Angela Merkel’s late-breaking proposal to join Macron in supporting some form of Eurobonds to support the Eurozone’s hardest hit countries, puts her in line for the moment with the European Central Bank’s determinedly pro-Euro stance. Thus the EU and Eurozone appear to have received the boost they need to recover economically from the pandemic. The ECB warns that the path forward will nonetheless offer enormous challenges.

The Consumer Confidence Index plunged across Europe over the last several months while savings rates went up sharply as consumers cut their spending in light of the uncertainty due to the pandemic. The European overall inflation rate has also dropped significantly to 0.1%, the lowest level since the summer of 2016, from 1.4% in January 2020.

RETAIL RATES:

Pandemic fails to put a dent in interest rate decline

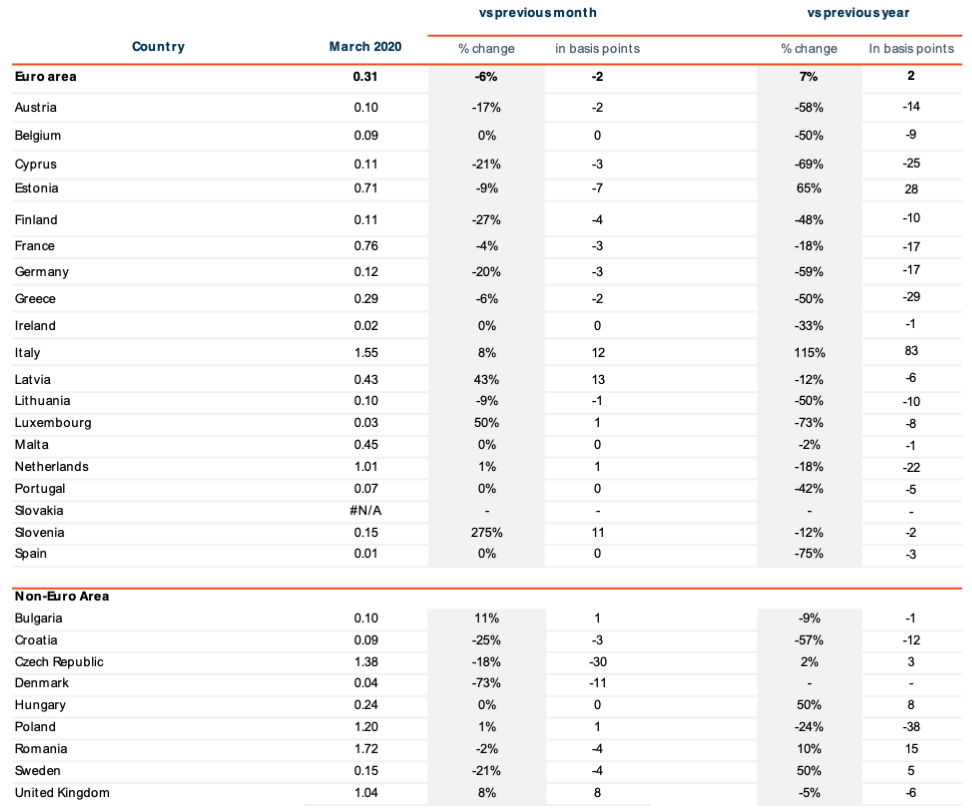

The latest European Central Bank data on interest rates across Europe indicates a slight decline overall, as the Czech Republic dove -30 basis points from the previous month and Denmark -11 basis points.

Ten European markets did not move more than 1 basis point in either direction, however, including Spain, Portugal, the Netherlands and Ireland. Germany and France both slid -3 basis points.

On the upside Italy and the UK both bounced as of the ECB’s March data, 12 and 8 basis points upward respectively, along with the smaller markets of Latvia (13 basis points up) and Slovenia (11 basis points up). According to our more recent data top rates in both Italy and the UK subsequently sank, likely bringing the average back down (see below).

Average Retail Rates across Europe – ECB

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

COMPARISONS:

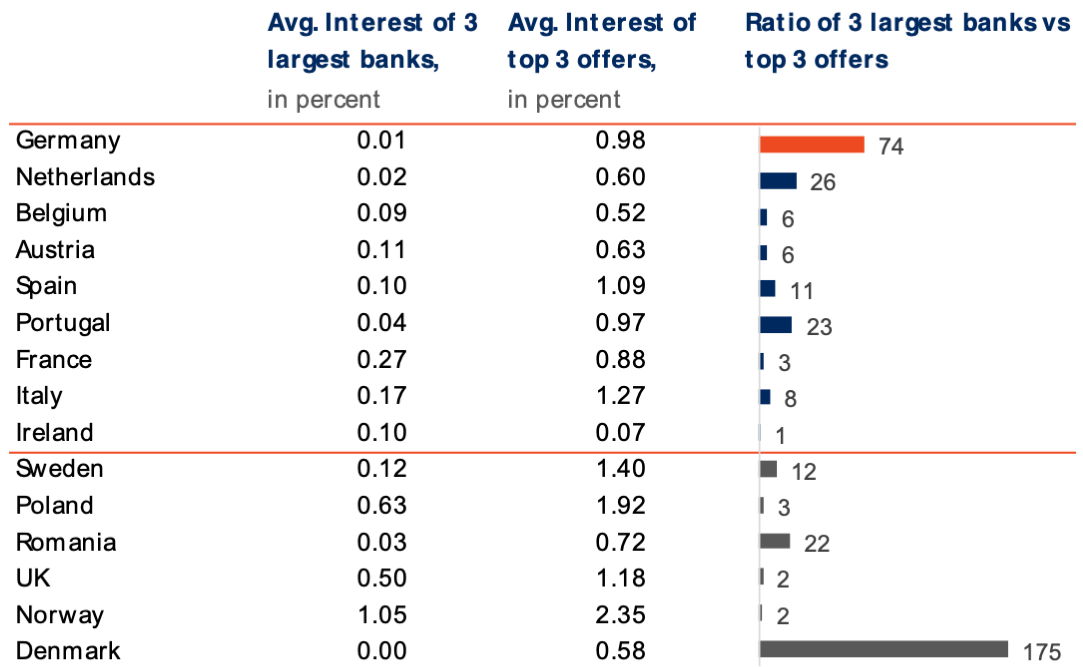

Indications of upturn in top rates flatten out as Germany slips back down

Raisin collects current intelligence on interest rates across the continent (two months ahead of the latest ECB data), which shows that the April uptick in interest rates held steady in Austria, the Netherlands, and Sweden. But the upward movement has stopped overall, with just three small increases.

Germany, the UK, and Poland all took big hits: the UK’s top 1-year rate fell from 1.52% last month to 1.18% this month, Poland’s from 2.32% to 1.92% this month, and Germany from 1.05% to 0.98%.

*This data excludes offers on Raisin platforms. The “top offers” category excludes offers from the three biggest banks and reflects the market’s best available offers outside those banks.

Top 1-year and 3-year rates

Average of the top 3 term deposit offers for retail customers based on local comparison sites as of 19/05/2020. Criteria: EUR 10,000 deposit; 1 product per bank; offers for both new and existing clients.

Due to the decrease in top interest rates in Germany, April saw a small contraction of the “interest rate shears” in Germany – the gap between the extremely low rates available from the country’s largest banks and the top available offers. Otherwise though there was almost no movement across Europe narrowing or widening the disparity between big banks and best offers.

Comparing big banks to top available offers

Average of 1-year term deposit offers for retail customers offered by the 3 largest banks in the local market; as of 19/05/2020. Criteria: EUR 10,000 deposit; offers for both new and existing clients. Usually, largest banks based on balance sheet size, which offer term deposits.

CORPORATE RATES:

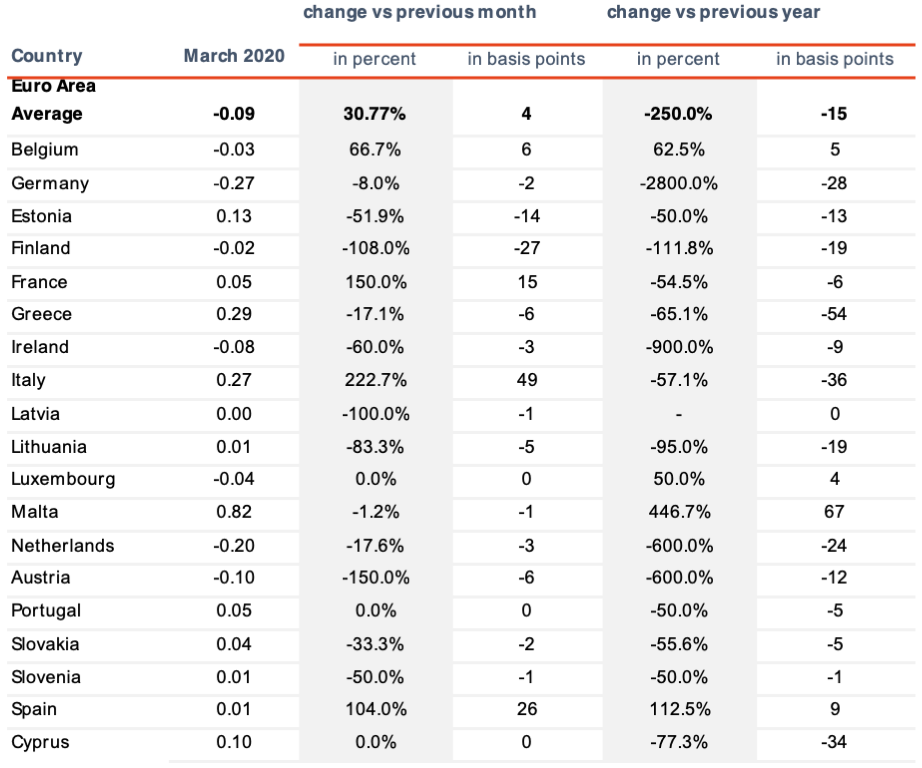

Interest rate increases in France, Spain and Italy countered by overall descent

The Eurozone average interest rates on corporate deposits slipped to -0.09%, with Finland dropping -27 basis points to -0.02% and Estonia and Austria -14 and -6 basis points respectively.

But several markets saw good news for business depositors. France and Spain emerged out of negative territory: Spain jumped 26 basis points and France 15 basis points. Italy meanwhile jumped 49 basis points, leaving negative rates behind to reach 0.27% in the more recent ECB data.

Germany, Austria, the Netherlands and Ireland, meanwhile, all descended further below zero, meaning corporates are paying ever more for the privilege of depositing their cash with banks.

Corporate rates

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

Other sources: European Central Bank, Raisin, Bloomberg, The Economist.

Header image: by j on Unsplash

About Raisin

A trailblazer for open banking and the leading pan-European one-stop shop for online savings and investments, Berlin-based fintech Raisin was founded in 2012 by Dr. Tamaz Georgadze (CEO), Dr. Frank Freund (CFO) and Michael Stephan (COO). Raisin’s platforms — under the brand WeltSparen in the German-speaking world — are breaking down barriers to better savings for European consumers and SMEs: Raisin’s marketplace offers simple access at no charge to attractive and guaranteed deposit products from all over Europe, as well as globally diversified, cost-effective ETF portfolios and pension products (currently available in Germany). With one online registration, customers can choose from all available investments and subsequently manage their accounts. Since launch in 2013, Raisin has placed 23 billion EUR for more than 260,000 customers in 28+ European countries and 92 partner banks. Raisin was named to Europe’s top 5 fintechs by the renowned FinTech50 awards and is backed by prestigious European and American investors such as btov Ventures, Goldman Sachs, PayPal Ventures, Thrive Capital, Index Ventures, Orange Digital Ventures and Ribbit Capital. Raisin UK in Manchester, banking-as-a-service provider Raisin Bank in Frankfurt, pensions specialist fairr, and Raisin Technology (formerly Choice Financial Solutions) all belong to Raisin.

Austria

Austria

Finland

Finland

France

France

Germany

Germany

Ireland

Ireland

Netherlands

Netherlands

Poland

Poland

Spain

Spain

United Kingdom

United Kingdom

United States

United States

Other (EU)

Other (EU)