Raisin Summer Saving Series: Part 1

Bargain Hunters: How Americans could earn 7x more on their savings

Home > Education Center > Americans Wish Shopping for Savings Were Easier

It’s no secret that things are expensive right now. Home prices are high. Groceries are expensive (at one point this year, a dozen eggs cost $8). And when times get tough, Americans turn into bargain hunters. A recent survey showed that 88% of people changed their grocery shopping habits because of inflation, with 1 in 4 people shopping at different stores with lower prices and using coupons more frequently.

We’ve all searched for coupon codes or celebrated Prime Day by loading up on household items we need to nab a 15-20% discount on retail prices. These bargain hunting habits are adding up to a few dollars saved here and there, but also hours of our time, all focused on spending less.

But what about earning more?

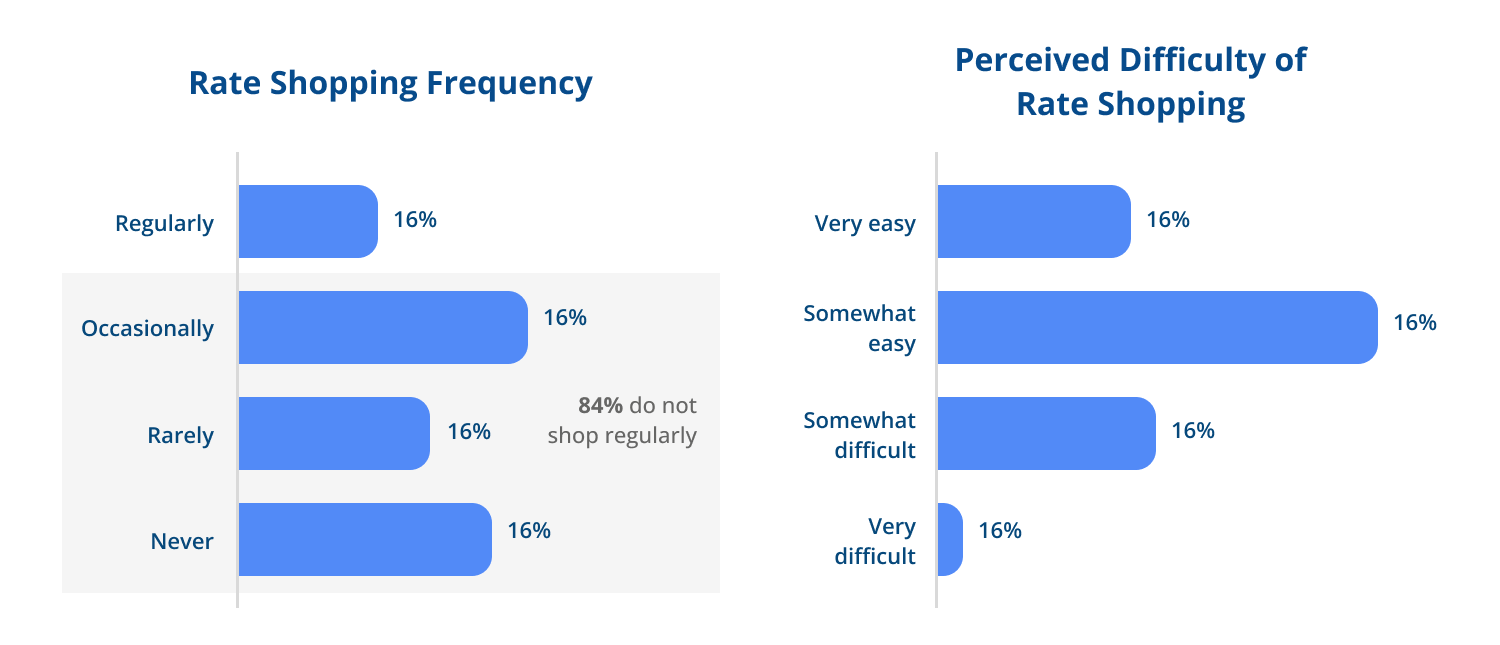

New data reveals that 84% of Americans don’t regularly shop for better savings rates. When it comes to our savings accounts, Americans are missing out on the opportunity to make more money with little effort because we’re settling for low yields instead of shopping for a better annual percentage yield (APY).

It turns out that if we saved like we shopped, Americans could earn 7x more than we are today.

Savings shopping: The money hack everyone needs

Despite the fact that most people aren’t getting the benefit of a higher APY in their savings accounts, people aren’t shopping for better savings rates, even if they’re expert bargain hunters.

According to our recent study, 84% of Americans don’t regularly shop for better savings rates. That’s probably due to:

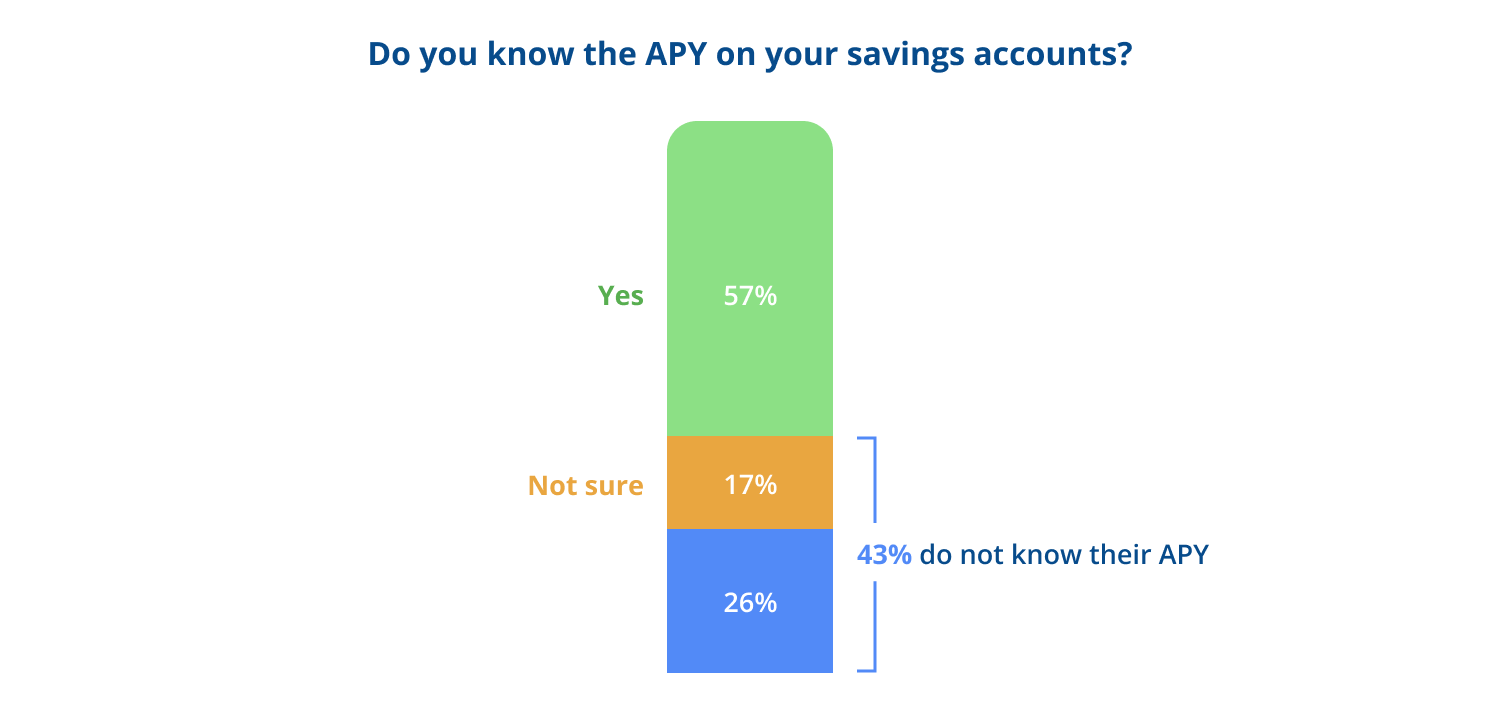

Lack of savings knowledge: 43% of Americans don’t know what the APY is on their savings account.

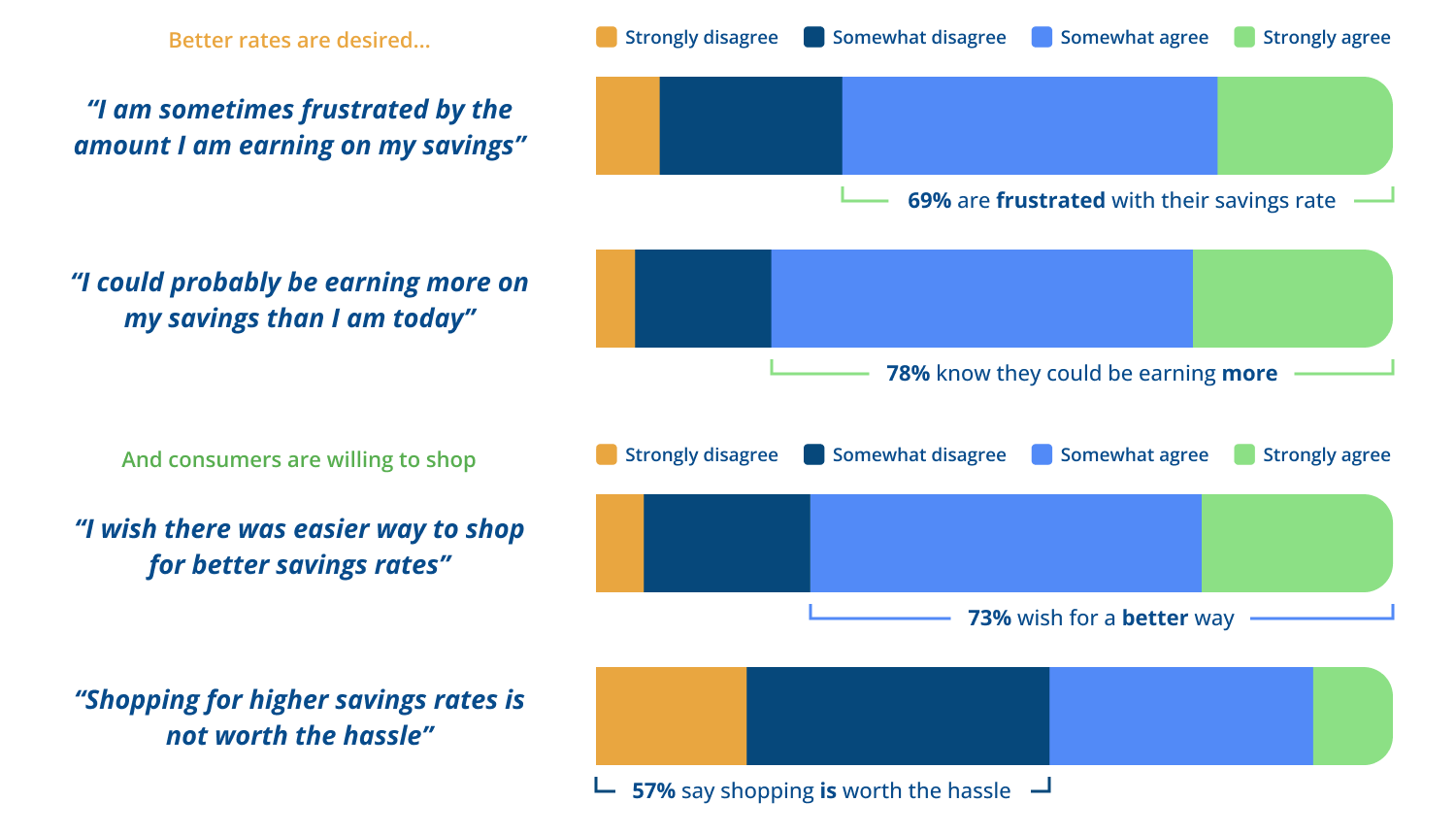

Perceived difficulty: 73% say they wish there was an easier way to shop for better savings rates and 40% feel that it is a hassle to switch or open a new account.

Our study revealed both dissatisfaction and opportunity when it comes to savings: 69% recognize they are frustrated with their savings rate and 78% say they know they could be earning more on their savings.

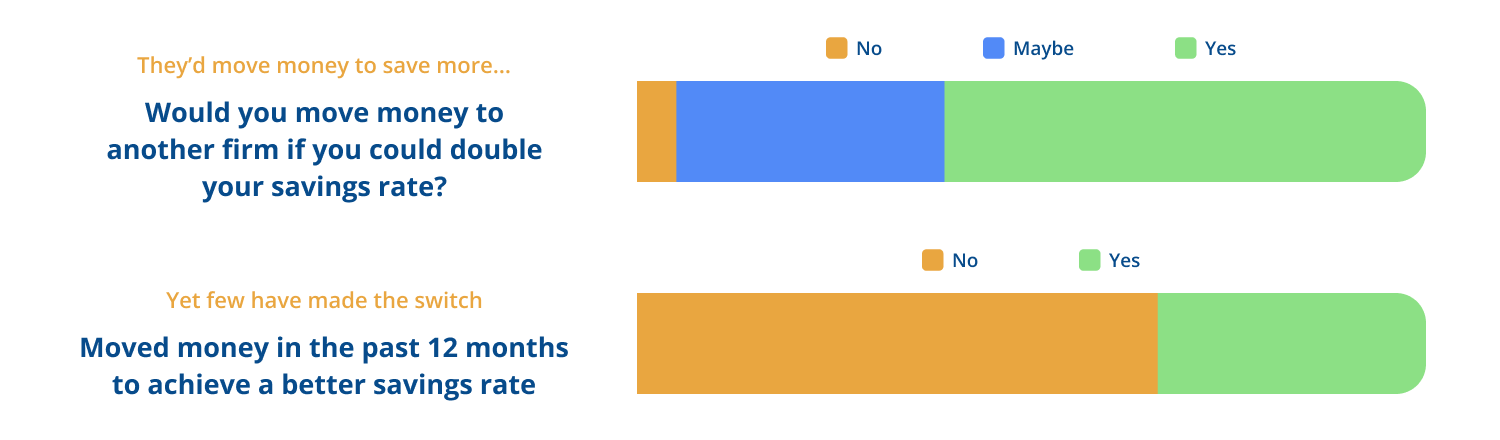

The data also revealed that while there is willingness, there isn’t follow-through. While 61% say they would move money to another firm if they could double their savings rate, only 34% of Americans have actually moved money to get that better rate.

While even online forums point people towards Google searches to find better rates or visiting different banking sites, the ultimate (and underutilized) money hack is using platforms like Raisin.com which aggregate high yield savings accounts and give you the ability to shop for better savings rates in one place so that you’re just only a few clicks away from earning more interest.

Why APY

APY is the total interest you can earn in a year, with the benefit of compounding interest i.e. getting interest on the interest you’re earning, having a multiplier effect on total savings (without having to lift a finger).

Today, the average APY on Americans’ savings accounts is .58%. But, you could be earning upwards of 4% APY. Why does that matter?

Let’s say someone has $10,000 in savings, earning the national average of .58% APY in interest. This means you’ll earn $58 in interest in one year.

But, if we shopped for a better rate (which with platforms like Raisin, might take you 30 minutes or less) and moved that $10,000 to a 4% APY account, you would earn $400 in interest in one year.

Compounding interest plays a powerful role over time, as evidenced by the fact that in five years, people could earn nearly $1900 more in interest if they’d switched to a 4% APY account.

There is over $11 trillion sitting in Americans’ savings accounts. If every US household took just 30 minutes to move their savings into a high yield savings account earning 4% APY instead of .58% APY, they would earn an additional $396 billion in interest annually.

From bargain hunter to savvy saver

Bargain hunting takes time – people spend 54 hours looking for a bargain each year. But shopping for a better savings rate might just take 30 minutes of your time. A few minutes invested in finding a higher APY can set you up for long-term financial health even better than waiting in line for a discounted TV or driving to Trader Joe’s for cheaper eggs.

Spending a few minutes to find a better high yield savings account isn’t just about interest, either. It’s about resolving financial anxiety. The need to save is motivated by the desire to provide for loved ones, prepare for unexpected emergencies, and stay ready for the future . And during times of heightened financial stress, this need to save can feel overwhelming. Only 22% of Americans feel very good about the amount they’re saving each year. The most common barriers to saving more include inflation and the higher cost of living (48%) and unexpected expenses (44%).

While the reality of today’s economic environment might mean that people can’t put more money into savings, what people can take comfort in is that they can make their hard-earned savings work even harder for them through a higher APY.

And while we might not necessarily feel satisfied with the total amount we’re saving each year, we can feel good that we’re maximizing the total interest our savings dollars are earning.

We can be bargain hunters and savvy savers.

Research methodology and details

This research is being released as a series, examining the savings behaviors of Americans against a backdrop of economic anxiety, rise of AI usage, and generational shifts in attitudes towards money.

The study was conducted by 8acre Perspective, an independent market research firm and recognized leader in financial services research. The online survey was conducted amongst a national sample of 1000 US consumers with the following criteria:

Adults - age 21+

Stated $5,000 in assets within bank accounts

Is the primary or shared decision maker for household savings decisions

Data was collected between May 16-29, 2025. This study was commissioned by Raisin, a one-stop savings marketplace that’s helped their one million customers worldwide earn over $5 billion in interest.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.