What is CD laddering, and how does it work?

How to build a CD ladder and lock in the best rates for your savings

CD laddering explained: A saving or investing strategy where money is invested in several certificates of deposit (CDs) with different maturities.

Is CD laddering a good idea: Savers benefit from their money becoming available at regular intervals while also taking advantage of the typically higher APYs on longer-term CDs.

How to ladder CDs: Your savings are split up and deposited into shorter- and longer-term CD accounts. When each CD matures, the money can be invested into a new long-term option to keep the ladder going.

What is a CD ladder?

CD laddering is a savings strategy where you spread cash equally across multiple certificates of deposit (CDs) with different maturity dates. This way, you capture the often higher rates of longer-term savings vehicles while ensuring liquidity by keeping portions of your money in shorter-term accounts. Instead of lumping all your funds in one CD, with a CD ladder strategy, not all of your savings are locked up for years.

Having your funds spread across multiple CDs also helps reduce the risk of locking in a single CD rate if interest rates continue to rise during your term. CDs are known for offering some of the highest interest rates among savings options, but their fixed terms can be a drawback. CD laddering is one solution to this issue. Because your money becomes available at regular intervals, you can easily explore your options for a potentially better rate elsewhere.

How to build a CD ladder in 5 steps

The basic idea behind building a CD ladder is to open multiple CD accounts with staggered maturity dates and reinvest the funds each time a CD matures.

Here are five steps to consider as you start your CD laddering strategy:

- Decide how much you want to save. Think about how much you can set aside for at least a year. That figure will be your starting point.

- Create a CD ladder structure. Decide how many CDs you want to open and what term lengths make sense for you. The traditional CD ladder example tends to use terms of between one and five years, but this is flexible, and you can choose shorter terms if you think you’ll need more frequent access. The goal is to have a variety of maturity dates.

- Compare and open the CD accounts. You’ll want to look out for the best CD ladder rates, so shopping around can help you find accounts with competitive interest rates. On the Raisin platform, you can easily compare CD rates by annual percentage yield (APY), which accounts for compounding. You can also sort by maturity to find the right one for your CD ladder strategy.

- Split money across multiple CD terms. Say you have $50,000 set aside. You could split it simply by putting $10,000 each in a 1-year, 2-year, 3-year, 4-year, and 5-year CD account.

- Reinvest as CDs mature. Once a CD in your ladder reaches the end of its term, you can roll that money, along with the interest earned, into a new 5-year CD. At that point, the 2-year CD will be a year away from maturity. So you’ll always have one CD coming due each year. If your plans change, you can always cash out your money instead of reinvesting.

How does CD laddering work?

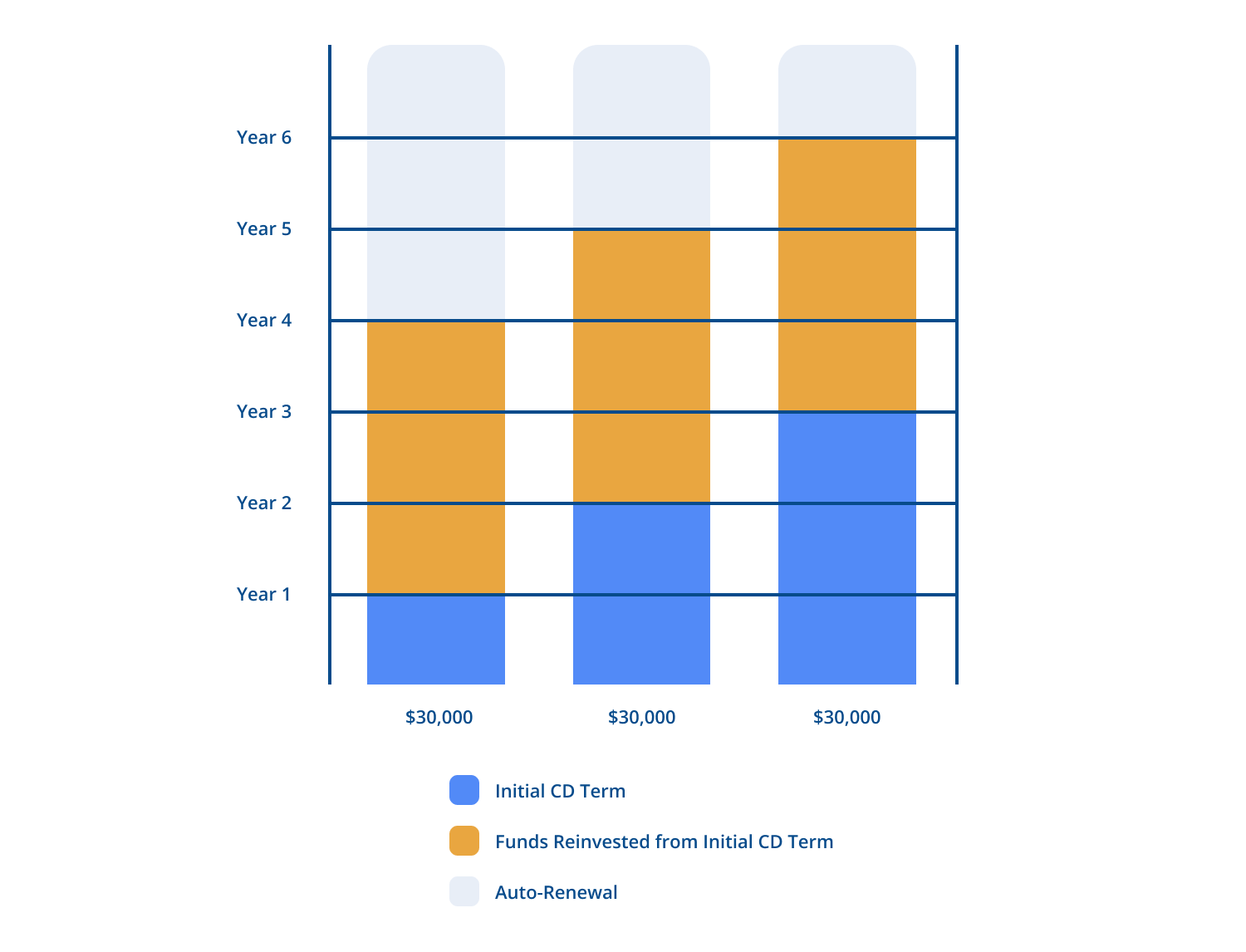

If you had $90,000 to save, you could spread out your money between three different CD accounts.

When the first CD matures after one year, you can cash out or choose to reinvest it into another three-year CD that offers a higher rate than a one-year CD. Each of the other CDs you opened will then be one year closer to their maturity dates.

The idea of CD laddering is to continue replacing each maturing CD with a CD rung that is farthest away. In this CD ladder example, that would mean adding a new three-year CD each time an existing CD matures.

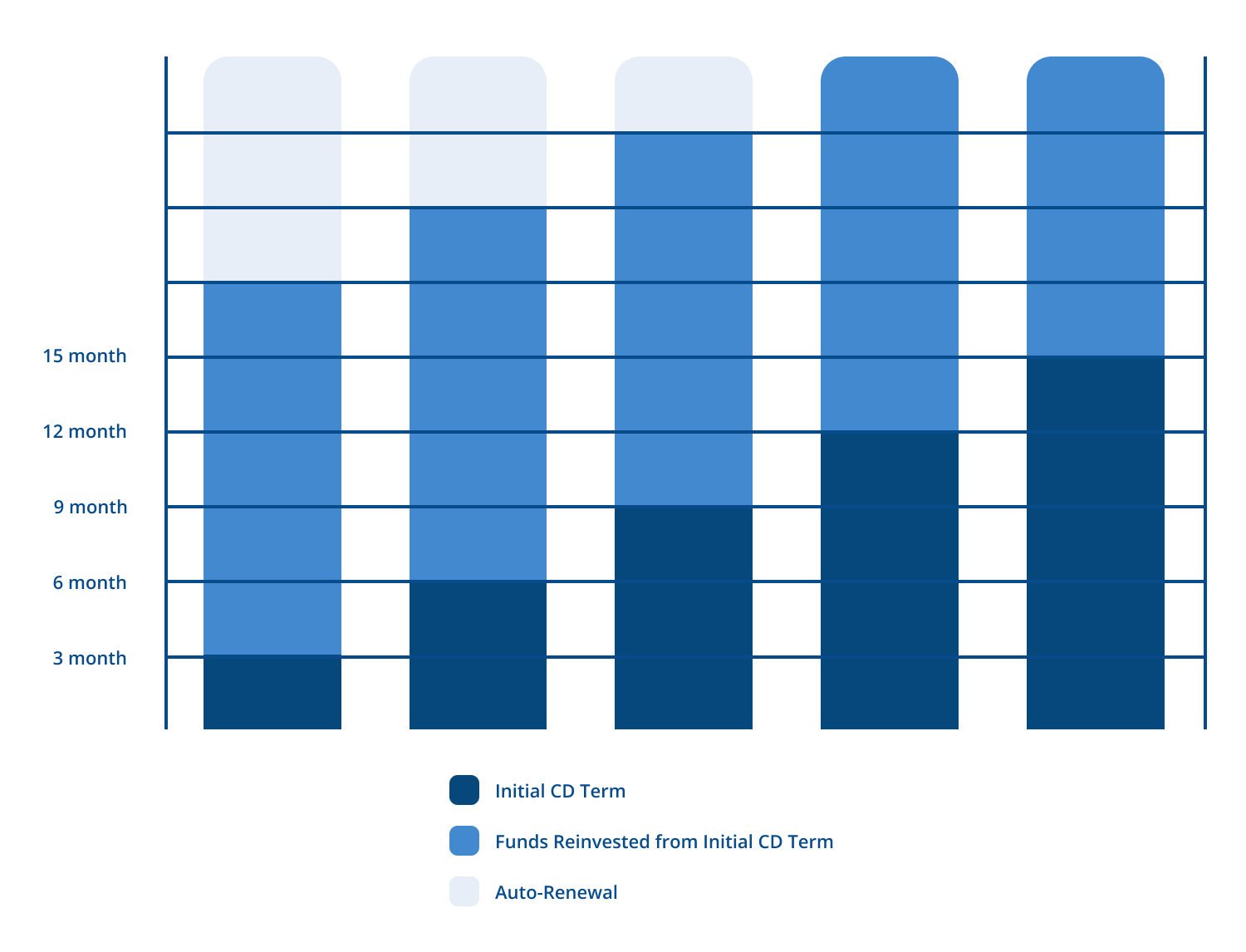

To take the example further, if you have $1 million to save and want shorter intervals to access your funds, you could spread your money in $200,000 increments across five CDs ranging from three to 15 months:

With higher deposit amounts as in this example, you would have to make sure that each CD balance (including any interest earned) stays below the $250,000 FDIC insurance threshold. You can use Raisin’s CD calculator to check how this might stack up.

It's easy to create a CD ladder like this with the Raisin platform. Not only can your savings grow steadily, but you also have the opportunity to adjust your CD laddering strategy every three months. You can find out more in our guide to certificates of deposit.

An example of CD laddering with interest rates

Taking the $90,000 example and adding interest rates, you can see how your money could grow using staggered CD terms and different interest rates.

Here’s how this CD ladder might work:

- $30,000 in a 1-year CD with a 3.80% APY

- $30,000 in a 2-year CD with a 3.95% APY

- $30,000 in a 3-year CD with a 4.20% APY

By the end of the first year, your 1-year CD will have matured, and you’ll have $31,140 (the initial $30,000 plus $1,140 in interest). You can then roll that $31,140 into a new 3-year CD, keeping the ladder moving and your savings growing.

Note: The APYs in the example above are for illustrative purposes only.

Alternative CD laddering strategies to explore

The traditional CD ladder example may be best suited to long-term savers who are happy to keep some of their cash locked away. But CD laddering is highly adaptable, so you can adjust it to suit your savings needs.

Here are a few other CD laddering strategies:

- Short-term CD ladder: Instead of using longer terms, you stick to short-term CD accounts, which means terms of less than a year (for example, three, six, nine, or 12 months). This means you keep your money more liquid while still earning interest.

- Barbell strategy: As the shape of a barbell suggests, you skip the middle terms and focus only on very short-term and very long-term CDs. For example, half your money might go into 3-month CDs, the other half into 5-year CDs. This could suit those who want to benefit from access to their money with short-term investments and the higher returns of long-term ones.

- Custom CD ladder for specific goals: Instead of evenly spacing your CDs, you match each maturity date with a specific financial goal — like paying for college in two years or buying a home in five. This way, your money becomes available exactly when you need it.

The best CD laddering strategy for you will ultimately depend on your goals and access needs. Find out more about how to find a CD for your needs.

Is CD laddering a good idea right now?

Although interest rates on savings products have come down slightly since the highs of 2024, savers and investors still have the opportunity to find and lock in relatively high rates.

Benefits of CD laddering

- Fixed interest rates mean predictable growth.

- CDs mature at regular intervals, giving you liquidity.

- You can take advantage of changes in the interest rate environment. If rates rise, you can reinvest at higher rates. If rates fall, your long-term CDs have already locked in higher rates. While more commonly found with investments, this is an example of diversifying your cash savings and creating a laddered CD portfolio.

- Eligible funds held in a CD account might be covered by FDIC insurance, which can protect your savings should your bank go bust.

- Compared to stocks or other forms of investments, which are vulnerable to complete loss of principal, CDs guarantee returns in a way that is impossible with riskier investments.

Risks of CD laddering

- If you need access to your money before the CD matures, you may face an early withdrawal penalty that reduces your returns. If this is a concern, you might consider including no-penalty CDs in your CD ladder strategy, where you can withdraw early without a fee.

- If inflation rises faster than your CD’s APY, your returns might not stretch as far. This means that, even though your balance grows, its buying power could decline.

- If interest rates fall significantly, the returns on new CDs may be lower than what you’ve locked in with your existing ladder.

Raisin can make CD laddering easier

Constantly opening new bank accounts to capture the highest CD ladder rates can be complicated and time-consuming. And if you choose multiple banks, that means multiple accounts, log ins, and balances to remember and review.

Raisin lets you put your cash to work by giving you access to an exclusive network of banks and savings products, including high-yield savings accounts, money market accounts, and CDs — all from a single, unified login.

Best of all, with Raisin you don’t have to worry about fees eating into your savings — we never charge you fees to save with us.

If you’re ready to make the most of your hard-earned money, without the hassle of multiple separate accounts, then check our guide on how to open multiple CDs with Raisin, view our latest CD offers below, and start your CD laddering journey.

Compare CD rates on Raisin

Bank

Product

APY

Maturity

mph.bank, a division of Liberty Savings Bank, F.S.B., Member FDIC

FDIC

Callable CD

3.81%

60 months

$1,905.00

HealthcareBank, a division of Bell Bank, Member FDIC

FDIC

High-Yield CD

3.50%

7 months

$1,750.00

Raisin is not an FDIC-insured bank or NCUA-insured credit union and does not hold any customer funds. FDIC deposit insurance covers the failure of an insured bank and NCUA deposit insurance coverage covers the failure of an insured credit union.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.