Raisin’s latest news on rates

Italy and the ECB interest rate policy are the two topics dominating the European interest rate landscape.

The increase in Italy’s sovereign funding costs is not yet reflected in retail funding conditions on Raisin platforms and we do not see signs of contagion elsewhere.

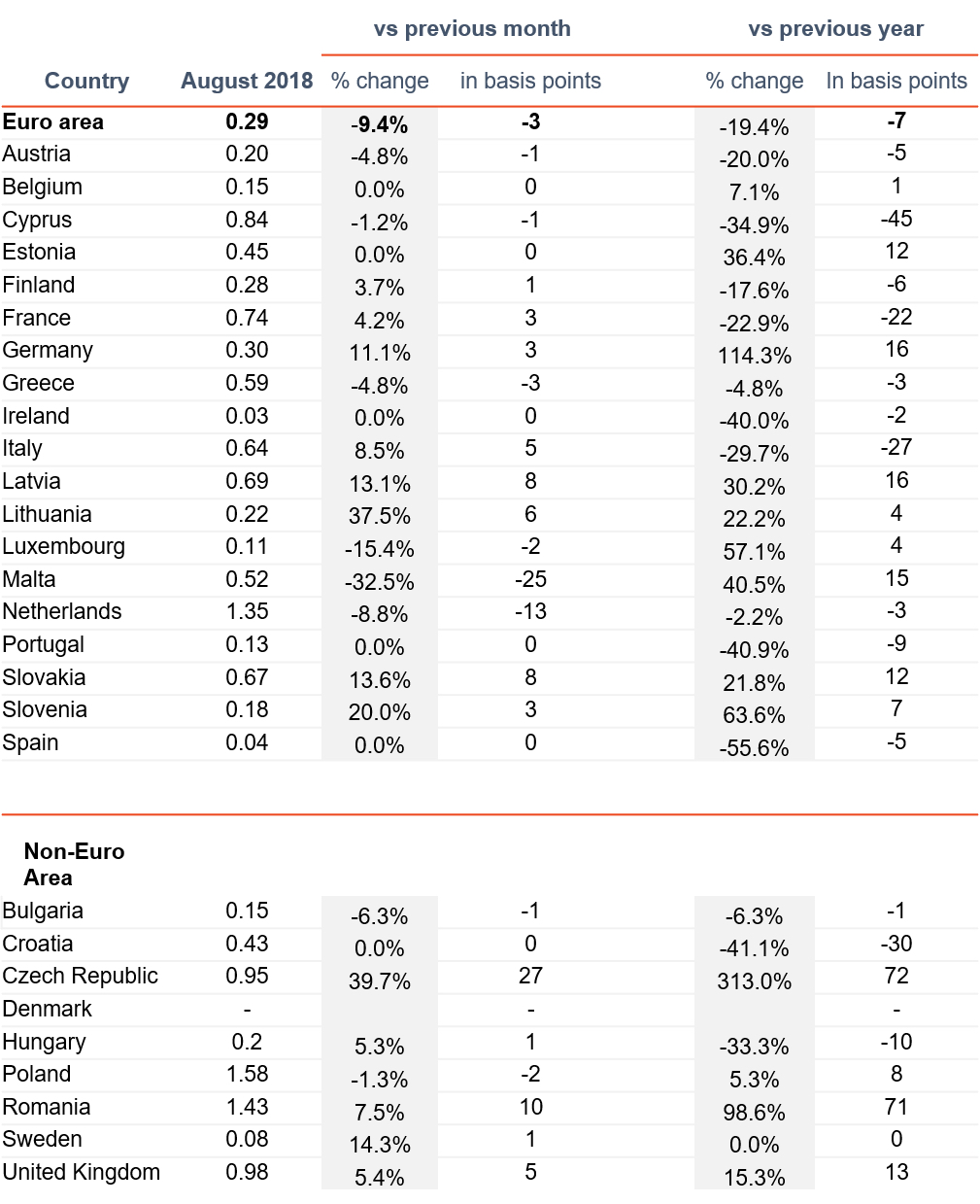

Market rates from ECB – Retail

The ECB’s time series do not reveal an upward trend in interest rates paid to households across the European Union – if anything, the opposite seems to hold: the average bank’s interest rate for household deposits decreased by 9.4% compared to July and by a staggering 19.4% compared to last year.

Surprisingly, average rates in Germany increased to 30 bps, which represents an increase of 114.3% compared to last year. Italian rates increased by 8.5% compared to the previous month, but still decreased by 29.7% compared to last year. Bear in mind, however, that the rates are from August, hence Italy’s recent rating change is not yet reflected in these numbers.

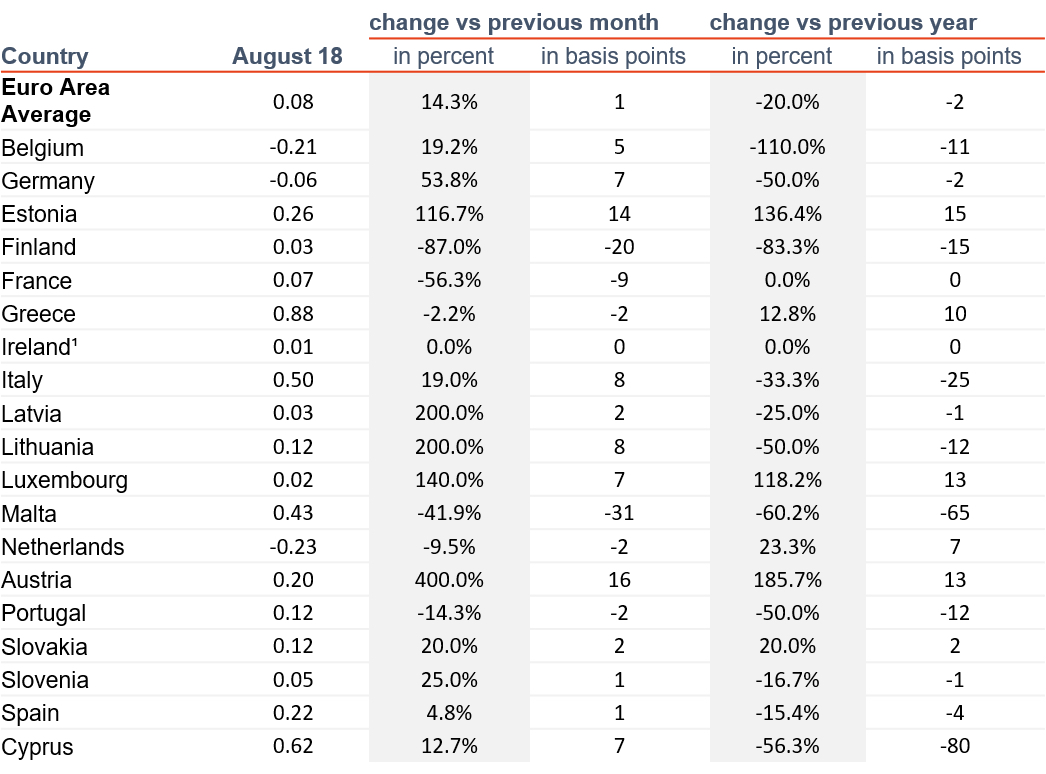

Current Retail Deposit Interest Rates in the EU

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data

Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

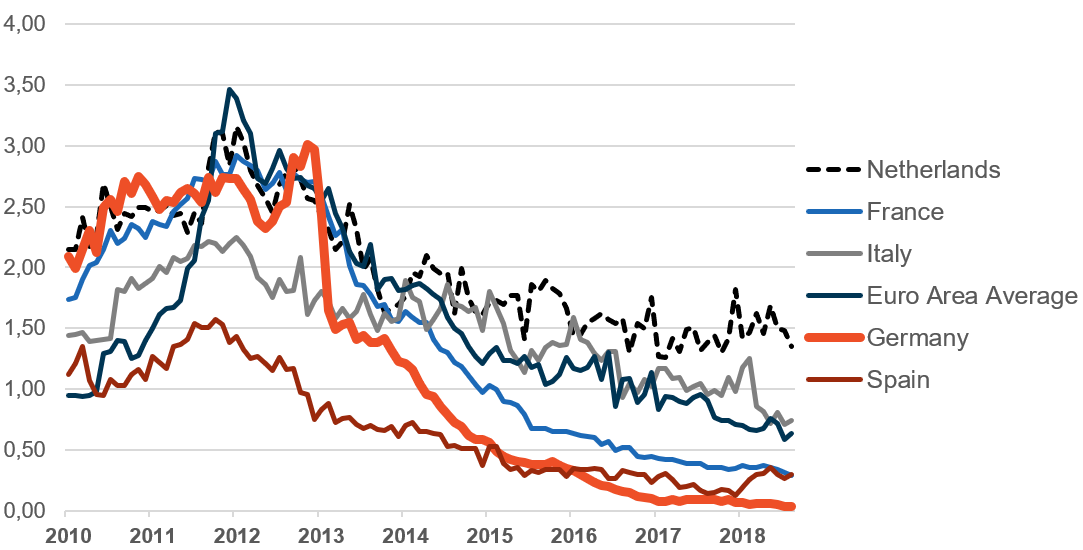

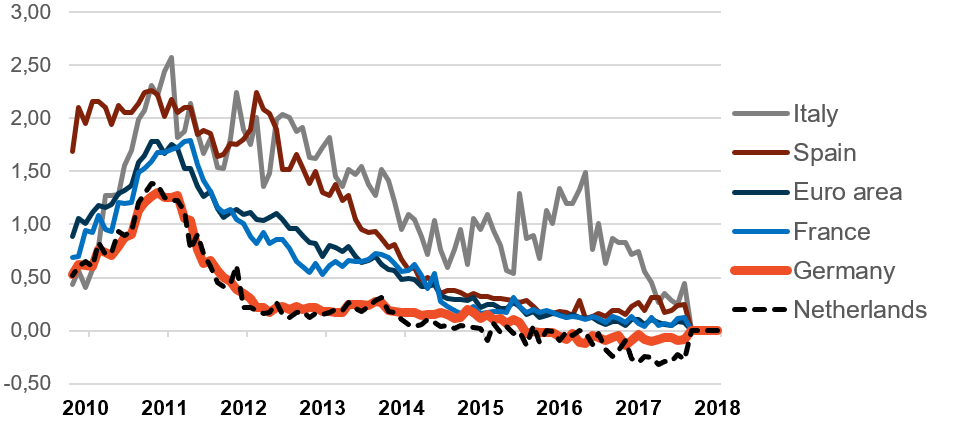

Historical Development of Retail Deposit Interest Rates

Average interest rate for new deposits, private households, maturities ≤ 1 year,

ECB data, in percent

Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

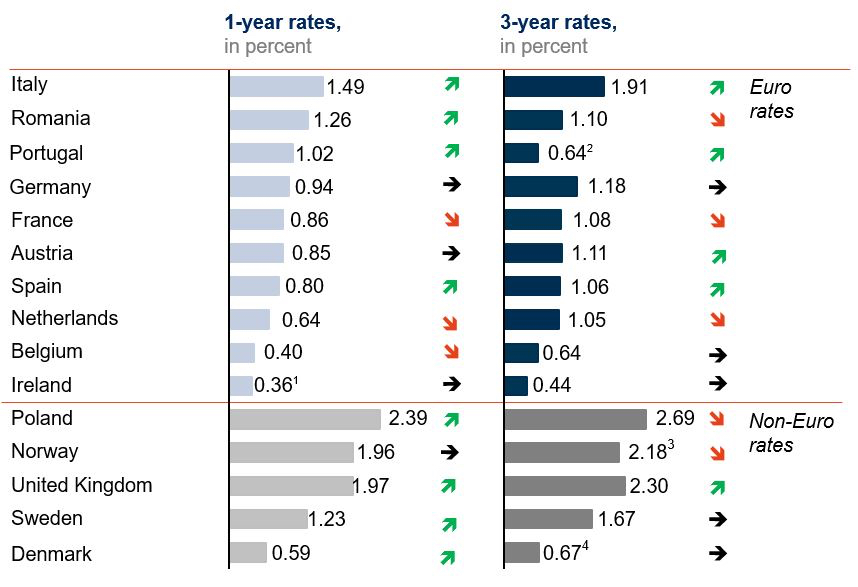

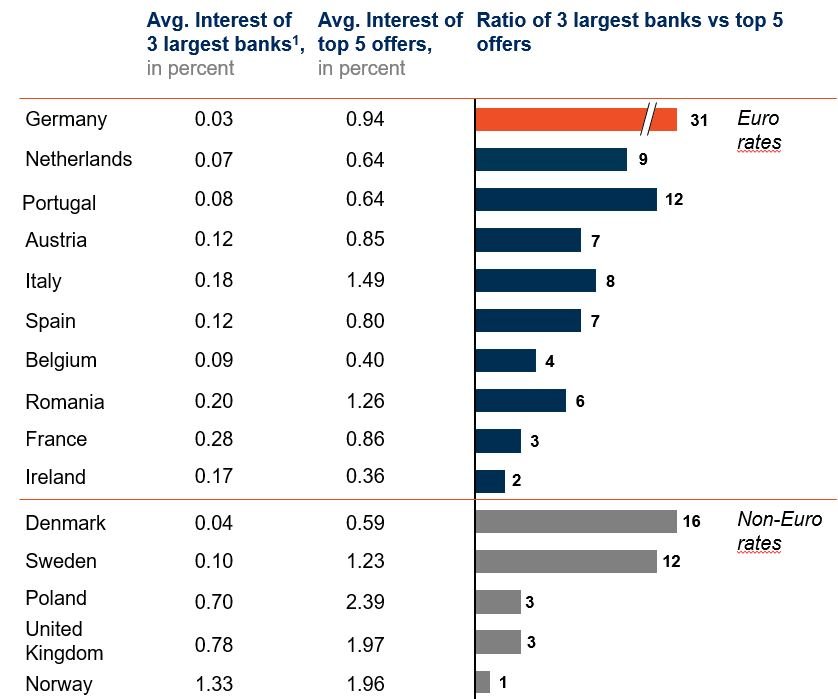

Highest retail rates

The recent retail top offers/rates reflect the changes in Italy: among the Euro-countries, Italy places highest with 1.49% on 1-year and 1.91% on 3-year deposits, which is even higher than the DKK and NOK deposit rates.

Germany stays put compared to our last issue and BENELUX — at least Belgium and the Netherlands — appear to have jointly decided on decreasing rates.

Highest Retail Deposit Interest Rates in the EU

In the Netherlands, the three largest banks increased their rates by 3bps on average, while the top offers decreased by 10 basis points, which, taken together, reduce the multiple from the previous 19 down to 9.

Germany still offers the highest ratio of 31 — German customers can achieve significantly higher returns by depositing with smaller banks.

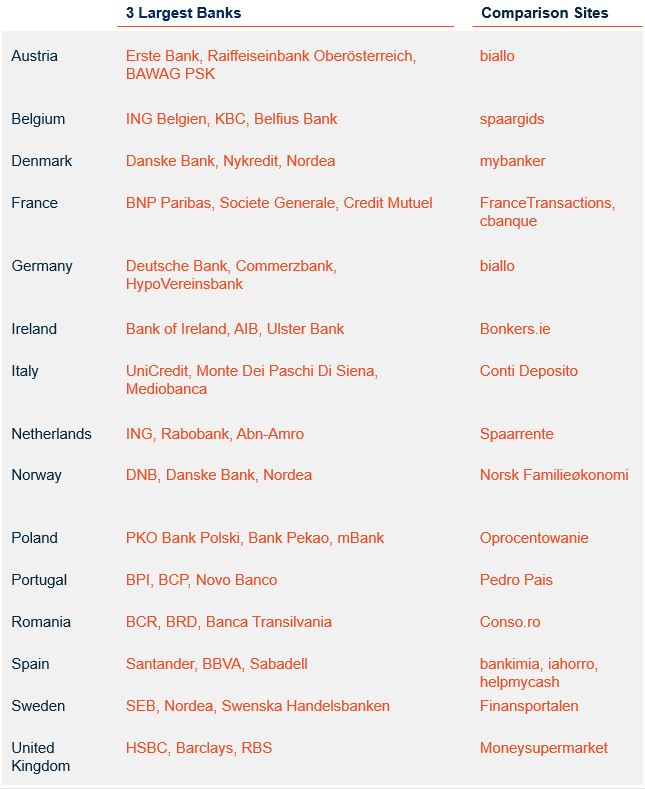

Retail Deposit Interest Rates of the 3 Largest Banks

Average of 1-year term deposit offers for retail customers offered by the 3 largest banks in the local market; as of 31-10-2018. Criteria: EUR 10,000 deposit; offers for both new and existing clients

1) Usually, largest banks based on balance sheet size, which offer term deposits

Market rates from ECB – Corporate

While retail interest fell month-on-month, corporate deposit rates increased slightly by 1 bp, or 14.3%. We note the 200% increase in Latvia and Lithuania as well as the 400% increase in Austria (from 4bp to 20bp).

Current Corporate Deposit Interest Rates in the Euro Area

Average interest rate for new deposits, corporates, maturities ≤ 1 year,

Euro Area Statistics

Historical Development of Corporate Deposit Interest Rates

Average interest rate for new deposits, corporates, maturities ≤ 1 year,

Euro Area Statistics, in percent