What is the Great Wealth Transfer?

What the largest transfer of wealth could mean for your money

Home > Retirement > What is the Great Wealth Transfer?

What is the Great Wealth Transfer: An estimated $124 trillion is due to pass from older generations to younger ones over the coming decades.

The challenges: Wealth transfer is not without its challenges, such as a potential tax burden, family conflicts, and heirs being unprepared for a huge windfall.

Generational differences: Trends can be recognized in the different attitudes toward inheritances, with Millennial Americans favoring sustainable investments.

What is the meaning of wealth transfer?

Wealth transfer is where assets are passed either from one generation to the next or within the same generation. Assets can include cash, investments, property, or even family businesses. Wealth is most commonly transferred after death through a will, but some may choose to gift money to children directly or spend their wealth on family activities while they are still alive. This is called “giving while living.”

Most wealth transfers occur between spouses or from parents to children. In some cases, the wealth may pass down in stages: first to a surviving spouse, then to the children later on. But it’s not always the next generation who benefits; wealth transfers can also skip a generation.

There are various strategies for a transfer of wealth, and many Americans want to do so in a tax-efficient way. Their goal is to lower or remove the tax burden on both the person transferring the wealth and the recipients.

Wealth transfers can be fraught with challenges – both for the person giving and the one receiving. Asset transfers, for instance, require careful planning. Meanwhile, heirs may need guidance from a qualified financial or wealth advisor to manage large sums of money or investments.

What does the Great Wealth Transfer mean?

You might be wondering, “What is the Great Wealth Transfer?” Dubbed “the largest transfer of wealth in history,” it refers to a phenomenon underway in the United States and other countries stemming from huge amounts of wealth accumulated by the so-called Baby Boomer generation and older.

As the Baby Boomer and Silent generations enter their later years, they are set to pass on an incredible $124 trillion through 2048, according to a report from Cerulli Associates.¹ In the process of this intergenerational wealth transfer, their heirs are poised to inherit $105 trillion, with the rest expected to go to charities.

So which generations are part of the Great Wealth Transfer?

- Silent Generation (born 1928 – 1945)

- Baby Boomers (born 1946 – 1964)

- Generation X (born 1965 – 1980)

- Millennials (born 1981 – 1996)

- Generation Z (born 1997 – 2012)

With these huge sums of wealth changing hands, many heirs may feel unprepared for a large windfall and unsure how best to manage the assets they inherit. At the same time, the Great Wealth Transfer opens up an opportunity for wealth advisors and asset management providers to pivot their offerings in a way that reflects the diverging investment and savings habits of the younger generations.

These generational differences are becoming increasingly clear. According to a recent study, Gen Z are showing greater emotional satisfaction with saving, a willingness to talk openly about finances, and optimism about their financial futures. Despite having a lower average savings account balance, 82% of Gen Z report feeling good about the amount they’re saving, compared to 67% of Millennials, 61% of Gen X, and 64% of Boomers.

Who benefits from the biggest wealth transfer?

It’s important to clarify that not all this wealth is passing directly to the younger heirs – a large portion (around 43%) will initially pass intra-generationally, i.e. to widowed spouses, before it is transferred intergenerationally to heirs and charities. And nearly three-quarters of this spousal wealth transfer is expected to firstly go to women from the Baby Boomer and older generations.²

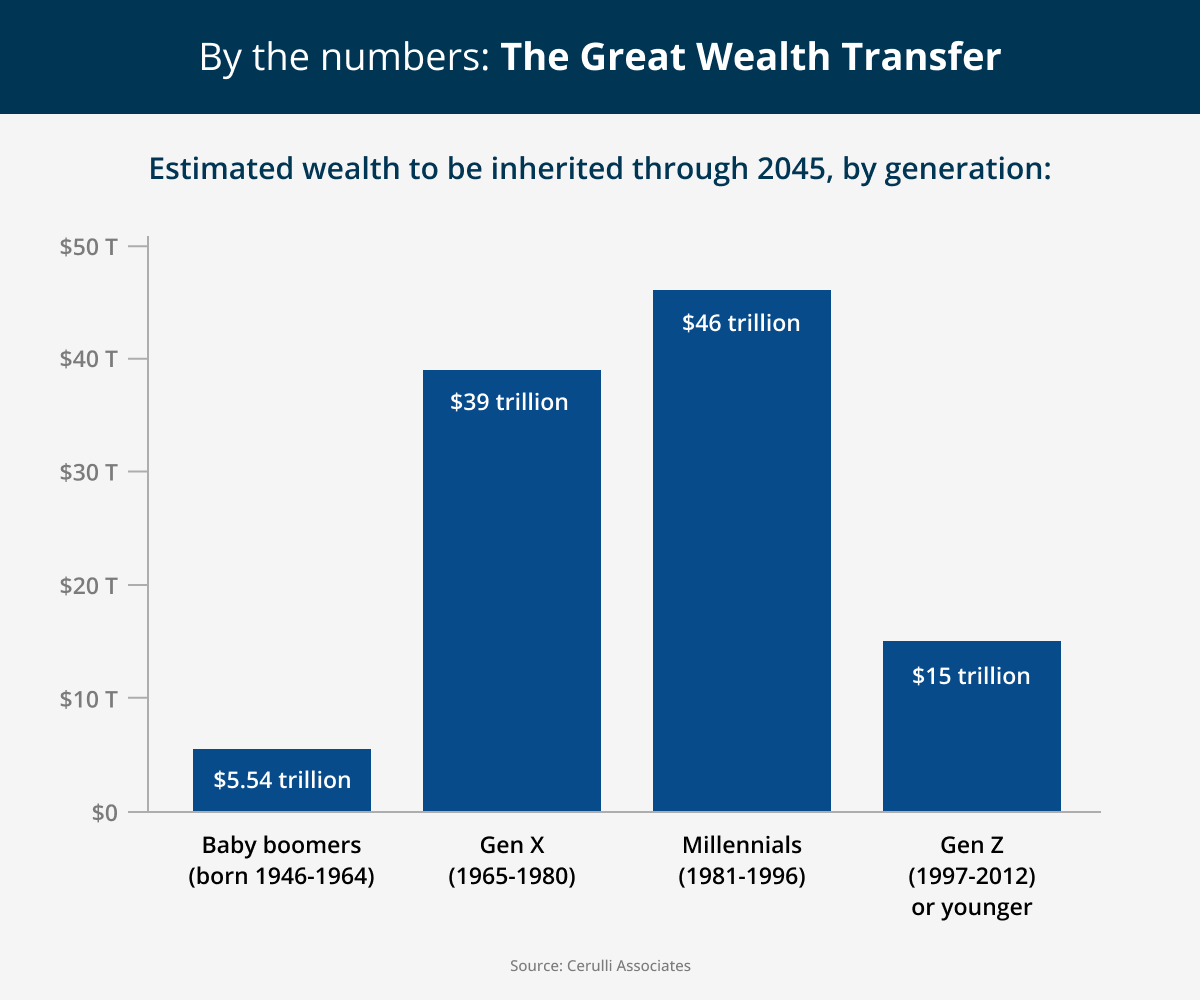

The heirs in the Great Wealth Transfer are as follows:

As you can see, Millennials are set to inherit the most of any generation in the Great Wealth Transfer. According to the report, Gen X are likely to access more of the transferred assets over the coming decade.² The younger generations, including Gen Z, may experience delays of years or decades due to the initial transfer of wealth to a widowed spouse. And with the average life expectancy rising, there’s a chance they won’t get to see any inheritance at all.

While Millennials are set to inherit the most wealth overall, Gen Z's savings behaviors may put them in a stronger position over time. In fact, according to a recent study, Gen Z is the most emotionally satisfied generation when saving: 65% feel secure and 60% feel smart when they do so.

What is causing the intergenerational wealth transfer?

There are several economic reasons why older Americans have accumulated so much wealth:

- Inflation. Rising prices have contributed to large amounts of wealth concentrated in real estate and financial assets. Privately held wealth has soared in recent years.

- Rising home prices. Having typically bought their properties decades ago, the older generations have accumulated substantial wealth from the appreciation of real estate.

- Rising stock prices. The value of investments has grown significantly.

- Wealth concentration. The richest American households hold a growing share of wealth. According to a report, the number of high-net-worth-individuals holding more than $1 million in assets has risen by 62% over the past decade.³

This wealth is now trickling down as part of the Great Wealth Transfer, and it has been made easier by tax laws that are allowing for significant wealth transfers without being subject to federal estate tax.

How different generations handle wealth transfer

As the Great Wealth Transfer gets underway, it is highlighting the varying attitudes each generation has toward inheritance, wealth management, and saving.

Some sources say that Baby Boomers may be more likely to give their wealth away while they’re still alive, rather than waiting to pass it on after death. That way, they get to see the positive impact they leave on their children, grandchildren, or charitable causes. They’re also less likely to impose conditions on that wealth transfer, opting instead to give freely and allow heirs to use the money as they see fit.

This may be tied to their long-standing saver mindset — a safety-first approach that prioritizes emergency preparedness. According to the 2025 Raisin Summer Saving Series, 76% of Boomers say saving for unexpected expenses is a top priority, and 58% identify as savers — the most of any generation.

Real estate tends to be viewed as a stable investment across generations, but the main divergence lies in financial behavior and outlook. Millennials, for example, are more likely to incorporate values-based decisions into their investment strategies, exploring sustainable, impact, and alternative investing. Yet they also face significant financial stress: the Raisin study found that Millennials are saving across multiple demands, including debt repayment (43%), childcare (34%), and education costs (29%). These overlapping needs may make wealth management more complex — especially when paired with the pressure of inheriting or preserving intergenerational wealth.

Meanwhile, Gen Z may be the most emotionally attuned generation when it comes to money. The study reveals that 82% of Gen Z feels good about the amount they’re saving, and 83% are willing to talk about savings openly with friends and family. These attitudes suggest that younger heirs may not only inherit wealth but also reshape what it means to save, manage, and grow it with an eye toward transparency, self-care, and long-term financial wellness.

How families can prepare for a wealth transfer

Given the generational differences, there are several strategies families might take to prepare the next generation for a wealth transfer.

Start planning your estate. Trusts are one option that can help protect assets for children – whether minors or adults – until they’re ready to manage them alone.

High-net-worth individuals or individuals with complex financial situations may find it beneficial to use the services of a wealth management advisor who can provide expert, personalized advice.

Start reading up on your options today. Even if your wealth transfer might be some time off, it can help to educate yourself, and your heirs, on the basics of investing, retirement planning, taxes, and savings. It can also be helpful to learn how to build generational wealth.

The younger generations may be expecting an inheritance, but it’s not always guaranteed or timely. Anyone can take control of their finances today by exploring high-interest CD accounts, which can help boost your savings for more immediate goals.

How much wealth can you transfer tax-free?

As of 2025, Americans can carry out wealth transfers of up to $13.99 million during their lifetime or at death without incurring federal gift taxes or estate taxes. This amount is called the lifetime exemption. For married couples, the exemption is double, at $27.98 million. However, it’s important to keep in mind that this could change at any point due to Congressional actions.

What are the main challenges of wealth transfer?

Even though the Great Wealth Transfer primarily benefits heirs who have grown up in wealthy families, many heirs can still find themselves unprepared for receiving large sums of money.

Some potential pitfalls during a wealth transfer include:

- Those inheriting may be landed with a tax bill that chips into the sums of money passed down.

- Wealth that may have been distributed unequally among the heirs can lead to family fallouts.

- Heirs may not understand the estate plan, leading to potential complications or a transfer of wealth that isn’t fully in line with the giver’s wishes.

- With a lack of financial literacy or professional advice, or even communication on the part of the giver, there is the potential for heirs to mismanage or lose their inheritance.

- The values of the heirs may not match those of the previous generation.

Build your savings to pass on more to your loved ones

Grow your wealth in a way that’s steady and reliable. Deposits can help you build a legacy for future generations. With a high-interest CD account, for instance, you’ll lock in a competitive interest rate for your chosen term.

Opening a savings account with Raisin is quick, simple, and free. By registering, you’ll gain access to competitive rates from trusted banks and credit unions, helping you leave more for your loved ones.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.