login to manage it all

Jumpstart your savings with up to $1000 on us

- 75+ products on one single platform

- Earn as much as 4.36% APY

- Get up to $1000 for your first deposit with code EASY¹

Testing Header Product Cards

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

$

Bank

Product

APY

Annualized Earnings

Raisin is not an FDIC-insured bank or NCUA-insured credit union and does not hold any customer funds. FDIC deposit insurance covers the failure of an insured bank and NCUA deposit insurance coverage covers the failure of an insured credit union.

Raisin's exclusive partner network

Partner bank

See all of the banks that have selected to partner with Raisin.

Learn more

Partner credit unions

Take a look at which credit unions have chosen to partner with Raisin.

Learn more

About Raisin

Our platform has been helping customers get more out of their savings since 2012.

Learn more

.png&w=1920&q=75)

Your savings, maximized

Maximize your interest earnings with a competitive suite of top savings products offered by our partner banks and credit unions. With no fees from Raisin, you can expand your savings portfolio with $1 minimum deposits and boost your interest-earning potential.

Your data and privacy, secured

A single Raisin login allows you to hold savings products from multiple institutions — without the need to create multiple usernames and passwords. As a SOC 2 certified organization, we have met the requirements outlined by the American Institute of Certified Public Accountants (AICPA) to ensure that we have the controls in place to keep customers' data secure and private. You can rely on our suite of cybersecurity measures, such as Multi-Factor authentication, encryption, and web application firewall advanced internet protection and monitoring, to keep your information secure.

Your solution to earn more

Our partner banks and credit unions rely on Raisin’s expertise in digital deposits to help them offer their products online to customers like you. In return, they pay us fees — so you don’t have to. That means you can design your own customized savings strategy, maximize your return with competitive rates and no pesky fees, and get help with reaching your savings goals faster.

Start saving in minutes

Select

the right product to kickstart your savings journey.

Register

for your no-fee login — it takes less than five minutes.

Fund

your new savings product and start earning interest.

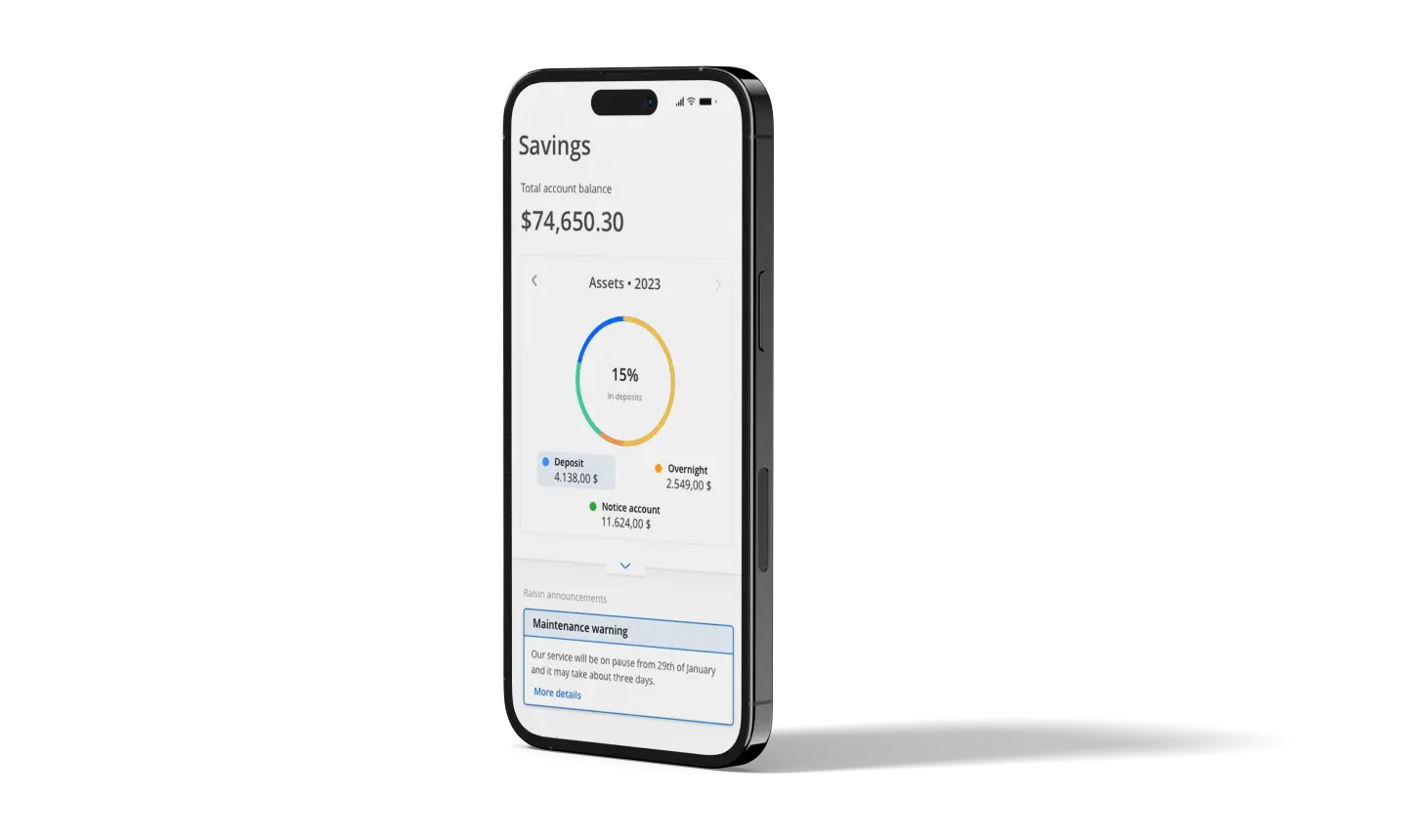

Optimize your savings on the go

Our free mobile app puts the Raisin experience at your fingertips, allowing you to manage your account from just about anywhere. Now, you can view your earnings, rebalance your portfolio, transfer funds, or add new products from our partner banks and credit unions with just a few taps. Our app also includes all of the same security features that protect your data, privacy, and transactions, so you can manage your money with confidence. Available now on iOS App Store for Apple devices and Google Play for Android devices.

¹New customers only. Earn a cash bonus when you deposit and maintain funds with partner banks on the Raisin platform. Customers will receive $75 for depositing between $10,000 and $24,499, $250 for depositing between $25,000 and $49,999, $500 for depositing between $50,000 and $99,999, and $1,000 for depositing $100,000 or more. To qualify for the bonus, your first deposit must be initiated between August 1, 2025, and September 30, 2025, by 11:59 PM ET, and the promo code EASY must be entered at the time of sign-up. Only funds deposited within 14 days of the initial deposit date and maintained with partner banks on the Raisin platform for 90 days will be eligible for this bonus. Bonus cash will be deposited by Raisin into the customer’s linked external bank account within 30 days of meeting all qualifying terms. This offer is available to new customers only and may not be combined with any other bonus offers. Raisin reserves the right to modify or terminate this offer at any time.