Where are the UK’s gardening and saving hotspots?

The UK is a nation of keen gardeners and keen savers. Curious to uncover the similarities between the nation’s saving and gardening habits, we commissioned a survey of 2,000 people to find out how long people spend gardening vs. researching their savings, which regions spend the most time gardening and saving, and how people think the two topics are related. Here’s what we found…

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

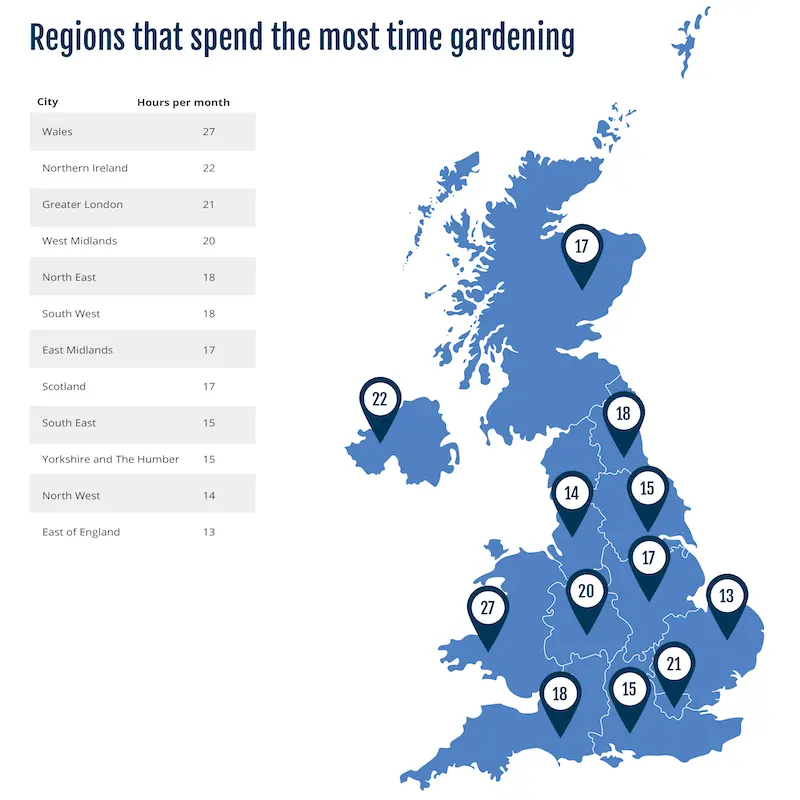

Welsh residents spend the most time gardening

Wales is renowned for its picturesque natural beauty, so it’s not a huge surprise to learn that Welsh gardeners spend an impressive 27 hours per month tending to their outdoor spaces (a whole 10 hours higher than the UK average).

At the other end of the scale, residents in the East of England and the North West spent just 13 and 14 hours respectively in the garden. Surprisingly, residents in the South East - home to ‘the Garden of England’, Kent - spent just 15 hours gardening per month.

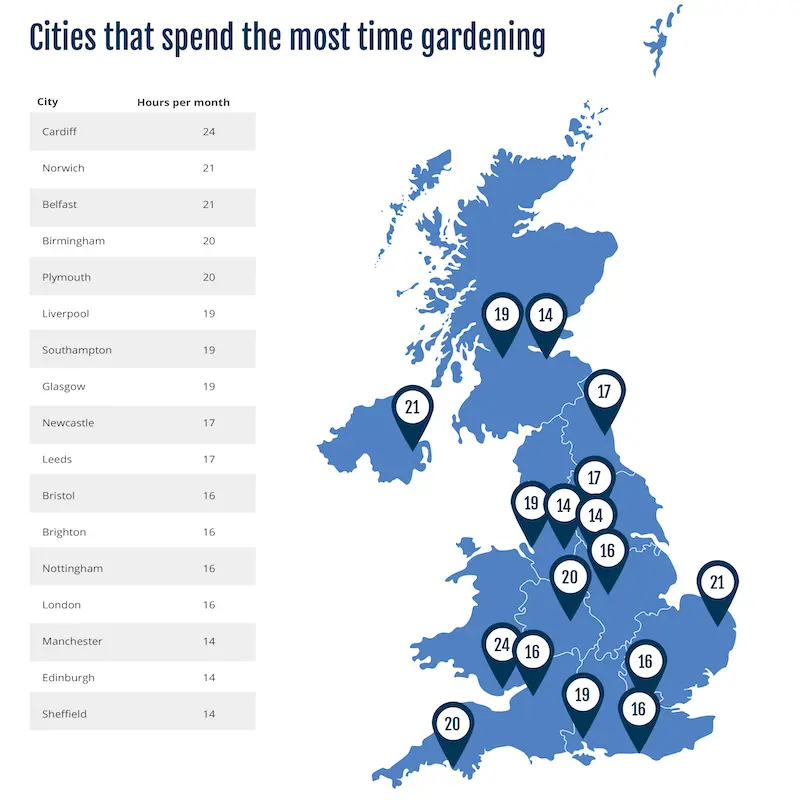

Cardiff is the UK’s gardening capital

Cardiff is the UK's gardening capital, with locals investing 24 hours each month into their gardens – that’s 41% longer than the UK average of 17 hours.

Sheffield, which is often described as having more trees than people, was one of the areas where people spend the least time gardening (14 hours), alongside Manchester (14 hours) and Edinburgh (14 hours).

UK residents spend less time financial planning than gardening

On average, people in the UK spend 16 hours a month researching savings accounts - only an hour less than they spend gardening on average.

Regionally, however, there are quite a few differences in priorities. Residents of Wales, the UK’s most dedicated gardening region, spend just 17 hours planning their finances - 10 hours less than they spend pruning their hedges and planting their flowers.

Which cities spend the most time gardening?

Residents of Nottingham and Sheffield spend the most time planning their savings, with Cardiff - where people spend the most time gardening - sitting in mid-table. Leeds is at the bottom of the list, with just 9 hours on average spent planning savings each month.

Kevin Mountford, co-founder and personal finance expert at Raisin, said:

“While at first savings and gardening might not appear very similar, there are many elements to gardening that translate to saving. It’s not just about personality traits like being calm, organised and adaptable - it is about the long game. In both cases, taking time up front to research your options based on your specific situation can see you make great rewards down the line. For example, with savings specifically, if you have the cash available, putting it into an ISA or fixed rate bond could see you benefit from competitive returns on your investment over time.”

Learn more about the connection between gardening and saving

Watch your savings blossom

Like growing a beautiful garden, building your savings requires the right tools and the right mindset. Raisin UK gives you everything you need to make your savings bloom, with competitive rates from over 40 FSCS-protected banks or building societies.

About us

Savings accounts

Guides

About us

Savings accounts

Guides

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time.

Raisin UK is a trading name of Raisin Platforms Limited which is authorised and regulated by the Financial Conduct Authority (FRNs 813894 and 978619). Raisin Platforms Limited is registered in England and Wales, No 11075085. Registered office: Cobden House, 12-16 Mosley Street, Manchester M2 3AQ, United Kingdom. The information on this website does not constitute financial advice, always do your own research to ensure it's right for your specific circumstances. Tax treatment depends on the individual circumstances of each customer and may be subject to change in the future.