Dear readers,

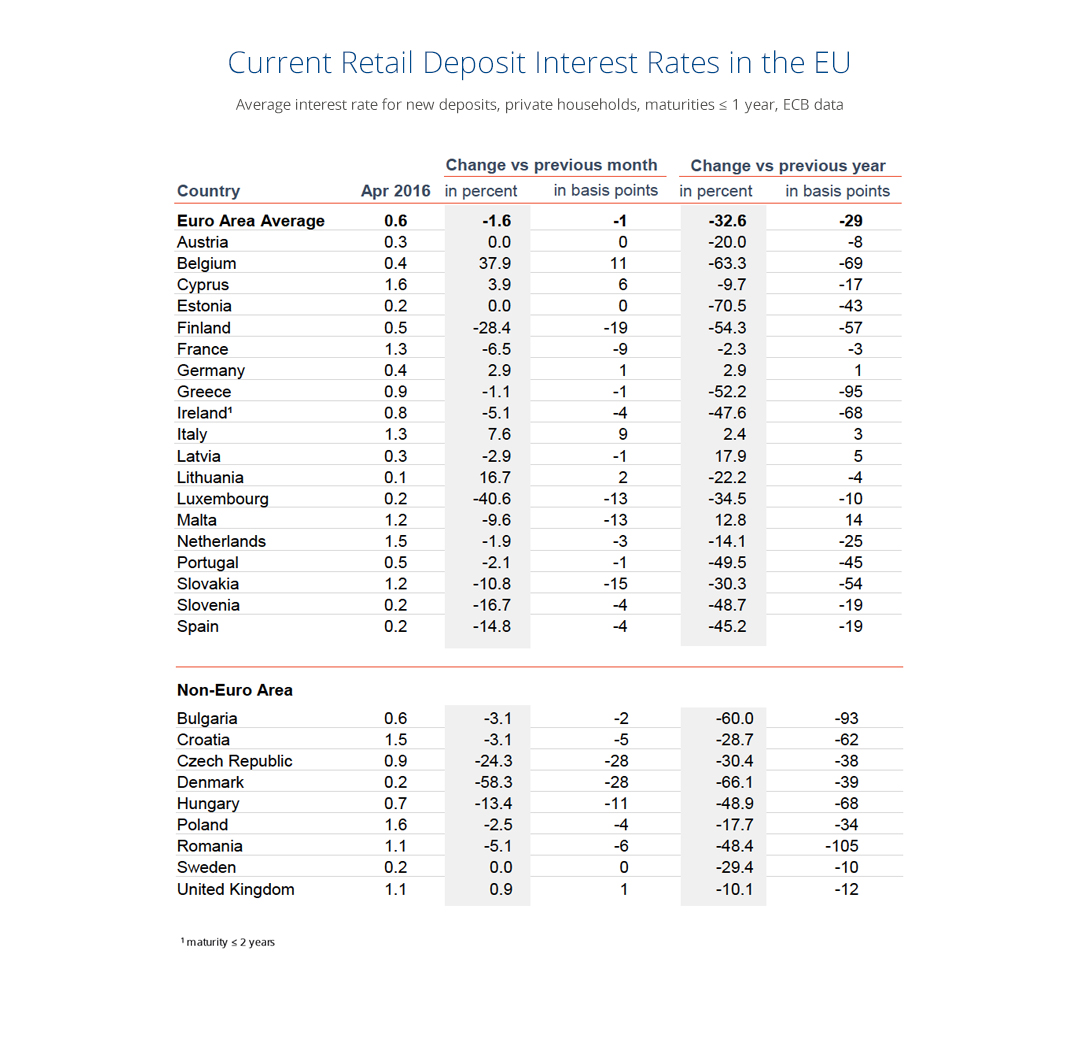

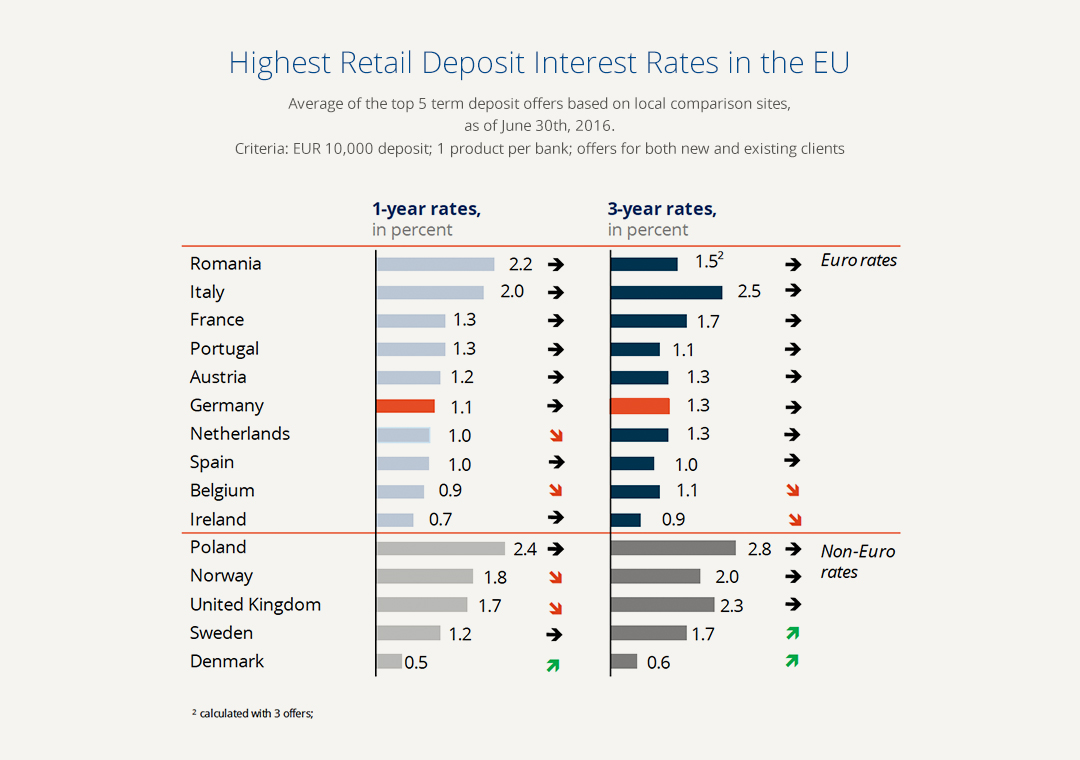

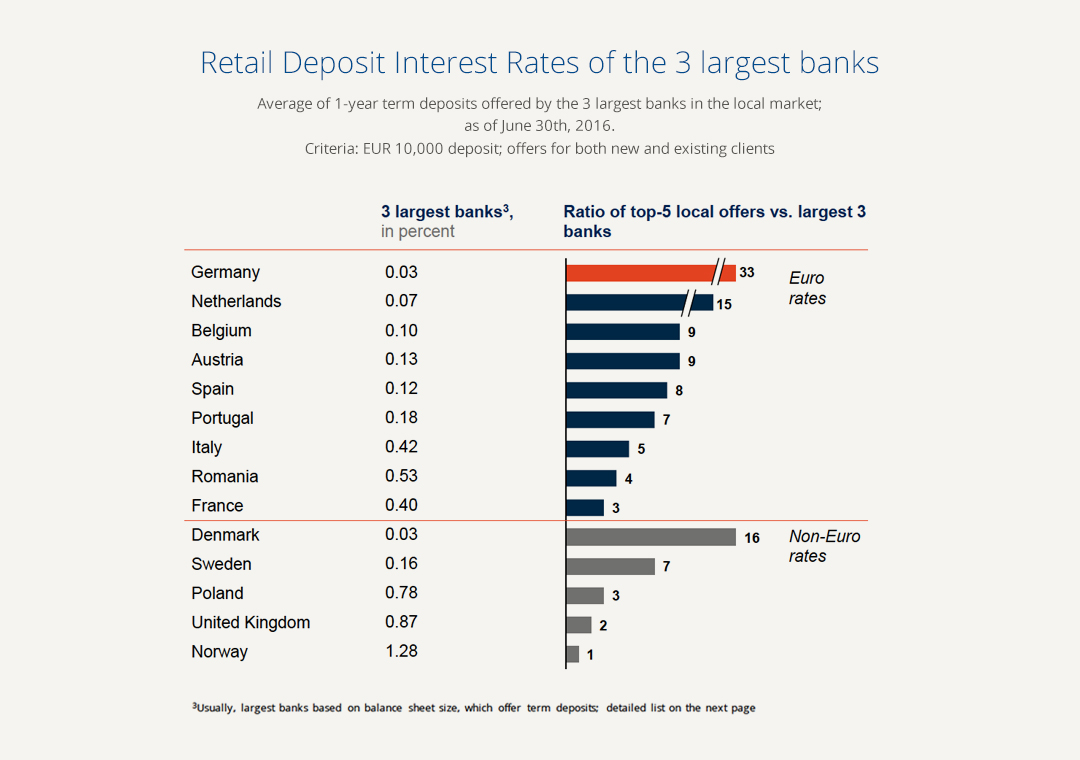

Please find enclosed our monthly interest rate radar. We at Raisin believe that transparency helps customers to select the right product. We provide you with current information on deposits – one of the main sources of funding of banks and still the most popular investment product for private customers. You can also find country-specific developments in the monthly country report.

In this issue we cover the British referendum on the withdrawal of the United Kingdom from the European Union (“Brexit”). On June 23, 2016 a slight majority of 51.9 percent voted for “Brexit” – despite the contradictory expectations. The turnout was 72 percent, however only 36 percent in the age group between 18 and 24 voted.

The British Prime Minister David Cameron failed to convince the population of the benefits of remaining part of the EU. As a consequence he announced his resignation for October 13, 2016. Theresa May, former interior minister, becomes prime minister succeeding David Cameron and will hold office as British Prime Minister and leader of the Tory party. From now on she will conduct the difficult exit negotiations with the EU.

According to the Lisbon Treaty, a Member State has the possibility to apply for an exit under Article 50, thus starting a two-year negotiation period. During this period, the state negotiates the terms for the withdrawal and the future relationship with the EU. Until the negotiations are completed, the state remains a full member of the EU with all rights and obligations. If the application for withdrawal is accompanied with the election of a new Prime Minister, it could result in a lasting period of political uncertainty and economic paralysis for the EU and the UK.

The announcement of Brexit on June 24, 2016 led to enormous losses on the international financial markets. At the start of trading the German index (DAX) experienced the biggest slump since the Lehman bankruptcy in 2008 and fell by approximately ten percent. Other European indices, especially in Italy and Spain, also significantly suffered from the slump. The British pound fell by up to eleven percent and reached the lowest level since 1985 on the day following the Brexit referendum. Nevertheless, the British deposit guarantee fund (Financial Services Compensation Scheme) confirmed that the coverage for deposits in British banks remains unchanged.

Further events are not foreseeable yet. Early elections on a renewed British referendum on the EU exit cannot the excluded.

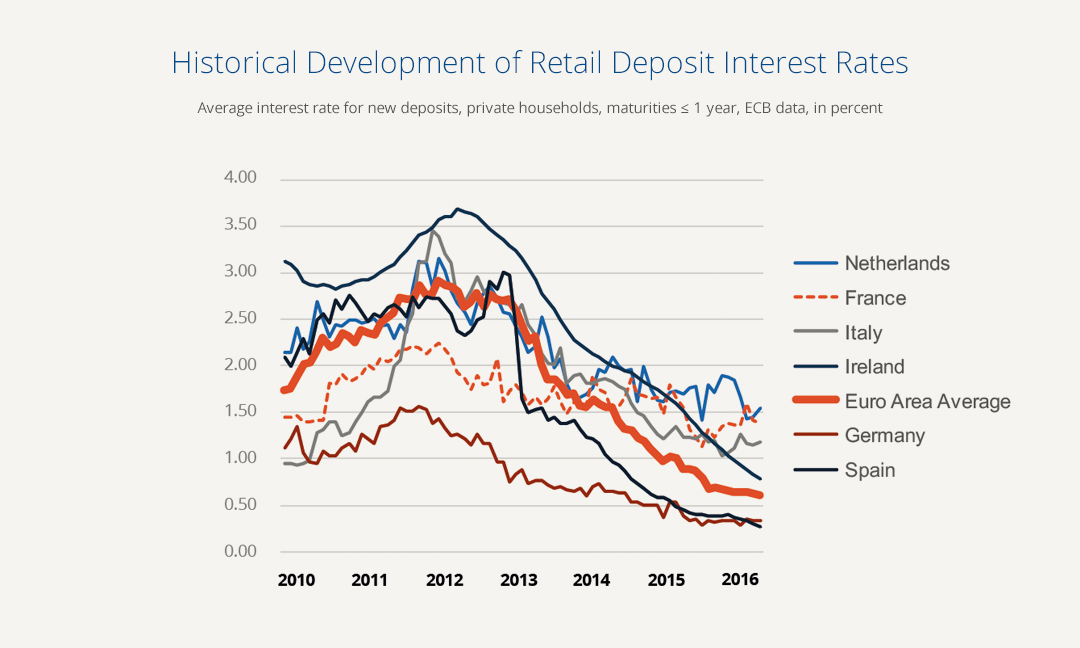

In addition, in both Scotland and North Ireland, a majority of the population voted against the Brexit, and are currently discussing a possible secession from the United Kingdom to prevent the withdrawal from the EU. Eventually, Brexit will lead to political uncertainties and economic fluctuations in the financial markets and probably a lasting period of low interest rates.