Compare deposit accounts for savers in Ireland

- Fixed interest rates up to 3.05% AER (02/2026)

- Terms ranging from 3 months up to 10 years

- No fees and no subscriptions

An offer from Raisin Bank AG trading as Raisin.

Home › Savings accounts › Deposit accounts

Last updated: 06/02/2026

"Best Savings Provider" 2025

Member of the CCMA

Featured in the CCPC Money Tools

Featured in the Irish Independent

How to open a deposit account with Raisin

- Register for free and verify your identity

Apply to open your deposit account quickly and easily using the VideoIdent process. Once your identity is confirmed, you’ll have access to all our savings accounts. - Choose an offer

Choose the right offer for you from our deposit accounts. - Transfer your funds

Transfer your chosen amount to your Raisin Account via SEPA transfer. Our secure online banking platform gives you full control at all times.

Key takeaways

A deposit account gives you the certainty of fixed, competitive return on your savings by locking away your cash for a set period

It can help to consider deposit account interest rates, fees, how long your money is locked away, and what kind of deposit protection is offered

At Raisin, savers can benefit from some of the most competitive deposit interest rates in Ireland, and all accounts come with deposit protection (up to €100,000 per person, per bank)

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

February deposit accounts update: what’s new?

Updated: 06/02/2026

On 5 February 2026, the ECB kept interest rates unchanged, leaving the deposit facility rate at 2.00% (with the main refinancing operations rate at 2.15% and the marginal lending facility at 2.40%). The ECB said inflation is expected to stabilise at its 2% target over the medium term and noted the eurozone economy remains resilient, while warning that the outlook is still uncertain due to global trade policy uncertainty and geopolitical tensions. This decision keeps borrowing costs stable and supports current returns for savers and investors. Find out more about how changes to ECB rates can impact what banks pay on savings deposits.

Looking to grow your savings? If you’re happy to lock your money away for a set period, deposit accounts generally offer competitive returns. Our top deposit account currently pays 3.05% AER.

Register today to access deposit accounts from our partner banks.

1. Open your free Raisin Account

Open your online account in minutes. Just complete a quick, secure video ID check.

2. Choose a savings account

Manage deposits across 30+ European banks from a single login.

3. Start saving

Transfer your funds and start earning interest.

What exactly is a deposit account?

A deposit account is an umbrella term for any kind of bank account where you can deposit and withdraw money. In Ireland, this includes both current accounts and savings accounts, but the term is most often associated with savings accounts.

If you have a lump sum you want to earn interest on, you can open:

Demand deposit accounts (withdraw anytime)

Notice accounts (withdraw with advance notice)

Term-based deposit accounts, sometimes known as fixed term deposits (lock money away for a fixed period at a guaranteed interest rate)

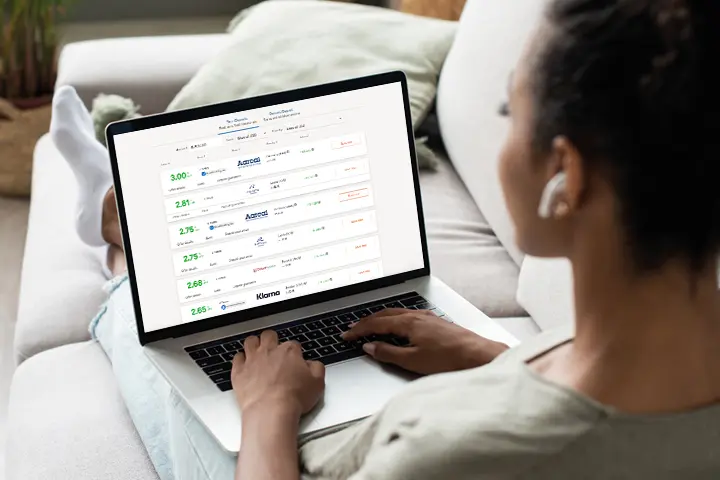

Compare deposit accounts in Ireland using the table above to find the right account for you.

What is the ideal length of deposit accounts in Ireland?

The right term length for you will depend on whether you're saving for something in particular (for example, a wedding) or you simply want to save money in the long term. If you're happy that you can afford to keep a lump sum locked away (with no access to the money until the savings account has matured) then you could consider 1, 2, 3, 4, or 5 year fixed term deposit accounts — or even longer.

In Ireland, State Savings (available through An Post) typically offers some longer term options. One of the most popular is the 10-year National Solidarity Bond, but they also offer a 3-year savings bond.

However, if you’re looking for more flexibility to manage your money and a shorter time frame, Raisin offers competitive deposit account interest rates in Ireland:

2.31% AER on 6-month deposit accounts

2.48% AER on 1-year deposit accounts

2.44% AER on 18-month deposit accounts

2.70% AER on 2-year deposit accounts

How to compare deposit accounts in Ireland

Comparing deposit accounts in Ireland is easy with comparison marketplaces such as Raisin. In addition to the term length, you might want to look closely at any fees charged, minimum deposits, and how interest works. At Raisin, we don’t charge any fees or subscriptions — it’s completely free to sign up.

Banks will often offer a higher interest rate for a fixed term deposit than for a demand deposit savings account. So if you have a lump sum you can afford to stash away for a couple of years, you can expect a higher rate. Generally speaking, the longer the duration, the higher the rate. This is because banks know they are guaranteed to have your money for a set period of time.

While the interest rates for demand deposit accounts are variable, our deposit accounts guarantee you a fixed interest rate for the entire duration. Right from the outset, you know what return you can expect one, two, or even seven years down the line.

What are the best deposit interest rates in Ireland?

If you’re looking for the best deposit interest rates in Ireland, it’s also important to consider inflation, which can lower the purchasing power of your savings. Raisin’s competitive deposit accounts can help Irish savers keep up with inflation and avoid their savings losing value over time.

The highest deposit interest rates in Ireland are subject to change, so it's best to do your own research and check comparison websites.

And it’s easy to do so. With Raisin, you can manage all your savings online, and it’s completely free. Plus, all partner banks are covered by their respective country’s national deposit guarantee scheme. This means your savings are protected up to €100,000 per depositor and bank.

Read more about how Raisin works.

When is interest paid out on deposit accounts in Ireland?

The interest on deposit accounts is often paid out upon maturity, meaning at the end of the fixed term, but this can vary depending on the individual offer. At Raisin, you can check the terms of each individual offer by clicking “Offer details” in the table above and looking at the details under “Interest payment”.

How do I find the best deposit accounts for me?

In our comparison table, we’ve made it easy to help you find the perfect balance between rate and duration. Based on your own needs, you can simply sort the table by top rate, duration, or even country rating to find the perfect term deposit for you.

Why choose a deposit account through Raisin?

Fixed terms from 3 months to 10 years, with rates up to 3.05% AER.

Opening and managing your deposit account is completely free.

All deposits are covered up to €100,000 per person, per bank, through the respective national deposit guarantee schemes.

Minimum deposits from €1.

Apply once and manage everything online from your Raisin Account.

Earn competitive interest with fixed returns, from 30+ banks across Europe.

If you have any questions, Raisin’s customer service team is here to help:

Phone: +353 1 5461020

Email: contact@raisin.com

Opening hours: Monday to Friday, 11:00 a.m. - 3:00 p.m.

FAQs about comparing deposit accounts in Ireland

Can I open a Raisin deposit account from Ireland?

What happens at the end of the fixed term?

At maturity, your deposit and interest are returned to your Raisin Account. Some products will automatically renew unless you opt out beforehand, while others offer the option to carry on with the same account by opting in. If you renew your deposit account, the interest you’ve earned will simply be added back to your existing balance. You can decide what to do in your Raisin Account a few weeks before the account comes to the end of its term.

Can I access my money before the term is up?

No, deposit accounts lock away your money for the entirety of the chosen term. Unless you have a compelling reason, early access is generally not allowed. If you think you might need access to your funds sooner, you might consider a demand deposit account instead.

Is my money safe in a deposit account?

All accounts are protected up to €100,000 per depositor, per bank, under the respective national deposit guarantee schemes. What that means is, if your chosen bank becomes insolvent, your funds will be returned to you.

Do I have to pay DIRT tax on deposit accounts?

Irish residents are required to declare interest earned on deposit accounts with European banks. While no DIRT is withheld at source, you must include interest when filing your annual tax return. Some accounts that state “no withholding tax” may be eligible for more favourable treatment. You can check the individual details of each account by clicking on the product details in the table above.

Find out more about savings accounts

Company & team

Savings accounts

Information

Company & team

Savings accounts

Information

© 2026 Raisin Bank AG, Frankfurt a.M.

All interest rates displayed are Annual Equivalent Rates (AER), unless otherwise explicitly indicated. The AER illustrates what the interest rate would be if interest was paid and compounded once a year. This allows individuals to compare more easily what return they can expect from their savings over time. Raisin Bank, trading as Raisin, is authorised/licensed or registered by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) in Germany and is regulated by the Central Bank of Ireland for conduct of business rules.