The pan-European deposits platform Raisin (www.raisin.com) regularly publishes the Raisin Interest Rate Radar to assess the ongoing effect of the ECB (European Central Bank) rate policy on savers throughout Europe. The data released by the ECB in August reflected rates up until two months prior to the release (June 2019).

ECB forces negative rates on deposits – retail savers aren’t safe

Tensions abroad and at home hinder EU planning, pressure spurs talk of recession

The Draghi era at the European Central Bank (ECB) comes to close with a return to quantitative easing and the bond purchasing program at a volume of €20 billion each month, starting from November, as per the EBC Governing Council’s 12. September 2019 meeting. The continuation of negative rates on deposits was also announced, pushing them even lower to -0.5%.

“Putting banks under increasing pressure, this decision marks a further step to drive interest rates into negative territory for retail savers across Europe. As a cross-border savings platform we’ve seen first-hand how banks are searching for relief,” commented Dr. Tamaz Georgadze, CEO of Raisin. “We’re experiencing increasing demand for fintech services like ours that enable financial institutions to deliver better rates to their customers, and to avoid penalties by reducing their excess cash — for instance by making our third-party deposit offers available on their own platforms.”

Brexit drama to trade war fallout: Europe faces growing uncertainties

Between the now notorious “inverted yield curve,” slipping European markets, and the theatrics of Great Britain’s Parliament-vs-Government impasse, European economies are strained. The continent is under continuing pressure from the lurching trade tensions between the U.S. and China and the seemingly interminable uncertainty of Brexit. Additionally a potential standoff with the apparently deficit-friendly new Italian government looms, not to mention the unwieldy question of how Europe would react to a potential crackdown by China in Hong Kong.

Particularly in the EU’s largest economy, Germany, exports are being hit hard by the trade war and experts are seeing indications of a coming recession. Debates are ongoing about using some of the country’s surplus on a stimulus package, e.g. to improve widely languishing German infrastructure, with the center-left finance minister apparently pushing for more public investment. While the ECB extends its negative interest penalties still further, despite mounting concerns about the strategy, the unpredictable political situations both in Britain and between China and the United States present new challenges to long-term planning for European governments.

Retail Deposit Interest Rates:

Rates slip further downward across continent, with 12 countries under 0.2%

Most Europeans continue to live in low-to-lower interest rate environments, with banks on average offering customers less than 0.3% interest.

France and Belgium both continued their upward trends, while Finland, as well as the UK, Romania, Czech Republic and Poland outside the EU zone, all showed significantly higher retail rates than elsewhere in Europe, from 0.99% and up.

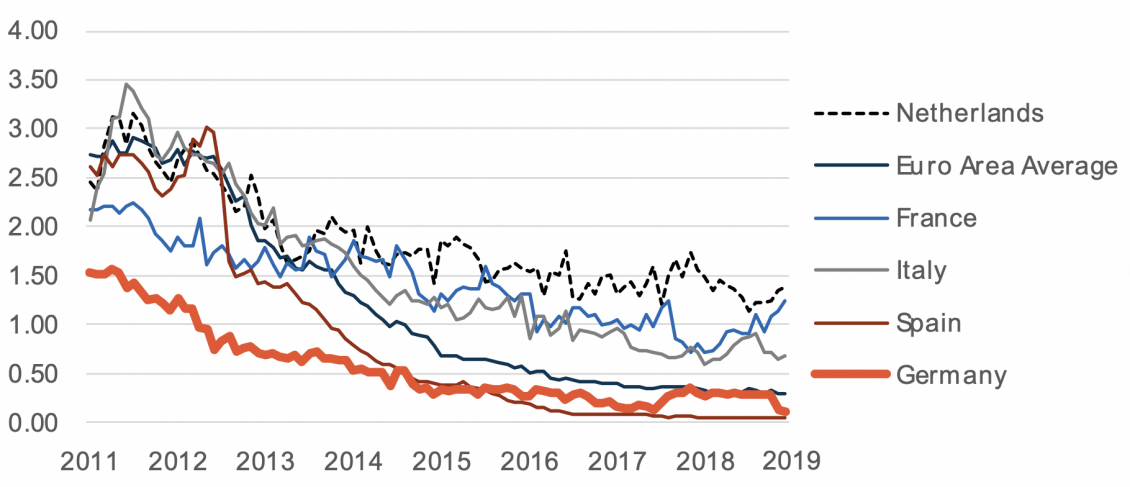

(Both France’s and the Netherlands’ higher retail rates — at such notable variance from the rest of Western Europe — represent state subsidies to savings plans and real-estate-related savings respectively, and are thus not actual outliers but, in effect, statistical disturbances.)

Current Retail Deposit Interest Rates in the EU

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

Retail rates on the rest of the continent, meanwhile, slipped further downward. Germany, after several flat months, has fallen to 0.1% (-20 bps from one year ago), with Ireland, already at the bottom, now even further down at 0.03%, and Spain still hovering at a dismal 0.04%.

Portugal, Belgium (despite its uptick), Austria, Slovenia, and Lithuania — plus outside the Euro zone Sweden, Denmark, Hungary, and Bulgaria — are also all under 0.2%.

Slovakia took a big hit losing -61 basis points, Cyprus extended its downward tick, and Estonia flattened out again after a recent upward bounce. Luxembourg’s rates meanwhile continued on a rollercoaster, up 175% from one month to the next, half a year ago, then down 27%, and now up 26 bps (+433%) in the ECB’s most recent data (June).

Historical Development of Retail Deposit Interest Rates

Average interest rate for new deposits, private households, maturities ≤ 1 year, ECB data, in percent Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

Retail Deposit Interest Rates — comparing top 3 banks with top 3 offers:

Biggest banks unable to offer more than half as much as market’s top offers — in Germany 35 x less

After a reprieve, Ireland has shown new declines in both 1- and 3-year top offers, but Germany also sank from 1.01% on 1-year to 0.92% and down to 1.14% from 1.22% on 3-year. Only Italian 3-year rates went up by more than 0.05%. UK 1- and 3-year rates fell noticeably, particularly the longer-term offers.

Ireland meanwhile saw its already low top offers’ average sink yet further from an interest rate of 0.37% to 0.30%, so down to just 2 times higher than what its biggest banks are currently providing.

Highest Retail Deposit Interest Rates in the EU

Average of the top 3 term deposit offers for retail customers based on local comparison sites as of 23/08/2019. Criteria: EUR 10,000 deposit; 1 product per bank; offers for both new and existing clients.

Germany’s notorious “interest rate shears” — the huge gap between rates on offers from the country’s 3 biggest banks and the offers with the highest rates on the market — is still closing fractionally, due to top offers on 1-year continuing to fall, now down to 0.92%. This makes rates on top 1-year term deposits “only” 35 times higher than the best offers of the 3 largest banks. The Netherlands’ biggest banks fractionally increased their best offers, thus halving the size of their rate “shears.”

Retail Deposit Interest Rates of the 3 Largest Banks

Average of 1-year term deposit offers for retail customers offered by the 3 largest banks in the local market; as of 23/08/2019. Criteria: EUR 10,000 deposit; offers for both new and existing clients. Usually, largest banks based on balance sheet size, which offer term deposits.

Average of 1-year term deposit offers for retail customers offered by the 3 largest banks in the local market; as of 23/08/2019. Criteria: EUR 10,000 deposit; offers for both new and existing clients. Usually, largest banks based on balance sheet size, which offer term deposits.

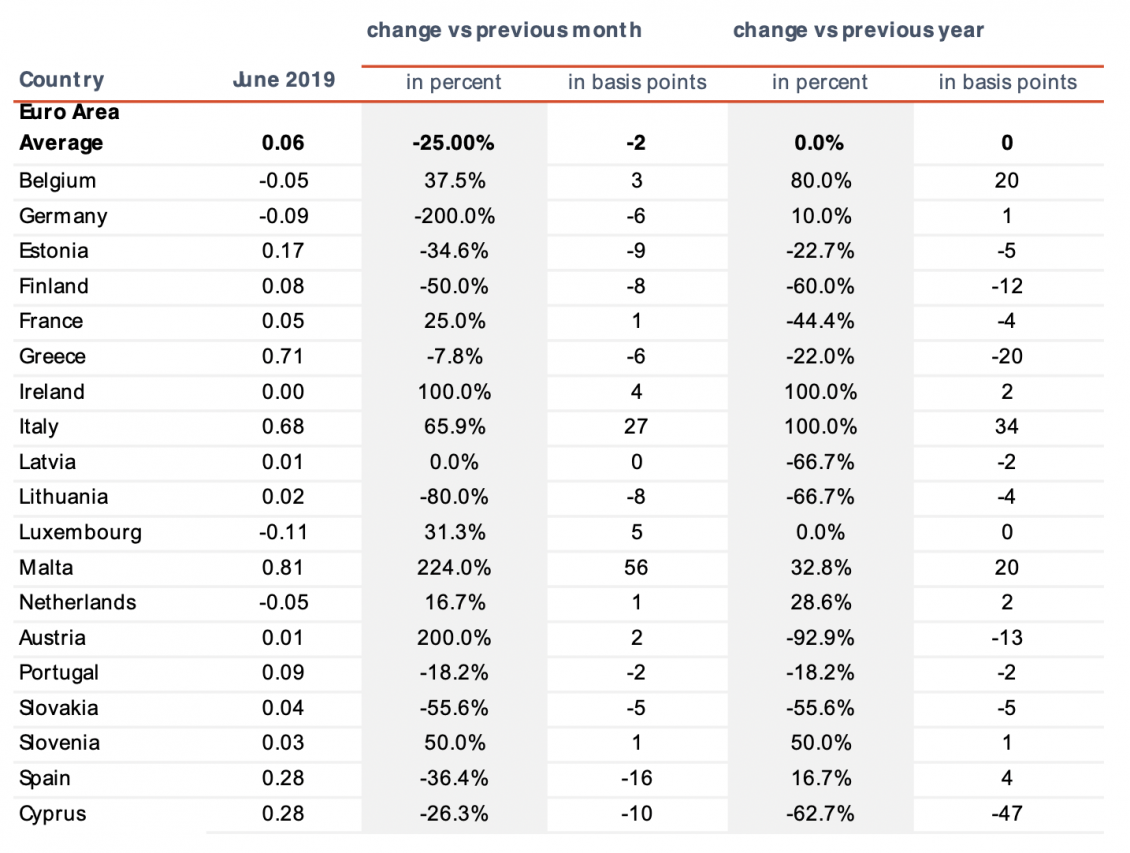

Corporate Deposit Interest Rates:

Punishing rates for companies with cash: most of the EU sees interest under 0.1%

Belgium and Germany, both in negative territory on interest rates for corporate deposits, looked to trade places in the latest data. Belgium’s corporate rates crept back up closer to 0% while Germany slipped to -0.09%, with Luxembourg and the Netherlands also stuck under 0%.

Meanwhile Austria, Slovakia, Slovenia, France, Portugal, Ireland, Latvia, Lithuania, and Finland have all held fast below 0.10%. Cyprus and Spain are higher but still under 0.30%.

Unsurprisingly, given both countries’ broader economic trends, Italy and Greece are seeing rates on corporate deposits sit steadily above half a percent (0.68% and 0.71% respectively).

Current Corporate Deposit Interest Rates in the Euro Area

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

Historical Development of Corporate Deposit Interest Rates

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics, in percentage.

Other Sources: Reuters, Bloomberg, The Economist, Bloomberg, Trading Economics, EuroNews, Reuters, Reuters, Reuters, Politico, Trading Economics, the ECB and Raisin.

Headline Image: Photo by Sara Kurfeß on Unsplash

About Raisin

A trailblazer for open banking and the leading pan-European one-stop shop for online savings and investments, Berlin-based fintech Raisin was founded in 2012 by Dr. Tamaz Georgadze (CEO), Dr. Frank Freund (CFO) and Michael Stephan (COO). Raisin’s platforms — under the brand WeltSparen in the German-speaking world — are breaking down barriers to better savings for European consumers and SMEs: Raisin’s marketplace offers simple access at no charge to attractive and guaranteed deposit products from all over Europe, as well as globally diversified, cost-effective ETF portfolios (currently available in Germany). With one online registration, customers can choose from all available investments and subsequently manage their accounts. Since launch in 2013, Raisin has brokered 15.5 billion EUR for more than 200,000 customers in 28+ European countries and over 80 partner banks. Raisin was named to Europe’s top 5 fintechs by the renowned FinTech50 awards and is backed by prestigious European and American investors such as btov Ventures, Goldman Sachs, PayPal Ventures, Thrive Capital, Index Ventures, Orange Digital Ventures and Ribbit Capital. Raisin UK in Manchester, banking-as-a-service provider Raisin Bank in Frankfurt and pensions specialist fairr all belong to Raisin.

Austria

Austria

Finland

Finland

France

France

Germany

Germany

Ireland

Ireland

Netherlands

Netherlands

Poland

Poland

Spain

Spain

United Kingdom

United Kingdom

United States

United States

Other (EU)

Other (EU)