Creating a balanced portfolio

How do I balance risk and growth in my portfolio?

What is a balanced portfolio: A portfolio aligned to the investor’s investing strategy and financial goals.

Building a balanced portfolio: This involves setting financial goals, assessing risk tolerance, determining asset allocation, diversifying your portfolio, and regularly rebalancing the investments.

Asset allocation shifts by age and life stage: Some investors gradually reduce their risk as they get older.

What is a balanced portfolio?

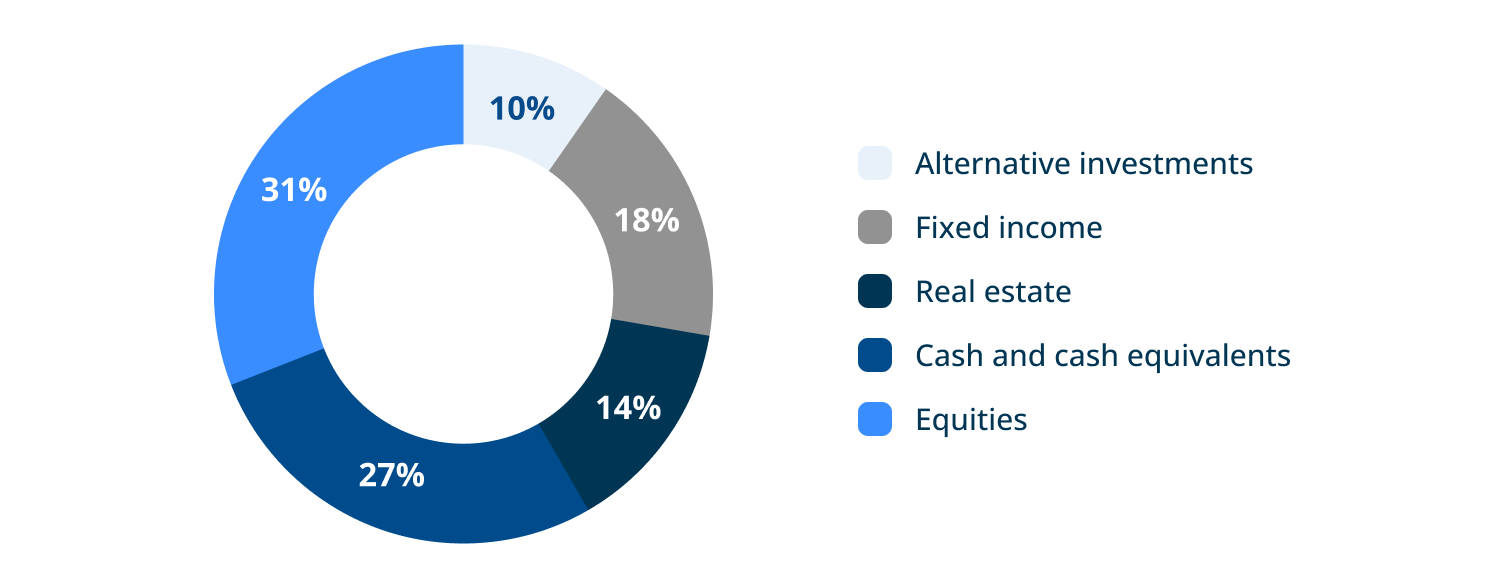

Balancing a portfolio is an investment strategy that combines different asset classes like stocks, bonds, cash, real estate, and commodities to achieve a desired level of risk and growth. A balanced portfolio provides diversification and therefore reduces the impact of market volatility on the overall portfolio value.

Why is diversification in a portfolio important?

A well-balanced portfolio is also a diversified one. By diversifying your portfolio, you can mitigate market volatility and better manage risk. With a diversified portfolio, you spread your investments across various asset classes, potentially increasing your chances of long-term growth. Instead of relying on the performance of a single asset class, you’re spreading the risk. That makes it possible to offset losses, stabilize your portfolio, and achieve your financial goals.

How do I build a balanced investment portfolio?

Building a balanced portfolio can be done in five simple steps:

Setting financial goals. Everyone has unique goals, timeframes, and capital requirements, which is why it can be helpful to set financial goals when starting investing. For example, if you’re investing for retirement, you would need to know when you are going to retire, how long your retirement will last by including your financial means in your considerations, and complement your capital requirements with financial investing.

Assessing your risk tolerance. It is important to consider your comfort with risk when building a portfolio and choosing your investments. For example, if you have a low risk tolerance, you might want to invest a larger percentage of your money in bonds and cash. On the other hand, if you’re willing to take on more risk for higher return potential, you might put more money toward stocks.

Determining your asset allocation. Having determined your financial goals, investment timeframe, and risk tolerance, the next step is to choose your investments and asset classes. The three main asset classes are stocks (equities), bonds, and cash. Your choice of asset classes and allocation will depend on the information from the first steps. For example, if you start saving for retirement at the age of 30, you might opt to invest in a larger percentage of stocks versus bonds or cash due to their higher growth potential. Alternatively, if you’re in your 50s, a less risky allocation that is more heavily weighted toward bonds or money markets might be better suited.

Diversifying your portfolio. Building a balanced portfolio also means investment diversification. This is where you divide your money between different asset classes to reduce risk. For example, having 60% of your money in stocks or equities could involve diversification by including foreign and domestic stocks as well as stocks with different market capitalizations. Similarly, you can diversify your cash savings or bonds by term and type. So, a well-balanced and diversified portfolio might include a combination of mutual funds, exchange-traded funds, and index funds.

- Rebalancing your investments. Since both your life circumstances and the financial markets are always changing, your portfolio (along with your investment strategy) might at some point be out of balance. That’s why it’s important to continually monitor your portfolio and regularly rebalance it. In this process, you evaluate the percentage of each asset class in your portfolio and shift money from overweighted areas into an underweighted category.

How your asset allocation may shift by age and life stage

The holy grail of investing is to maximize the return while minimizing the risk. As there are many factors that might affect the asset allocation, such as age, income, net worth, financial goals, propensity to spend, risk tolerance, number of children, hometown with a specific cost of living, and other factors, there’s no optimal portfolio balance for everyone.

With age, your goals might change, and the asset allocation in your portfolio will likely change as a result. Although there are many factors that might affect the investments in your portfolio, the general advice for people in particular life situations is to align their portfolio with their risk tolerance. One general rule of balanced investing is to gradually reduce your risk as you get older.

Portfolio balancing in your 20s

Investors in their 20s may choose to put more money in riskier investments, such as stocks, because there is more time to recover from any losses than at a higher age. For example, a balanced investment portfolio in your 20s might contain 80% stocks and 20% bonds. Growth stocks or exchange-traded funds can offer higher returns, but they come with far greater risk.

You may also choose to take advantage of the compound interest that some savings accounts offer, which is a way money invested in your 20s can grow over time. This is essentially interest earned on existing interest, and it’s a fast way to boost your money.

You can also automate your investments by setting up regular contributions to a retirement account, such as a 401(k), IRA, or other funds in your portfolio. This can ensure consistent growth and help you build a habit of saving.

Portfolio balancing in your 30s and 40s

Some investors have a lower risk tolerance in their 30s and 40s. At this point, you might not bet major portions of your portfolio on single investments. And if you have children, you might want to start saving for their education. But to avoid becoming a burden for your kids in retirement, it’s worth making sure you’re saving enough for retirement. To achieve both, you might want to consult with a retirement financial advisor to create a plan that addresses both needs effectively.

At this point, a well-balanced portfolio is important to meet your increased responsibilities and to have financial growth aligned with your risk tolerance. Investors might continue investing in stocks but also incorporate more bonds and fixed-income assets to lessen the effect of volatility on your portfolio. Another important step is diversification across different asset classes. Investors might consider real estate or mutual funds that can help with risk management and still provide chances for growth. What also might be helpful is a liquid fund for emergencies while continuing with the automated investments for the long term.

Portfolio balancing near retirement

In your 50s and early 60s, you might start planning for income streams that will support you in retirement. At this life stage, you might want to reassess your risk tolerance and investment goals and move toward assets that have a higher return and less volatility.

For example, a balanced investment portfolio near retirement might consist of the three traditional asset classes of securities: stocks, bonds, and cash (in decreasing order of risk and of potential return).

In retirement, it’s important to focus on preserving your accumulated capital and generating a steady income. As a result, your portfolio might shift toward income-generating investments, such as Treasury bonds, high-quality bonds, and conservative dividend stocks. Along with balanced investing, you might create an estate plan and also consider potential healthcare costs.

Tailoring your portfolio to your risk tolerance

In order to make the right investment decisions for you, you could start by identifying your investor profile. This could be conservative, moderate, or aggressive. It is an important step in aligning your asset allocation with your financial objectives, risk tolerance, and time horizon for retirement.

Your investor profile isn’t static and will likely change over time.

Here are the different investor profiles in detail:

Conservative investing. Having a higher percentage of bonds and cash in your portfolio is a capital preservation strategy that might suit high-net-worth individuals with shorter investment horizons or greater income needs.

Moderate investing. A balance between stocks and bonds allows potential growth while managing volatility. This investor profile might be right for individuals with a moderate risk tolerance.

- Aggressive investing. An investor with a higher risk tolerance is growth-focused. Their portfolio may contain a larger share of equities, alternative investments, or private equity. While having potential for significant returns, it involves more volatility.

When and how to review and adjust your portfolio mix

It’s best to regularly, such as once a year, to see if your portfolio is still balanced, as markets and your financial circumstances can change. Rebalancing your portfolio means realigning your allocation to your initial investment goals and risk tolerance.

Tax considerations with portfolio planning

Your individual tax situation requires consideration for maximizing your after-tax capital gains and the growth of your portfolio over time. The following points might be worth considering when planning your portfolio:

Investments with high taxable income, such as bonds or high-dividend stocks, may be placed in tax-deferred accounts like IRAs or 401(k)s.

Long-term capital gains and qualified dividends commonly receive lower tax rates than ordinary income and that different investments are taxed differently.

Investing in municipal bonds can give tax-free income if you’re in a higher tax bracket. Typically, the interest from these bonds is exempt from federal taxes and sometimes state taxes.

By selling investments at a loss, you might offset capital gains from other investments.

As tax laws can be highly complex and apply differently based on your situation, it’s crucial to seek professional tax advice.

Diversify your portfolio and start saving with Raisin

No matter what investor profile you have, by exploring accounts with competitive interest rates, you can grow your portfolio in a way that matches your risk tolerance. Compare the top rates on our marketplace and get started today!

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.