Raisin’s latest news on rates

ECB ends 4-year, €2.6tn Asset Purchasing Program. Confirmed on Dec. 13th, the decision will remove an essential stimulus instrument aimed at keeping interest rates low and largely insensitive to sovereign risk differentials across the Eurozone. A large degree of monetary support will remain in place as cash from maturing bonds will be invested back into the market for an extended period of time after a first rate hike. Mario Draghi stated that interest rates were to remain at current levels “at least through the summer” of 2019. Market prices currently reflect a first increase in 2020.

Weaker economic data points towards a slowdown of economic activity. Eurozone output grew by only 0.2% in 3Q18 – the slowest since 2014. Both the Italian and the German economy contracted as Germany faces weaker demand for exports and Italy’s row with the EU over its budget remains unresolved. A recent drop in oil prices further reduces pressure on already subdued inflation expectations. The ECB considers this slowdown to be temporary and due in part to a normalization following a period of very strong growth and job creation.

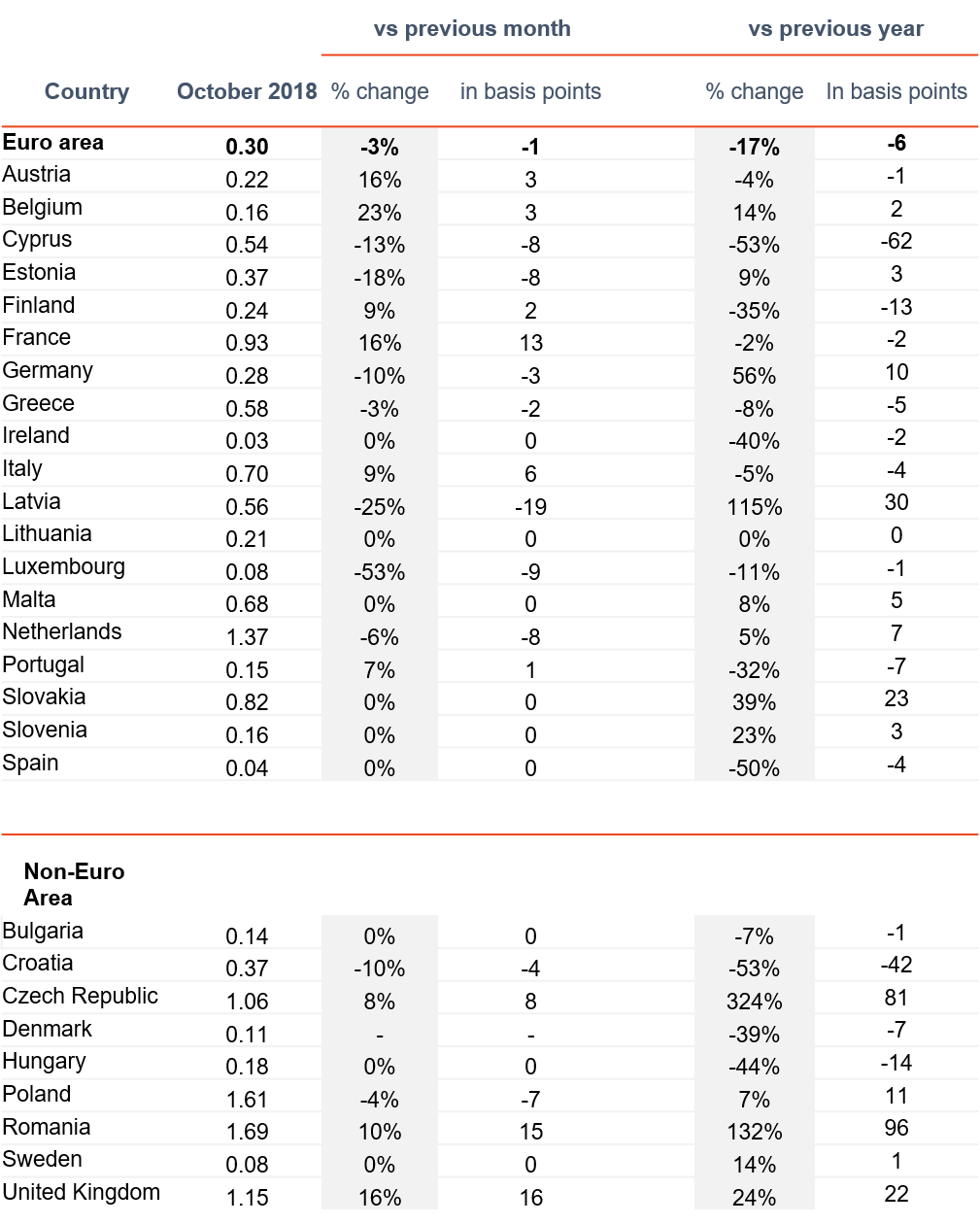

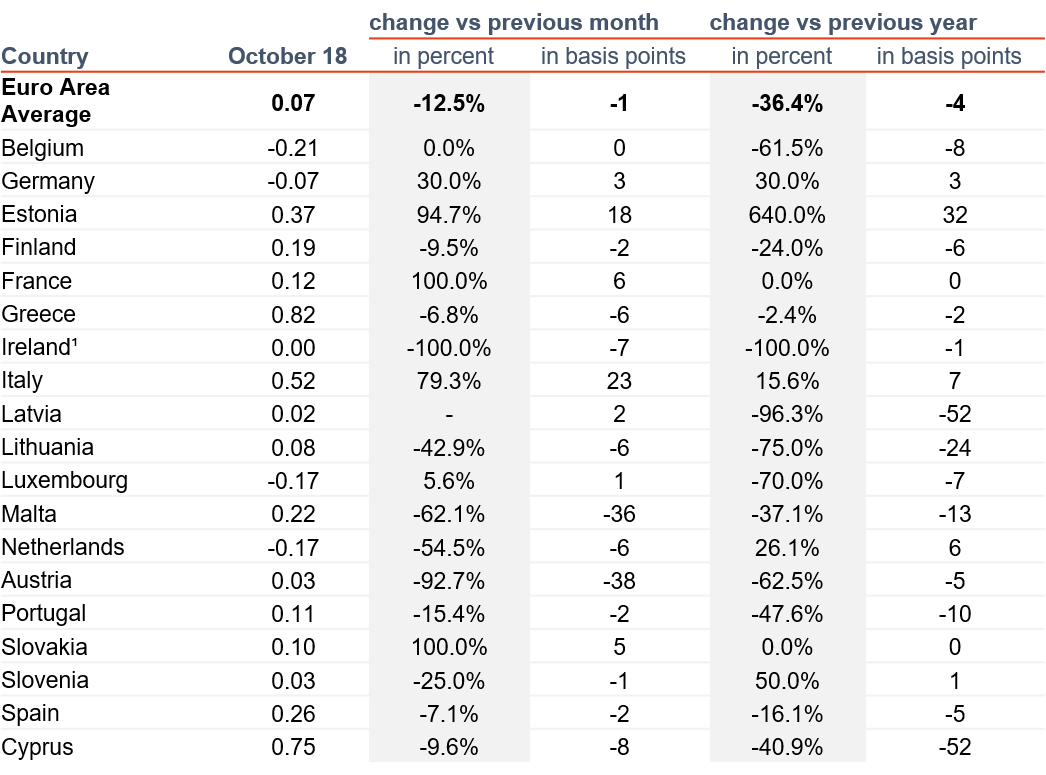

Market Rates from the ECB — Retail

The decline in interest rates paid to households across the European Union seems to continue: the average bank’s interest rate for household deposits decreased by 3% compared to September and by 17% compared to last year.

After a quick increase of 1 bp from August to September, average rates in Germany declined by 3 bps to 28 bps, however, this represents an increase of 56% compared to last year. Italian rates increased by 9% compared to the previous month, but still decreased by 5% compared to last year. There is no change in interest rates in Slovakia, Slovenia and Spain, with the former not having changed since July this year.

Looking at the non-Euro countries, the Czech Republic has increased rates steadily since August 2017, now up 81 bps compared to last year. Romania pulled off a similar rate hike, up 96 bps compared to last year.

Whether Brexit is manifesting itself in the retail funding conditions is up for speculation: however, we do see an increase of 16 bps compared to previous month and 22 bps compared to last year.

Current Retail Deposit Interest Rates in the EU

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data.

Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

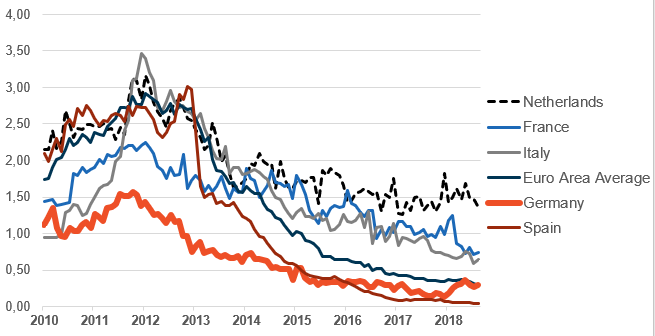

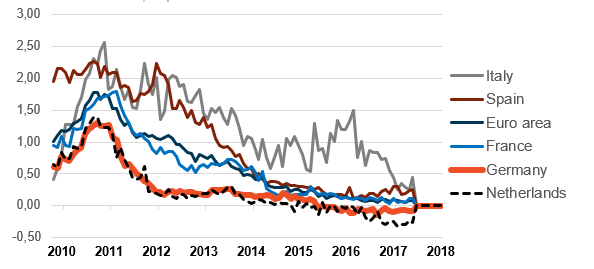

Historical Development of Retail Deposit Interest Rates

Average interest rate for new deposits, private households, maturities ≤ 1 year, ECB data, in percent.

Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

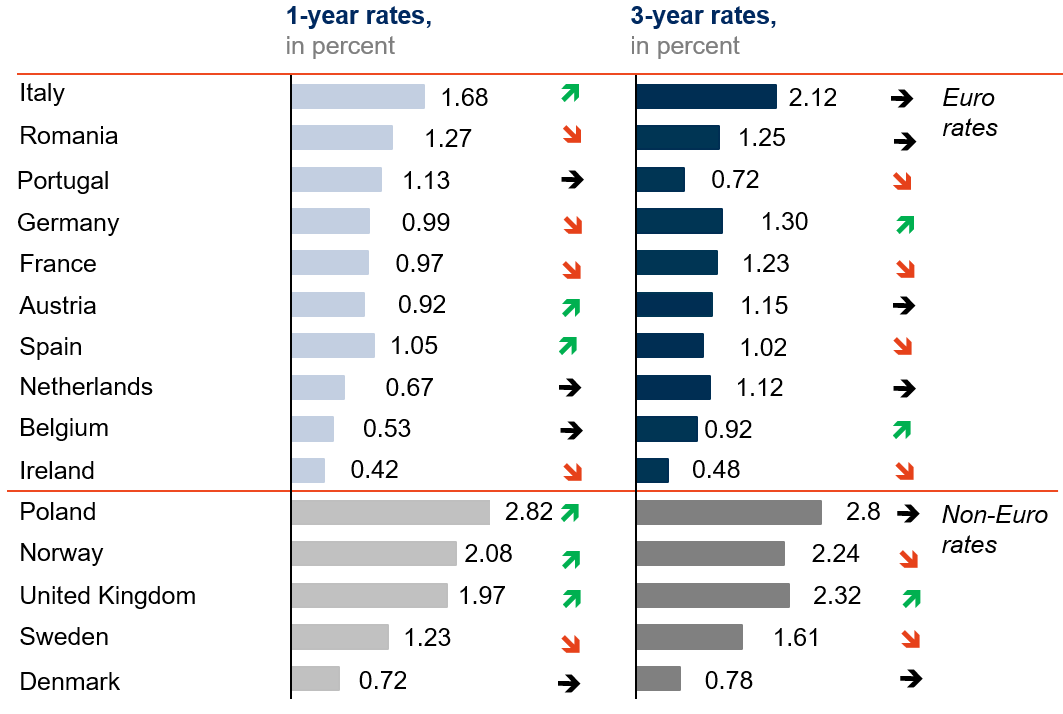

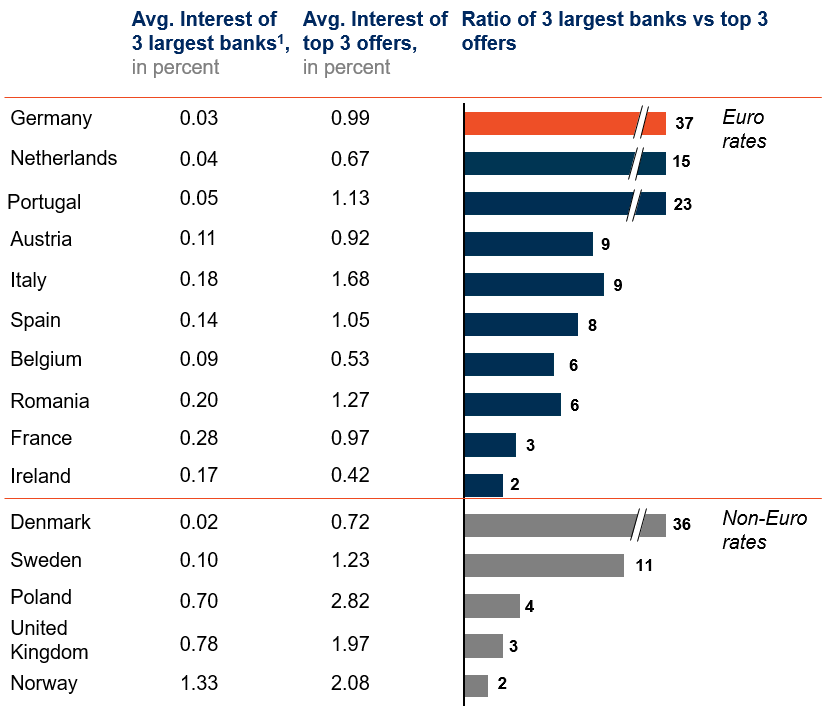

Highest Retail Rates

We strive to depict an unbiased market overview and therefore exclude offers from Raisin or similar platforms. For the purpose of comparability and to accurately show and consistently reflect the top market offers, we will consider, going forward, the top 3 retail offers in every country.

The recent retail top offers/rates reflect funding conditions in Italy: among the Euro-countries, Italy places highest with 1.68% on 1-year and 2.12% on 3-year deposits, which is even higher than the DKK and SEK deposit rates.

Germany slightly decreased compared to our last issue and BENELUX — at least Belgium and the Netherlands — stayed put.

Overall, 1-year FX deposit rates have increased since the last issue, while 3-year rates mostly decreased or remained unchanged.

Highest Retail Deposit Interest Rates in the EU

Average of the top 3 term deposit offers for retail customers based on local comparison sites as of 10.12.2018. Criteria: EUR 10,000 deposit; 1 product per bank; offers for both new and existing clients.

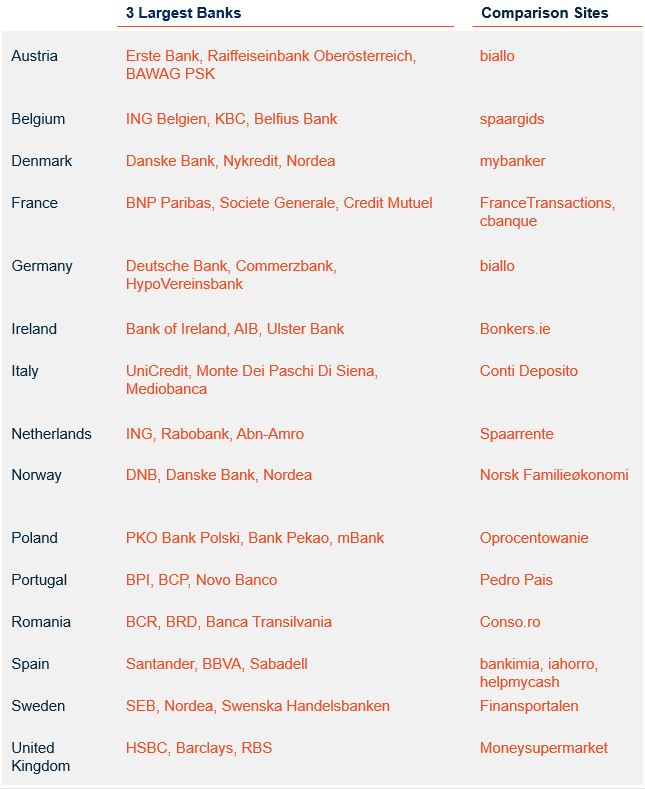

In Denmark the big banks cut rates, leading to an average of 0.02, which leads to a high multiple of 36, placing Denmark a notch below Germany with regards to the divergence between big banks and top offers.

Germany still offers the highest ratio of 37 — German customers can achieve significantly higher returns by depositing with smaller banks.

Retail Deposit Interest Rates of the 3 Largest Banks

1 Usually, largest banks based on balance sheet size, which offer term deposits; detailed list on the next page.

Average of 1-year term deposit offers for retail customers offered by the 3 largest banks in the local market; as of 10-12-2018. Criteria: EUR 10,000 deposit; offers for both new and existing clients.

Market Rates from ECB — Corporate

Generally, corporate deposit rates decreased compared to last month. However, Estonia increased rates by 18 bps representing a 94.7% increase compared to last month and a stunning 640% compared to last year.

France and Slovakia increased corporate rates to last year’s level. Austria’s brief increase in August and September has been reverted and rates are back to July levels at 3 bps.

Current Corporate Deposit Interest Rates in the Euro Area

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

Historical Development of Corporate Deposit Interest Rates

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics, in percent.

Sources and Glossary