What is the effect of negative interest rates on the banking sector?

Since March 2016, banks have to pay an annual negative interest rate of 0.40% on their deposits at the European Central Bank (ECB). One of the goals of the ECB’s negative interest rate-policy is to spur companies and consumers to borrow and spend more in order to revive the European economy and move inflation to the ECB’s stated goal of a figure lower, but close to 2%.

Numerous European banks already charge their corporate customers negative interest rates, but recently German savings banks and cooperative mutual banks like Skatbank have gone a step further and started charging even private customers negative interest rates on their savings accounts.

Despite these signals, in general European banks are hesitant to pass on negative interest rates to savers directly, fearing this would drive many customers away. The fact banks are not passing on their ECB deposit losses to customers is hurting the profitability of the entire banking sector.

These problems have been compounded by the fact that customers are saving more money in banks in order to compensate for the income loss caused by lower interest rates.

If negative interest rates persist or become more pronounced, banks will need to pass on negative interest rates, charge their customers more substantial fees and cease to cross-subsidise products. It is no coincidence that Germany’s popular Postbank and other institutions recently introduced fees on personal current accounts. Banks which do not adopt these measures will lose money and eventually be replaced by more proactive banks.

In this scenario, banks will also need to consider cost-cutting measures, mergers and partnerships with the emerging fintech sector to offer more products and more revenue-generating services to customers. Although these steps each have costs and risks, doing nothing will not bring profits back to the banking industry.

About the interest rate radar

At Raisin we believe that transparency can help customers find the right savings product. Since deposits are one of the main sources of financing for banks and are still the preferred investment product of private customers, we are pleased to provide you with the latest information on savings.

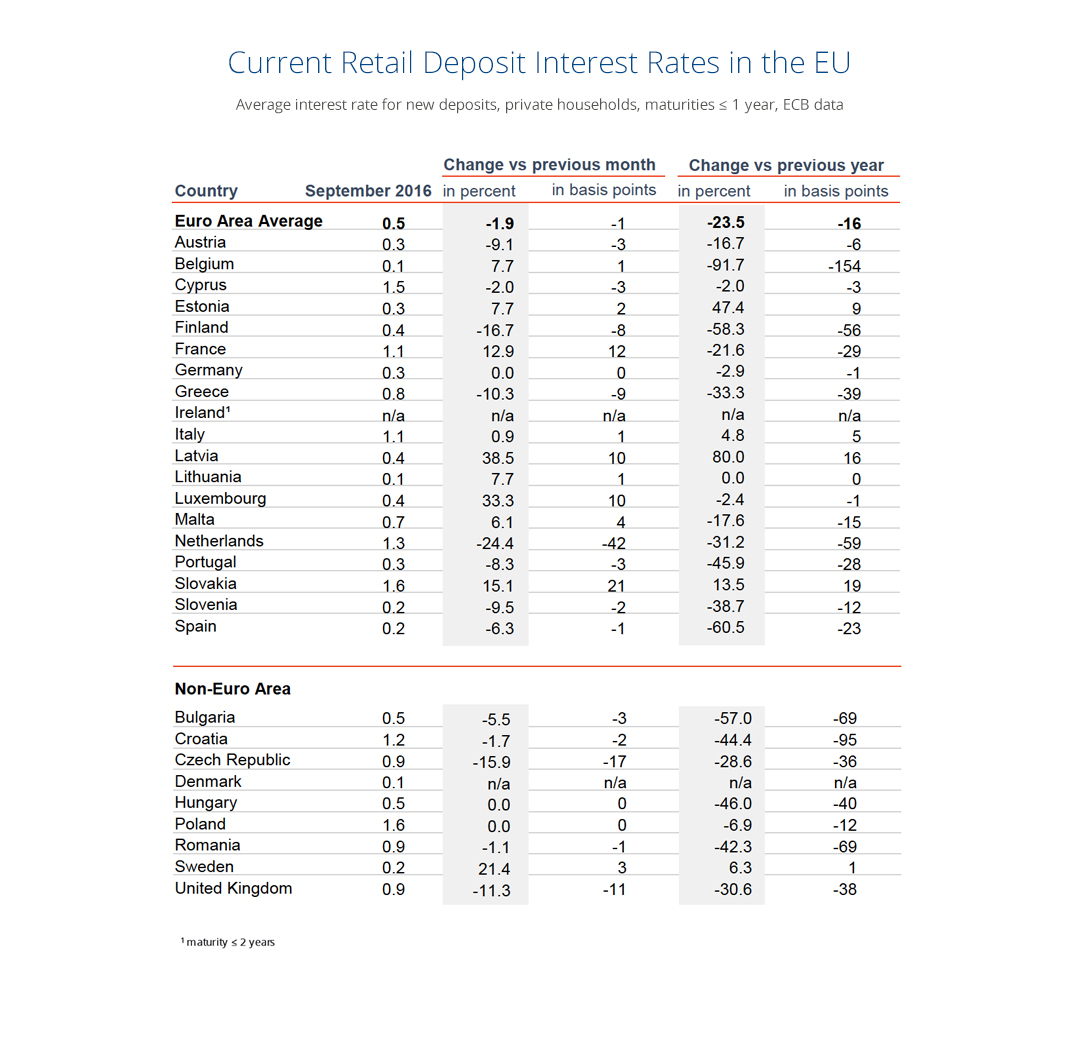

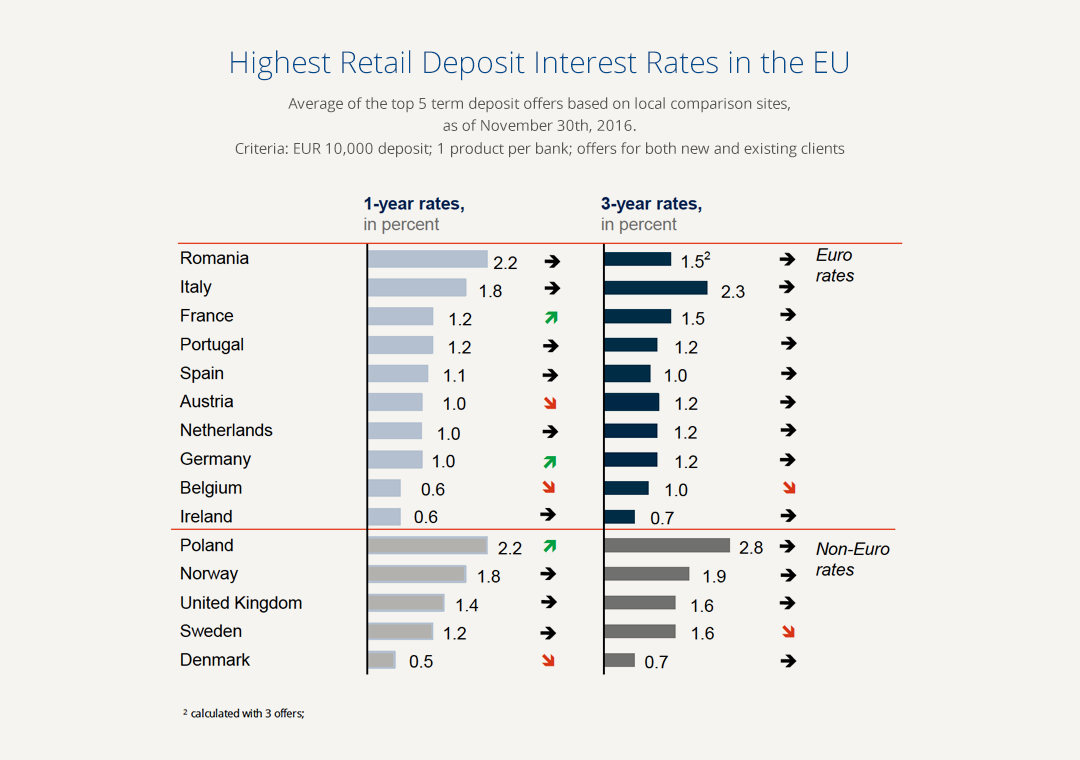

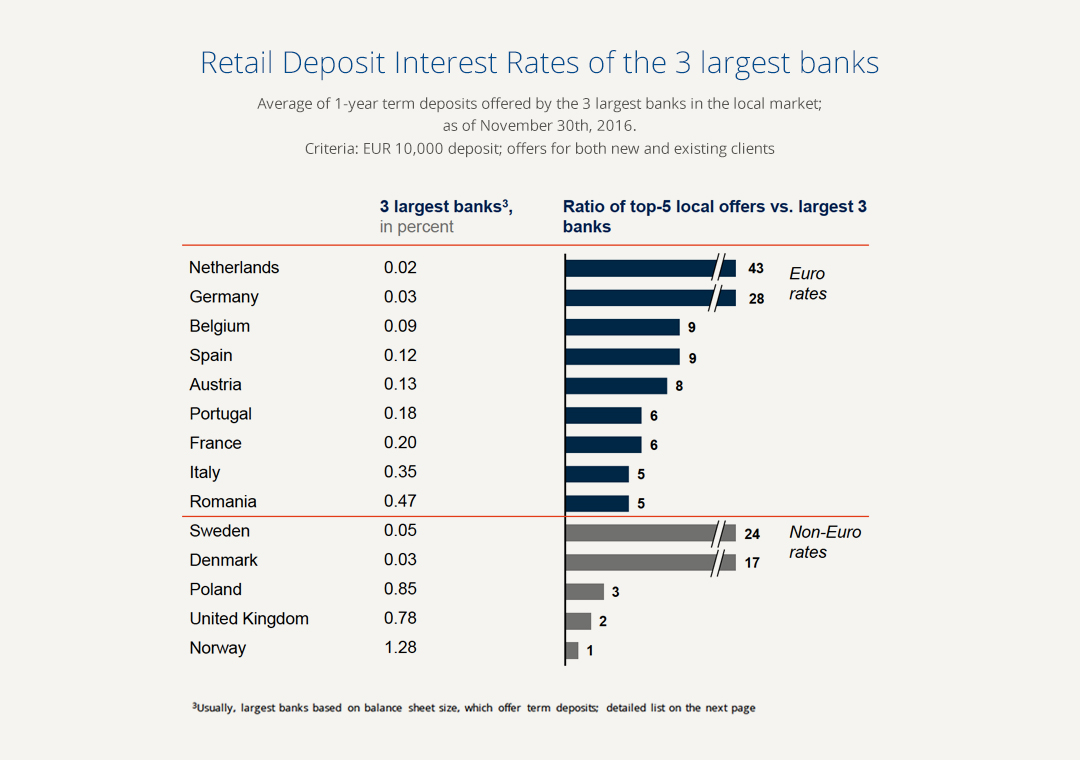

Effective date: 30/11/2016, Sources:

Austria: biallo; Erste Bank, Bank Austria, Landesbank Oberösterreich

Belgium: Spaargrids; ING Belgien, KBC, Belfius Bank

Denmark: maybanker; Dankse Bank, Nykredit, Nordea

France: FranceTransactions; BNP Paribas, Societe Generale, Credit Mutuel

Germany: biallo; Deutsche Bank, Commerzbank, HypoVereinsbank

Ireland: Bonkers.ie; Bank of Ireland, AIB, Ulster Bank

Italy: Conti Deposito; UniCredit, Monte Dei Paschi Di Siena, Mediobanca

Netherlands: Spaarrente; ING, Rabobank, Abn-Amro

Norway: Norsk Familieøkonomi; DNB, Danske Bank, Nordea

Poland: Oprocentowanie; PKO Bank Polski, Bank Pekao, mBank

Portugal: Pedro Pais; BPI, BCP, Novo Banco

Romania: moneycenter; BCR, BRD, Banca Transilvania

Spain: tucapital; Santander, BBVA, Sabadell

Sweden: Finansportalen; SEB, Nordea, Swedbank

United Kingdom: Moneyfacts; HSBC, Barclays, RBS