How to invest in the S&P 500

A beginner’s guide to understanding and investing in the S&P 500

What is the S&P 500: The S&P 500 is a stock market index tracking 500 of the largest U.S. companies, offering broad exposure across multiple sectors.

Investing in the S&P 500 for beginners: While you cannot directly invest in the index, you can gain exposure through index funds, ETFs, mutual funds, or individual stocks.

Historical performance of the S&P 500: The index has delivered an average annual return of approximately 10.3% since 1957, though inflation-adjusted returns are closer to 6.5%. However, past performance does not guarantee future results.

What is the S&P 500?

The Standard & Poor’s 500, more commonly known as the S&P 500, is a stock market index that tracks the market performance of 500 of the largest public companies in the United States. Companies listed under the S&P 500 share common traits and cover over 11 sectors representing different segments of the U.S. economy, with information technology, financial, and healthcare companies holding the largest concentrations. This index allows investors to gain a better picture of the U.S. stock market and the broader economy, since it covers many sectors across the market.

The value of the S&P 500 is determined using the combined average performance of stocks within the index, with larger companies carrying more weight. When the index value increases, this shows that enough stocks increased in value significantly enough to boost the total average value.

How to invest in the S&P 500 for beginners

To help better understand how to invest in the S&P 500, it is important to note that the index is not a stock, but rather a list of companies. So, because it is not a security itself, it is not possible to directly invest in it. Instead, you can use index funds, mutual funds, exchange-traded funds, or even individual stocks as a way to invest in the S&P 500.

Mutual funds

Mutual funds are pools of money collected from many investors to invest in a basket of securities (such as stocks, bonds, and other assets). Some mutual funds may invest in S&P 500 companies but are not required to mirror the index exactly.

Mutual funds are more actively managed, where a manager tries to beat the market by choosing investments they believe will perform best. Actively managed mutual funds may try to outperform the S&P 500, which can result in higher fees.

Index funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to match the performance of a market index rather than beat it. These are passively managed funds that mirror the performance of the S&P 500 by holding all 500 stocks at the same weight as the index does.

One of the most common ways to invest in the S&P 500 is through index funds, and may also be more cost-effective for long-term investing, as they tend to come with lower fees due to the passive management approach.

Exchange traded-funds (ETFs)

Exchange-traded funds are baskets of securities you can buy and sell like stocks, which can help you gain more exposure to stocks and other investment types. Many ETFs are designed to replicate the S&P 500 performance by holding the same 500 companies in the same proportions as the index — similar to index funds. You may also encounter equal-weight ETFs, which have an even balance across all 500 companies, which may offer more balance diversification, but potentially greater volatility.

These ETF options also tend to be passively managed, and they aim to mirror rather than outperform the index. S&P 500 ETFs typically have low expense ratios and may even allow you to invest in fractional shares.

Stocks

If you would like to attempt to mimic the performance of the S&P 500 index on your own, you can buy individual stocks in equal weights as listed in the index. This approach may take a lot of work and active research to manage your portfolio and may not be as cost-effective as investing in an S&P 500 index-managed product, such as ETFs or index funds. This strategy involves higher risks when it comes to investing in the S&P 500.

How much does it cost to invest in the S&P 500?

The cost to invest in the S&P 500 depends on how you choose to invest (i.e., stocks, index funds, or ETFs). When investing in the S&P 500, you need to consider the following:

Minimum investment requirements: The price of one share (or less if your broker allows fractional shares) or minimum initial investment amounts can influence the cost of your investment. Both prices can vary depending on the product and trading platform you use, whether a brokerage, robo-advisor, or other financial advisor.

Expense ratios: Expense ratios, or the annual fee charged by your fund provider, are often taken as a percentage of your investment. Index funds and ETFs tend to have very low expense ratios (e.g., 0.03% = $3 per year on every $10,000 invested), but actual rates may vary.

Brokerage costs: While some major brokers offer commission-free trades on ETFs and index funds, this might not always apply to individual stocks. Furthermore, you may also want to consider other management and service costs of your brokerage account, robo-advisor, or financial advisor.

When determining how much to invest in the S&P 500, you should also consider your financial situation, goals, investment horizon, and risk tolerance. This can help you better understand how much money you can set aside to invest and help you create a better budget.

Can I invest $100 in the S&P 500?

If you want to invest $100 in the S&P 500, this could be a good entry point for someone who is getting started with investing. Depending on how you choose to invest in the S&P 500, some products offer investment minimums as low as $1, so your $100 investment would be possible.

This allows investors to have more flexibility when it comes to investment amounts. If your financial situation changes, you can also increase or reduce your investment amount to cater to your needs.

However, if you want to invest in the S&P 500 using individual stocks, you might want to check the price of company shares, or if they allow fractional shares, as they may be more costly investments compared to ETFs and other index funds. For example, if a stock trades for $220 a share, and you only have $100, then you can purchase 0.45 shares. Fractional shares can be useful if you want to invest in companies with higher share prices but are either unwilling or unable to allocate a larger budget.

So if you’re wondering if you can invest $100 in the S&P 500, the short answer is it depends. If your investment product (such as an index fund or ETF) has no minimum, you can usually purchase a dollar amount of your choice, meaning you can invest $100. You may want to double-check individual stock share prices or consider fractional shares if individual stocks are more than $100.

If you’re getting started with investing or want to add more liquid assets to your portfolio, you might also want to consider certificates of deposit (CDs) or other high-yield savings products. High-yield savings options tend to have higher interest rates than traditional savings accounts, allowing you to increase your savings potential. Explore account types at Raisin and start boosting your savings today!

Bank

Product

APY

New Raisin Users: 60-Day Rate Lock

opensky, a division of Capital Bank, N.A., Member FDIC

FDIC

High-Yield Savings Account

3.90%

$1,950.00

mph.bank, a division of Liberty Savings Bank, F.S.B., Member FDIC

FDIC

High-Yield Savings Account

3.86%

$1,930.00

mph.bank, a division of Liberty Savings Bank, F.S.B., Member FDIC

FDIC

Money Market Deposit Account

3.76%

$1,880.00

Adda Bank, a division of Southwest Heritage Bank, Member FDIC

FDIC

High-Yield Savings Account

3.50%

$1,750.00

Paprika Capital Bank, a division of Tradition Capital Bank, Member FDIC

FDIC

High-Yield Savings Account

3.45%

$1,725.00

HealthcareBank, a division of Bell Bank, Member FDIC

FDIC

Money Market Deposit Account

3.40%

$1,700.00

RBMAX, a division of Republic Bank, Member FDIC

FDIC

High-Yield Savings Account

3.15%

$1,575.00

Raisin is not an FDIC-insured bank or NCUA-insured credit union and does not hold any customer funds. FDIC deposit insurance covers the failure of an insured bank and NCUA deposit insurance coverage covers the failure of an insured credit union.

Do S&P 500 ETFs and funds pay a dividend?

Many companies in the S&P 500 pay dividends to shareholders, which can provide additional income to investors. This means investors can also potentially receive dividends by investing in the S&P 500 through index funds and ETFs. As of August 2025, the S&P 500 has a dividend yield (the percentage of a company’s stock price that is paid out to shareholders as annual dividends) of about 1.22%, slightly below its long-term average of around 18.%.2

What is the average annual return of the S&P 500?

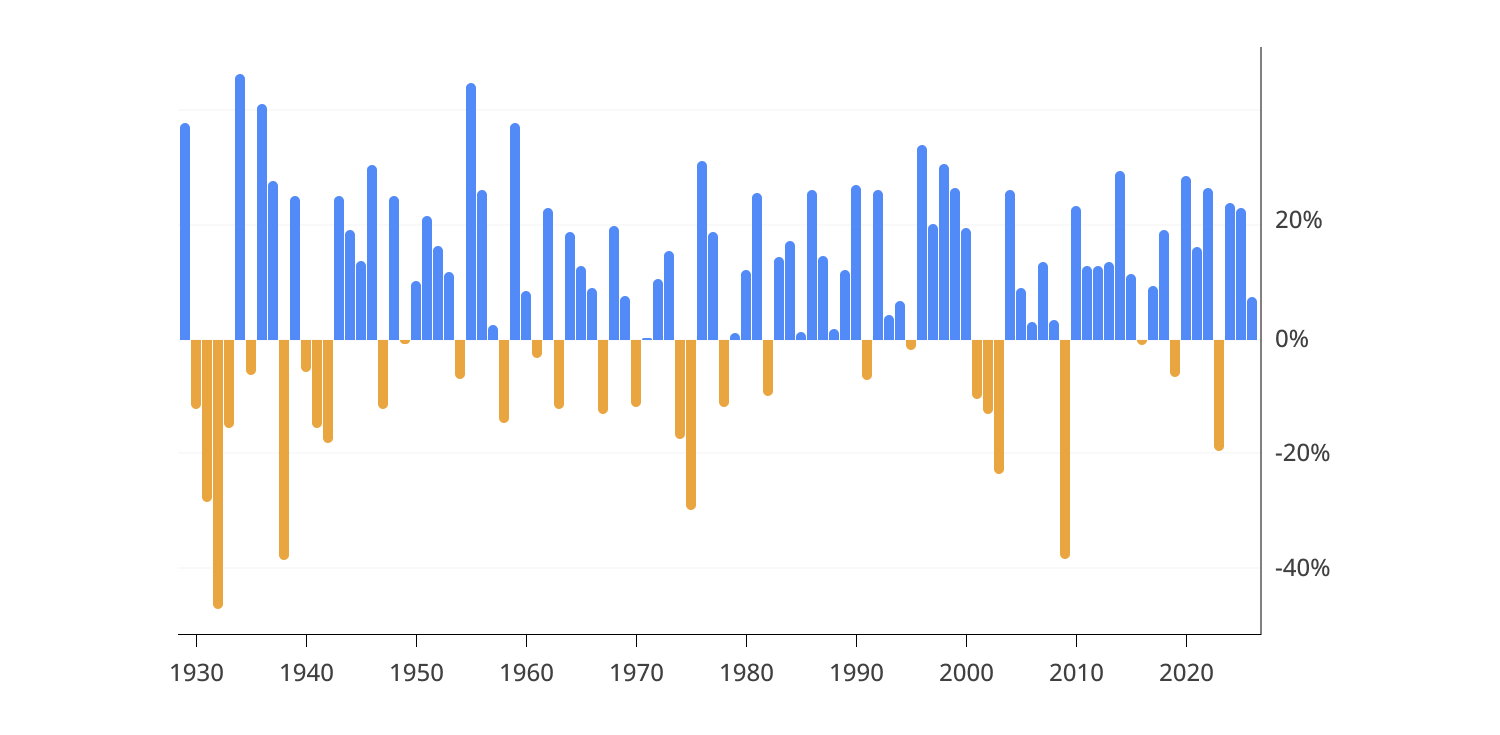

Based on data going back to its inception in 1957, the S&P 500 has historically delivered an average annual return of roughly 10 – 11% before inflation.1 When accounting for inflation, the average return is closer to 6 – 7%. However, while this is an average of annual returns, actual yearly returns can vary from big gains (for example, +30% or more) to major losses (-40% or more, like in the 2008 crash).

The index has experienced significant losses, such as during the financial crisis of the late 2000s, but downturns are often balanced by strong-performing years. It is also important to remember that regardless of its historical annual return, you can still face major losses, and past performance is no guarantee of future results. Therefore, it is important to be aware of associated risks before deciding to invest in the S&P 500.

Pros and cons of investing in the S&P 500

Investing in the S&P 500 may be a good long-term investment strategy or a way to diversify your portfolio; however, you may want to consider the advantages and possible drawbacks that come with this type of investment. Being aware of the pros and cons can help you weigh out the risks and rewards and help you better tailor your investment strategy.

Here are some things to consider before investing:

Advantages of investing in the S&P 500

- Consistent returns: The S&P 500 has had an average of about 10% of annualized returns over the last century.1 Returns may vary from year to year, and it is important to note that historical trends do not guarantee future gains.

It can provide a simple way to diversify: Investing in the S&P 500 through index funds and ETFs allows you to create a portfolio of hundreds of stocks with a single purchase, allowing for almost instant diversification and more exposure to the market. However, you may also want to note that while you are diversifying across stocks in your portfolio, you are not necessarily diversifying across asset classes.

Generally lower fees: Index funds and ETFs tracking the S&P 500 often have lower fees than other, more actively managed funds, allowing you to benefit more from your potential returns.

- No intricate analysis required: The S&P 500 includes a variety of dynamic companies, so investing in it through ETFs or index funds means you don’t have to do extensive research and analysis on individual stocks. However, you should still analyze the specific product you want to invest in.

Disadvantages of investing in the S&P 500

- Risk of loss: As mentioned above, while the S&P 500 has had consistent returns, this does not ensure you will have the same returns in the future. You can still face potential losses, so you might want to consider your risk tolerance before investing large amounts of money.

Limited exposure to mid- and small-cap stocks: Only large-cap companies are included in the S&P 500, meaning you can miss out on potential gains and opportunities from mid- to small-cap stocks and emerging companies.

Only includes U.S. companies: The S&P 500 only includes U.S. companies, which reduces your exposure to international companies and other investment opportunities.

- It comes with fees: While index funds and ETFs tend to be a more cost-effective option for investing in the S&P 500, they still take a marginal cut of your investment. If you choose to invest in individual stocks, you might also have to pay trading and other management fees.

Bottom line

Making an informed decision on if and how you want to invest in the S&P 500 includes identifying your financial goals, risk tolerance, and investment horizon and knowing your investment options. It is important to be aware of the distinct advantages and disadvantages that come with this investment, and you might even want to consider seeking professional advice from a financial advisor before making any major decisions.

If you’re not ready to take the leap or simply want to diversify your cash savings, Raisin is here to help. The Raisin marketplace gives you access to a variety of high-yield savings products to make the most of your savings. Browse through competitive interest rates, compare account types, and start boosting your savings potential today!

Related Content

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.