|

The pan-European deposits platform Raisin (www.raisin.com) regularly publishes the Raisin Interest Rate Radar to assess the ongoing effect of the ECB (European Central Bank) rate policy on savers throughout Europe. The data released by the ECB in June reflects rates up until two months prior to the release (April 2019).

Negative-rate-quakes felt across Europe

No end in sight: now in the final stretch of his term as Head of the European Central Bank Mario Draghi is extending his legacy in the ECB’s latest decision to continue negative interest rates in the form of penalties on excess liquidity on banks’ balance sheets. Out of concern for inflation and a broader slowdown due to the ongoing trade uncertainty, Draghi and others have also signalled an openness to more stimulus, probably in September.

At the recent annual central bank conference in Sintra, Portugal, Draghi emphasized that in the coming weeks the ECB Governing Council will be considering how their instruments can be used to meet the gravity of the risk to price stability. For bank and savers this means that negative interest rates will continue to be implemented as an instrument of monetary policy. In the EU’s largest economy consternation was expressed: according to the German financial regulatory agency BaFin’s president, Felix Hufeld, high penalties weaken German banks even further in the absence of profitability, and lead to banks dying off. Ultimately, though, many banks lack an awareness of the problem and the readiness to make needed reforms.

The announcement elicited outrage internationally, with Donald Trump, among others, seeing ECB politics as a source of competitive distortion. The American president did not note the disadvantages of the stimulus program for banks and consumers, however. European central banks expect an inflation rate of 1.4% in 2020 followed by 1.6% in 2021. Draghi’s statement caused markets to break out in something of a rash — perceptible negative-rate-quakes. Yields on European capital markets sank noticeably, with German 10-year federal bonds hitting a record low. Stock markets on the other hand reacted positively.

European economy softens, with UK inflation-interest rate ratio especially tough on savers

Despite the ECB’s inflation targets for the Euro zone at just under 2%, Euro zone inflation sank 0.5 percentage points from April’s level, to 1.2%. Consequently, additional rate drops as well as bond purchases by the ECB have grown more likely, as measures to stem an economic slowdown. International clashes around Brexit and American trade policy along with the threat of an Iran-U.S. conflict have had further dampening effects on European economic strength.

In the UK, inflation, already much higher than on the continent, sank to 2.1%. But with retail interest rates in the UK significantly below that level — and banks typically at 1/3 of the central bank’s interest rate — British savers are being hit particularly hard.

Recession talk

The Germany-based Business Climate Index, covering the Euro zone, fell to a 4.5 year low. In May 2018 it was still at 1.44 points but by May of this year was hovering as low as 0.3 points — a drop of 80%. The BCI’s parent, IFo Institute for Economic Research in Munich, expects Germany’s economic growth to decrease by half. On the other hand, the Purchasing Managers’ Index for the Euro zone manufacturing sector rose slightly, by 0.1 point to 47.8 points, in June 2019.

Lagarde to step into Draghi’s shoes — is it the end of an era?

On 11. June 2014, the European Central Bank introduced negative interest rates for the first time, surprising one and all, and yet managing to strengthen the Euro zone’s position as an exporter. Five years later the sector is longing for a turnaround on penalty interest. Now, fittingly perhaps, Mario Draghi’s term as president of the ECB is coming to a close along with an era, it appears — on 31. October 2019, which is also the final deadline for a Brexit deal.

Speculation is heating up in time for the summer holidays, over the politics surrounding penalty interest and the sovereign debt dispute between Italy and the EU, while the question of Draghi’s successor has been settled with the nomination of IMF Chief Christine Lagarde for new President of the ECB.

Current Retail Deposit Interest Rates in the EU

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

Retail Deposit Interest Rates:

Roller coaster, slide or park bench — where are European economies on rates?

In the most recent ECB data, the bulk of Euro countries are shown to be within 0 to 5 bps of where they were one year ago, despite individual ups and downs in the meantime. The countries suffering flatlining rates include Germany, Austria, Luxembourg, Ireland, Italy, Spain, Portugal, Greece, Slovenia and Lithuania. They have seen no significant movement for at least the last half year, excepting Italy, Austria and Lithuania, who’ve each only seen one notable drop. Outside the Eurozone, Poland has stayed flat while Sweden continues a recent upward spike but both are still around where they were a year ago.

Meanwhile, the smaller economies of the Netherlands, Belgium, Finland, Latvia, Malta and Cyprus have taken meaningful hits from where they were a year ago, dropping between -7 and -70 bps. However, Latvia, Malta and Belgium are all seeing a steady upward trend, along with Croatia outside the Eurozone.

France continues a bumpy ride (upward, in the most recent data) nonetheless landing +26 bps relative to one year ago, with Slovakia likewise up +45 bps from last year despite a recent downward turn on its roller coaster. Estonia saw no movement for months but then most recently jumped notably, now +22 bps from last year at this time. Outside the Euro area, just the UK, Czech Republic and Romania — though seeing no recent changes — are up +27, +87 and +61 bps respectively.

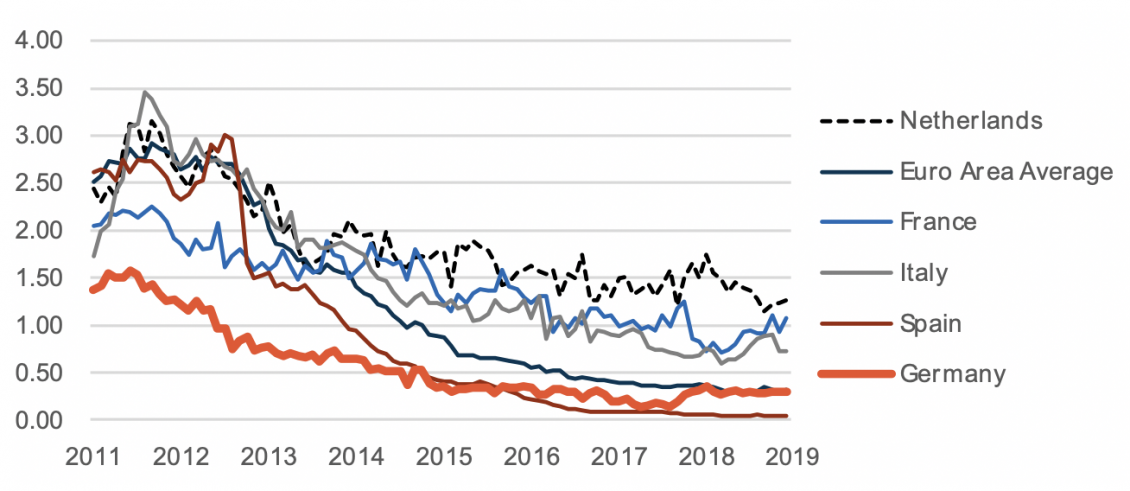

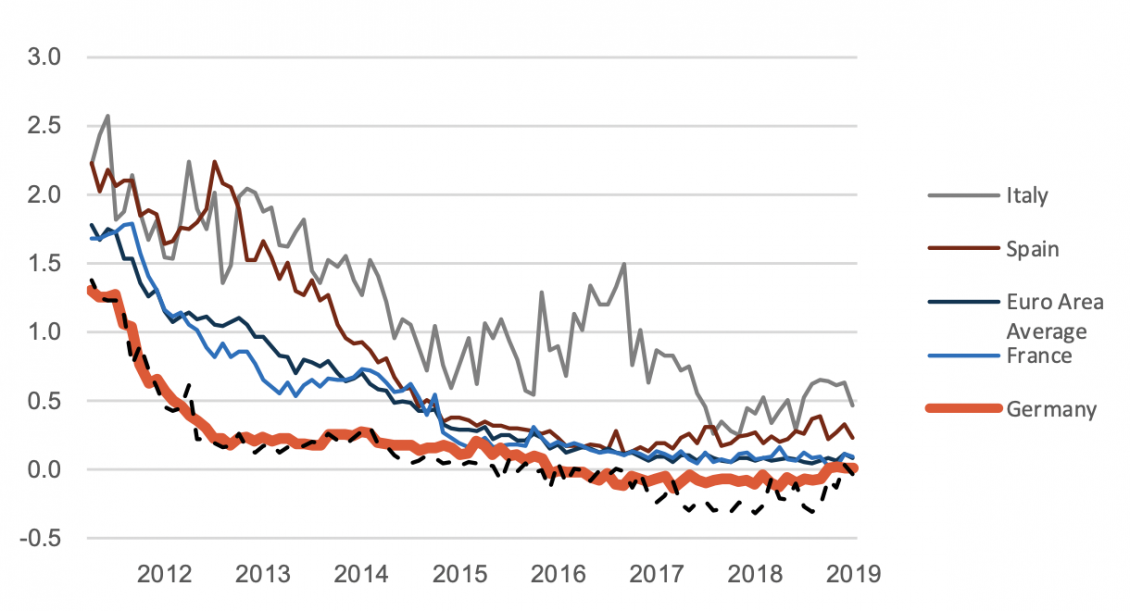

Historical Development of Retail Deposit Interest Rates

Average interest rate for new deposits, private households, maturities ≤ 1 year, ECB data, in percent Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

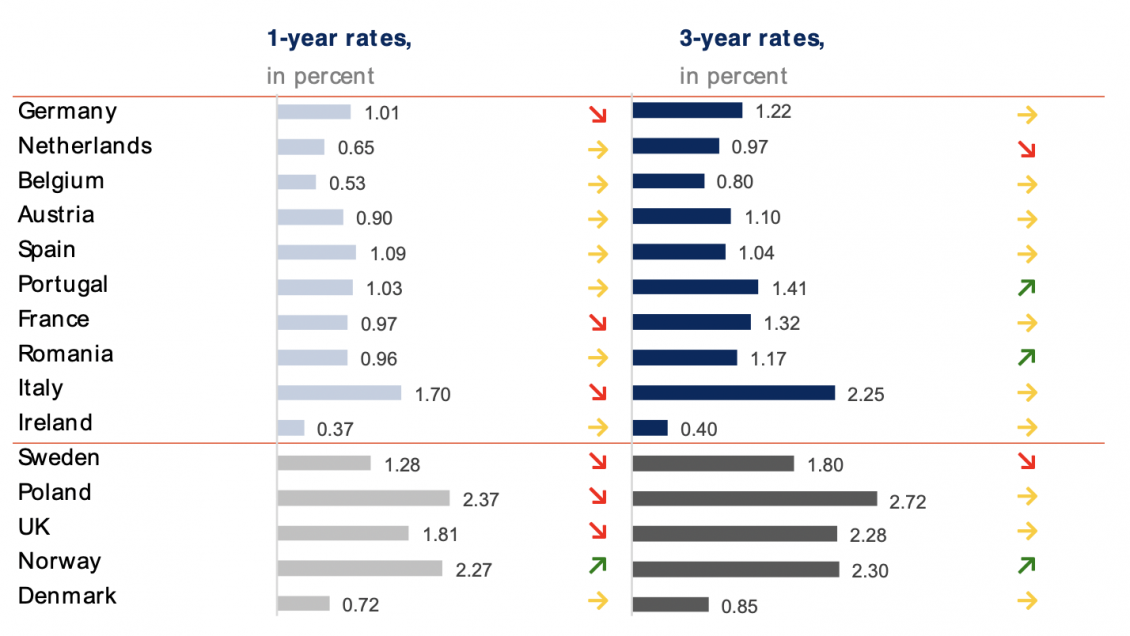

Retail Deposit Interest Rates — comparing top 3 banks with top 3 offers:

Lost gains in individual markets, while German dip stops its notorious rate gap from widening further

From a half year ago until the period of our current data rates on 1- and 3-year deposits in the individual markets of the European Economic Area have remained fairly stable, with continuing upticks only in Norway, Portugal and Romania. The other Scandinavian increases have now stopped or even reversed, and Germany and Italy have also lost small gains on 1-year deposit rates.

Meanwhile in our comparison between the top three offers and each country’s three biggest banks, we see only a slight narrowing in the German rate gap, due to the decrease in rates on top offers. The German rate “shears” remain gaping open, with Ireland on the other end of the spectrum, suffering from flatlined low rates across the board.

Highest Retail Deposit Interest Rates in the EU

Average of the top 3 term deposit offers for retail customers based on local comparison sites as of 21/06/2019. Criteria: EUR 10,000 deposit; 1 product per bank; offers for both new and existing clients.

Retail Deposit Interest Rates of the 3 Largest Banks

Average of 1-year term deposit offers for retail customers offered by the 3 largest banks in the local market; as of 21/06/2019. Criteria: EUR 10,000 deposit; offers for both new and existing clients. Usually, largest banks based on balance sheet size, which offer term deposits.

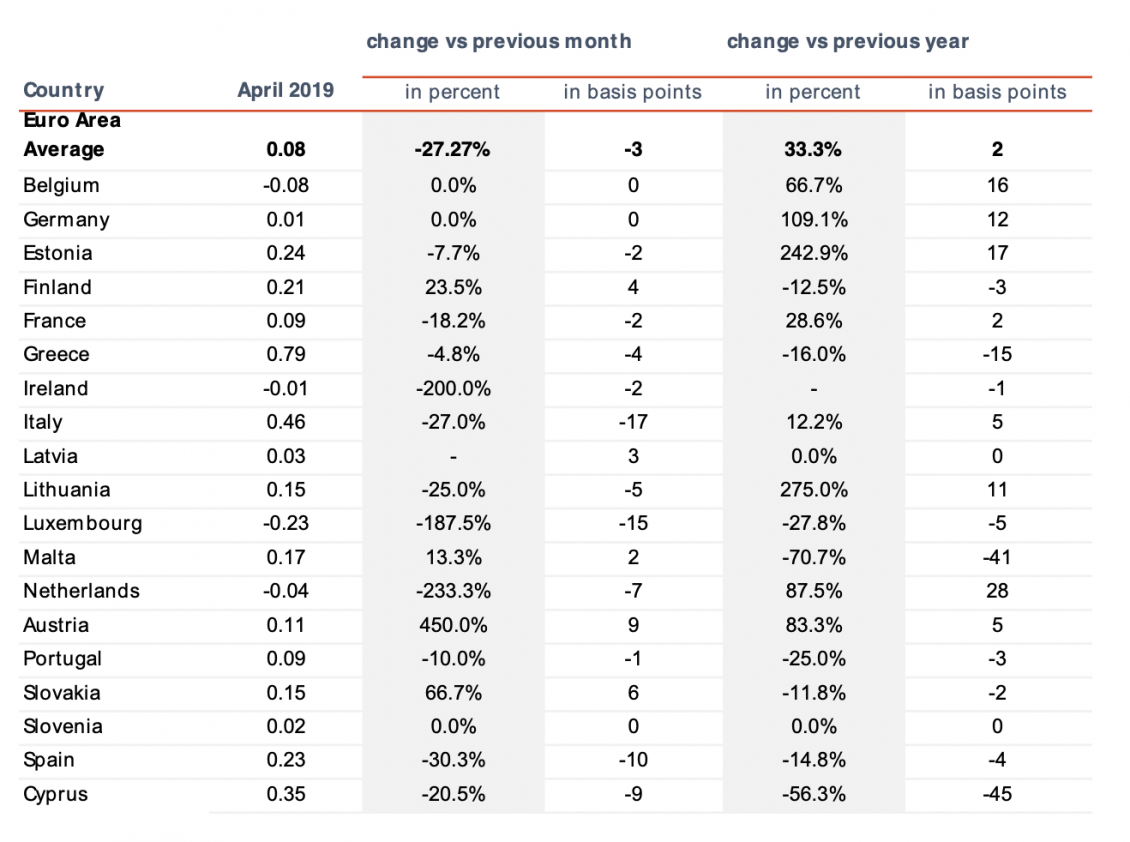

Corporate Deposit Interest Rates:

Steady upward movement in EU’s big economies, seen from year-long perspective

According to the ECB’s most recent data, compared to one year ago the biggest economies in Europe have seen real upward jumps with respect to corporate interest rates. Lithuania, Germany, Belgium, Estonia and the Netherlands have all seen significant bumps with +12 to +28 bps, though the Netherlands has been on a roller coaster recently and Estonia is sliding downward. Austria (continuing its climb from last month), Italy and France have ticked upward between +2 and +5 bps.

Landing in the same place they sat a year ago were the smaller economies of Portugal, Slovakia, Slovenia, Ireland and Latvia, with Latvia, Portugal and Ireland losing recent gains but Slovakia moving upward.

In steady decline on corporate rates were Greece, Malta and Finland, with Spain, Cyprus and Luxembourg on a bumpier ride but also down. All of these countries are down from where they were a year ago, with Greece, Cyprus and Malta the steepest, with drops from -15 to -45 bps. Greece is still the highest in the EU by a lot, though, at 0.79%.

Current Corporate Deposit Interest Rates in the Euro Area

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

Historical Development of Corporate Deposit Interest Rates

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics, in percentage.

Other Sources

Bloomberg, Bloomberg, Independent, Trading Economics, Trading Economics, Euro News, the ECB and Raisin.

Plus, sources in German (Finanznachrichten, ARD Boerse / ZEW, Investing.com, statista.com, Business Insider, DE, ARD Boerse / ZEW, Boerse-online.de, Reuters,

Headline Image: Photo by Andrew Buchanan on Unsplash

About Raisin

A trailblazer for open banking and the leading pan-European one-stop shop for online savings and investments, Berlin-based fintech Raisin was founded in 2012 by Dr. Tamaz Georgadze (CEO), Dr. Frank Freund (CFO) and Michael Stephan (COO). Raisin’s platforms — under the brand WeltSparen in the German-speaking world — are breaking down barriers to better savings for European consumers and SMEs: Raisin’s marketplace offers simple access at no charge to attractive and guaranteed deposit products from all over Europe, as well as globally diversified, cost-effective ETF portfolios (currently available in Germany). With one online registration, customers can choose from all available investments and subsequently manage their accounts. Since launch in 2013, Raisin has brokered 13.5 billion EUR for more than 180,000 customers in 28+ European countries and almost 80 partner banks. Raisin was named to Europe’s top 5 fintechs by the renowned FinTech50 awards and is backed by prestigious European and American investors such as PayPal, Thrive Capital, Index Ventures, Orange Digital Ventures and Ribbit Capital. |