Raisin customers earned up to 50% more interest

on their savings compared with the market average.*

Receive a welcome bonus of up to £150 when you register for a Raisin UK account using the code SAVE, open a fixed rate bond with a term of 1 year or longer and deposit a minimum of £10,000 by 16 January 2026.

New customers only, terms apply. (see bottom of this page)

*Based on Raisin UK data from launch (Feb 2018) to June 2025, comparing total interest earned by Raisin customers with what they would have earned at the UK average savings rate over the same period.'

Whatever your savings goals, we can help build your financial future with access to competitive savings accounts from a wide range of partner banks - all with a single log-in.

Locking your money into a fixed rate bond with Raisin UK can help protect your savings from the impact of inflation as well as falling interest rates. Estimates suggest UK savers could potentially lose up to £2.3 billion in interest over the next 12 months by leaving their savings idle, so now could be the time to explore your savings options.

To help get you started, new customers can receive a welcome bonus on their first qualifying deposit between 5 January 2026 and 16 January 2026. To qualify, follow these steps:

- Register for a Raisin UK account and enter the code SAVE in the promo code box (please note: you must enter the code to qualify, it is not auto-applied).

- Open and fund a fixed rate bond with a term of 1 year or over by 16 January 2026.

- The bonus you receive depends on how much you deposit:

Foundation | £10,000 – £24,999 | £40 |

Growth | £25,000 – £49,999 | £100 |

Legacy | £50,000 – £120,000 | £150 |

All your savings in one account

Manage your money across easy access savings, fixed rate bonds and notice accounts with a single log-in.

Free and easy to set up

Open your free Raisin UK account and apply once for access to our entire range of accounts.

A diverse range of providers

Why stick to the high street? Save with accounts from over 40 banks and building societies.

Deposit protection

Raisin UK is authorised and regulated by the FCA (FRN: 813894). Our partner banks and building societies are protected by the Financial Services Compensation Scheme (FSCS), which covers up to £120,000 per person, per bank.

Free to use

From registering to applying for your first savings account, Raisin UK is free to use with no hidden fees or charges.

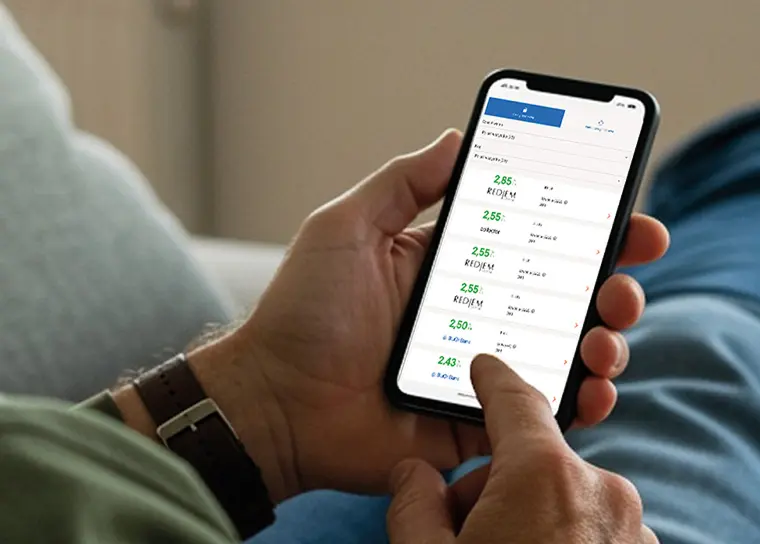

Featured savings accounts

These terms and conditions ("Terms and Conditions") govern the Raisin UK 'SAVE' welcome bonus offer. The bonus offer is available to customers who satisfy the eligibility criteria below and open a qualifying fixed rate bond through Raisin UK between 00:01 GMT on 5 January 2026 and 23:59 GMT on 16 January 2026 (the “Qualifying Period”).

Interpretation

References in these Terms and Conditions to “Raisin UK”, “we”, “us” or “our” mean Raisin Platforms Limited, trading as Raisin UK. References to “you” and “your” mean the customer participating in this Bonus Offer.

1. The Bonus

1.1 If you meet the eligibility criteria, you will receive a one-time cash bonus (the “Bonus”) based on the value of your first qualifying deposit into an eligible fixed rate bond through Raisin UK during the Qualifying Period.

1.2 The Bonus amount will be determined in accordance with the following tiers:

i. £40 for a first qualifying deposit of £10,000 - £24,999.99;

ii. £100 for a first qualifying deposit of £25,000 - £49,999.99;

iii. £150 for a first qualifying deposits of £50,000 - £120,000

Please note that FSCS protection currently applies up to £120,000 per eligible depositor, per UK-authorised institution. Any amount above the FSCS protection limit is not covered by FSCS.

1.3 The Bonus will be paid into your Raisin UK Transaction Account within 28 days after the relevant savings account becomes active and we have verified your eligibility.

1.4 The maximum Bonus amount you can receive under this offer is £150.

2. Eligibility Requirements

2.1 The Bonus is available only to new Raisin UK customers who have never previously opened or funded any savings account via Raisin UK prior to 00:01 GMT on 5 January 2026. This offer is not available to anyone who already has a Raisin UK account.

2.2 To qualify for the Bonus you must complete all of the following during the Qualifying Period:

a. Register for a Raisin UK account and enter the promo code ‘SAVE’ in the “promo code” field at registration.

b. Open a fixed rate bond with a term of 12 months or longer and make a single deposit of at least £10,000.

c. Ensure that the fixed rate bond remains open in accordance with its terms. If the order is cancelled, rejected, reversed, switched to another product or not successfully funded, you will not be eligible for the Bonus.

d. Only your first successfully funded qualifying deposit during the Qualifying Period will be used to determine the Bonus amount. Deposits made into any other savings products or any subsequent deposits do not qualify and will not alter your Bonus tier.

e. The Bonus amount will be determined by the value of your first qualifying deposit at the time it is first successfully funded. If that deposit is withdrawn, cancelled, partially reversed or otherwise reduced at any time, you will not qualify for the Bonus.

3. General

3.1 The Bonus offer is limited to one Bonus per person. We may use reasonable checks to detect duplicate, fraudulent or suspicious registrations.

3.2 We may exclude a participant from this offer, withhold, cancel or reclaim a Bonus, if we reasonably suspect that these Terms have been breached, that the Bonus was obtained unlawfully, or where their Raisin UK account is closed or suspended due to a breach of Raisin UK’s account terms and conditions.

3.3 We reserve the right to withdraw or change this offer at any time without prior notice and without giving reasons where we reasonably consider it necessary to do so, for example, due to legal or regulatory changes, or events outside our reasonable control.

3.4. The Bonus is a cash payment and is non-transferable. No alternative or substitute bonus will be provided.

3.5. This offer cannot be used in conjunction with any other promotional offer or bonus.

3.6. You are solely responsible for determining any tax liability and for reporting and paying any tax that may be due in relation to the Bonus.

3.7. If any provision of these Terms and Conditions is held to be invalid or unenforceable, the remaining provisions will remain unaffected.

3.8. By participating in this offer, you agree to be bound by these Terms and Conditions.

4. The Promoter

The promoter of this offer is Raisin UK. Raisin UK is a trading name of Raisin Platforms Limited (registered no 11075085) registered office Cobden House, 12-16 Mosley Street, Manchester M2 3AQ, United Kingdom. Raisin Platforms Limited is authorised and regulated by the Financial Conduct Authority (FRN: 813894 and 978619).

5. Governing Law and Jurisdiction

These Terms and Conditions shall be governed by the laws of England and Wales. Any disputes arising under them shall be subject to the exclusive jurisdiction of the courts of England and Wales.

About us

Savings accounts

Guides

About us

Savings accounts

Guides

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time.

Raisin UK is a trading name of Raisin Platforms Limited which is authorised and regulated by the Financial Conduct Authority (FRNs 813894 and 978619). Raisin Platforms Limited is registered in England and Wales, No 11075085. Registered office: Cobden House, 12-16 Mosley Street, Manchester M2 3AQ, United Kingdom. The information on this website does not constitute financial advice, always do your own research to ensure it's right for your specific circumstances. Tax treatment depends on the individual circumstances of each customer and may be subject to change in the future.