What are market-linked CDs, and how does principal protection work?

Equity-linked CDs explained

Principle protection: Market-linked CDs offer principal protection if held to maturity, making them appealing to conservative investors seeking market exposure without risking their initial deposit.

Return potential: Returns of equity-linked CDs are tied to the performance of a market index but are typically subject to caps and participation limits, which can reduce your potential upside.

Terms: Index-linked certificates of deposit have complex terms and limited liquidity, so understanding how they work – and how they compare to traditional alternatives – is essential before investing.

What is a market-linked CD?

A market-linked CD (also known as a market index CD, equity-linked CD, or stock-indexed CD) is a type of time deposit where the return is tied to the performance of a market index, such as the S&P 500. These structured products are typically offered by banks, credit unions, or investment firms, and often come with FDIC insurance – just like traditional CDs.

The key distinction is that while traditional CDs offer a guaranteed fixed interest rate, market-linked certificates of deposit offer variable returns based on stock market performance, but with the assurance that your principal is guaranteed if the CD is held until maturity.

What is the difference between an index-linked CD and traditional CDs?

In short, traditional CDs provide guaranteed interest with predictability, while CDs linked to the stock market offer the potential for higher returns but with market-based risks and limitations.

Features | Market-linked CD | Traditional CD |

|---|---|---|

Return type: | Market-based (variable) | Fixed interest rate |

Principal protection: | Yes, if held to maturity (FDIC-insured) | Yes, if with FDIC-insured financial institution |

Upside potential: | Limited (due to caps and participation) | Fixed and predictable |

Term length: | Typically 4–8 years | Usually 6 months to 5 years |

Liquidity: | Low (penalties for early withdrawal) | Moderate (penalties apply, unless you opt for a no-penalty CD) |

Complexity: | Higher (structured product) | Simple and transparent |

How do market-linked CDs work?

When you invest in a stock-indexed CD, your return is linked to a specific market index, such as the Dow Jones, Nasdaq, or S&P 500. Some products may track a basket of indexes to diversify market exposure.

These market-linked CD offerings are designed to protect your principal but expose your return to market movement. The issuing institution (usually a bank or credit union) outlines how the return is calculated and when the market-linked CD will mature. You must typically hold the market-linked certificate of deposit for the full term — often 4 to 8 years — to receive both the principal protection and any potential return.

How returns on a market-linked certificate of deposit are calculated

If you are wondering where to invest money to get good returns, a market-linked CD could be worth considering. Returns on equity-linked CDs are determined by the issuer using several key features:

- Participation rate: This determines the percentage of the market gain that you will receive. For example, a 70 percent participation rate on a 10 percent market gain would earn you 7 percent.

- Cap rate: The maximum return allowed, regardless of how well the index performs. Even if the index rises 15 percent, your index-linked CD might be capped at 6 percent.

- Averaging method: Some market-linked CDs average index values over time, which can reduce volatility but may also reduce your return.

- Base or minimum return: Some market-linked certificates of deposit include a small guaranteed interest amount, though many only guarantee the return of principal.

- Maturity date: To ensure full protection and earn any return, you must hold the index-linked certificates of deposit until maturity. Selling early may result in fees and loss of earnings.

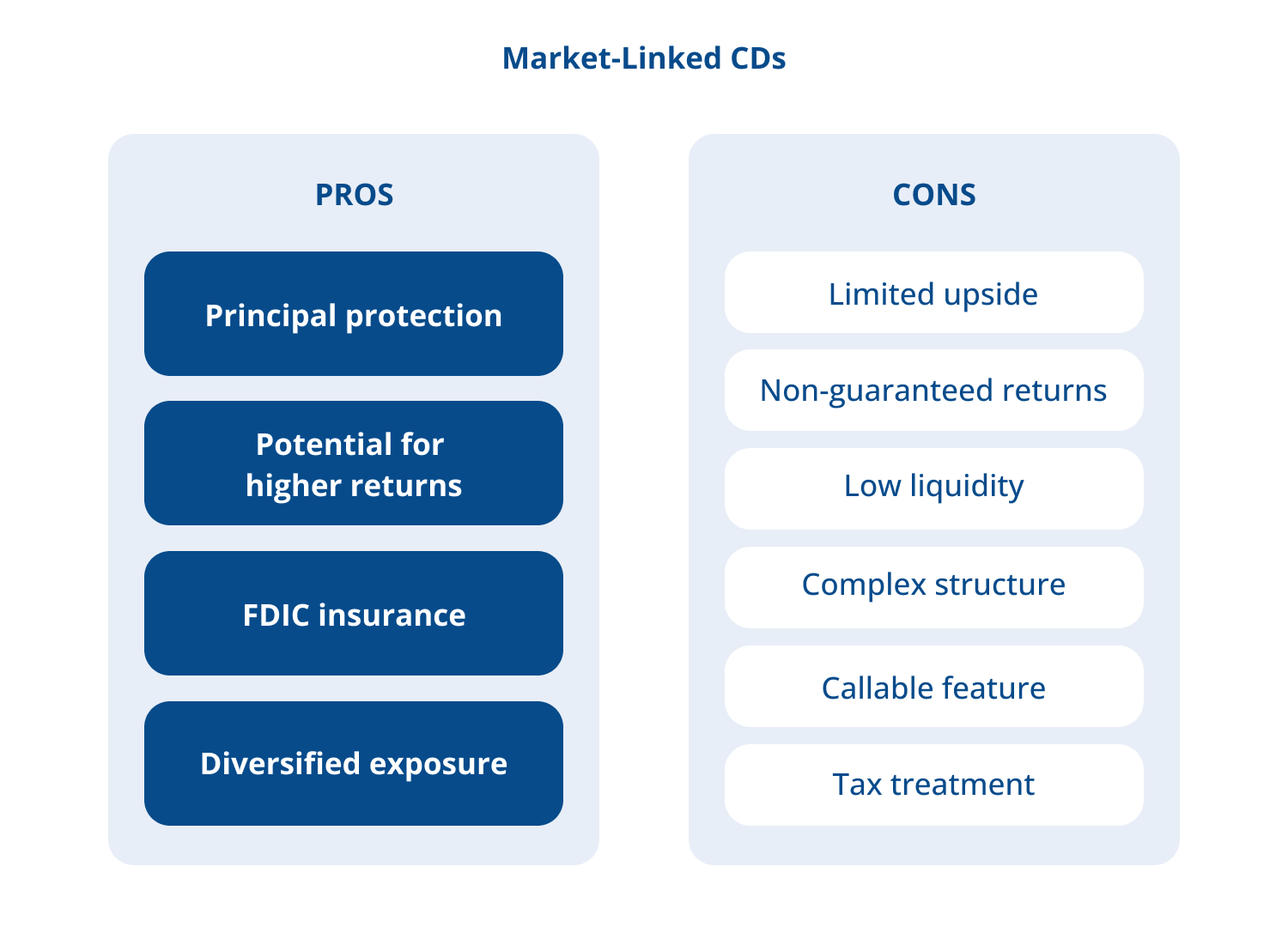

What are the pros and cons of a market-linked CD?

Equity-linked CDs strike a balance between safety and growth potential, but they are not right for every financial investor. In order to make an informed decision about any investment, you should carefully weigh the advantages and disadvantages before investing in a market-index CD.

Pros of market-linked CDs

Market-linked certificates of deposit have a few advantages that make them interesting for financial investors:

- Principal protection: Your original deposit is secure if held until maturity, even if the stock market performs poorly.

- Potential for higher returns: Tied to market performance, index-linked CDs can outperform traditional fixed-rate CDs in strong market conditions.

- FDIC insurance: Market-linked CDs issued by FDIC-member banks are insured up to the applicable limits ($250,000 per depositor, per institution) — but this doesn’t cover everything. Only the principal and any guaranteed investment returns are covered.

- Diversified exposure: Through indexes or index baskets, you gain access to stock market performance without direct equity risk.

Cons of market-linked CDs

In order to find the best market-linked CD for a financial investment, you also need to be aware of potential disadvantages:

- Limited upside: Cap rates and participation percentages may significantly limit your potential gain, even in bull markets.

- Non-guaranteed returns: Because market-linked CDs are dependent on the performance of a market index, the returns can be unpredictable, and there’s every chance you only get back what you initially invested.

- Low liquidity: Early withdrawal can lead to penalties, reduced returns, and potentially even a loss of principal in extreme cases.

- Complex structure: These products involve detailed terms and may be harder for some investors to fully understand without guidance.

- Callable feature: Some are callable CDs, meaning the issuer can redeem the CD before maturity, especially if interest rates fall.

- Tax treatment: Returns are typically taxed as ordinary income rather than capital gains, which may impact investors in higher tax brackets.

Are market-linked CDs a good investment?

This depends on the investor’s risk tolerance and financial goals. Market-linked CDs may be ideal for investors with moderate risk tolerance who are comfortable with the possibility of limited returns due to cap rates or participation limits but still want to avoid losing principal. On the other hand, they may not be appropriate for highly risk-averse investors or risk-seeking investors.

An investor might choose a market-linked certificate of deposit if they want to:

- Participate in market growth without risking principal: If you are seeking growth potential but want to avoid the risk of losing your initial deposit, equity-linked CDs offer principal protection while allowing you to benefit from market performance.

- Balance risk and reward: For those who are risk-averse but still want some exposure to the market, these index-linked CDs offer a middle ground. They are not as risky as direct stock investments but provide the chance for higher returns than a traditional CD can offer.

- Plan for long-term goals: If you do not need immediate access to your funds, a market-linked deposit can be a good option, as they typically have longer terms ranging from 4 to 8 years.

Alternatives: Traditional CDs, bonds, and other investment opportunities

If you want to explore other options beyond market index-linked CDs, you might consider the following alternative investment options:

- Traditional CD accounts: These offer fixed interest rates and are fairly straightforward to understand. They provide a secure, predictable way to invest for those who prefer a low-risk, low-maintenance option, though they may not offer high returns.

- U.S. Treasury Bonds: Backed by the government, these bonds provide predictable income over a specified term and are exempt from state and local taxes. They are considered one of the safest investments, especially suitable for conservative investors seeking stability, though their yields may be lower compared to other assets.

- Municipal or corporate Bonds: These bonds offer higher potential yields than treasury bonds but come with varying levels of credit risk depending on the issuing entity. Municipal bonds are often tax-exempt, making them attractive to investors in higher tax brackets, while corporate bonds may offer more growth potential but carry more risk, depending on the issuer’s financial health.

- Fixed-indexed annuities: Similar in structure to market-linked certificates of deposit, these are insurance products with returns tied to a stock market index. However, they are typically not FDIC-insured, and may come with higher fees as they are sold by insurance agents. They are a good choice for those looking for a balance between risk and return, but they require careful consideration.

- Low-cost ETFs or index funds: These funds provide broad market exposure, more liquidity, and favorable capital gains tax treatment. While they offer the potential for higher returns and greater diversification, they do not provide principal protection, which can be a drawback for more risk-averse investors.

Each alternative comes with its own balance of risk, return potential, and liquidity. The right choice depends on your financial goals, risk tolerance, and investment horizon. It is essential to evaluate your individual situation and consider speaking with a financial advisor before making any significant investment decisions.

Where to find index-linked certificates of deposit

You can explore market-linked CD offerings through:

- Banks and credit unions: Many large institutions issue CDs tied to stock market indexes. These traditional financial institutions may provide reliable customer service and a range of CD terms.

- Brokerage firms and financial advisors: Some market-linked certificates of deposit are sold through investment professionals, such as brokers or financial advisors. These experts can help you navigate the complex options available and ensure that the terms of the CD align with your specific financial goals, risk tolerance, and time horizon. This option may provide access to a broader selection of products and personalized advice.

- Online marketplaces: There are various platforms that aggregate and compare the best market-linked CD rates and terms available across different institutions. These marketplaces allow you to easily compare different options, helping you find the best rates and investment conditions without the need to visit multiple banks or firms.

If you found an equity-indexed CD that you are interested in, before purchasing, always:

- Confirm FDIC insurance and applicable limits: Ensure that the market-linked CD is backed by FDIC insurance, offering protection up to the legal limit, in case the bank fails.

- Understand all terms: Pay close attention to details such as cap rates, participation rates, maturity dates, and call features. These factors directly influence your returns and the overall performance of your investment.

- Compare multiple offerings to find the best market-linked CD for your needs: Researching and comparing different institutions can help maximize your investment potential and minimize risks.

Always keep your risk tolerance and your financial goals in mind. If you are more risk-averse, you could combine a traditional CD with a market-linked certificate of deposit.

Diversify your portfolio with Raisin

You can diversify your portfolio and ensure a guaranteed return by adding traditional CDs. At Raisin, you can explore competitive CD accounts, high-yield savings accounts, and money market accounts from a variety of banks and credit unions. Once you set up a profile, you can manage all your accounts in one place.