Should I pay off my mortgage early in Ireland?

Is it better to save or pay off your mortgage early?

Homeowners sometimes face the dilemma of whether to pay off their mortgage early or put extra money in savings instead. Interest rates are one key deciding factor, but it’s also important to consider your financial situation and goals. On this page, we’ll look at what it means to pay off a mortgage early in Ireland and what to consider.

Key takeaways

When deciding whether to pay off your mortgage or save,

It's important to check your mortgage agreement, as some banks

You may want to prioritise , and making sure you have savings that can be easily dipped into in case of emergencies

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

What does it mean to pay off your mortgage early?

Paying off a mortgage early simply means you’re able to pay off the loan on your home before the term ends. Homeowners may be attracted to the idea of becoming mortgage-free sooner as it could reduce the total interest paid over the loan term. There are two main ways of doing so:

Overpaying on your mortgage by making extra monthly payments on top of the amount originally agreed

Contributing a lump sum to lower the capital part of your mortgage.

Some mortgage types are easier to pay off early than others. If you’re on a fixed rate deal in Ireland, lenders might charge an early repayment fee. That’s why it’s important to check your mortgage terms first to see whether it’s an option for you.

How do I know if saving or paying my mortgage off early is better for me?

Because each person’s financial situation is unique, there’s no straightforward answer to the question of whether your money is better used on early mortgage repayment or savings.

Here are some important questions to consider:

Can you overpay on your mortgage without incurring penalties? As of November 2025, most new mortgage holders (89%) are in a fixed rate agreement, and breaking a fixed term early might incur a fee. On the other hand, if you want to pay off a tracker mortgage early in Ireland, lenders may be willing to allow overpayments free of charge.

Do you have outstanding debts with high interest rates? Some debts, like credit cards or personal loans, have higher annual percentage rates (APRs) than the interest rates on a mortgage. Weighing up the costs of different debts can provide clarity.

Have you established an emergency fund to cover unexpected expenses? Many financial planners suggest keeping three to six months’ worth of expenses saved in an accessible account for emergencies. This fund might be larger if you have dependents who would face financial challenges if something happens to you or your income.

Are you earning a competitive interest rate on your savings? Checking what’s happening with the European Central Bank’s interest rates can help you make an informed decision.

Are you saving into a pension? Pension contributions can qualify for tax relief and benefit from compound growth over the years.

Consider seeking impartial financial guidance if you’re unsure which option suits your situation.

What are the benefits of paying off my mortgage early vs saving?

Your mortgage is likely your most substantial debt, spanning several years, and accumulating significant interest. Paying it off early can reduce your overall monthly payments, but it can help to use an online mortgage calculator to check this. And if the mortgage interest rate is higher than the interest rate on your savings account, you might prioritise mortgage repayment, since you are ultimately paying more to have that debt than you’d earn through interest. But, if the reverse is true, putting extra money into a high-yield savings account could be worth considering, depending on your financial situation.

Here are some of the differences at a glance:

Reduce total interest paid over the life of your loan | Earn potential returns through savings |

Own your home sooner | Keep your money accessible for emergencies |

Lower your monthly outgoings | Benefit from compound growth if offered on the account |

One less long-term financial obligation | You can withdraw or redirect funds more easily |

Overpayment limits or fees may apply, so check your lender’s policy | Interest earned from savings in Ireland is generally subject to Deposit Interest Retention Tax (DIRT) |

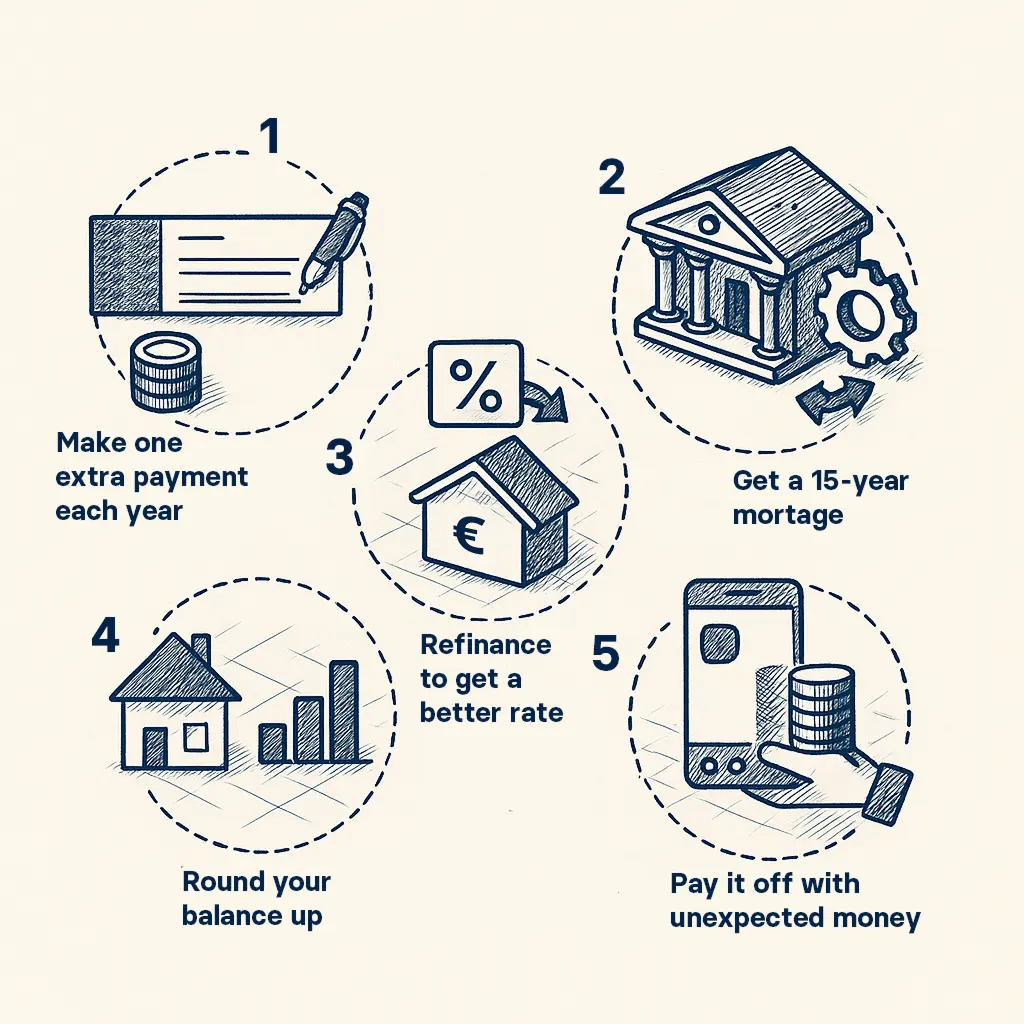

How to pay off your mortgage early in Ireland

Before you make any changes to your monthly payments, check with your lender about overpayment limits or charges. Here are some of the different ways to pay off your mortgage faster:

Make regular overpayments. Overpayments up to a certain amount may be permitted. This is where you add even a small extra amount to your monthly payment.

Refinance to a lower interest rate. Switching to a lower interest rate can help reduce your interest costs. Compare different lenders or use mortgage comparison tools to see how much you could save.

Switch to a shorter-term mortgage. Reducing your mortgage term increases monthly payments but lowers the overall interest. You’d have to check whether the higher payments fit within your budget.

- Use lump sums or windfalls. Bonuses, inheritance, or savings can be applied directly to your mortgage principal, reducing your outstanding balance faster.

At what age should I pay off my mortgage?

Some people strive to pay off their mortgage in their fifties so they can contribute more towards their pension before retirement. However, rising house prices and the cost of living in Ireland could be making this goal increasingly difficult.

If you find yourself paying off your mortgage during retirement, you might explore ways to reduce monthly costs. Some lenders offer interest-only arrangements or allow term extensions, although these options depend on your individual circumstances.

Can I use my pension to pay off my mortgage early?

Some people choose to use part of their pension to pay off a mortgage. This may be an option if you have an outstanding interest-only mortgage with no means to settle the remaining balance. At the same time, it also means drawing on savings that may be needed later.

Whether this makes sense depends on your individual circumstances, including your pension size, remaining mortgage term, and overall financial needs. You should seek independent financial advice before using pension funds to repay debt.

Should I pay off my mortgage early or save for retirement?

You may even want to think about paying off your mortgage early or saving for retirement. Even though this depends on individual circumstances, you may see the benefits of pensions if you’re able to start saving for your retirement as early as possible. By investing in your pension, you can take advantage of compound interest. Starting early allows your pension contributions more time to grow through compound interest. However, returns aren’t guaranteed and depend on market performance.

Can you balance saving and paying off your mortgage?

It can be a challenge to build savings when interest rates are low. In such cases, overpaying on your mortgage can be one way to reduce your mortgage term. However, make sure to review the terms of your mortgage agreement, as overpaying can lead to penalties. It’s not always an either/or decision, and some homeowners in Ireland choose to keep money in savings regardless.

The next step is to consider what type of savings account suits your needs. For instance, high yield savings accounts generally offer competitive interest rates on lump sum deposits.

Regardless of the savings account you choose, having an emergency fund helps you prepare for unexpected events. With a demand deposit account, you benefit from more flexibility, making it quick and easy to access your funds when needed.

Start saving with Raisin

With a Raisin Account, you can compare and open savings accounts from a variety of partner banks — all online and in one place.

Competitive interest rates across a range of accounts

Flexible options to suit your goals, whether short-term or long-term

Deposits of up to €100,000 per person and bank are legally protected by the national deposit protection scheme of the country where the bank is headquartered

If you want to quickly and easily open savings accounts, simply register for a Raisin Account and log in to apply online for free today.

If you have any further questions, our Ireland-based Customer Services Team would be happy to help.

Company & team

Savings accounts

Information

Company & team

Savings accounts

Information

© 2026 Raisin Bank AG, Frankfurt a.M.

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time. Raisin Bank, trading as Raisin, is authorised/licensed or registered by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) in Germany and is regulated by the Central Bank of Ireland for conduct of business rules.