Deposit Interest Retention Tax (DIRT) in Ireland

Information provided courtesy of the Revenue Commissioners under a Creative Commons Attribution 4.0 International (CC BY 4.0) licence. For further information, please see Revenue.ie. This information is correct as of January 2026.

Key takeaways:

DIRT is a and deposit accounts, and it applies to Irish-resident individuals with deposit accounts

, you must declare the interest earned when filing your tax return

Whether you submit your taxes using Form 11 or Form 12, it’s straightforward to declare deposit interest for both EU and Irish accounts using the steps below

The information provided here is for informational and educational purposes only and does not constitute tax advice. You should consult with a qualified tax professional or adviser regarding your individual tax situation. Tax laws and regulations are complex and subject to change, and the information provided may not be applicable to your specific circumstances. We are not liable for any tax decisions or actions you take based on this information.

What is the current DIRT rate?

Last updated: January 2026

As of January 2026, the DIRT tax rate is 33% of the interest earned.

What is Deposit Interest Retention Tax (DIRT)?

Deposit Interest Retention Tax (DIRT), often referred to as DIRT tax, is a tax deducted by Irish financial institutions from deposit interest paid or credited to the accounts of Irish residents. This means that any interest payments you receive on your savings are subject to DIRT.

What constitutes a financial institution?

- a licensed bank in any European Union (EU) Member State

- a building society in any EU Member State

- a trustee savings bank

- the Post Office Savings Bank

- a credit union

Which other taxes may apply?

When do you pay DIRT?

This depends on where your savings are held:

- Irish bank or credit union – They typically deduct DIRT automatically before paying you the interest, but it’s important to check your bank statement to make sure.

- Financial institution in an EU/EEA or non-EU country – No DIRT is deducted automatically. You must declare the interest yourself on your annual tax return and pay any tax due.

How do you declare DIRT tax in Ireland?

If DIRT has already been deducted from your savings interest, you usually only need to declare the interest if you’re filing a tax return. You must include any deposit interest you received and enter the total interest payment before the deduction of DIRT.

In Ireland, the type of return you must complete depends on whether you’re registered for self-assessment or you’re a Pay As You Earn (PAYE) worker:

Self-assessed: If your non-PAYE income is €5,000 or more, or you’re self-employed, you should include any income received from deposit accounts on your Form 11 in Section G ‘Irish Other Income’. Use Revenue Online Service (ROS) to submit your Form 11.

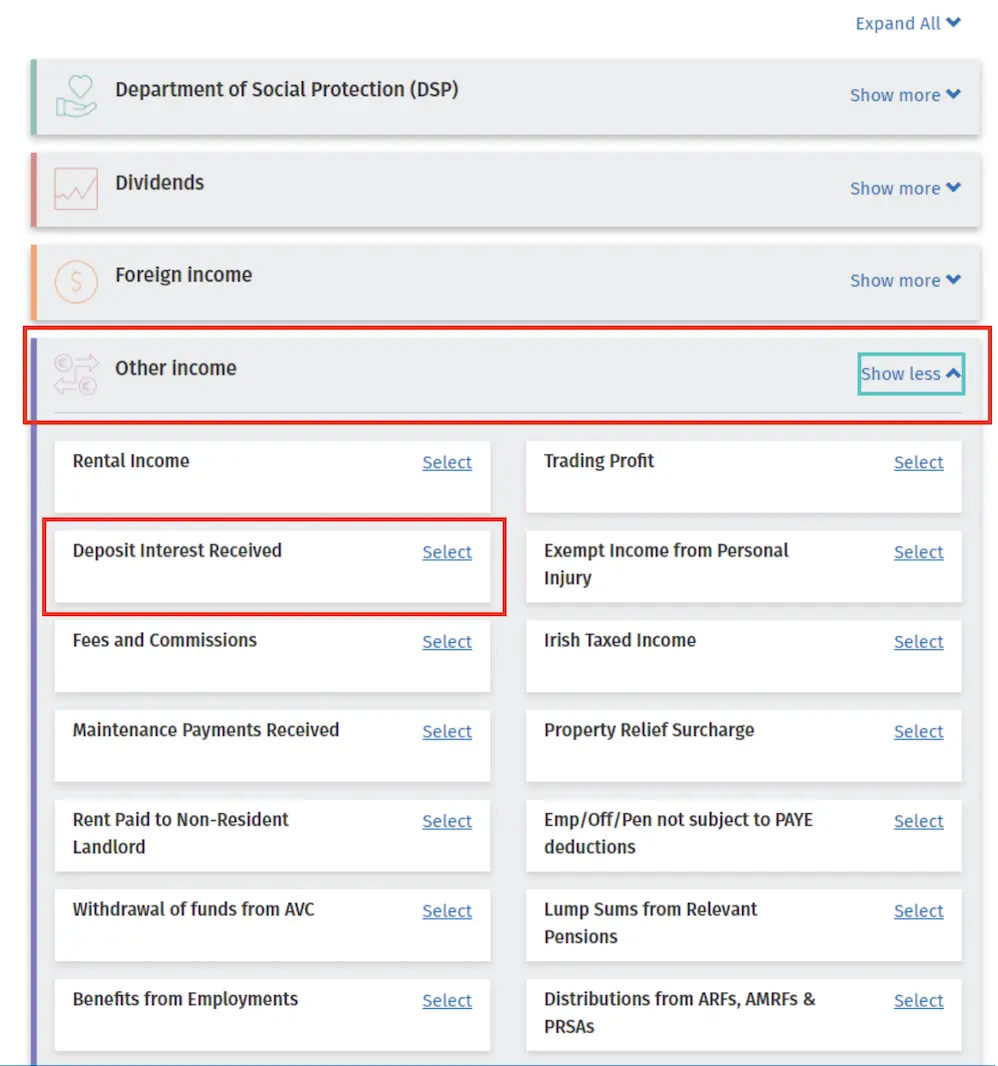

PAYE taxpayer: If you are a PAYE taxpayer, you can use MyAccount to submit your income tax return. You should include any interest income on your Form 12 under ‘Irish Deposit Interest/Credit Union Dividends’ – but only if your total non-PAYE income (including interest subject to DIRT) is less than €5,000. This is found under ‘Other Income’.

You might want to keep hold of your bank statements in case Revenue requests them later. Learn more about filing a tax return in Ireland.

How do you report foreign deposit interest in Ireland?

If you receive deposit interest from an account in another EU Member State, EEA country, or non-EU country, this is called foreign deposit income (or Foreign Income on MyAccount). As a resident of Ireland, you must include the details of this on your annual tax return.

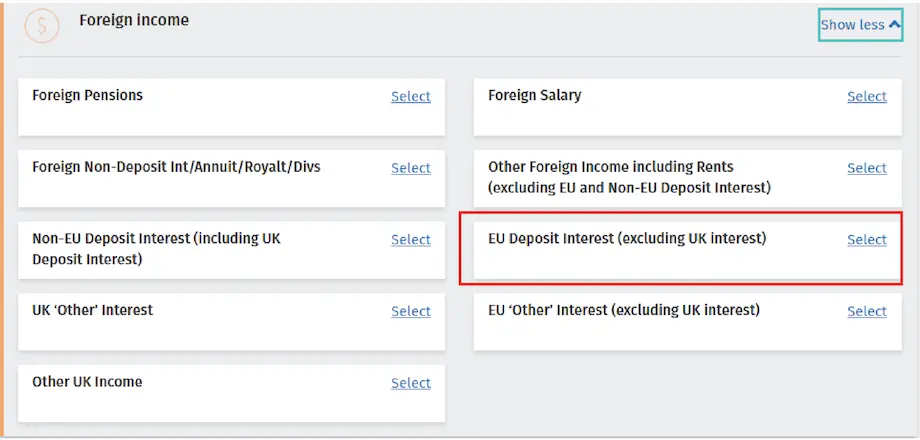

When reporting EU/EEA deposit interest, navigate to ‘Foreign Income’ and select ‘EU Deposit Interest (excluding UK interest)’.

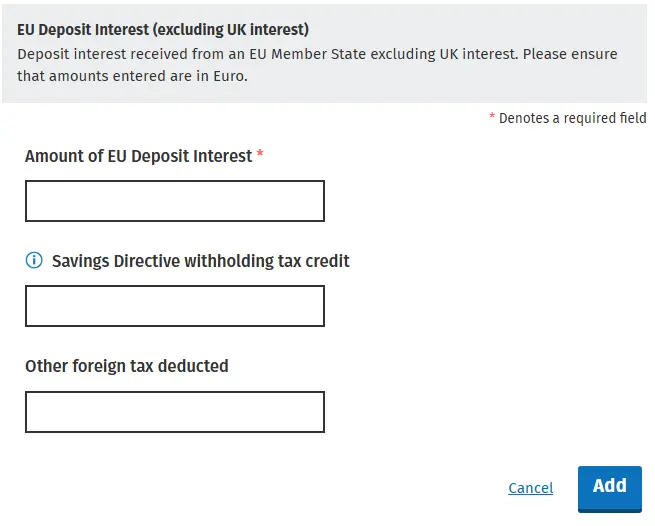

Enter the interest amount in this section.

You must pay the current DIRT rate on the interest income. The income will be subject late-filing surcharges and/or interest if it is not returned on time. Find more about your tax return deadline.

For accounts outside the EU/EEA, the rate that applies is the higher of the DIRT rate and your marginal tax rate. If you are a higher-rate taxpayer, for example, your interest will be taxed at 40% (your marginal rate).

For more information, read our FAQ on how to declare EU deposit interest to Revenue.

Foreign deposit interest for PAYE taxpayers

If you’re a PAYE taxpayer, you can declare EU sourced deposit interest on myAccount, by following these instructions:

- Sign in to myAccount.

- Click 'Review your tax for the previous 4 years' under 'PAYE Services'.

- Select the tax year for which you would like to submit an Income Tax Return and receive a Statement of Liability.

- Click 'Request' to begin the process.

- Select 'Complete your Income Tax Return'.

- In the section 'Non-PAYE Income', select 'EU Deposit Interest (excluding UK interest)' under 'Foreign Income'.

- Input all details of deposit interest received.

- Complete the process, input your password and submit your Income Tax Return.

Double taxation of foreign deposit interest

If you earn interest from accounts outside Ireland, you may already pay withholding tax on it. As an Irish resident, you still need to declare this income on your tax return and it may be subject to DIRT. To prevent this income being taxed twice (in both countries), Ireland has Double Taxation Agreements (DTAs) with other countries that limit the tax charged in the source country and allow you to claim a credit for tax already paid abroad.

For example, if an Irish resident individual earns €100 of interest in Portugal in respect of a deposit held in a bank account with a Portuguese bank.

The DTA between Ireland and Portugal limits the Portuguese tax on such interest to 15%. Ireland (being the country of residence) will then give a credit for the tax already paid in Portugal (the source country).

The Irish tax position is:

Interest income | €100 |

Tax @ 33% | €33 |

Less Portuguese tax | (€15) (being 15% as set out in the DTA) |

Irish tax due | €18 |

Where the source country withholds tax in excess of the rate set out in the relevant DTA, account holders will have to contact the tax authority in that country to claim any refund of tax due.

In all cases, the specific terms of the relevant DTA should be consulted.

Find out more in Revenue’s manual on the taxation of deposit interest income.

How DIRT tax affects Raisin customers

Raisin’s partner banks are all based in EU countries outside Ireland, so you will have to declare EU deposit interest when filing your tax return. In some cases, you can reduce or cancel withholding tax by submitting a certificate of tax residence from Revenue or other documentation. Details are listed alongside every offer in our savings account comparison table. You can also check the complete list of withholding taxes in each country.

If you have any questions, contact our customer service team.

Who is exempt from DIRT tax in Ireland?

You can receive interest without paying DIRT (DIRT-free account) in certain conditions. To do this, you must complete a declaration form stating that you, your spouse or civil partner are:

- 65 years of age or over when making the declaration. In order to be exempt from DIRT over the age of 65, your total income for the year, including the interest, must be below the annual exemption limit. For 2026, this limit is €18,000 for a single, widowed, or surviving civil partner, and €36,000 for those who are married or in a civil partnership.

- permanently incapacitated due to a physical or mental disability

If you are a trustee of a special trust for permanently incapacitated individuals, you can apply for an exemption from DIRT. You must be the holder of this account. The trust must meet the following conditions:

- it is set up only for the benefit of one or more permanently incapacitated persons

- the funds of the trust are from subscriptions given by the general public

- the specified incapacitated person(s) must own the funds in the account

Learn more about how trusts work.

How to apply for a DIRT tax exemption

If you’re over 65 years of age and your income for the year is below the exemption limit, complete Form DE1 and send it to your financial institution. You can access this form by contacting your financial institution or by downloading it directly from their website.

If you’re permanently incapacitated or the trustee of a relevant trust, complete Form DE2 and send it to your Revenue Office. They will tell your financial institution that you’re exempt from paying DIRT. You can find the form at Revenue.ie.

You will need a separate form for each account you hold. Should your personal circumstances change, it may affect your exemption from DIRT. You can find out more about how a change in circumstances affects this tax.

Can you claim a DIRT refund?

You might be able to claim a refund if:

- you turned 65 and now qualify for the exemption

- your income temporarily exceeded the limit but otherwise meets exemption criteria

- you became permanently incapacitated

- you qualified for exemption but DIRT was still deducted

If one of the above applies to you, you can complete Form 54 Claims and send it to your local Revenue Office. Once Revenue processes your claim and accepts it, they will send you the refund.

First-time buyers

Under the Help to Buy (HTB) scheme, first-time buyers may be able to claim back DIRT paid in the 4 tax years before the year you apply. This helps cover the cost of buying or building a first home. You may be entitled to claim back income and DIRT tax paid over the previous four years.

Non-resident account holders

If you’re not a tax resident in Ireland, you may not need to pay DIRT. To qualify you must:

- Be non-resident in Ireland for tax purposes.

- Complete a non-resident declaration form (your bank will provide this).

- Not pay tax in Ireland.

- Hold the account in your name only (if you have a joint account with someone who is tax resident in Ireland, the exemption doesn’t apply).

You may claim a refund of some or all of the DIRT you paid if both of these conditions apply:

- you’re not resident in Ireland for tax

- Ireland has a Double Taxation Agreement with the country of residence.

You can complete a Form IC5 to claim a refund.

No deduction of DIRT

If Ireland doesn’t have a Double Taxation Agreement with the country you’re resident in, you can’t get a DIRT refund. However, you might not need to pay DIRT. You can ask your financial institution if a declaration of non-residency can be submitted.

Save across Europe with Raisin

Now that you know how DIRT tax works on accounts within and outside Ireland, you might want to explore savings opportunities in other EU countries. At Raisin, you can compare competitive rates on deposit and demand deposit accounts from a range of partner banks across Europe. Simply register for a free Raisin Account, choose and apply to open an account that works for you, and transfer your funds.

Company & team

Savings accounts

Information

Company & team

Savings accounts

Information

© 2026 Raisin Bank AG, Frankfurt a.M.

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time. Raisin Bank, trading as Raisin, is authorised/licensed or registered by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) in Germany and is regulated by the Central Bank of Ireland for conduct of business rules.