns.

Another substantial pitfall is the issue of forgotten or lost funds. Across the UK, an estimated 20 million people have unclaimed money, totalling up to £82 billion.24 This includes 4.8 billion unclaimed pension pots worth £50 billion and around £2 billion in unclaimed Child Trust Funds. Forgotten savings accounts, investments, and other financial products also contribute to this figure. These dormant assets underscore the importance of keeping track of all financial accounts and checking in on investments regularly to ensure they are actively working for you.

The impact of inflation and rising costs

Inflation and rising costs remain major concerns for all Brits. Nearly four in 10 (37%) cite these factors as primary reasons for dipping into savings. For adults aged 55+, inflation often means relying more on savings to cover day-to-day expenses (30%), while younger savers prioritise financial buffers.

Financial stress remains a significant issue, particularly as people approach retirement. 71% of those aged 35-44 express concerns about their financial future - suggesting that worries about long-term stability peak in midlife.28 Although the rate of financial stress is lower among the 55+ group at 46%, this still represents nearly half of older adults feeling financially strained, a sobering figure considering they have less time to adjust or make up for financial shortfalls.

Generational views on financial institutions and savings products

Preferences for financial institutions and savings products vary significantly across generations. Factors such as trust, convenience, and financial education influence this diversity.

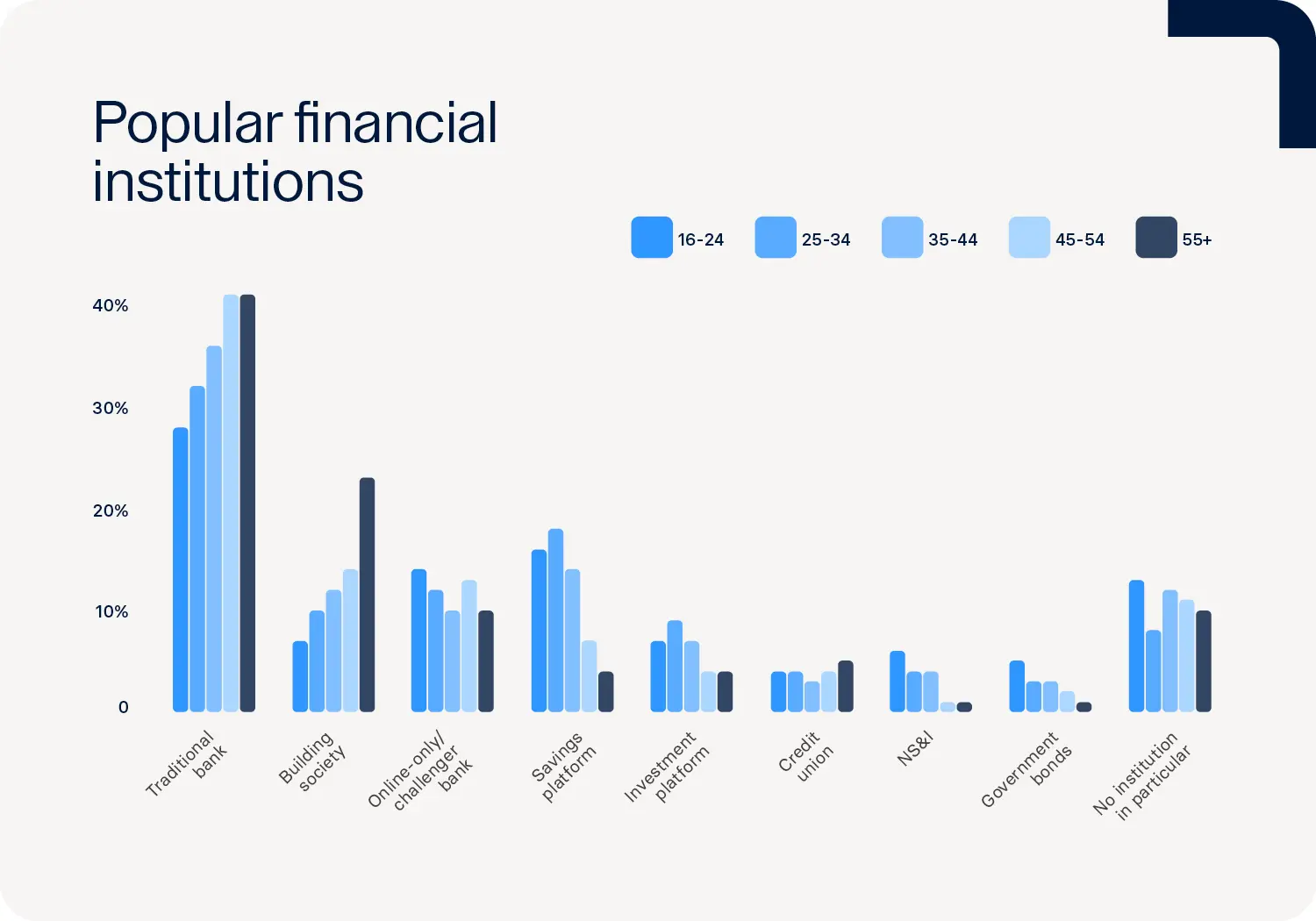

Traditional banks remain the most popular choice for savings accounts overall, with over one-third (37%) of Brits using them. Older generations often prefer traditional banks and building societies, valuing the stability and familiarity they offer. Meanwhile, younger savers (16-24) are more inclined towards online-only banks, with 14% preferring digital solutions compared to just 10% of those aged 55+.31 Savings platforms are particularly popular among the 25-34 age group (18%), highlighting that younger savers are more inclined to embrace online-only banks and savings platforms.

This generational shift reflects growing comfort with digital finance and a desire for convenience and competitive rates.

A significant barrier to saving is a lack of trust in financial institutions, which is especially prevalent among younger demographics. Around a quarter (26%) of respondents without a savings account cite distrust in banks, with 39% of those aged 25-34 specifically highlighting this as an issue.

.jpg&w=3840&q=75)

The psychological side of savings

How do your finances make you feel? Psychological factors play a huge role in how people save, influencing stress levels, confidence, and financial behaviour. Younger adults, particularly those in their 30s, tend to experience high levels of financial stress. This is sometimes due to the overwhelming complexity of savings and investment options. In contrast, older adults tend to report less stress and greater confidence in their savings decisions.

While almost two-thirds of Brits (58%) feel stressed about their financial future, this figure drops to just under half (46%) among those aged 55+, compared to a high of 71% for those aged 35-44. Interestingly, only 43% of respondents believe their savings habits improve their quality of life, with older adults less likely to feel overwhelmed by their investment choices, with only 42% feeling this way compared to 68% of those aged 25-34.

How to build better savings habits

Building strong savings habits is essential for long-term financial security, but consistency and discipline can be difficult. Three-quarters of Brits (74%) are motivated by setting clear savings goals, but many struggle with common pitfalls, like dipping into savings too often.

The most frequent mistake is withdrawing money too often - over a quarter (26%) of Brits admit to this. Younger savers are particularly prone to this issue, with 31% of those aged 16-24 reporting frequent withdrawals. Older adults (55+), while often more disciplined, face other challenges, such as keeping their money in low-interest accounts, which can limit growth, particularly during periods of high inflation.

Conclusion: a path to financial security

Each generation faces unique challenges when it comes to saving, but understanding these barriers and opportunities allows you to better tailor your approach. Essentially, saving successfully means adapting your strategy to your life stage.

With the right tools and strategies, Brits of all ages can achieve financial security. By setting clear goals, staying consistent and regularly reviewing your progress, you can overcome obstacles and build a secure financial future.

About us

Savings accounts

Guides

About us

Savings accounts

Guides

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time.

Raisin UK is a trading name of Raisin Platforms Limited which is authorised and regulated by the Financial Conduct Authority (FRNs 813894 and 978619). Raisin Platforms Limited is registered in England and Wales, No 11075085. Registered office: Cobden House, 12-16 Mosley Street, Manchester M2 3AQ, United Kingdom. The information on this website does not constitute financial advice, always do your own research to ensure it's right for your specific circumstances. Tax treatment depends on the individual circumstances of each customer and may be subject to change in the future.