If you are a customer of a European bank your savings are protected up to an equivalent of €100,000 per bank and customer according to an EU directive. Several protective measures like ex ante and ex post contributions ensure a reimbursement of savers in case of a bank failure. According to the European Banking Authority, ensuring the reimbursement is one of the “primary goals of the authorities, the EU, and the legislative framework when dealing with bank failures.”

How does a deposit guarantee scheme work?

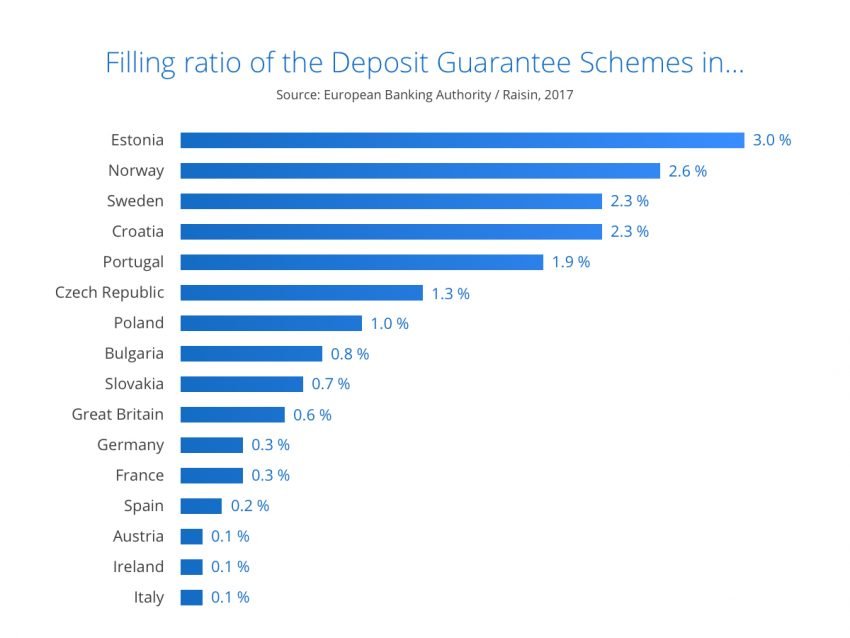

To ensure immediate operational readiness in case of a bank failure, each European deposit guarantee scheme will have to cover at least 0.8 percent of the respective protected deposits by 2024. To meet this requirement, banks pay regular contributions into their deposit guarantee schemes.

In case available funds are insufficient to cover the reimbursement of savers in the event of a bank failure, the deposit guarantee scheme is able to call extraordinary contributions from all its members to cover the shortfall. In addition, member states have to ensure that sufficient financing alternatives are available to national deposit guarantee schemes to reimburse savers. This may mean that member states may have to provide these funds temporarily – if required even by borrowing money from other EU members. Deposit guarantee schemes may also borrow the needed funds from another deposit guarantee scheme, another market player, or another financial institution.

Which countries have already reached their goal of 0.8 percent?

Estonia, Norway, Sweden, Croatia, Portugal, Czech Republic, Poland, and Bulgaria have reached or exceeded their goal of covering at least 0.8 percent of the respective deposits. Conversely, Italy, Ireland and Austria only reached a percentage of 0.1 percent. Spain is at 0.2 percent, Germany and France both reached 0.3 percent. Slovakia and Great Britain almost reached the goal – they have accumulated 0.7 and 0.6 percent.

Is a coverage of 0.8 percent sufficient?

Is a coverage of 0.8 percent sufficient?

The goal of each deposit guarantee scheme is to protect every individual saver covered by the fund. Since the probability of simultaneous large bank failures is extremely low, the extent of coverage was selected in such a way that it is sufficient for a vast majority of scenarios while simultaneously reducing the outflow of liquidity from the financial system for an event that occurs extremely rarely.

What does it mean when a deposit guarantee scheme does not cover 0.8 percent of respective deposits?

The fact that a national deposit guarantee scheme does not yet cover 0.8 percent of respective deposits has no immediate consequences for savers: Deposit guarantee schemes can be realized through alternative financing. In the past, it has also been demonstrated that supranational institutions such as the EU Commission and the ECB are willing to contribute with direct and indirect monetary policy measures to protect savers. However, it demonstrates that the deposit guarantee scheme does not yet meet the requirements set by the European Union.

Therefore, the European Banking Authority suggests to carefully take into consideration how well-funded the respective deposit guarantee schemes are. At the latest by 2024, all European countries have to equip their national deposit guarantee schemes with at least 0.8 percent of the respective protected deposits.

Read more: