Raisin Summer Saving Series: Part 3

AI’s influence on financial decision-making

People’s daily usage of generative AI tools has exploded. A recent Menlo Ventures study showed that more than half of American adults have used AI in the past and nearly one in five rely on it every day.

People are increasingly using AI in nearly every aspect of their lives, from daily information seeking to improving work productivity to even social chats. One recent Good Morning America segment featured a parent saying she “uses ChatGPT for everything from meal planning and grocery lists to managing toddler tantrums and even her own emotions.” She even went so far as to call GPT a “third co-parent.”

What starts with grocery lists and daily advice is quickly scaling up — Americans are now bringing AI into one of the most high-stakes areas of their lives: their money.

From income to equity: Who trusts AI with their finances

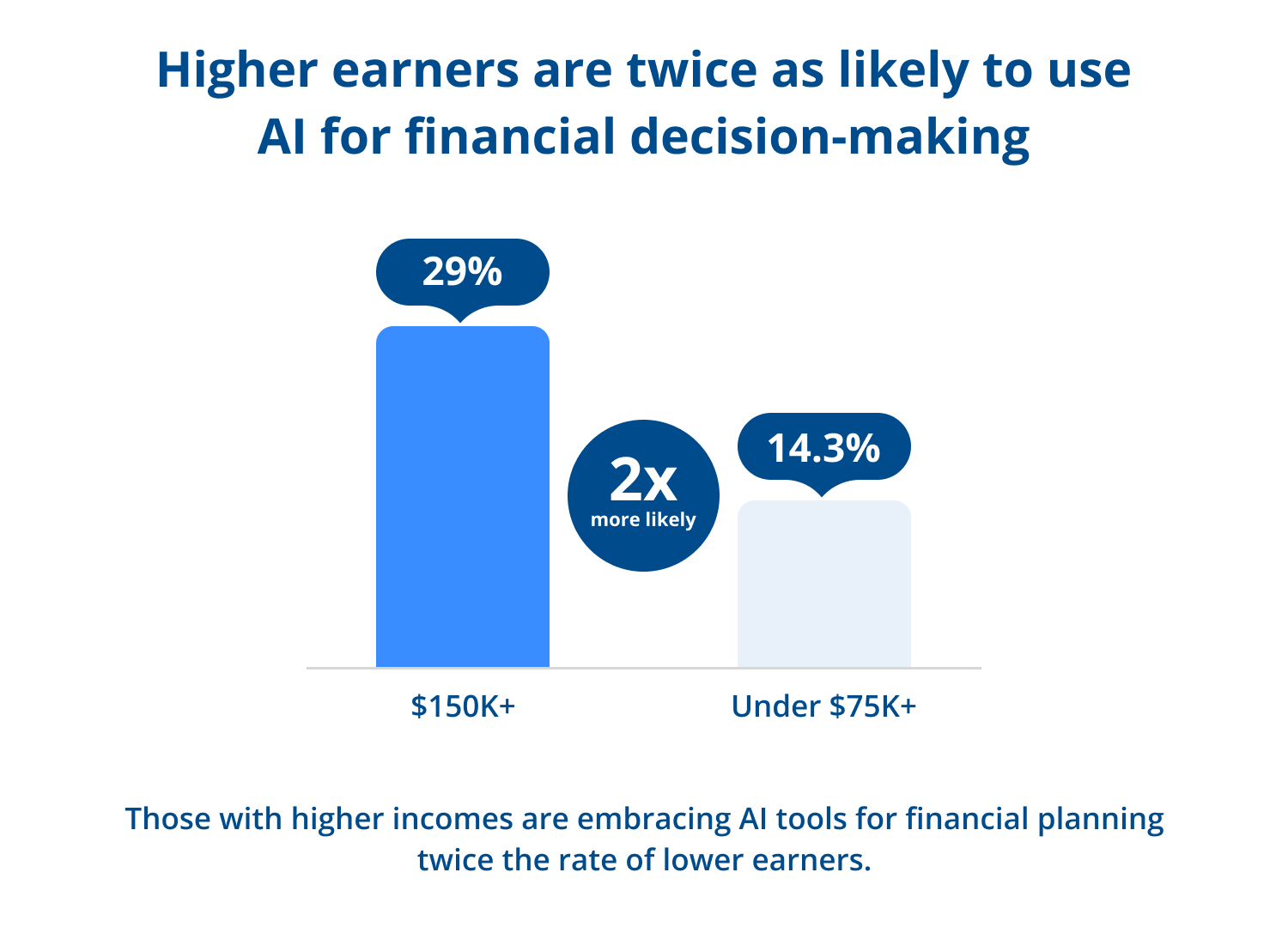

When it comes to financial decision-making, one of the strongest dividing lines isn’t just age — it’s income. Nearly three in ten high-income earners (29%) say they use AI to help guide money moves, compared with only 14.3% of those earning less than $75,000. That makes affluent households twice as likely to trust AI with their finances, even though they arguably have the most to lose if the advice goes wrong.

Higher earners are also more likely to have access to AI tools through work, hold advanced degrees, and exhibit higher levels of digital fluency, all of which may accelerate their comfort with bringing AI into such high-stakes areas of life.

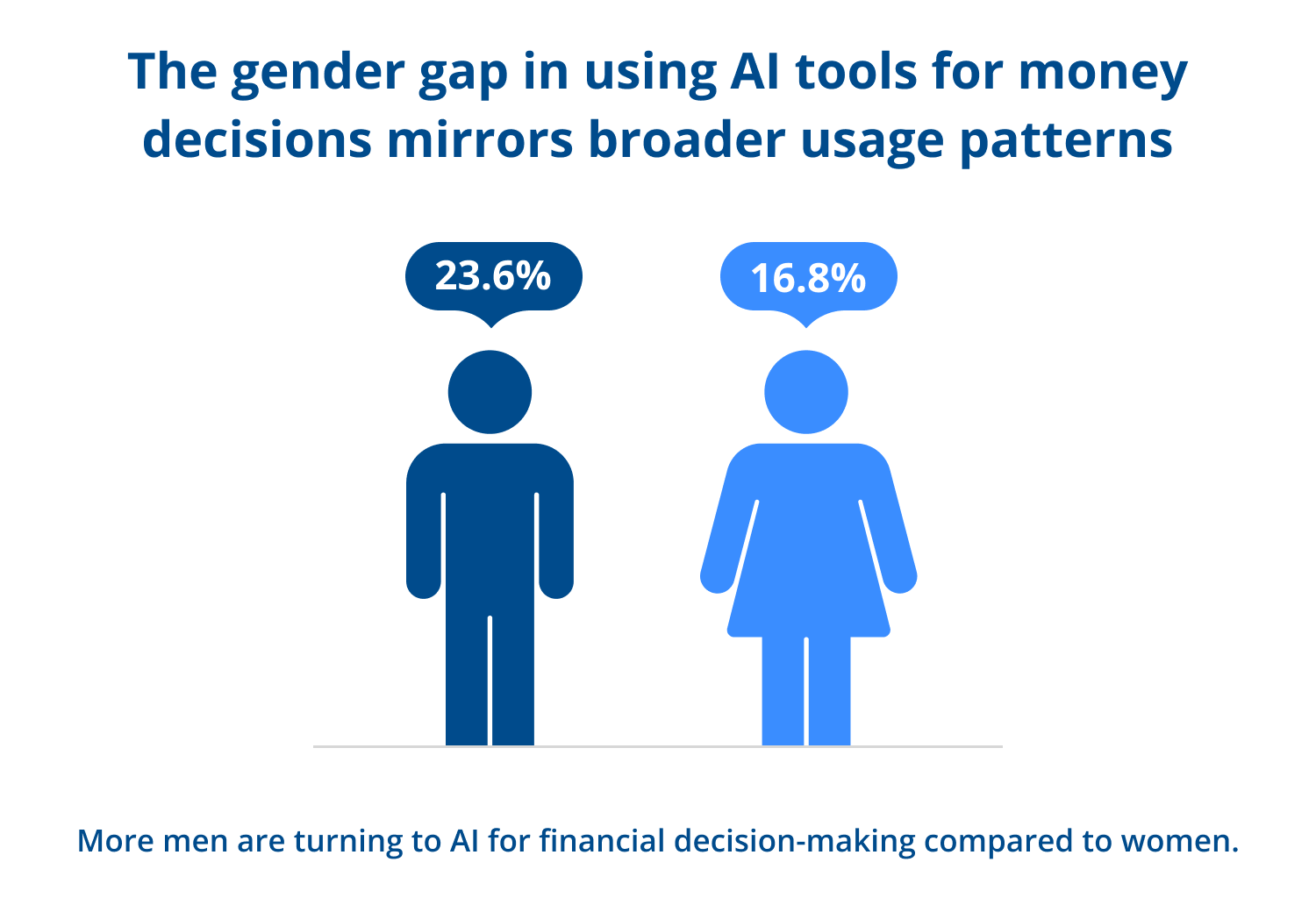

But income isn’t the only dividing line. Gender and generational differences also play a role in who is most comfortable letting AI into their financial lives. Men (23.6%) are more likely than women (16.8%) to use AI for money decisions, a gap that mirrors broader AI adoption trends. A Pew Research Center study found that women are more likely than men to say they feel concerned rather than excited about AI in their daily lives. Academic researchers echo this trend: University of Chicago professor Anders Humlum recently commented on the “staggering gender gap in ChatGPT adoption — even among workers in the same occupations handling similar tasks.”

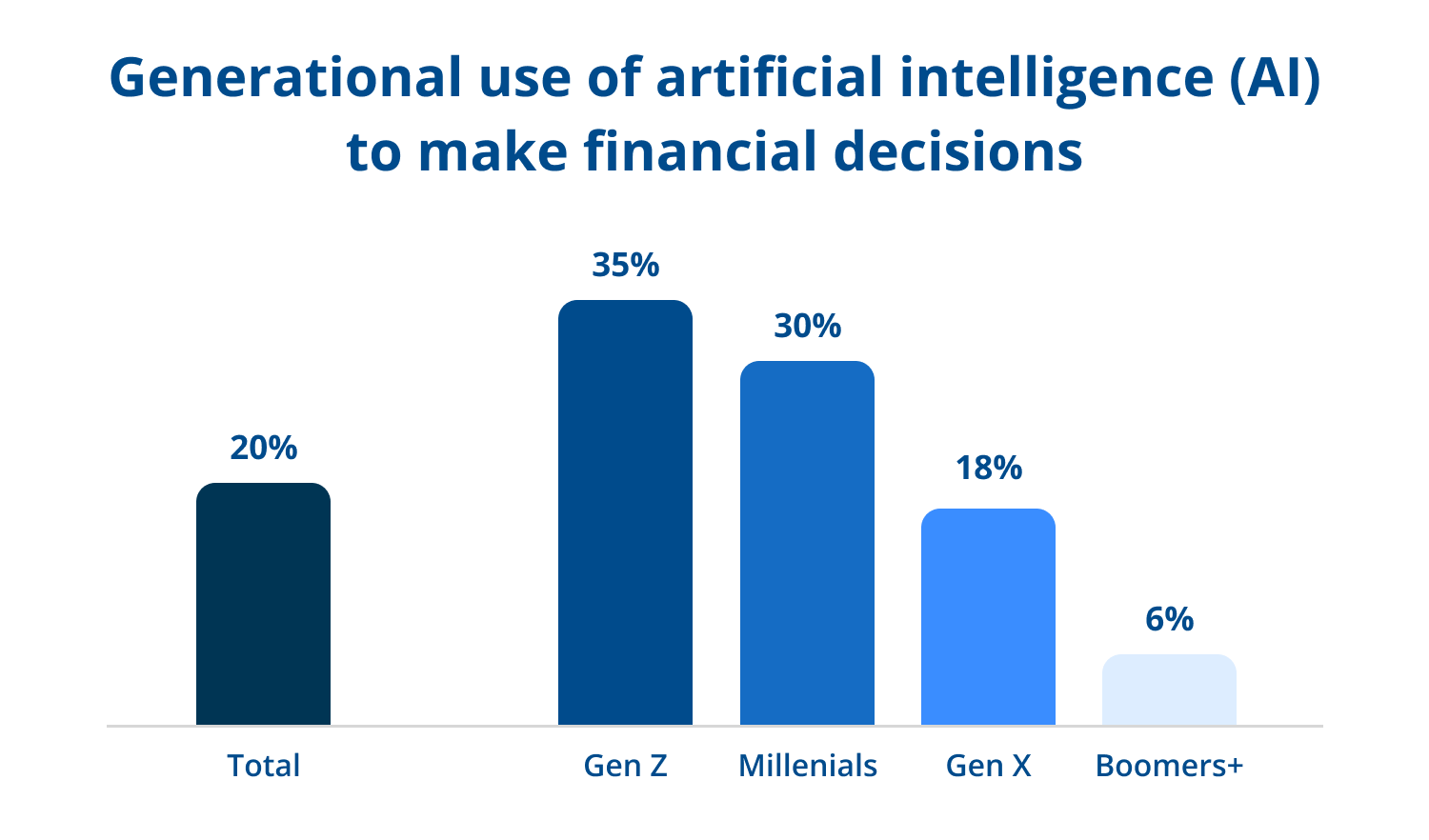

Generationally, younger Americans are leading the way. Thirty-five percent of Gen Z and 30% of Millennials say they use AI to make financial decisions, compared with only 18% of Gen X and just 6% of Boomers. OpenAI CEO Sam Altman has observed this firsthand, remarking, “They don’t really make life decisions without asking ChatGPT what they should do.”

For many in their 20s and 30s, AI has become less a tool and more of a trusted partner — whereas older Americans often still use it more like a search engine. Even so, new AARP data shows that adoption among adults 50+ is accelerating, with usage of AI doubling since last year.

Taken together, these findings suggest that while men and younger consumers may be more comfortable experimenting with AI, income is the factor that most strongly determines whether Americans will put real financial trust in these tools.

AI and the consumer–bank relationship

As generative AI gains traction within banking and financial services, its influence on consumer decision-making is likely to grow. This raises an important question: what will today’s consumers expect from their financial services providers as a result?

According to Raisin’s study, one-third of consumers (34%) said they would save more if banks used AI to design personalized savings plans, and another 34% said they would save more if banks provided AI-driven education about different types of accounts.

AI may actually drive greater education and awareness among consumers about how they can improve their financial health and take advantage of bank-offered products. For financial institutions, the opportunity is clear: as AI adoption grows, banks that embrace hyper-personalization and proactive education will be better positioned to deepen customer trust and engagement.

Research methodology and details

This research is being released as a series, examining Americans' savings behaviors against a backdrop of economic anxiety, the rise of AI usage, and generational shifts in attitudes towards money. This study was commissioned by Raisin, a one-stop savings marketplace that’s helped their 1 million customers worldwide earn over $5 billion in interest.

The study was conducted by 8acre Research, an independent market research firm and recognized leader in financial services research. The online survey was conducted amongst a national sample of 1000 US consumers with the following criteria:

Adults - age 21+

Stated $5,000 in assets within bank accounts

Is the primary or shared decision maker for household savings decisions

Data was collected between May 16-29, 2025.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.