US Federal Reserve raises reference interest rate

In this issue, we cover the Fed rate increase on December 14, 2016, and analyse how the US reference interest rate might behave in 2017. For the second time since the financial crisis in 2007, the Fed has inched up the reference interest rate, which now lies in a span between 0.50 and 0.75 percent. By comparison, the reference interest rate before the outbreak of the financial crisis in September 2007 was 4.75 percent, which is roughly ten times the current one. The decision of the 10-member Fed Committee to increase the reference interest rate by 25 basis points was taken unanimously.

The reasons for the renewed interest rate rise are healthy economic growth indicators and a persistently low unemployment rate, which currently stands at 4.6 percent. In addition, inflation in the US has been steadily rising since the end of 2015 up to 1.6 percent (as of October 2016) , as a result of a strong job market, leading to salary growth and an increase in energy and raw material prices.

The President of the Federal Reserve Janet Yellen has signaled further interest rate increases in coming years. However, it remains unclear to what extent President-elect Trump’s economic policy will affect the Federal Reserve’s monetary policy. Trump‘s promises in the election campaign to drastically increase public spending and invest heavily in infrastructure could boost the American economy in the short term and raise inflation. Thus, the Federal Reserve could counteract higher than expected inflation rates in order to keep the inflation rate near but below two percent, according to the president of the Ifo Institute Clemens Fuest.

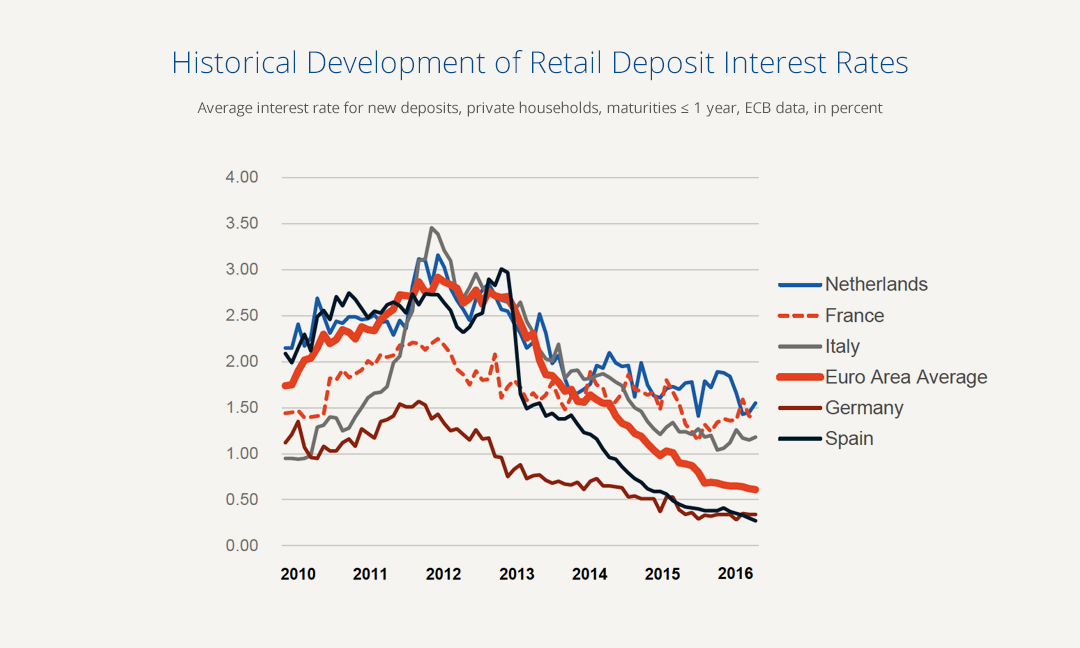

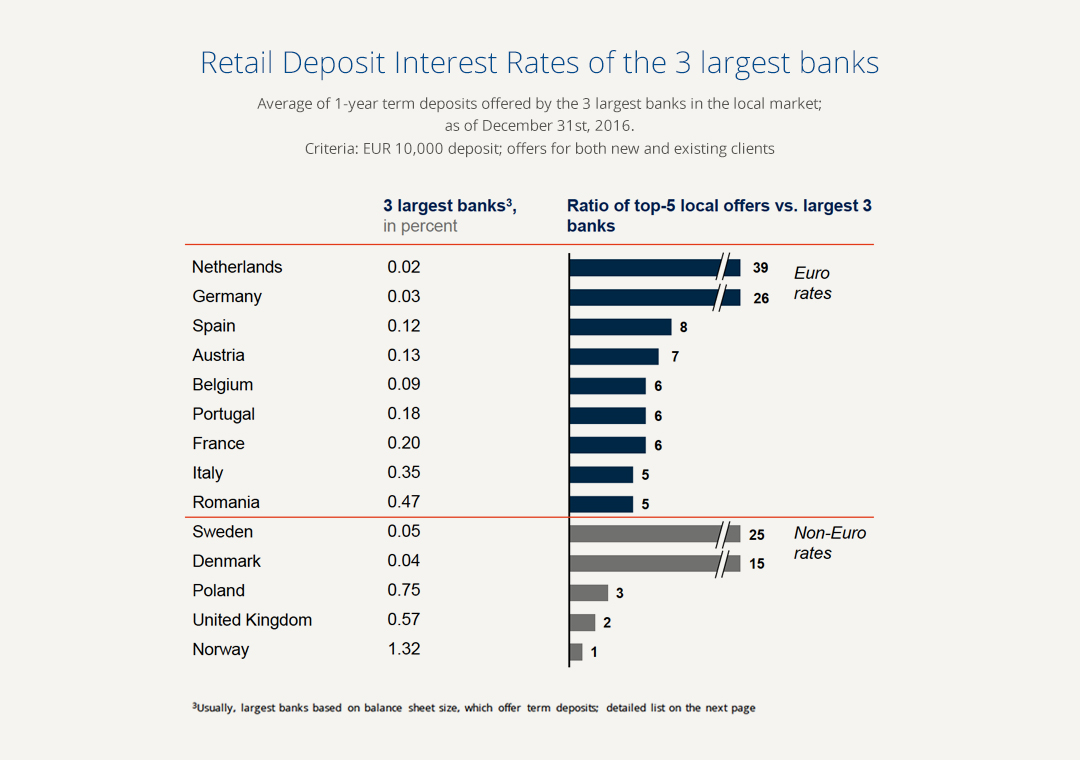

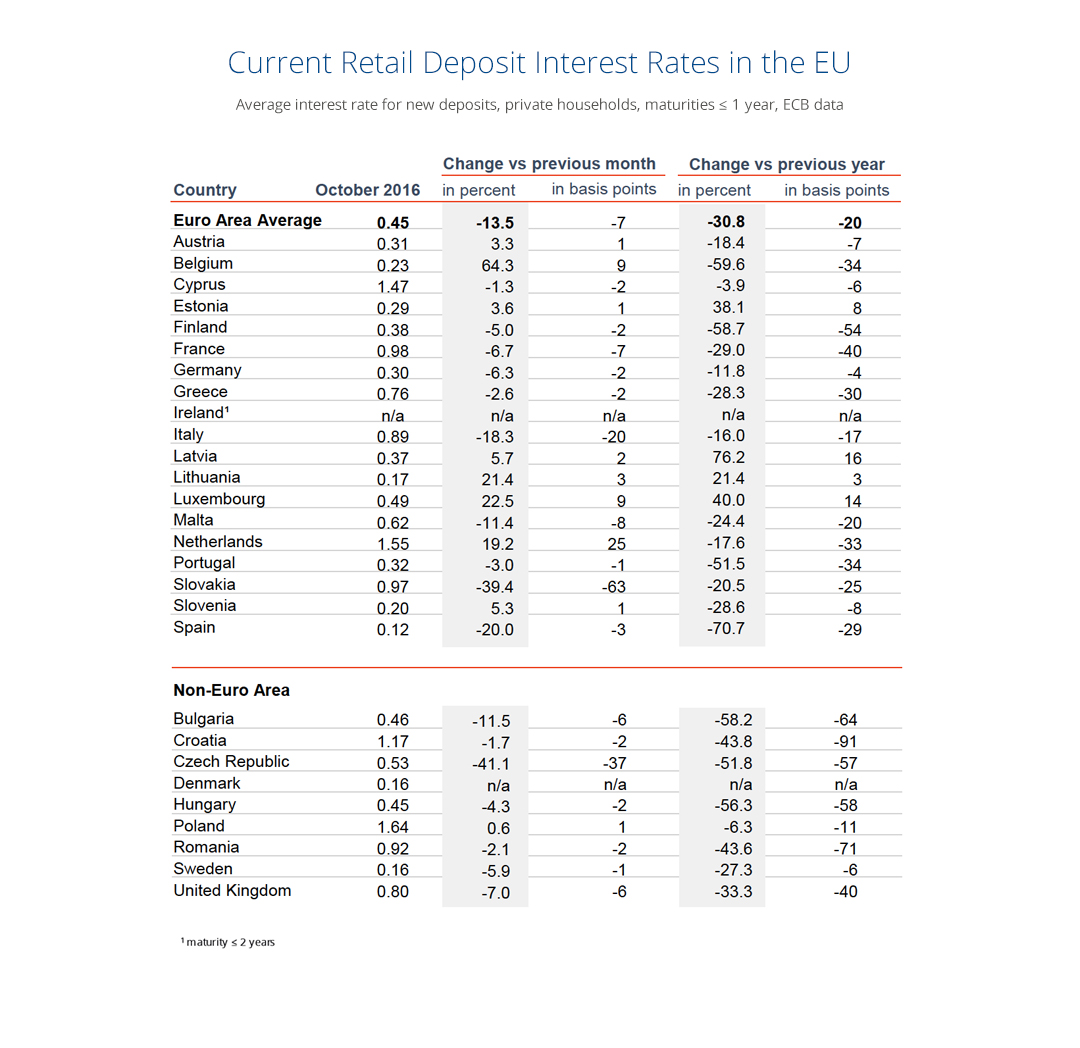

However, analogous interest rate developments are not expected to take place in the euro zone in the near future. One week before the US interest rate hike, the President of the European Central Bank (ECB) Mario Draghi announced the extension of the bond purchase program until at least December 2017. The ECB chief economist Peter Praet sees an ECB interest rate hike as a threat to the economic stability of the euro zone. As a result, European savers will have to continue to actively look for attractive saving opportunities in the foreseeable future in order to avoid the negative effects of low interest rates.

About the interest rate radar

At Raisin, we believe that transparency helps customers find the right savings products. Since deposits are one of the main funding sources for banks and still the most popular investment product for private customers, we want to provide you with the latest information on the topic. In addition, you can find country-specific developments in our monthly country report.