Withholding tax for Irish savers

Understanding how foreign deposit income is taxed in Ireland.

This information is up to date as of February 2026.

For Irish tax residents, interest from foreign bank accounts (such as those held through Raisin’s partner banks) must be declared on your income tax return. This page explains how foreign interest is taxed, what documentation you may need, and what steps you should take to comply with Irish tax rules.

Key takeaways

Irish tax residents are required to declare any interest earned on deposits held in foreign (non-Irish) banks

Raisin’s partner banks are all located outsideIreland, so interest earned must be included in your annual income tax return

Some countries, such as Sweden, don’t levy withholding tax on interest paid to non-resident account holders, but Irish tax residents must still declare foreign-earned interest to Revenue

The information provided here is for informational and educational purposes only and does not constitute tax advice. You should consult with a qualified tax professional or adviser regarding your individual tax situation. Tax laws and regulations are complex and subject to change, and the information provided may not be applicable to your specific circumstances. We are not liable for any tax decisions or actions you take based on this information.

How is foreign deposit income taxed in Ireland?

For Irish tax residents with accounts at Irish banks, deposit interest retention tax, or DIRT, is charged at 33% of the interest earned, and the bank will usually automatically deduct and pay this tax to the Revenue Commissioners on your behalf.

Interest earned on savings held in EU banks outside Ireland is also subject to DIRT, but it isn't taken at source.

Since all of Raisin’s partner banks are located outside Ireland, any interest you earn through your Raisin savings account(s) must be included in your Irish tax return, as required under Irish Revenue rules.

The table below summarises the withholding tax rules that apply when saving with Raisin’s partner banks across the EU.

Austria | 25% | 0% |

Czechia | 15% | 0% |

France | No withholding tax on interest income for permanent residents of Ireland. | |

Italy | No withholding tax on interest income for permanent residents of Ireland. | |

Germany | No withholding tax on interest income for permanent residents of Ireland. | |

Latvia | 25.5% | 10% |

Luxembourg | No withholding tax on interest income for permanent residents of Ireland. | |

Lithuania | 15% | 10% |

Malta | No withholding tax on interest income for permanent residents of Ireland. | |

Norway | No withholding tax on interest income for permanent residents of Ireland. | |

Poland | 20% | 10% |

Portugal | 25% | 15% |

Slovakia | 19% | 0% |

Spain | 19% | 0% |

Sweden | No withholding tax on interest income for permanent residents of Ireland. | |

Documentation required to reduce withholding tax

To reduce or receive a full exemption from withholding tax on interest earned from foreign banks, you may need to provide specific documentation. Requirements and deadlines for submitting the necessary forms vary, so it’s important to follow each country’s rules carefully.

France, Italy, Germany, Luxembourg, Malta, Norway, Sweden

Raisin partner banks: Aareal Bank AG, Banca CF+, Banca Privata Leasing, Banca Profilo, BFF, BTG Pactual, CA Auto Bank, Carrefour Banque, Collector Bank, EuroExtra, Hamburg Commercial Bank, Imprebanca, Izola Bank, Klarna Bank AB, Morrow Bank ASA, Nordax Bank AB, Northmill Bank AB, Raisin Bank, Resurs Bank, TF Bank AB, Younited Credit.

Required: No action required.

There is no withholding tax on interest income for tax residents of Ireland.

Austria

Required: The form Declaration by individuals for the purpose of unilateral tax relief at source

You will need to ensure that the form is signed and stamped by Revenue.

Czechia

Raisin partner bank: J&T Banka

Required: Certificate of Tax Residence confirming your valid Irish tax residency.

The Czech tax authorities now only accept tax documents that are issued or signed within 90 days of the date of the interest payment. The certificate must be sent at least four weeks before the deposit’s maturity date.

Latvia

Raisin partner banks: BluOr Bank AS, Rietumu Bank

Required: Residence Certificate (Raisin will provide this to you once your account is opened)

You should submit the certificate to Revenue at least 12 months before the date of the interest payment to allow sufficient time for processing. The original form must then be posted to Raisin no later than eight weeks before the interest payment, after which we will forward it to the partner bank on your behalf.

Lithuania

Raisin partner bank: Fjord Bank

Required: Certificate of Tax Residence confirming your valid Irish tax residency.

Lithuanian tax authorities only accept documents that are correctly dated and signed in the same year as the deposit’s maturity. If your deposit matures in the early weeks of a new year, it may not be possible to submit valid documentation in time, so the withholding tax cannot be reduced. Documentation must be submitted at least four weeks before the deposit's maturity date.

Poland

Required: Certificate of Tax Residence confirming your valid Irish tax residency.

The original certificate, completed by you and signed by the Irish tax authorities, must be sent to Raisin no later than six weeks before the interest payment, but no earlier than six months before.

Portugal

Raisin partner banks: Banco Português De Gestão, Haitong Bank

Required: The form 21-RFI (Raisin will provide this to you once your account is opened)

You must submit the completed form to Revenue no earlier than 12 months before the interest payment is due. The original, completed and signed form must then be posted to Raisin no later than four weeks before the interest payment. We will then forward it to the partner bank on your behalf.

Slovakia

Raisin partner bank: Privatbanka

Required: Certificate of Tax Residence confirming your valid Irish tax residency.

This certificate must be submitted at least four weeks before the maturity of the deposit.

Spain

Raisin partner bank: A&G Banco

Required: The form Auto Declaración de Residencia Fiscal de Persona Física y Jurídica

This form must only be submitted once per customer, prior to opening your first deposit account. It is not required for any additional deposits or renewals. The form will be available in the “Documents” section of your Raisin Account immediately after you make your first deposit request.

How do I declare my foreign income in Ireland?

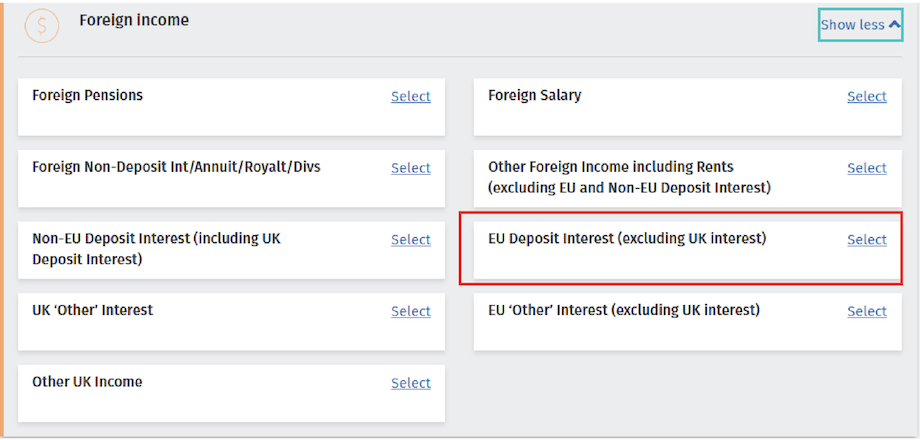

You’ll need to declare all foreign income, including interest earned on deposits held in banks through Raisin, on Form 11 when you file your Irish income tax return. Foreign deposit income should be included in Section F (“Foreign Income” under “EU Deposit Interest”) — find out more here.

How this looks on MyAccount

If foreign tax is withheld on the interest income, you may also be eligible for double tax relief under Ireland’s double taxation agreements.

It's also important to note that in certain cases, Irish tax residents may still be liable for Pay Related Social Insurance (PRSI), and capital gains from foreign assets may be subject to Capital Gains Tax (CGT).

Save with Raisin

Managing your savings through Raisin gives you clear control over what happens when your fixed term deposits mature. As your account approaches its end date, you can choose to renew your term, switch to another savings account or withdraw your funds. Renewal options are shown in your Raisin Account ahead of maturity, so you have time to review your choices and decide how you want your savings to work next.

Company & team

Savings accounts

Information

Company & team

Savings accounts

Information

© 2026 Raisin Bank AG, Frankfurt a.M.

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time. Raisin Bank, trading as Raisin, is authorised/licensed or registered by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) in Germany and is regulated by the Central Bank of Ireland for conduct of business rules.