In new research, pan-European savings marketplace Raisin has found a wider-than-ever gap between low interest rates at the largest banks and the – much higher – best available deposits across Europe. Despite the European single market, banking customers are getting wildly different offers depending on where they live and where they bank. Their access to a return on their savings depends on their ability to ditch the biggest banks and head out to greener pastures at other institutions. Corporate customers are in even more dire straits, with businesses in most of Europe paying a penalty for keeping cash in the bank.

COMPARISONS: RETAIL INTEREST RATES ANALYSIS BY RAISIN

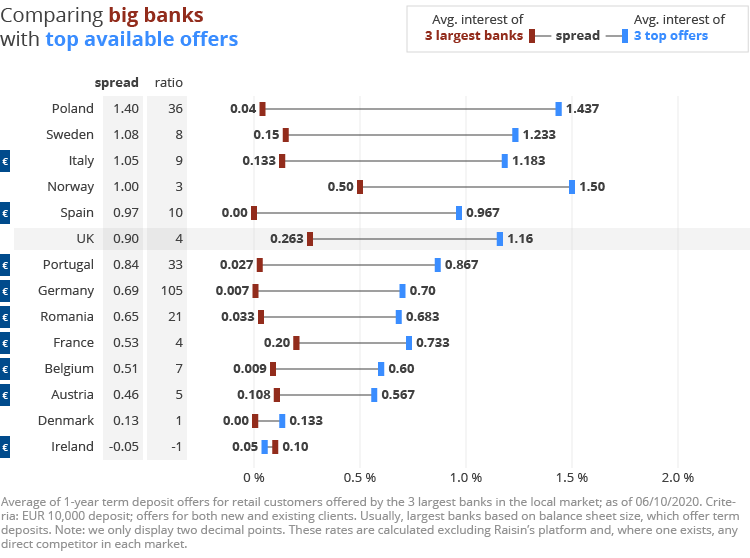

Top 3 banks versus top 3 offers in European countries

The top interest rates slumped this month for most Europeans but they are still many multiples higher than fixed-term savings offers at the biggest banks. Only the UK, Norway, and Poland bucked the trend, with top available interest rates going up. And as ever, the Irish remain stuck with the lowest interest rates in Europe.

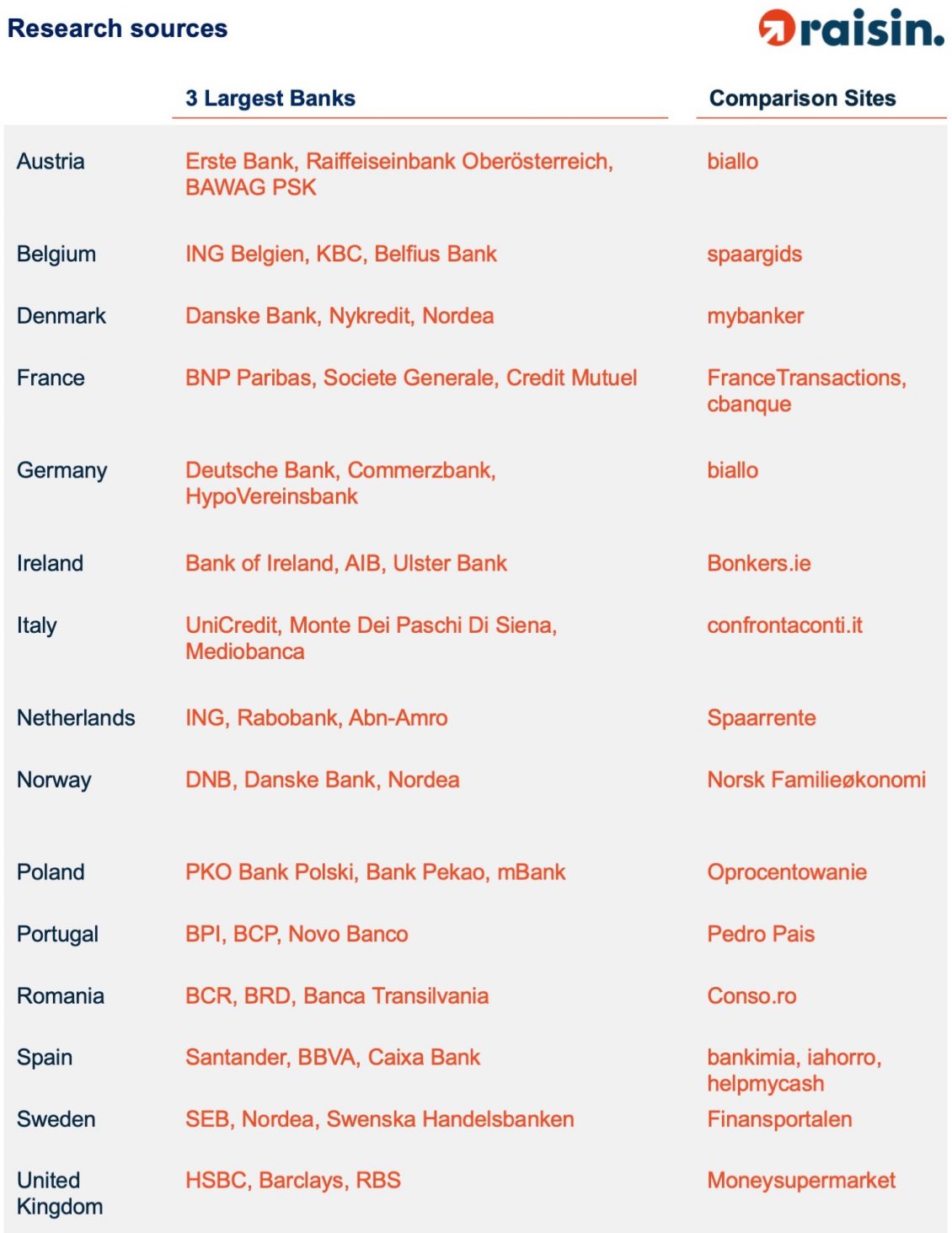

These rates are calculated excluding Raisin’s platform and, where one exists, any direct competitor in each market.

- Best interest rates in Europe: Best offers in the UK, Sweden, Norway, Italy, and Poland are at well over 1%.

- Worst rates: Customers at the biggest banks in Spain, Germany, the Netherlands, Portugal and Poland all facing fixed-term interest rates under 0.05%. If they switch to other providers their yields multiply 10 to 30 x higher.

- Not worst, but…: Depositors in Ireland, Austrian, Belgium and Italy face not much better with big bank rates hovering around 0.1%.

- 70 cents vs. 70 euros: German interest rate gap stretches to a 105 x difference between average big bank deposits and top available rates. A banking customer with 10,000 euros in a 1-year deposit at one of the biggest banks ends up with a 70 cent profit, against a 70 euro return if they go with the market’s top offers. The situation is even more dramatic in Spain, where customers at the biggest banks are earning 0 euros on 10,000 euros 1-year deposits, but if they go with the top offer they come home with 97 euros. In France it’s a 20 to 73 euros difference, and a 2.30 to 47 euros gap in the Netherlands.

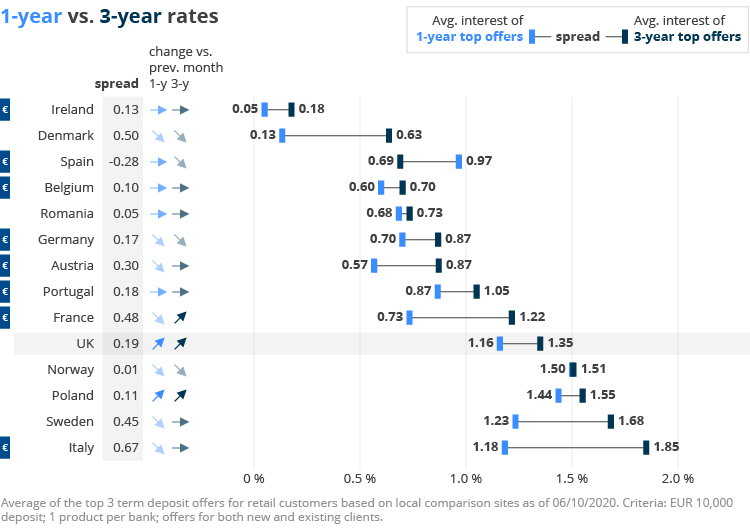

Top 1-year versus top 3-year deposit rates in European countries

Europeans in the Eurozone alone have 4.7 trillion euros on current accounts earning no interest. The top offers suggest that, unless they’re moving money out of the big banks, they’re losing tens of billions.

- In face of the coronavirus pandemic, many people don’t want to lock their savings away right now for the longer term, but fixed-term deposits of 1-year and less still offer profitability.

- Consumers in Europe’s five largest economies (UK, DE, FR, ES, IT) can find top rates between 0.70% and 1.85%.

- Most top rates slipped downward. Only the UK, Poland, and France saw small upticks.

- Italy has the highest spread between 1-year and 3-year deposit with 0.67%, while in Norway there’s hardly a difference with 1- to 3-year terms at 1.50 % and 1.51%.

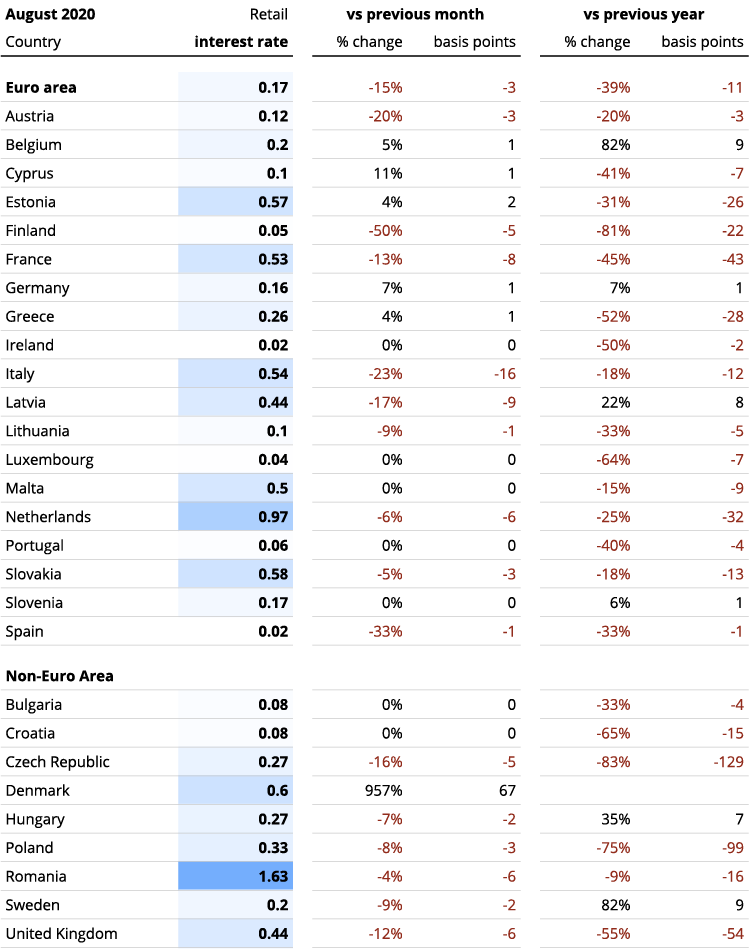

ECB DATA: RETAIL INTEREST RATES

Another month, another drop in average interest rates in Europe. The European Central Bank’s latest data from August, released in early October, shows nearly every country losing ground on the most common fixed term deposits 1-year or less.

But the spread of rates for consumers across Europe remains wide, from 0.02% in Ireland and Spain to just over half a percent in France and Italy, to 0.97% in the Netherlands, to 1.63% in Romania.

Average Retail Rates across Europe – ECB

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- Italy, France, and the UK were the hardest hit large economies in terms of interest rates falling.

- Ireland is truly stuck, and from an interest rate perspective the worst place to be stuck (the bottom).

- Though nearly all the major economies slipped at least a few basis points, German savers were among the few who escaped punishment, with the German average even moving up a (single) basis point.

- And in a late summer surge that our research above suggests won’t last, Denmark’s average rate shot up an astonishing 67 basis points. (Let’s hope Danish depositors locked in August’s high rate.)

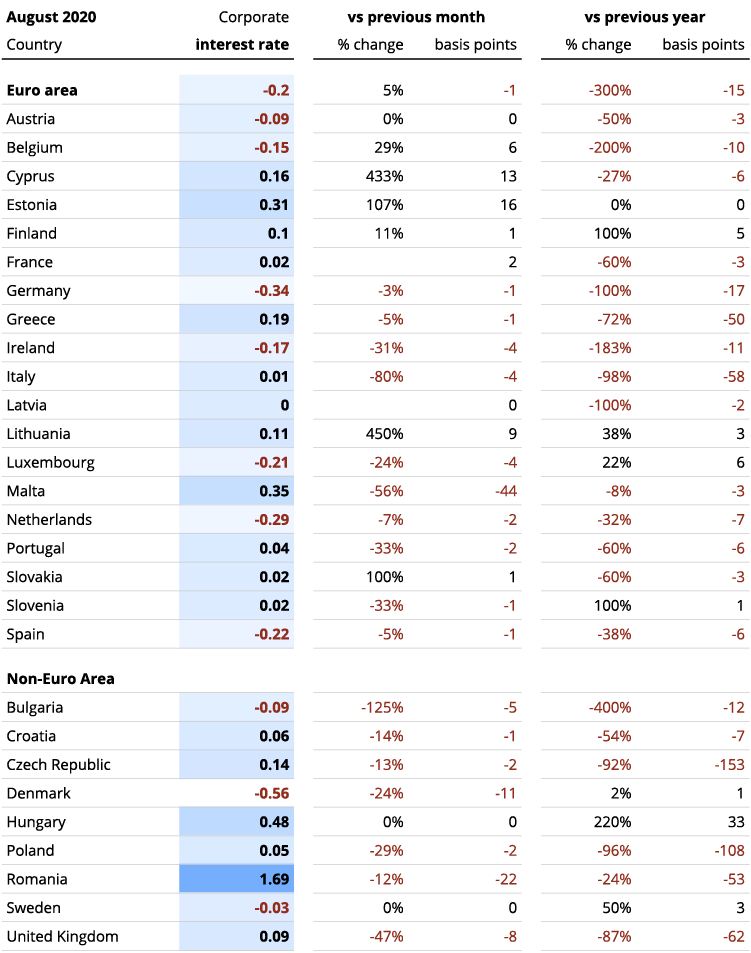

ECB DATA: CORPORATE INTEREST RATES

Businesses have fewer options across the continent when it comes to leaving their cash in the bank. Ten markets still feature negative rates on average, according to the European Central Bank’s most recent data. In another ten, corporate deposits only offer between 0% and 0.1%.

Average Corporate Rates across Europe – ECB

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- German corporates are still at rock bottom with an average interest rate of -0.34%, the Netherlands not far behind at -0.29%.

- Italy and France (0.01% and 0.02%) are at least above water, along with the Baltics and Eastern Europe.

- Of Europe’s five largest economies, only the UK is up (“up”) at 0.09%. Grateful for the small things.

Is it risky to invest deposits in countries with higher interest rates?

Not exactly, Raisin France General Director Emmanuel Rodriguez explains. He also reveals what most Europeans still don’t know about sending their savings across borders.

“Interest rates on fixed-term deposits always indicate a balance: on one side the risk level investors are willing to accept by depositing their cash, and on the other the growth the banking sector expects. More risk means investors will be expecting a higher interest rate to compensate for depositing their money with that bank and/or the country where it’s domiciled. The financial crisis of 2008-2010 illustrated this point. But one shouldn’t forget the other side of the equation. It reflects the bank’s appetite for funding and expectation for economic growth going forward. If the economic outlook isn’t optimistic, banks aren’t willing to lock in medium/long term funding with higher rates for economic activity that may not materialize. This can be particularly the case in countries highly dependent on exports (e.g. Germany) but also countries where competition is not at play, either because the banking sector is highly concentrated or because its residents have an overall preference for saving instead of borrowing.

“What most regular retail customers don’t realize though, is that they can simply ‘arbitrage’ the market, accessing higher rates with other providers’ top offers – in their home market and elsewhere in Europe – without taking any market risk. European countries and their local banks have all signed onto the European Deposit Insurance scheme. Up to 100,000 euros per person per bank are guaranteed. Furthermore, the single market for banking services is being pushed forward right now, with Europe adopting and implementing additional measures to make the European banking sector even more secure and accessible. This redounds directly to the benefit of European retail banking customers.”

Sources: European Central Bank, Raisin

Header image: Markus Spiske on Unsplash

About Raisin

A trailblazer for open banking and the leading pan-European one-stop shop for online savings and investments, Berlin-based fintech Raisin was founded in 2012 by Dr. Tamaz Georgadze (CEO), Dr. Frank Freund (CFO) and Michael Stephan (COO). Raisin’s platforms — under the brand WeltSparen in the German-speaking world — are breaking down barriers to better savings for European consumers and SMEs: Raisin’s marketplace offers simple access at no charge to attractive and guaranteed deposit products from all over Europe, as well as globally diversified, cost-effective ETF portfolios and pension products (currently available in Germany). With one online registration, customers can choose from all available investments and subsequently manage their accounts. Since launch in 2013, Raisin has placed 27 billion EUR for more than 290,000 customers in 28+ European countries and 97 partner banks. Raisin was named to Europe’s top 5 fintechs by the renowned FinTech50 awards and is backed by prestigious European and American investors such as btov Ventures, Goldman Sachs, PayPal Ventures, Thrive Capital, Index Ventures, Orange Digital Ventures and Ribbit Capital. Raisin UK in Manchester, banking-as-a-service provider Raisin Bank in Frankfurt, pensions specialist fairr, and Raisin Technology (formerly Choice Financial Solutions) all belong to Raisin.

Austria

Austria

Finland

Finland

France

France

Germany

Germany

Ireland

Ireland

Netherlands

Netherlands

Poland

Poland

Spain

Spain

United Kingdom

United Kingdom

United States

United States

Other (EU)

Other (EU)