Savers have earned up to 50% more with Raisin UK*

Now protected up to £120,000 per person, per bank under the Financial Services Compensation Scheme (FSCS)

Raisin UK customers have earned up to 50% more interest than the UK market average*, helping them make more of their savings through access to competitive rates from a range of UK partner banks and building societies.

And with the Financial Services Compensation Scheme (FSCS) protection limit increasing from £85,000 to £120,000 per person, per bank across all UK-regulated banks from 1 December 2025, you can now hold a higher balance with our partner banks and building societies covered by the deposit guarantee scheme (please note: some of our partner banks offer a lower maximum deposit limit).

*Based on Raisin UK data from launch to June 2025, comparing total interest earned by Raisin customers with what they would have earned at the UK average savings rate over the same period.

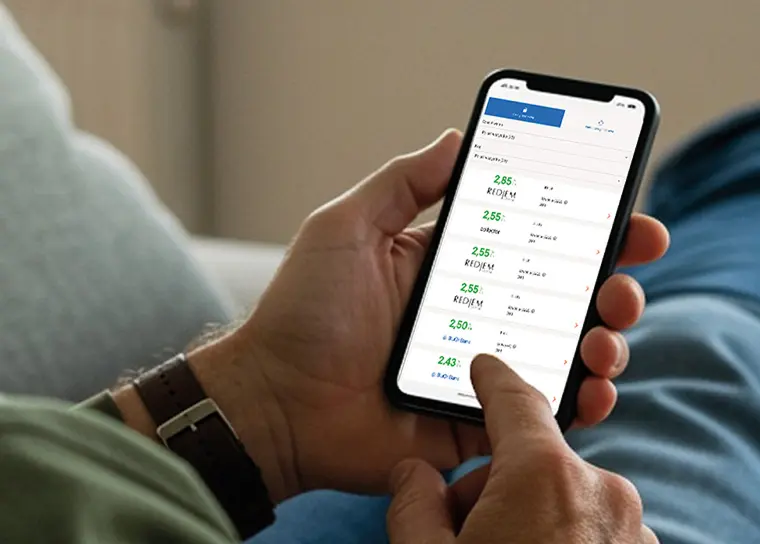

Raisin UK is a savings marketplace that connects you with competitive savings accounts from partner banks and building societies. You’ll get direct access to offers across easy access, fixed rate bonds, and notice accounts, allowing you to compare and manage your savings in one place.

Register for free

Set up your Raisin Account in minutes.

Browse competitive savings accounts

Explore a range of FSCS-protected products from our partner banks and building societies.

Open your chosen account

Apply for as many savings accounts as you want directly through Raisin, all with a single login.

FSCS deposit protection update

From 1 December 2025, the Financial Services Compensation Scheme (FSCS) protection limit has increased from £85,000 to £120,000 per person, per bank.

This means you can now hold a higher balance with each bank or building society while remaining covered under FSCS guarantee scheme.

If a bank or building society on Raisin UK were to fail, the FSCS would provide compensation for eligible deposits up to £120,000.

You can find details on FSCS protection for all of your savings held with Raisin UK by logging into your account and viewing each of your deposits.

Protection applies to eligible deposits under FSCS rules. Amounts above the limit are not protected. For more information, visit FSCS.org.uk.

Why you can trust Raisin UK

Raisin UK is part of Raisin SE, one of Europe’s leading savings marketplaces with more than €60 billion in deposits under administration.

All eligible deposits held with partner banks and building societies through Raisin UK are protected by the Financial Services Compensation Scheme (FSCS) up to £120,000 per person, per bank.

Raisin UK holds a Trustpilot TrustScore of 4.2 out of 5, based on more than 3,600 customer reviews (as of 25 November 2025).

To open savings accounts with competitive rates from a range of UK partner banks and building societies, register for a Raisin UK Account today. Registration is free and only takes a few minutes.

Once your account is approved, you can select the savings products that suit you, make your deposit, and manage everything securely in one place.

About us

Savings accounts

Guides

About us

Savings accounts

Guides

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time.

Raisin UK is a trading name of Raisin Platforms Limited which is authorised and regulated by the Financial Conduct Authority (FRNs 813894 and 978619). Raisin Platforms Limited is registered in England and Wales, No 11075085. Registered office: Cobden House, 12-16 Mosley Street, Manchester M2 3AQ, United Kingdom. The information on this website does not constitute financial advice, always do your own research to ensure it's right for your specific circumstances. Tax treatment depends on the individual circumstances of each customer and may be subject to change in the future.