Savings Abroad Grows By 20% In One Year

Key takeaways

Irish savers moved additional €636 million to savings accounts in other eurozone countries between March 2024 and March 2025

Savings volumes abroad reach record high at €3.82 billion, up from €3.59 billion at the end of 2024

Share of total savings held in foreign eurozone deposits also reaches record high, though still modest at 2.26%

Recently published data from the European Central Bank (ECB) shows that saving money abroad is trending upwards among Irish households. Between March 2024 and March 2025, the total volume of savings held in other EU countries by Irish residents rose by €636 million – an increase of 20%.

The total amount now held by Irish savers in foreign savings accounts has reached a record high of €3.82 billion. While this still represents a relatively modest share of overall household savings – around 2.26% of the estimated €169 billion total – it marks the highest proportion ever recorded. The actual share of savings held in other EU countries is likely to be higher, with deposits held in non-eurozone countries such as Sweden not included in the ECB figures.

Historic interest rates in Ireland lagging

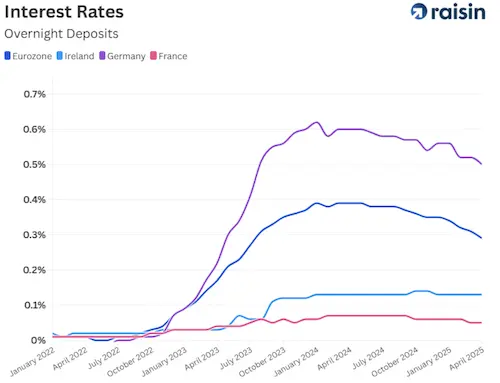

A historical comparison of interest rates maintained by the European Central Bank (ECB) and performed by Raisin reveals that Irish savers haven’t been spoiled by high interest rates in the past years. The average annualised interest rate received on demand deposits this millennium amounts to roughly 0.36%. This is lower than the 0.50% received in the eurozone on average. German savers have been able to accrue double the interest, at 0.73%.

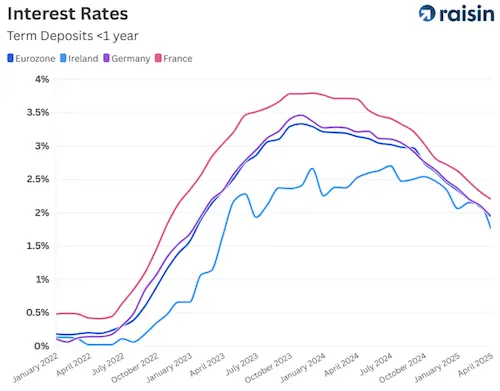

Term deposits deliver better results, but here too Irish rates lag behind the rates received by other savers in Europe. The average rate on new term deposits with a short maturity of up to one year stands at 0.70% in the period from July 2017 to now. The eurozone average is almost fifty percent higher, at 1.03%, with German savers receiving 0.99%. When looking at just the past one and a half years, Irish savers took home an average of 2.37%, against a Eurozone average of 2.76%.

“Active savers are smart savers who benefit"

Eoghan O’Hara, Country Head Ireland at Raisin, is happy to note that savers are increasingly looking for alternatives. “Savers need to overcome their inertia and look for the best deals out there. Whether this is with a bank in Ireland or in the EU, or even just shifting money into a term deposit: the vast majority of savers are able to get more each and every year by investing just half an hour of their time every few months to compare the best off ers out there. Active savers are smart savers who benefit from increasing competition.”

Company & team

Savings accounts

Information

Company & team

Savings accounts

Information

© 2026 Raisin Bank AG, Frankfurt a.M.

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time. Raisin Bank, trading as Raisin, is authorised/licensed or registered by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) in Germany and is regulated by the Central Bank of Ireland for conduct of business rules.