Raisin Summer Saving Series: Part 2

How Gen Z is re-shaping savings culture for the better

Talking about money was once considered taboo. But with the rise of finfluencers and #moneytok, Gen Z is helping to radically reshape our relationships with money, and for the better.

New research reveals that Gen Z are ahead of other generations when it comes to how they think and feel about money and their savings, even if their average savings account balance is less than other generations. It’s this mindset shift that may set them up for longer-term financial health by the time they reach retirement age.

Savings as an identity

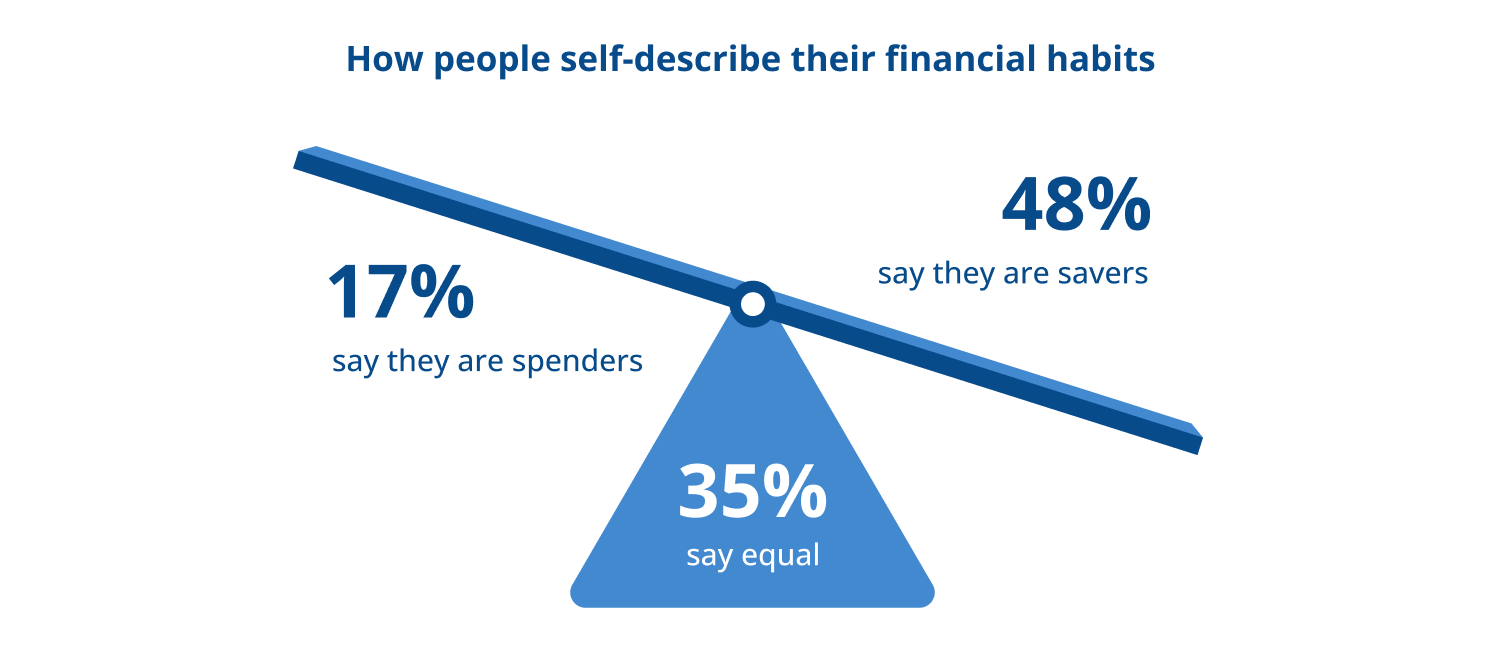

According to our 2025 study of Americans’ savings habits, it turns out that nearly one in two people identify as savers. And people are 3x more likely to consider themselves savers than spenders.

When examining generational differences, Boomers stand out as steady savers, with a safety-first mindset. They’re the most likely to identify as savers (58%) and are also hyper-focused on saving for unexpected emergencies (76%).

But it’s Gen Z that feels better about their overall finances.

Gen Z: Re-shaping savings culture

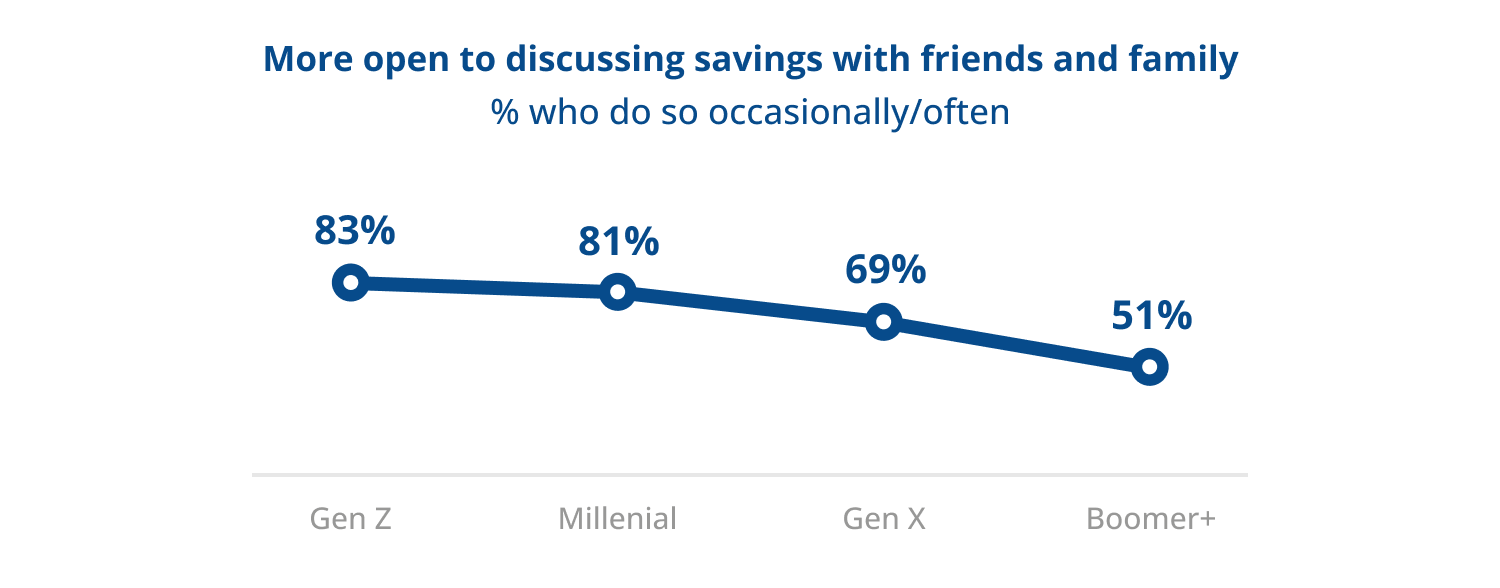

Willingness to talk: 83% of Gen Z is open to discussing savings with friends and family compared to just 51% of Boomers.

Money happy: 82% of Gen Z feels good about the amount they’re saving — compared to just 67% of Millennials, 61% of Gen X, and 64% of Boomers.

Optimistic about the future: When it comes to Gen Z retirement savings, 58% of Gen Z say that because they have a good income or good earnings potential, they don’t feel the need to save a lot now (compared to 39% and 29% of Millennials and Gen Z respectively).

Satisfied with saving: Gen Z is the most emotionally satisfied generation when saving, with 65% who feel secure and 60% who feel smart when saving.

Gen Z’s positive money mindsets are helping them adopt positive financial behaviors. A recent New York Times article showcased how well Gen Z is saving towards retirement thanks to a wide range of factors, from increased financial literacy, access to fintech apps and internet-based information, to AI. The article quoted one Gen Zer as saying, “‘I wanted to start saving early because the more the money sits, the more it compounds, the more it’s going to grow.’”

Barrier | Gen Z (n=130) | Millennials (n=316) | Gen X (n=262) | Boomers / Seniors (n=292) |

|---|---|---|---|---|

Inflation / increasing cost of living | 38% | 51% | 51% | 48% |

Unexpected costs / expenses that arise | 33% | 47% | 48% | 43% |

Debt payments | 21% | 30% | 27%* | 19% |

Low income | 25% | 23% | 27% | 20% |

Living paycheck to paycheck | 23% | 26% | 25% | 14% |

Desire to spend now and enjoy life | 30% | 26% | 20% | 12% |

Impulse spending | 28% | 22% | 19% | 9% |

Optimistic about future finances | 21% | 7% | 7% | 4% |

Not knowing best ways to save | 14% | 8%* | 6% | 2% |

Inertia / just not making the time to do it | 8% | 5% | 4% | 1% |

Other | 0% | 1% | 2% | 1% |

N/A; comfortable with amount I am saving | 12% | 12% | 11% | 21% |

Gen X: The lost generation

A National Institute on Retirement Security report stated, “Generation X often is referred to as the forgotten generation, sandwiched between the large and culturally powerful Baby Boomer and Millennial generations. Today, Generation X commands less attention than Boomers and Millennials from both researchers and the media.” They were the first generation to grow up with personal computers, video games and the internet. Gen X also witnessed the dot com bubble burst and experienced the 2008 financial crisis as working adults.

Gen X faces a confluence of factors impacting their financial health and outlooks:

Financial stress: Gen X is the most financially strapped — 38% carry a credit card balance each month, the highest of all generational groups. They are the most stressed about their level of debt.

Struggling with costs: Gen X is also the most likely generation to cite unexpected costs and expenses as a barrier to saving more.

Low income: They are also the most likely to cite low income as a barrier to saving more (27%)

Despite these challenges, Gen X still has time to take advantage of high interest rates by moving their savings into higher APY accounts and maxing out their retirement contributions.

Millennials: Stressed (but not about avocado toast)

Not long ago, media outlets skewered Millennials for splurging on avocado toast instead of saving money. But the truth is that millennials are being pulled in all directions, which is impacting the average millennial savings amount.

Needing to save: Data shows that millennials report the most savings needs.

Simultaneous needs: Millennials are saving to meet a number of demands, from paying down debt (43%), paying for kids’ expenses (34%), and education expenses (29%).

Stressed out: Along with Gen X, millennials are the most stressed about their level of debt (56%).

Having lived through two recessions — the 2008 great recession and pandemic shutdowns — millennials are well aware of the impacts of economic downturns. As a result, they’ve likely learned difficult lessons around the importance of saving and building wealth.

Boomers: Steady savers and financial pessimists

While we’ve analyzed the widespread attitudinal differences between Boomers and Gen Z, there remains the truth that Boomers have reached a stronger state of financial security as they likely enjoy retirement. Boomers have saved steadily towards their retirement with a safety-first mindset. This generation is the most likely to identify as savers (58%).

Unexpected emergencies: Boomers are the most focused of all generations on saving for unexpected emergencies (76%), likely having experienced any number of cost-heavy situations, from home repairs to health crises.

Less stress: Only 34% feel stressed about the debt they carry, the lowest compared to other generations.

Lacking in optimism: Despite the stability, Boomers are the least optimistic about their future finances compared to every other generation (4%).

Despite Boomers’ lack of optimism, their steady savings approach has helped them achieve the financial security that Gen Z is striving for.

Savings is self-care

A growing number of research studies point towards Gen Z’s open attitudes towards self-care and mental health — and now, including a healthy mindset towards money and savings. While Gen Z is just starting their savings journeys, their positive outlook, willingness to talk openly about their money, and positive emotional associations with saving money may be what sets future generations on the right track toward financial health.

Research methodology and details

This research is being released as a series, examining the savings behaviors of Americans against a backdrop of economic anxiety, rise of AI usage, and generational shifts in attitudes towards money.

The study was conducted by 8acre Research, an independent market research firm and recognized leader in financial services research. The online survey was conducted amongst a national sample of 1000 US consumers with the following criteria:

- Adults - age 21+

- Stated $5,000 in assets within bank accounts

- Is the primary or shared decision maker for household savings decisions

Data was collected between May 16-29, 2025. This study was commissioned by Raisin, a one-stop savings marketplace that’s helped their 1 million customers worldwide earn over $5 Billion in interest.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.