From branches to apps: How Americans are rethinking where they bank

American consumers are expecting more of their banks, and financial institutions of all types have an opportunity to stand out by meeting those expectations or risk falling behind.

Consumers today expect more choice, stronger digital tools, clearer value, and easier access to their cash. When those expectations are not met, they are increasingly willing to look elsewhere.

That shift is putting pressure on retail banks, fintechs, and the companies that support them. Comparing bank options is easier than ever, and consumers are taking advantage. Brand familiarity and long-standing habits still matter, but they are no longer enough on their own.

To better understand how these expectations are changing, Raisin surveyed a nationally representative sample of 750 Americans. The findings offer a clear picture of what consumers value today and what banks need to deliver to stay competitive.

How to use this report

Whether you’re evaluating where to bank, competing for customers, or building the technology that supports modern banking, this report brings together insights to help inform decisions across today’s banking landscape.

- Consumers can use these insights to better understand how banking options differ, where value is being left on the table, and how digital access, trust, and flexibility shape everyday banking decisions.

- Retail banks can use the findings to understand how consumers evaluate banks today, where loyalty is breaking down, and which areas matter most when competing for deposits and long-term relationships.

- Fintechs and B2B banking service providers can use the insights to identify where traditional banking falls short and where technology plays a critical role in improving access, clarity, and customer experience.

Americans are clear in what they want from banks

Americans know what they want from banks, and it starts with a hybrid experience that combines digital and in-person services. Expectations for community engagement and values alignment are also rising.

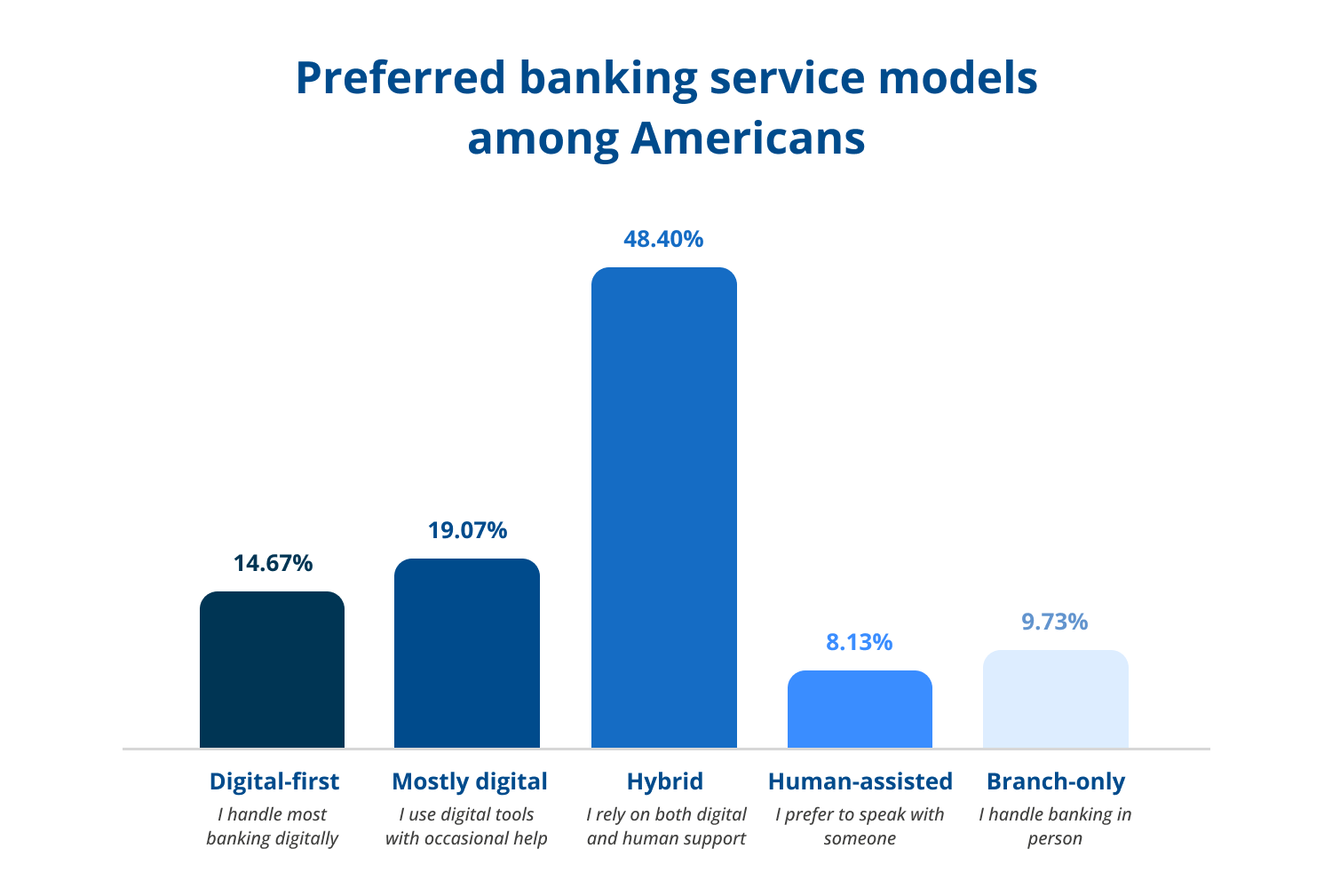

Hybrid banking defines the standard

While digital banking is growing, 48% of respondents still prefer a mix of digital and physical options. 62% of respondents say that having a physical location is very important or essential, making hybrid banking the preferred option for nearly all Americans. Only 15% want a fully digital experience, and just 10% want in-person only.

For banks, the implication is clear. Consumers expect reliable digital tools for everyday banking, alongside access to human support when questions or issues arise. Banks that lack strong digital experiences face a choice: invest in improving those capabilities or work with partners that can help close the gap. At the same time, the continued importance of human interaction shows that digital progress does not require removing personal support, but integrating it into a more flexible experience.

Banking customers value community engagement

When it comes to creating a personal — not just a transactional — relationship with consumers, banks have options. And respondents were clear on what they want: community engagement built around shared values.

Almost 70% of respondents offered ideas on how they might feel more connected to a bank. Most answers tended toward community:

- Supporting local community development or small business (37%)

- Offering financial education or programs that help consumers improve financial wellness (31%)

- Demonstrating strong environmental or sustainability practices (23%)

- Donating to charitable or community causes (23%)

- Actively supporting diversity, equity, and inclusion (DEI) initiatives (22%)

What this means for consumers: Banks that combine digital convenience with physical access offer the greatest flexibility. When evaluating a new bank, look for easy cash access, dependable mobile tools, and transparent pricing. If shared values are important to you, spend time getting to know the bank and make sure it aligns with what's important to you.

What this means for retail banks: Consumers are open, but cautious. An easy-to-understand value proposition, paired with strong digital capabilities and accessible support, can turn consideration into conversion. So can shared values and community engagement. Communication remains important, especially with digitally savvy and well-researched consumers.

What this means for fintechs and B2B services: As customer expectations rise, many banks face constraints in building and maintaining modern digital and omni-channel capabilities on their own. B2B providers play a critical role in bridging this gap by delivering scalable, secure solutions that extend banks’ capabilities without requiring extensive in-house development. By enabling seamless digital experiences, reliable access to cash, and consistent support across channels, these providers help institutions of all sizes compete on convenience, trust, and value.

Most Americans don’t feel loyal to their banks

Almost two-thirds of Americans have switched banks at some point — and while most are hesitant to go through the administrative hassle of choosing a new financial institution, many will do so if given a compelling reason.

Nearly 20% of Americans stay with their bank because “most banks seem the same” and they don’t see a compelling reason to change. That being said, if another financial institution provides notable benefits, consumers are willing to change.

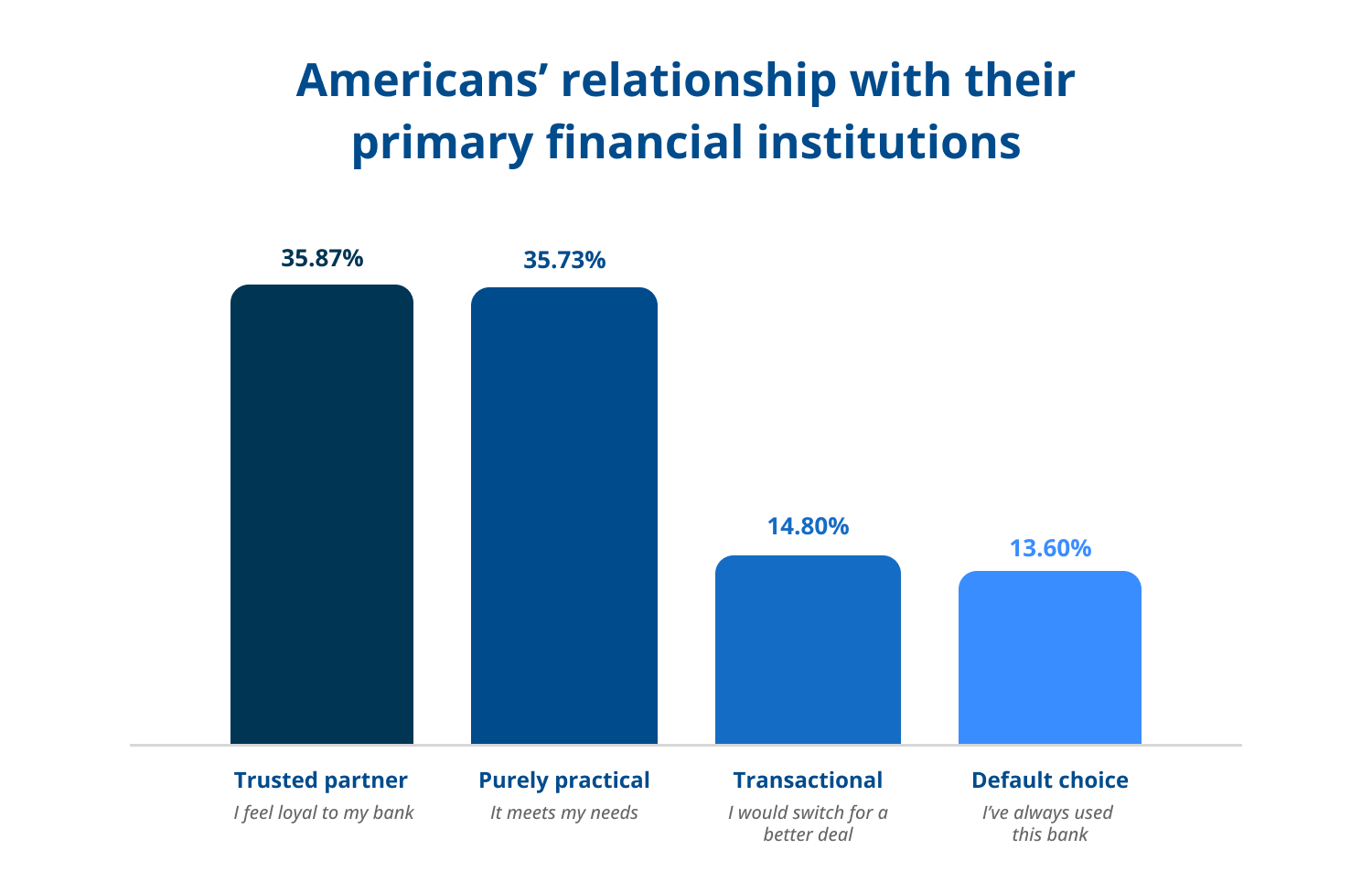

Most Americans (51%) stick with their bank because they feel comfortable with it and are confident that it's secure and reliable — and almost a third (32%) say that they'd hesitate to switch banks because setting up new accounts and transferring is inconvenient. Survey respondents were equally split between their bank relationship being a purely practical one (36%) and that of one with a trusted partner (36%).

While consumers are hesitant to switch banks, it's not rare. 65% of Americans have switched at least once, and 32% have switched multiple times. The barrier isn’t willingness — it’s whether the benefit outweighs the inconvenience.

What motivates consumers to stay or switch? Here's what our respondents said keeps them at their bank:

- Low or no fees (57%)

- Customer service (56%)

- Convenient branch and ATM access (50%)

- Brand recognition or familiarity (43%)

- A convenient digital or mobile experience (42%)

This list reflects the growing expectations of American consumers — if they feel like the fees they pay are too high, customer service is lacking, or it's difficult to get access to their money (in person or virtually), they may start looking for a new financial institution.

Notably, 15% of respondents said they would be happy to switch banks if they found a better deal. With fees at the top of the list of priorities, banks that provide low- or no-fee banking are well-positioned to take advantage by clearly communicating these benefits.

While consumers are increasingly open to switching banks, perceived friction in the process remains a key barrier. Institutions that reduce this friction through simple account setup, secure data handling, and transparent communication around rates and features are better positioned to earn consumer trust and deposits.

What this means for consumers: If your bank isn't meeting your needs when it comes to fees, customer service, access, or anything else that you feel is important in meeting your needs, you're not alone — and it may be time to look for an alternative.

What this means for retail banks: Consumer expectations are consistent: low fees, great customer service, and easy access to cash, both in person and via digital tools. If you're getting feedback from members that you're not meeting those expectations, it's a good idea to take them seriously.

What this means for fintechs and B2B services: Offering products and services that help banks satisfy consumers is key. Establishing your service as a way for financial institutions to meet customer needs will create a huge amount of value for both banks and consumers.

Americans are missing out on the value of their cash — for now

Despite growing adoption of digital financial tools, many Americans continue to overlook one of the most fundamental drivers of financial value: earning competitive interest on their savings. As a result, significant returns remain unrealized across large segments of the population.

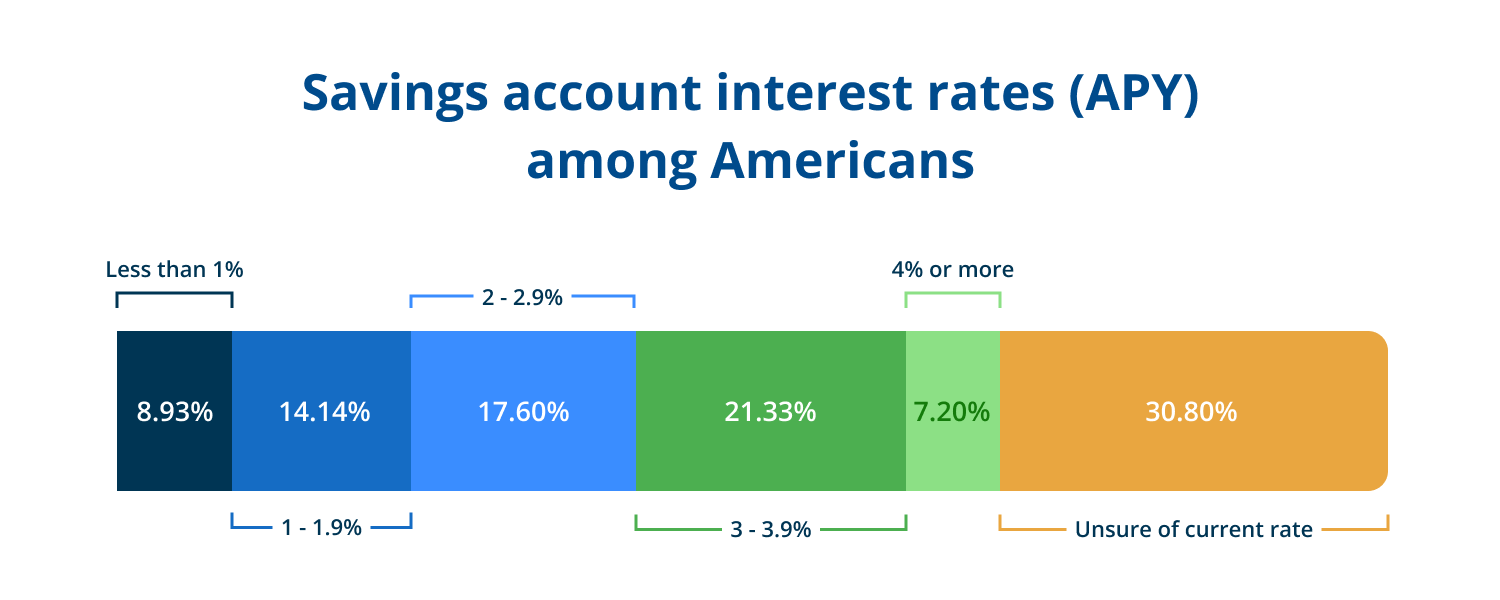

Only 7% of Americans currently earn 4% APY or more on their savings, while nearly one-third (31%) do not know their savings interest rate at all. Among Baby Boomers, that figure rises to 38%, the highest of any age group. This lack of awareness leaves meaningful money on the table — gaps that can compound into thousands of dollars in foregone interest over time.

At the same time, this behavior appears increasingly out of step with broader consumer trends. Although rate comparison tools are widely available and easy to use, 27% of Americans report never having compared savings interest rates.

By contrast, higher earners — those making $150,000 or more annually — are significantly more likely to know their rate, earn 3% APY or more, and actively compare options across banks. This group also demonstrates greater engagement and a clearer understanding of how rates impact long-term outcomes.

These patterns suggest that low savings-rate awareness is less a permanent condition than a lagging behavior. As consumer expectations around transparency, convenience, and financial optimization continue to rise — driven by increased engagement with personal finance, investing, and digital financial tools — attention to savings rates is likely to follow.

Banks that provide simple, effective digital tools will help drive changes in American banking behavior around savings — not only helping Americans get more out of their money, but increasing deposits, as well. This is especially true among institutions that emphasize clarity in their rates with well-presented options.

What this means for consumers: Comparing savings rates pays off. Digital tools make it easy to earn more interest with minimal effort, and most Americans have the opportunity to significantly improve returns on their cash.

What this means for retail banks: Many consumers don’t know what they’re earning — or how it compares to the market. Transparently sharing competitive interest rates, especially those at or above 4% APY, can be a powerful way to attract and retain customers.

What this means for fintechs and B2B services: Low consumer awareness around savings rates creates an opportunity for tools that proactively show value. Rate comparison engines, personalized alerts, data aggregation, and plain disclosures can help banks educate customers — while positioning B2B providers as enablers of better financial outcomes.

When switching, Americans are willing to consider smaller banks

44% of respondents said they would consider a smaller bank if it offered a clear benefit. This openness to smaller institutions indicates a growing opportunity for innovative financial institutions.

Despite many Americans being willing to consider a smaller bank, consumers still have concerns. Here are the reasons consumers said they might be nervous about using a smaller or lesser-known bank:

- Harder to get cash (ATM/branch access) (38%)

- Setup is a hassle (32%)

- Prefer recognized brands (32%)

- Worries about safety/security (30%)

- Digital/mobile tools might not work as well (29%)

Reflecting rising expectations around access to cash, smaller banks have an opportunity to appeal to Americans across generations by providing a convenient experience with low fees and good customer service (Gen Z especially values customer service, with 46% saying they'd be worried about a less effective experience from smaller banks).

Young Americans stood out as being slightly hesitant to work with a smaller institution. They cited concerns about safety and security, customer service, and access to their cash.

Taken together, these findings suggest that while many consumers are open to banking with smaller institutions, that openness depends on whether options are visible and easy to evaluate. When benefits like rates, protections, and access can be compared across institutions — and acted on without added friction — smaller banks are more likely to be considered. Banking comparison platforms provide this capability and give banks of all sizes the opportunity to compete not just on reputation, but on value.

What this means for consumers: For many consumers, the best banking option is defined less by brand size and more by value. When rates, fees, and access are easy to compare, smaller banks offering strong service are increasingly worth considering.

What this means for retail banks: Most consumers stay out of convenience, not deep loyalty. Emphasizing tangible benefits — especially around fees, service, and access to cash — can resonate with customers who feel underserved by their current institutions.

What this means for fintechs and B2B services: In a low-loyalty environment shaped by convenience and value, banks increasingly rely on technology partners to reduce perceived friction and stand out to consumers. B2B providers that enable seamless onboarding, transparent pricing, reliable access, and strong customer service experiences play a direct role in helping banks attract deposits, build trust, and compete beyond brand recognition.

Higher earners engage with their banks more

The way in which Americans engage with their banks differs not only between generations, but also between income levels.

Overall, 44% of respondents use a large national bank to store most of their cash. Among those earning $150,000 or more, that number jumps to 66%. Meanwhile, only 15% of higher earners rely primarily on regional banks or credit unions (vs. 31% overall).

Interestingly, higher earners are also more open to smaller banks:

- 15% of all respondents are very open to banking with a smaller institution.

- 29% of those earning $150,000+ are very open.

- 38% of those earning $200,000+ are very open.

Higher earners value the same fundamentals as other groups — low fees, strong customer service, and convenient access — but they’re more concerned about whether smaller banks can deliver high-quality digital experiences, highlighting the fact that they engage with their banks more often.

They’re also less likely to believe “all banks are the same,” which may explain their willingness to explore lesser-known institutions. These consumers are more likely to research options, compare rates, and ultimately earn more on their savings. Banks looking to increase deposits from higher earners will benefit from easing the comparison process and emphasizing terms and rates.

What this means for consumers: Regardless of income, shopping around leads to better outcomes. Taking the time to compare rates and account features can significantly increase long-term earnings.

What this means for retail banks: Smaller institutions have strong potential with higher earners. Emphasizing competitive rates, service quality, and digital capabilities can help attract this engaged and value-conscious audience.

What this means for fintechs and B2B services: Higher earners are more engaged, more discerning, and more willing to explore alternatives — but only if the experience meets their needs. B2B providers that offer advanced analytics, premium digital experiences, and sophisticated cash-management or savings tools can help banks attract and retain this high-value segment.

Gen Z signals a shift in how all Americans engage with banks

Americans are breaking with tradition when it comes to banking. Younger generations, from Gen X to Gen Z, are becoming increasingly likely to use and prefer digital-first banking experiences.

Younger Americans are digitally savvy and significantly more comfortable than previous generations using digital-first solutions to manage their money:

- 24% of Gen Z members use payment apps like PayPal, Venmo, or Cash App as their primary financial institution (vs. 15% overall).

- Members of Gen Z are almost twice as likely to use a digital-first bank or neobank as their primary institution (10% vs. 6% overall).

- Digital money tools — including automated investing and savings apps, budgeting and expense-tracking tools, payment apps, and cryptocurrency or digital asset platforms — are used more widely among members of Gen Z than any other generation.

But this shift isn’t limited to Gen Z. Younger generations often act as early indicators of broader societal change — and banking behavior appears to follow that pattern.

Both members of Gen Z (10%) and millennials (7%) use digital banks or neobanks as their primary financial institution at above-average rates. While Gen X is less likely to rely on these institutions, they're still twice as likely as baby boomers to use them to hold most of their cash.

A similar trend appears with automated investing and savings apps. Gen Z (20%) and millennials (17%) exceed the overall average (14%), while Gen X (11%) still outpaces baby boomers (7%).

While Gen Z is often described as the first digital-native generation, millennials and Gen X also show higher adoption of non-traditional banking tools than older cohorts — suggesting a lasting shift, not a passing phase.

What this means for consumers: Banking is increasingly digital. Americans are embracing mobile-first and tech-enabled tools, and future banking experiences are likely to rely even more heavily on them. If you’re not comfortable with digital banking yet, now is a good time to start exploring.

What this means for retail banks: Consumers expect instant, mobile access to their money. Institutions that fail to deliver seamless digital-native experiences risk losing customers to more agile, tech-forward competitors — especially in an environment where convenience matters more than loyalty.

What this means for fintechs and B2B services: Digital-first expectations are being set by Gen Z, but older generations aren't far behind. Fintechs and B2B providers that enable fast onboarding, intuitive mobile experiences, real-time payments, and embedded financial tools will be critical partners as banks modernize and raise their standards.

Conclusion: Convenience, clarity, and value will define the next era of banking

The data makes one thing clear: the modern banking market is defined by rising expectations.

Across generations and income levels, Americans are prioritizing convenience, easy-to-understand terms, and digital access — while showing limited loyalty to any single institution. At the same time, many consumers are still leaving value on the table, whether through low-yield savings, unexamined fees, or underused digital tools.

For consumers, this moment represents leverage. More options, better rates, and easier switching mean individuals have greater control than ever over where — and how — their money works for them. Taking advantage starts with small, practical steps: comparing savings rates, understanding fees, and choosing banks that balance digital convenience with reliable access to cash and support.

For retail banks, the data reveals a challenge: loyalty can no longer be assumed, and differentiation must be earned. Winning and retaining customers requires delivering frictionless digital experiences, emphasizing tangible benefits, and reinforcing trust through consistency and service. Institutions that simplify banking, show immediate value, and provide a convenient hybrid banking experience will be best positioned to compete in a market defined by choice.

For fintechs and B2B banking service providers, the findings point to growing influence and responsibility. As banks race to modernize, the quality of their customer experience increasingly depends on the platforms, infrastructure, and partnerships behind the scenes. Providers that help banks reduce friction, improve transparency, enable hybrid experiences, and meet the rising need for digital tools will shape not just individual products — but the future of banking itself.

Taken together, these insights suggest that the next era of banking won’t be defined by size or brand alone, but by execution. The institutions and partners that succeed will be those that translate data into action, technology into trust, and convenience into real, measurable value for everyone in the ecosystem.

Platforms that help consumers find banks that meet their needs are a central place for Americans to find the banks that meet their expectations, while allowing financial institutions of all sizes and types to display the features that differentiate them.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.