- Italy remains an outlier with some of the highest rates in Europe

- European economies show no mercy for most depositors, despite tiptoeing back the last few months

- Businesses in two of Europe’s four largest economies pay negative rates

Raisin’s latest savings market analysis shows that, as the pandemic begins a second wave, interest rates have continued to fall. European countries feature significant spreads, however, between the interest rates at the biggest banks and the most competitive available deposits. Consumers in Europe can take advantage of the more profitable interest rates by looking countrywide or even across borders, particularly as inflation has fallen, but also compare between shorter and longer-term offers.

Following the analysis, Raisin VP for Business Clients and Partnerships Benedikt Voller explains the liquidity situation banks find themselves in and how it also impacts customers.

COMPARISONS: RETAIL INTEREST RATES ANALYSIS BY RAISIN

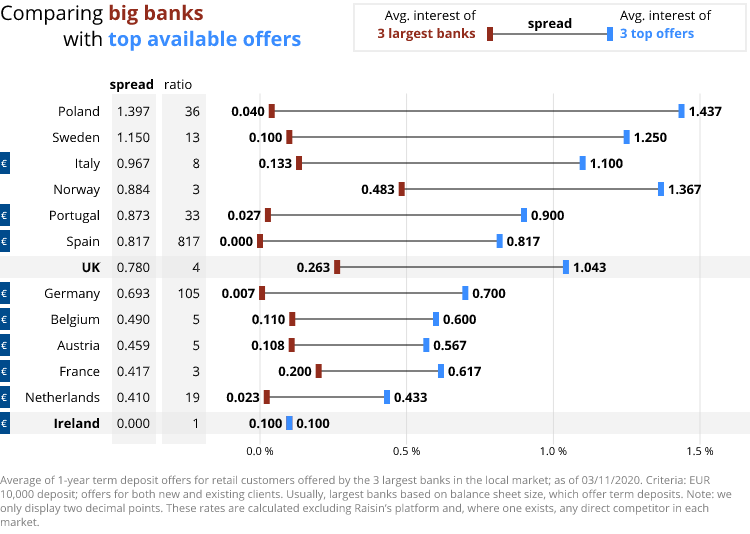

Top 3 banks versus top 3 offers in European countries

Poland, Sweden, Italy, and Norway feature the widest spreads between interest rates offered by their biggest banks and each market’s top available rates. Top 1-year rates ticked downward across western and southern Europe in the face of the pandemic’s second wave. The biggest banks’ held steady in nearly every country.

Even with most countries averaging best rates under 1%, those top yields remain multiples higher than the largest banks on average – 4 times higher in the UK, 8 times higher in Italy, up to 105 times higher in Germany and more than 800 times higher in Spain.

*Creating a ratio between Spain’s big bank average of 0% and the top offers of 0.817% is mathematically impossible but 817 better captures the real situation. These rates are calculated excluding Raisin’s platform and, where one exists, any direct competitor in each market.

- Downward trend: From the UK to France, Spain, Portugal and Italy, and up to Norway, top interest rates on 1-year deposits slipped.

- No change at big banks, except: Interest rates at the biggest banks in Belgium gained, while 1-year rates at Norway and Sweden’s biggest banks fell slightly.

- Pennies add up: Changes in the last month were all marginal – usually a few hundredths of a percent. Yet the shifts are enough to earn or lose tens of millions in interest across the continent, given that in just Germany, France, Spain and Italy there are over 6 trillion euros in household deposits, according to the ECB.

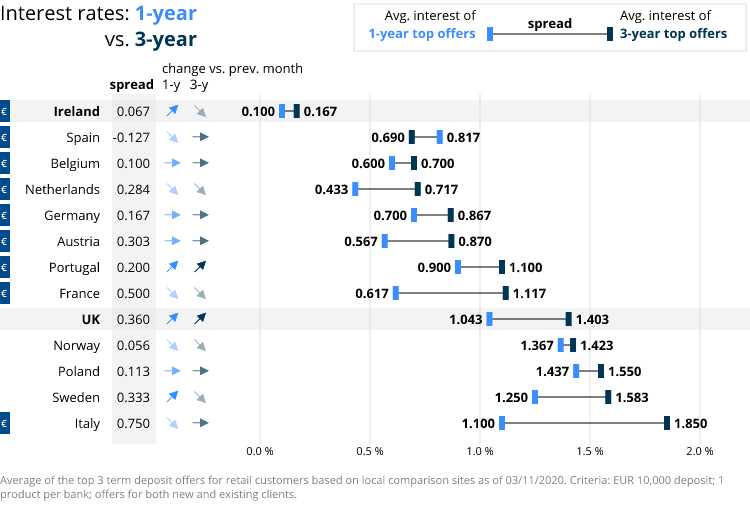

Top 1-year versus top 3-year deposit rates in European countries

Amidst an overall flatlining, Germany, France, Belgium and Spain all hover in place or sink yet further. With two of the highest savings rates in Europe, Spain and Germany are stuck at the lower end for top rates – meaning a ton of money sitting in the bank not earning great returns. Ireland’s few banks, flush with cash, continue to feature the lowest interest in Europe, while Italy’s stressed economy keeps its rates competitive despite sliding slightly the last few months.

- The economics of shorter and longer term rates are on display between the 0.17% spread in Germany – where there’s less risk but lower expectation for growth – and a 0.75% spread in Italy, with a higher risk factor but also a modicum of growth potential.

- Still, central and southern Europe have options, with top rates from 0.57% to 1.85%.

- Spain continues to experience an inversion with the highest available 1-year rates topping than 3-year rates.

- The top rates in Norway continue a months-long downwards trend.

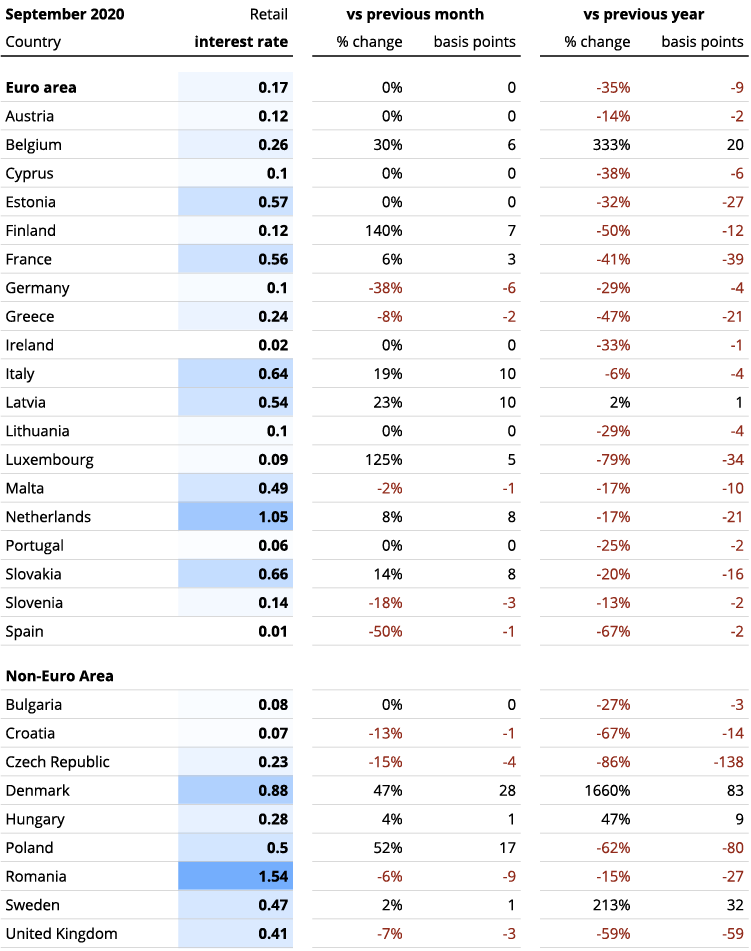

ECB DATA: RETAIL INTEREST RATES

The end of summer saw upticks in retail rates on average in most of Europe. Across the Euro area nearly every country is seeing lower interest rates, however, compared to fall 2019, from just a couple of basis points lower in Spain and Germany to -39 basis points in France.

The latest announcements from the European Central Bank point to rates undergoing further pressure downward in December and suggest that the ECB will proceed with some easing of its monetary policy stance. President Lagarde mentioned at her recent press conference that, “we have little doubt, given what is expected as a result of the risks that we are seeing, that circumstances will warrant the recalibration and the implementation of this recalibrated package.”

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- Spain and Ireland’s average interest rate on term deposits 1-year or less are down to 0.01% and 0.02% respectively.

- Of the largest five economies, average rates in Germany, the UK, and Spain all sank at the start of autumn, while France and Italy climbed to 0.56% and 0.64%.

- Eastern and northern Europe saw gains, with rates in Denmark, Poland, Slovakia, Finland and Latvia all rising on average.

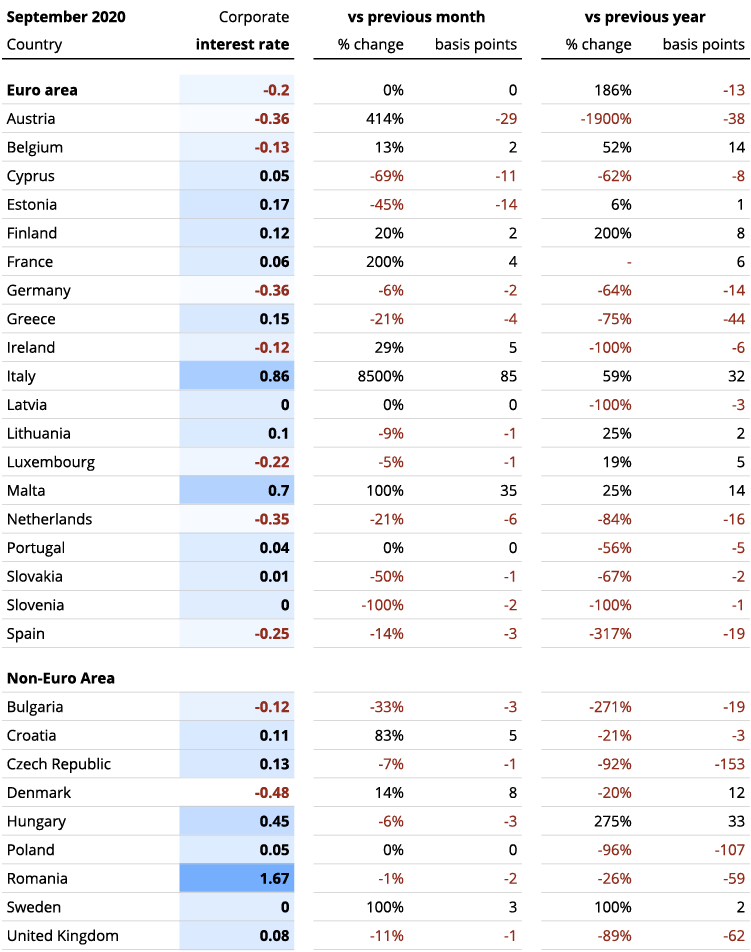

ECB DATA: CORPORATE INTEREST RATES

The magic numbers are 1, 2, and 3: half of the countries in our European Central Bank data went up or down 1, 2, or 3 basis points. But this also means businesses in nine European countries still pay negative interest on their deposits on average, and another nine countries earn less than 0.10%.

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- Austria and Estonia were the unfortunate outliers, with interest on corporate accounts there dropping -29 and -14 basis points.

- Italy and Malta by contrast leapt 85 and 35 basis points, setting businesses there up to earn tidy little returns on their cash.

- Corporates in Germany, Spain, and Ireland continue to face dismally low interest rates well below 0%, paying penalties, in effect, for any money in the bank.

Raisin VP for Business Clients and Partnerships Benedikt Voller explains how banks are experiencing the current low rates as well as fiscal stresses caused by the Coronavirus pandemic:

“In the current environment of ongoing low and negative interest rates, European banks have received guidance from the ECB to keep economies across Europe afloat, accompanied by liquidity being pumped into the market via pandemic-related subsidies. As a result, however, many banks are facing an over-liquid situation on their balance sheets. Not all the deposits can be used to create more assets and deliver loans onto the market. Significant costs thus occur, including:

- Payments of bank levies and contributions to Deposit Guarantee Schemes

- Increased equity requirements that are based on the amount of deposits held

- Negative interest penalties for liquidity placed in the wholesale market or directly held by the ECB

In order to minimise the impact, retail banks must often lower interest rates for customers, sometimes even pushing rates below zero, to nudge customers’ liquidity into other products. Or simply away, to other providers. This creates not just a dilemma for customers – missing potential yields on their savings and having to leave their home banks – but also for banks. Financial institutions stand to lose long-standing customer relationships unless they succeed in offsetting low or negative rates with attractive enough alternative products or services. So the current liquidity situation is driving banks to look for innovative solutions to the longer-term interest rate impasse.”

Sources: ECB, Raisin

Header image: Maxime Lebrun on Unsplash

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – biallo.at

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

About Raisin

A trailblazer for open banking and the leading pan-European one-stop shop for online savings and investments, Berlin-based fintech Raisin was founded in 2012 by Dr. Tamaz Georgadze (CEO), Dr. Frank Freund (CFO) and Michael Stephan (COO). Raisin’s platforms — under the brand WeltSparen in the German-speaking world — are breaking down barriers to better savings for European consumers and SMEs: Raisin’s marketplace offers simple access at no charge to attractive and guaranteed deposit products from all over Europe, as well as globally diversified, cost-effective ETF portfolios and pension products (currently available in Germany). With one online registration, customers can choose from all available investments and subsequently manage their accounts. Since launch in 2013, Raisin has placed 27.5 billion EUR for more than 295,000 customers in 28+ European countries and 100 partner banks. Raisin was named to Europe’s top 5 fintechs by the renowned FinTech50 awards and is backed by prestigious European and American investors such as btov Ventures, Goldman Sachs, PayPal Ventures, Thrive Capital, Index Ventures, Orange Digital Ventures and Ribbit Capital. Raisin UK in Manchester, banking-as-a-service provider Raisin Bank in Frankfurt, pensions specialist fairr, and Raisin Technology (formerly Choice Financial Solutions) all belong to Raisin.

Austria

Austria

Finland

Finland

France

France

Germany

Germany

Ireland

Ireland

Netherlands

Netherlands

Poland

Poland

Spain

Spain

United Kingdom

United Kingdom

United States

United States

Other (EU)

Other (EU)