How much do you need to retire?

Find out how much to save for retirement with these rules of thumb

Home > Retirement > How much to save for retirement

How much money you need to retire: There are many guidelines out there, including aiming to save 10 times your salary by retirement age or using age-based benchmarks to track your progress

Try a retirement calculator: Crunching the numbers with a calculator can give you a more accurate idea of whether you’re on track for your retirement goal

No one-size-fits-all: Factor in what age you want to retire, your annual income, your desired retirement lifestyle, your expected Social Security benefits, and what you’ve already built up in your retirement nest egg

Why it’s important to figure out how much you need to retire

Everyone dreams about living comfortably in their later years of life.Whether you have big plans to travel the country in an RV, or put down new roots by the ocean, getting there will take some planning. If you’re wondering, “How much do I need to retire?” you’re not alone.

The economic uncertainty caused by upheavals such as the Covid-19 pandemic has made this ever more clear for many Americans. Many now realize the importance of building a nest egg.

Unfortunately, awareness about the need to save more for your golden years is only half the battle; the other half is actually setting a plan in motion.But where do you begin? And how much money do you need to retire? Given the uncertainty around the topic, it’s time to clarify just how much you should plan to save, so you can eventually sit back and enjoy your retirement just the way you want.

How much do you need to retire? These rules of thumb may help provide answers

Figuring out how much money you need to retire can feel daunting. Experts have developed financial guidelines to help.

How much should you save every year for retirement?

Personal finance expert and Certified Financial Planner Liz Weston suggests setting aside 10% of your annual income for retirement to cover the basic needs, 15% if you want to live comfortably, and 20% if you really want to escape.

To help you visualize what that might equate to over time, here’s an example using this advice:

Consider a couple who earns a collective $75,000 per year in salaries. They decide to save 15% of their wages for retirement. Both start at age 25 and continue to save 15% of their salaries annually for 40 years.

At age 65, the couple will have built a retirement nest egg worth $1,430,643, assuming a 5% annual return. And this doesn’t include any Social Security benefits for which they might qualify.

What are the retirement savings goals by age?

Others may prefer to look at saving for retirement from a benchmark standpoint.

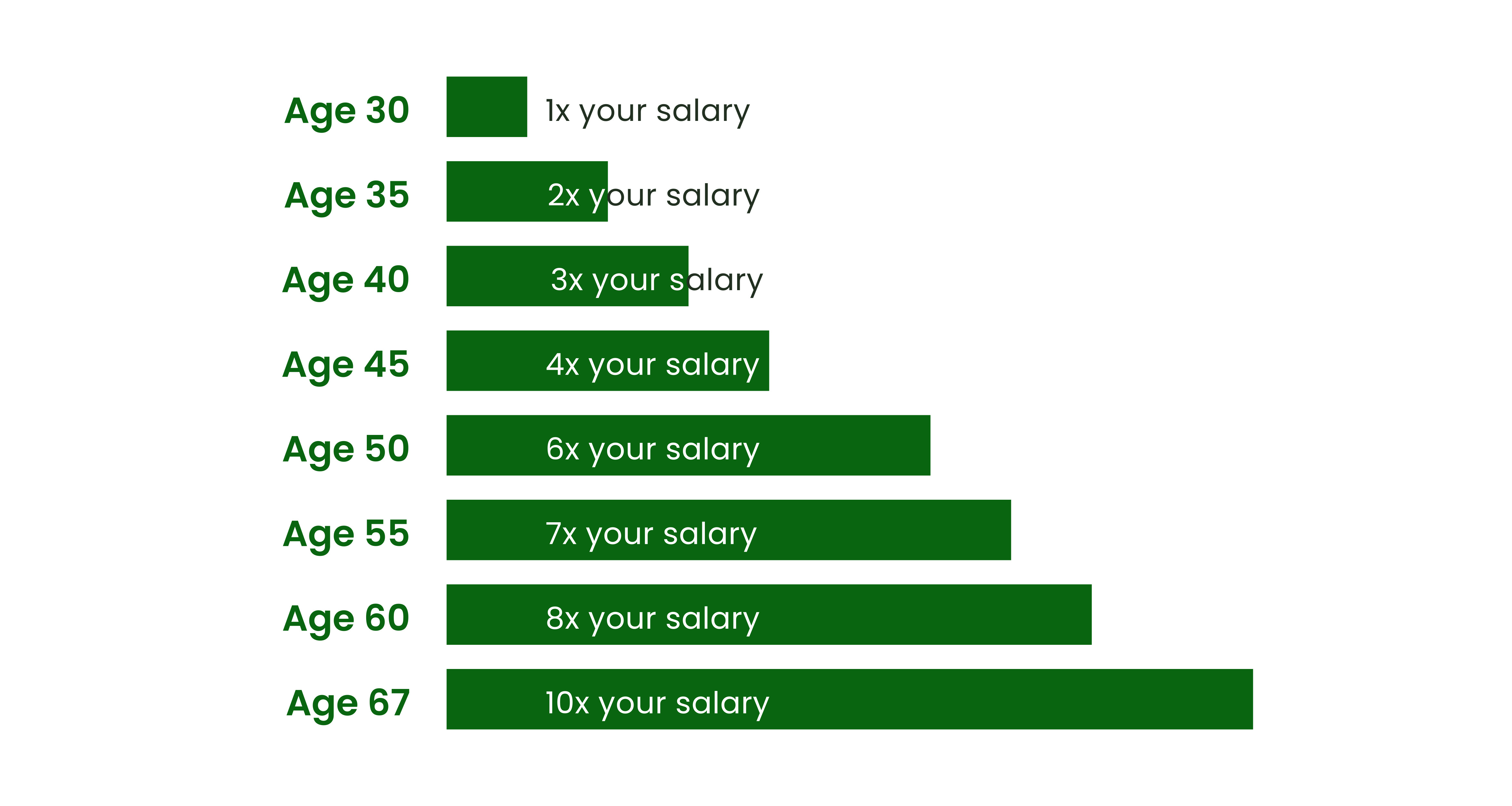

Some investment management companies¹ suggest using your age and salary to figure out how much you should already have saved for retirement. Here’s what they recommend:

You can also check average retirement savings by age to see how your savings compare. But if these financial goalposts feel daunting for you, or your income is inconsistent, you might focus instead on the ultimate goal of saving around 10 times your expected annual income at retirement age.

How much do you need to retire comfortably?

What type of lifestyle do you envision in retirement? There’s a big difference between planning for a modest lifestyle and saving to splurge on travel or luxury goods.

And it’s not just about those nice-to-have extras; where you live will also play a role in how much you need to save for retirement. You can check how your retirement savings goal stacks up against average retirement savings by state in the U.S.

Some experts suggest aiming to plan for about 70% of your pre-retirement income. That estimate assumes you’ll spend less in retirement and that Social Security will help cover a portion of your annual living expenses.

What is the 4% retirement rule?

Along with asking “how much money do I need to retire,” it’s just as important to figure out how to withdraw that money. Retirement isn’t just about building a big pile of cash and spending freely once you stop working. Your savings may need to last 30 years or more. And the longer your money stays invested — whether in a pension plan or elsewhere — the more time it has to grow.

The 4% rule is a guideline that suggests you can withdraw 4% of your retirement savings each year without running out of money too soon. The idea is to give you steady income while giving the bulk of your investments more time to grow.

If you want $80,000 a year in retirement, you’d need to save 25 times that amount (because 1 divided by 0.04 equals 25). So your financial goal would be $2,000,000.

Aside from these rules of thumb, there is plenty more advice out there on just how much you’ll need for retirement. But remember, these are only recommendations and may not be the perfect fit, as your personal financial circumstances are as unique as you are.

You may wish to consider consulting with a retirement financial advisor or professional to guide you, or commit you to a savings plan that’s tailor-made for you.

How much do you need to save for retirement? Use calculators to help

While rules of thumb are helpful, they don’t replace running the numbers for yourself. You can use a retirement calculator to see how much money you could save if you start investing today.

Some retirement calculators allow you to plug in several basic variables — including your age, income, existing savings, and planned retirement age — to see if you’re on track for retirement. Others take into account inflation, potential salary increases, and projected rate of return on your investments to give you a more accurate estimate of how much you should save for retirement.

Don’t forget to consider any Social Security benefits you might receive in the future. You can use the Social Security Administration’s calculator to estimate how much you may be eligible to earn. Just keep in mind that Social Security benefits alone are not intended to make up the only source of retirement income.

Make sure you’re factoring in all aspects of your retirement plan before settling on how much money you really need to retire the way you want. There’s no right or wrong way to come up with this number, so take your time to figure out the best plan for you.

After you’ve determined your “number,” focus on savings and diversification

Figuring out how much you need to retire is one thing — knowing how to save for it is another. You’ve likely heard the saying, “Don’t put all your eggs in one basket.” And the same is true for your retirement investments. This strategy, known as diversification, is when you spread your investments and savings out among multiple assets and investment vehicles to manage risk more effectively.

If you’ve already got a 401(k), IRA, Roth IRA, or other types of brokerage and savings accounts — or you plan to open them soon — you’ll want to ensure your savings are diversified.

Diversification may help your portfolio weather financial storms because if one asset is doing poorly, another might still be doing well.

Why you should consider cash as part of your retirement plan

In addition to investment accounts, having cold-hard cash within your portfolio can provide some much-needed stability as you invest for, get closer to, and enter retirement. Cash and cash equivalents usually refer to money in vehicles such as high-yield savings accounts, money market accounts, and certificates of deposit (CDs).

Cash savings are important because, unlike investments, they do not come with risks. Instead, the money you deposit into your account is guaranteed to earn you interest over time. Find out why savings accounts should be part of your retirement strategy.

When it comes to keeping cash in your portfolio, the key is finding the best possible return on your money. You may do so by diversifying your savings across multiple high-yield savings products. You can also use Raisin’s savings account calculator to see how much you could earn based on your initial deposit.

Here are some savings products to consider and the benefits and features of each:

High-yield savings & MMDA | Fixed-term CDs | No-penalty CDs | |

|---|---|---|---|

Definition | Expedite your savings with APYs significantly higher than the national average. | Guaranteed rates and clear terms for easy planning or laddering — whatever your timeline. | Stability and flexibility in one: guaranteed interest rates, plus penalty-free full withdrawal. |

Benefits | Receive a competitive rate with the ability to withdraw or add funds whenever you like. | Lock in to a competitive interest rate for a fixed period to better manage your return expectations. | The best of both worlds; lock in to a competitive fixed term interest rate with the flexibility of withdrawing. |

Interest rate | Variable, depending on market conditions. | Fixed for CD term regardless of market conditions. | Fixed for CD term regardess of market conditions. |

Withdrawals | Flexibility to withdraw as much as you want, whenever you want; there are no restrictions. | Full withdrawal when fixed term expires. Penalty fee applies for early withdrawal, varies by institution. | You can make a full withdrawal as soon as 7 days after funding but rules may vary at different institutions. |

Diversifying your retirement money is easy with Raisin

Raisin provides an easy solution to help ensure your cash savings are earning as much as possible without the headaches of opening and managing multiple bank accounts separately.

You can sign up for Raisin in just a few minutes and get access to high-yield savings accounts and CDs from Raisin’s partner banks all in one place.

Find out how to get started with Raisin, choose an account, and see how easy it is to maximize your returns and manage your money all in one place.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

¹https://www.fidelity.com/viewpoints/retirement/how-much-do-i-need-to-retire

Related Articles

- Early retirement

- Savings accounts for retirement strategy

- Retirement financial advisor

- How long will my retirement savings last

- Average retirement savings by state

- Social security benefits

- How is social security calculated

- How many retirement accounts can I have

- What is a retirement account

- Retirement CDs

- Pensions vs 401K

- Average retirement savings by age