What is consumption tax?

Exploring examples of consumption tax and what it means for consumers

Spending-based tax: Consumption tax is charged on what you buy, not what you earn.

Regressive impact: It tends to weigh heavier on lower-income households, who may spend more of their income.

Saving incentive: Consumption tax can encourage saving by taxing purchases only, making mindful spending essential.

What is a consumption tax?

A consumption tax is a tax on goods or services purchased, not on what you earn. This highlights the core idea: consumption tax applies when you spend money, not when you earn it. Understanding this difference is key to grasping how taxes affect your finances.

Unlike income taxes, which apply to what you earn, a consumption tax targets what you spend. It’s levied on goods and services rather than wages or investment income. This structure may encourage saving and investing, since taxes are only paid when money is spent. To understand its full impact, it can help to explore its common forms and how it compares to income tax.

Common forms of consumption tax

Before diving into specifics, it’s helpful to know that consumption tax comes in several forms, each designed to tax different aspects of consumption. By understanding these different types, you’ll be better equipped to recognize how consumption tax impacts your everyday purchases.

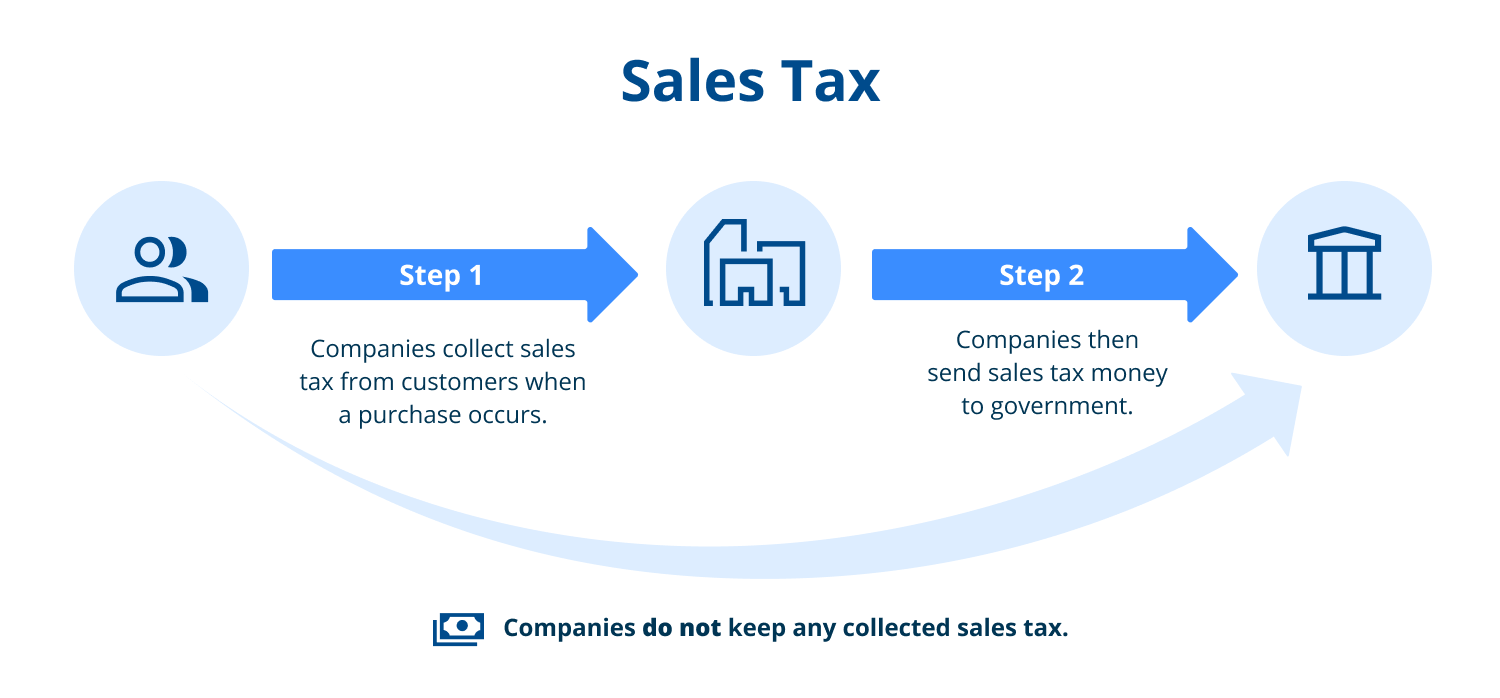

Sales tax: Charged by states and local governments on most retail purchases.

Excise taxes: Applied to specific goods such as alcohol, tobacco, and gasoline.

Value-added tax (VAT): Charged at each production stage but ultimately paid by consumers (not federally used in the U.S.).

- Tariffs: Taxes on imported goods, which increase prices on foreign products.

What’s the difference between consumption tax and income tax?

Income tax is taken from your earnings before you spend them, while consumption tax is charged only when you actually make a purchase. This distinction creates different incentives for saving and spending, which, in turn, influence both personal financial strategies and broader economic trends.

Income tax: Taken from earnings before you spend.

Consumption tax: Charged only when you spend.

This difference creates distinct incentives: consumption tax may encourage people to save, since money isn’t taxed until it is spent, whereas income tax reduces disposable income upfront.

Why understanding consumption tax matters for savers

Consumption taxes don’t just influence government revenue — they may affect how much households save. Since these taxes apply when you make purchases, they can raise the cost of everyday items and may affect how much you’re able to set aside. Understanding how consumption taxes work can help you make more intentional spending decisions and build stronger saving habits.

Impact on spending

Higher consumption taxes increase prices, especially on non-essential items. This may lead to reduced discretionary spending on things like dining out or entertainment, and it can also influence budgeting decisions.

Impact on saving

Because consumption tax is only triggered when you spend money, it can influence saving behavior. But for households with limited income, higher prices can make it harder to save at all.

Tax bias: saving vs. spending

Unlike income tax, which is taken upfront, consumption tax shifts the burden to purchases. While this setup favors saving (in theory), it could also disproportionately affect lower-income households, who might tend to spend a larger portion of their income.

Types of consumption tax in the U.S.

Consumption taxes in the U.S. come in several forms, each affecting purchases differently. Here’s a breakdown of the major types and how they apply in real life.

Sales tax

Sales tax is the most familiar type of consumption tax in the U.S., collected at the state and local levels, rather than federally. Since states have autonomy over sales tax rates and exemptions, the amount you pay can vary widely depending on where you live. Some necessities like groceries and prescription medicines are often exempt to ease the burden on lower-income consumers.

Charged by states/localities: Rates vary widely; for example, California’s state rate is 7.25%, plus local taxes that can bring it close to 9%.¹

- Exemptions: Essentials like groceries, medicines, and clothing are often exempt or taxed at lower rates.

Excise taxes & "sin taxes"

Excise taxes are levied on specific products. Some, referred to as “sin taxes”, have the goal of discouraging unhealthy or harmful behaviors. Others, like gasoline taxes, primarily generate revenue. These sin taxes apply to alcohol, tobacco, and gasoline, and their purposes can include:

Targeting specific goods such as tobacco, alcohol, and gasoline.

- Aiming to discourage harmful consumption and raise revenue.

Value-added tax (VAT) and national consumption tax

While the U.S. does not have a federal VAT, many countries use this system, which taxes the added value at each stage of production. In the U.S., proposals like the Fair Tax advocate for a national consumption tax to replace income tax, applying a single tax at the retail level.

No federal VAT in the U.S., but common globally.

The Fair Tax proposal would replace income tax with a national consumption tax at the retail level.

- VAT taxes value added at each production stage but the cost ultimately rests on consumers.

Pros and cons of a national consumption tax

The implementation of a national consumption tax has been the subject of debate. Supporters say that, in theory, it could simplify the tax code, promote saving, and broaden the tax base. Opponents argue it’s regressive and politically difficult to pass, especially as a replacement for income tax. Here’s a look at the key arguments for and against such a tax.

Pros

- May encourage saving and investing over spending

Can simplify tax filing and reduce administrative costs

- Broadens the tax base to include most consumer activity

Cons

- Regressive without mitigation measures, placing a larger relative burden on lower-income households

Could require high rates (around 30% or more²) to generate equivalent revenue to current income taxes

- Faces political resistance; as of September 2025, major proposals like the Fair Tax haven’t advanced

How consumption tax impacts your saving strategy

Consumption tax doesn’t just affect spending — it also has consequences for saving habits. Since the tax is only levied when you spend money, choosing when and how to spend can either increase or decrease your overall tax burden. Savvy savers might look for ways to minimize taxable purchases and leverage financial accounts that maximize returns. By understanding consumption tax’s influence on disposable income and budgeting, you can design a saving strategy that preserves more of your wealth and helps you meet long-term goals despite rising consumption costs.

A saving strategy could include:

Minimizing taxable purchases when possible.

Using high-yield savings accounts to grow your savings faster and offset the impact of taxes.Treating savings as a tool to resist overspending that triggers consumption taxes.

How to make smart use of savings accounts

The right savings account can help offset the impact of consumption taxes. High-yield accounts grow your money faster, and separating funds for different goals — like emergencies or long-term savings — gives you more control. Tracking spending categories most affected by consumption tax can also help you budget your money more effectively.

Here are some tips that could help:

Choose high-yield over low-interest accounts.

Keep emergency savings separate and accessible.

Use account “buckets” to monitor taxable vs. non-taxable spending.

Focus on reducing spending in high-tax categories whenever possible.

Consumption tax vs. income tax at a glance

While income tax targets earnings, consumption tax targets spending, creating distinct economic incentives and distributional effects. For example, income tax systems are often centered around progressive tax, with higher earners paying a larger percentage, whereas consumption taxes can be regressive, disproportionately affecting lower-income households. This table summarizes the main differences:

Consumption tax | Income tax | |

Tax base | Spending on goods and services | Earnings and income |

When taxed | At purchase | When income is earned |

Saving incentive | May encourage saving (tax only on spending) | May discourage saving (tax on income) |

Burden distribution | Can be regressive without rebates | Often progressive via brackets |

Complexity | Generally simpler | Often complex with deductions and credits |

Consumption tax example: Laptop purchase calculation

Let’s say you buy a $1,000 laptop in California. With a 7.25% state sales tax, you’d pay an extra $72.50 for a total of $1,072.50. Being aware of how these taxes can add to your purchase price can help you better prepare your budget.

Consumption tax is a spending-based levy, applied when you buy — not when you earn. Knowing how it works helps you plan smarter, spend more intentionally, and protect your savings. By minimizing taxable purchases and using high-yield savings accounts, you can keep more of your money working for you.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.